PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911777

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911777

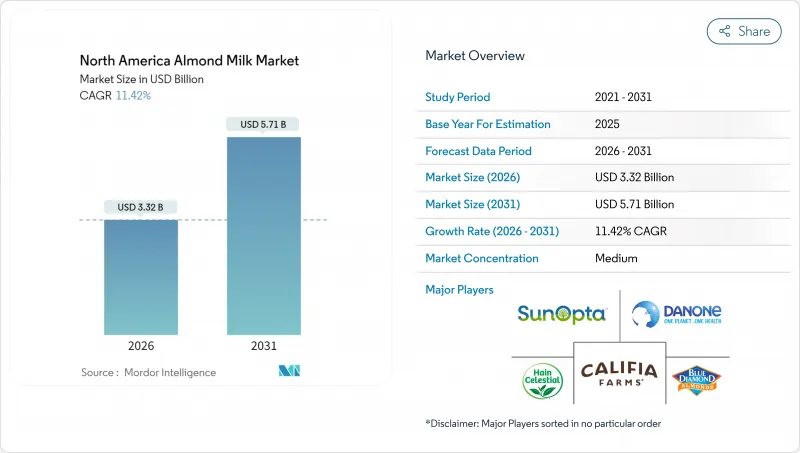

North America Almond Milk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North American almond milk market was valued at USD 2.98 billion in 2025 and estimated to grow from USD 3.32 billion in 2026 to reach USD 5.71 billion by 2031, at a CAGR of 11.42% during the forecast period (2026-2031).

The driving force behind this growth is the prevalence of lactose intolerance, which affects 36% of the population in the United States, 59% in Canada, and 48% in Mexico, as reported by the National Institutes of Health. This has naturally steered consumers towards lactose-free beverages. Furthermore, with 47% of U.S. adults now identifying as flexitarians, almond milk is witnessing a sustained boost as households shift from traditional dairy to plant-based alternatives, a trend highlighted by the Centers for Disease Control and Prevention. As oat, soy, and pea alternatives vie for market share, intensifying competition, established almond milk brands are responding by emphasizing barista-grade foaming, fortifying with proteins, and promoting clean-label formulas devoid of gums and oils. Concurrently, the institutional food service sector is increasingly adopting plant-based creamers to meet sustainability goals. Coffee chains, having removed non-dairy surcharges in 2024, are seeing heightened on-premise attachment rates, bolstering revenue prospects for almond milk manufacturers.

North America Almond Milk Market Trends and Insights

Rising prevalence of lactose intolerance and dairy allergies

According to the National Institute of Diabetes and Digestive and Kidney Diseases, 36% of Americans, 59% of Canadians, and 48% of Mexicans grapple with lactose malabsorption. This widespread issue creates a structural advantage for non-dairy alternatives, a lead that established dairy players find hard to match. Compounding this challenge is the growing awareness of dairy allergies. Unlike lactose intolerance, these allergies provoke immune responses, steering consumers towards plant-based substitutes known for their cleaner allergen profiles. Given its natural lactose and casein-free properties, almond milk emerges as the go-to choice for both children and the elderly, demographics particularly sensitive to digestive issues. The National Institutes of Health highlights that lactose intolerance is notably prevalent among Asian, African, and Hispanic communities, with rates exceeding 70%. Notably, this demographic is expanding at a pace outstripping the broader North American population. In response, manufacturers are enhancing almond milk with calcium, vitamin D, and vitamin B12, aligning its nutritional profile closer to that of dairy. This strategy aims to ease the transition for health-conscious families.

Expanding vegan and flexitarian consumer base

In the U.S., a growing number of consumers are adopting a flexitarian approach, cutting back on animal products without completely eliminating them. Meanwhile, the popularity of fully plant-based diets is on the rise. This trend is less about strict ethical beliefs and more about practical health benefits: half of those adopting plant-based diets do so for wellness reasons, while a smaller 9% are motivated by the rising costs of animal products. Almond milk has gained a significant advantage, having made its debut in mainstream retail before oat and pea alternatives. This early entry allowed it to secure prime shelf space and establish strong brand recognition. As a result, almond milk now holds a significant portion of the U.S. retail milk sales, with many households buying plant-based milk at least occasionally. Notably, Generation Z is consuming about 20% less dairy milk than the national average, indicating a trend that is likely to intensify over time. In response to these shifts, brands are innovating with hybrid products. For instance, in January 2024, Blue Diamond introduced its Almond and Oat Blend, featuring 4 grams of sugar and 450 milligrams of calcium per cup, targeting consumers who are hesitant to fully commit to a single plant-based option.

Intensifying competition from oat, soy, and pea milks

Oat milk is set to eclipse almond milk, both in volume and dollar growth, as consumers lean towards its creamier texture and reduced environmental impact. In a nod to the North American market, Oatly unveiled its first beverage innovations in five years: Unsweetened Oatmilk and Super Basic Oatmilk, debuting in January 2024. SunOpta, capitalizing on its expanded oat-milk capacity, boosted by a USD 26 million investment in Modesto, California, completed in June 2024, announced in October 2024 that its Dream Oatmilk Barista will hit 6,700 stores in January 2025, thanks to a partnership with a major coffee chain. Planting Hope made waves in 2024 by launching its Hope and Sesame milk at Kroger stores nationwide and in 20 Costco warehouses, touting a 75% reduction in water usage compared to almond milk and boasting 8 grams of complete protein per serving, directly countering almond's sustainability claims. While soy milk, with its 7-gram protein content, enjoys steadfast loyalty from Asian and health-conscious consumers in the U.S., pea milk is carving out a niche in allergen-sensitive households. As alternatives to almond milk gain momentum, almond's dominance in the plant-based category is waning, pushing brands to emphasize functional attributes, like barista performance and protein content, over mere novelty.

Other drivers and restraints analyzed in the detailed report include:

- Product innovation in flavors, fortification, and barista blends

- Protein-fortified almond milks targeting sports-nutrition users

- Water-footprint backlash against California almond farming

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, unsweetened almond milk captured 47.05% of the market, reflecting early adopters' preference for low-calorie, low-sugar options aligned with ketogenic and paleo diets. However, sweetened almond milk is growing at a 12.66% CAGR through 2031, as mainstream consumers prioritize taste. Brands are incorporating functional sweeteners like monk fruit, stevia, and allulose to offer indulgence without glucose spikes. Blue Diamond's Almond and Oat Blend, launched in January 2024, balances 4 grams of sugar per cup to target the "better-for-you indulgence" market. In food-service channels, sweetened almond milk is gaining traction as baristas report that unsweetened variants can impart chalky or bitter notes in espresso drinks. Coffee chains are increasingly stocking lightly sweetened options that enhance coffee flavor. Califia's Vanilla Oat and Almond Barista Blends, launched in the US in May 2024, use organic cane sugar to improve foaming stability and mouthfeel. The shift toward sweetened products is notable in Mexico, where sweeter beverages are preferred, and among U.S. Gen Z consumers, who view sugar less critically than older generations.

Unsweetened almond milk remains dominant in health-food stores, natural retailers, and among fitness-focused consumers who closely track macronutrients. Brands like MALK Organics and Elmhurst 1925 focus on premium, minimal-ingredient, unsweetened formulations, appealing to those who value clean labels and organic certification. PLANTSTRONG launched in February 2024 at 500 Whole Foods stores with an Unsweetened Almond SKU free of gums or oils, targeting Whole30 and anti-inflammatory diet followers. The unsweetened segment benefits from rising awareness of added-sugar health risks, with many consumers monitoring intake based on American Heart Association guidelines of 25 grams per day for women and 36 grams for men. Manufacturers are fortifying unsweetened variants with calcium, vitamin D, and vitamin B12 to match dairy's nutritional profile and counter perceptions of nutritional inferiority.

In 2025, carton packaging held a 37.12% market share, driven by the popularity of Tetra Pak and SIG Combibloc formats, which enable ambient distribution and extended shelf life without refrigeration. Glass bottles are growing at a 13.35% CAGR through 2031, as premium brands leverage their recyclability, inert properties, and shelf appeal to justify higher price points. MALK Organics and Elmhurst 1925 exclusively use glass bottles for refrigerated SKUs, positioning them as quality indicators of minimal processing and ingredient purity. Glass also eliminates concerns about bisphenol A or phthalate migration, appealing to health-conscious parents buying almond milk for children. In March 2024, Califia Farms transitioned all U.S. and Canada refrigerated bottles to 100% recycled polyethylene terephthalate, reducing greenhouse gas emissions by 19% and energy use by 50%. However, the company retained plastic to maintain cost competitiveness and avoid breakage during distribution. Plastic bottles remained significant in 2024, favored for their lightweight, shatter resistance, and compatibility with high-speed filling lines. Yet, Extended Producer Responsibility mandates across North America are pushing manufacturers toward higher recycled-content ratios.

Carton packaging remains dominant in the almond milk category, especially for shelf-stable SKUs sold in grocery and mass merchandise channels. SunOpta operates four aseptic plants in Modesto, California; Allentown, Pennsylvania; Alexandria, Minnesota; and Midlothian, Texas, producing shelf-stable almond, oat, soy, and coconut milk for private-label and branded customers. The company completed a 252,000-square-foot warehouse in Alexandria in December 2023 and a USD 26 million expansion in Modesto in June 2024, highlighting the capital intensity of aseptic carton production. Shelf-stable cartons enable distribution to convenience stores, dollar stores, and rural markets with limited refrigerated cold-chain infrastructure, expanding almond milk's reach beyond urban coastal markets. However, North America's fragmented carton recycling infrastructure often leads to landfill disposal, posing reputational risks for sustainability-focused brands. In August 2024, Milkadamia introduced Flat-Pack Organic Oat Milk sheets, achieving a 94% packaging reduction and 85% weight reduction, with an almond-milk version planned, signaling potential disruption to the carton-plastic-glass dynamic.

The North America Almond Milk Market is Segmented by Product Type (Sweetened and Unsweetened), Packaging Type (Carton, Plastic Bottle, Glass Bottle, and Others), Flavor (Flavored and Unflavored), Distribution Channel (On-Trade and Off-Trade), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Blue Diamond Growers

- Danone S.A. (Silk, So Delicious, Alpro)

- Califia Farms LLC

- The Hain Celestial Group Inc.

- SunOpta Inc.

- Elmhurst 1925 (Elmhurst Milked)

- MALK Organics LLC

- Pacific Foods of Oregon LLC

- Three Trees Foods Inc.

- Mooala Brands LLC

- Earth's Own Food Company Inc.

- Orgain Inc.

- Hiland Dairy Foods Company

- Kirkland Signature (Costco)

- Trader Joe's Company

- Whole Foods Market (365)

- New Barn Organics Inc.

- Nestle S.A. (Purely Plant)

- Wal-Mart Private-Label (bettergoods / Great Value)

- Ripple Foods PBC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of lactose-intolerance and dairy allergies

- 4.2.2 Expanding vegan and flexitarian consumer base

- 4.2.3 Product innovation in flavors, fortification and barista blends

- 4.2.4 Food-service shift toward plant-based coffee creamers

- 4.2.5 Retail private-label expansion enhancing price accessibility

- 4.2.6 Protein-fortified almond milks targeting sports-nutrition users

- 4.3 Market Restraints

- 4.3.1 Intensifying competition from oat, soy and pea milks

- 4.3.2 Premium price gap versus dairy milk

- 4.3.3 Water-footprint backlash against California almond farming

- 4.3.4 Yield volatility and supply-chain risk in the United States almond crop

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Product Type

- 5.1.1 Sweetened

- 5.1.2 Unsweetened

- 5.2 Packaging Type

- 5.2.1 Carton

- 5.2.2 Plastic Bottle

- 5.2.3 Glass Bottle

- 5.2.4 Others

- 5.3 Flavor

- 5.3.1 Flavored

- 5.3.2 Unflavored

- 5.4 Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarket/Hypermarket

- 5.4.2.2 Convenience Store

- 5.4.2.3 Specialist Stores

- 5.4.2.4 Online Retail Store

- 5.4.2.5 Other Distribution Channels

- 5.5 Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Blue Diamond Growers

- 6.4.2 Danone S.A. (Silk, So Delicious, Alpro)

- 6.4.3 Califia Farms LLC

- 6.4.4 The Hain Celestial Group Inc.

- 6.4.5 SunOpta Inc.

- 6.4.6 Elmhurst 1925 (Elmhurst Milked)

- 6.4.7 MALK Organics LLC

- 6.4.8 Pacific Foods of Oregon LLC

- 6.4.9 Three Trees Foods Inc.

- 6.4.10 Mooala Brands LLC

- 6.4.11 Earth's Own Food Company Inc.

- 6.4.12 Orgain Inc.

- 6.4.13 Hiland Dairy Foods Company

- 6.4.14 Kirkland Signature (Costco)

- 6.4.15 Trader Joe's Company

- 6.4.16 Whole Foods Market (365)

- 6.4.17 New Barn Organics Inc.

- 6.4.18 Nestle S.A. (Purely Plant)

- 6.4.19 Wal-Mart Private-Label (bettergoods / Great Value)

- 6.4.20 Ripple Foods PBC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK