PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911779

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911779

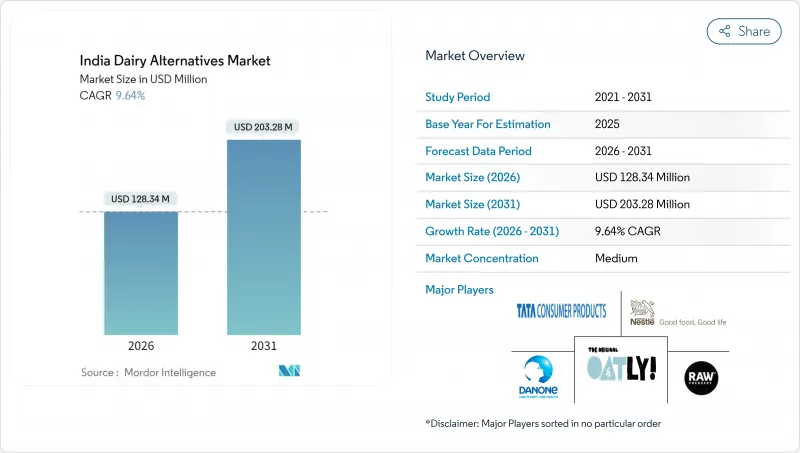

India Dairy Alternatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Dairy Alternatives Market size in 2026 is estimated at USD 128.34 million, growing from 2025 value of USD 117.05 million with 2031 projections showing USD 203.28 million, growing at 9.64% CAGR over 2026-2031.

This growth trajectory reflects a fundamental shift in Indian consumer preferences, driven by rising health consciousness and the significant lactose intolerance prevalence affecting 66% of South Indians and 27% of North Indians . The market's expansion aligns with India's broader organized retail growth, which reached USD 70 billion in 2024 and continues expanding at 15-20% annually. Growing cafe culture, digital influence, and shifting youth preferences toward vegan and flexitarian eating provide additional momentum, while established players sustain product development through scale advantages in distribution, formulation, and packaging. Investment priorities revolve around shelf-life extension and taste enhancement because cold chain gaps outside metros keep wastage rates above those of ultra-high temperature (UHT) dairy, which restrains penetration in tier-2 and tier-3 cities. Despite these frictions, the Indian non-dairy alternatives market continues to attract capital as disposable incomes rise and government regulators adopt progressive labeling rules that clarify consumer choice.

India Dairy Alternatives Market Trends and Insights

Presence of Lactose Intolerance Population Drives Market Foundation

India's genetic predisposition toward lactose intolerance creates an inherent market foundation for non-dairy alternatives, with 66% of South Indians and 27% of North Indians experiencing lactose malabsorption according to the National Institute of Nutrition. This biological reality translates into approximately 400 million potential consumers who experience digestive discomfort from conventional dairy products, creating sustained demand for plant-based alternatives. The regional variation in lactose intolerance prevalence explains why southern states like Tamil Nadu and Karnataka demonstrate higher per-capita consumption of non-dairy products compared to northern regions. FSSAI's (Food Safety and Standards Authority of India) recognition of this health imperative has led to streamlined approval processes for lactose-free and plant-based dairy analogues, reducing regulatory barriers for manufacturers. The demographic shift toward urbanization amplifies this trend, as urban consumers demonstrate greater willingness to experiment with alternative products and possess higher purchasing power to afford premium plant-based options.

Youth Shifting Toward Vegan, Flexitarian Diets Accelerates Adoption

India's millennial and Gen-Z demographics increasingly embrace flexitarian and plant-forward eating patterns, with 63% of urban consumers aged 18-35 incorporating plant-based alternatives into their diets at least twice weekly, according to recent consumer surveys. This generational shift stems from environmental consciousness, health awareness, and exposure to global dietary trends through digital platforms and international travel. The trend gains momentum through educational institutions, where hostel mess services and campus cafeterias increasingly offer plant-based options to cater to diverse dietary preferences. Corporate wellness programs in IT hubs like Bangalore and Hyderabad actively promote plant-based nutrition, creating workplace demand that extends to retail purchasing decisions. The segment's purchasing power continues expanding as India's median age remains 28 years, ensuring sustained market growth as these consumers mature and establish household purchasing patterns according to the Ministry of Statistics and Programme Implementation.

Shorter Shelf Life Compared to UHT Dairy Constrains Distribution Economics

Plant-based alternatives typically maintain 7-14 days refrigerated shelf life compared to UHT (Ultra-high temperature) dairy's 6-month ambient storage capability, creating significant distribution and inventory management challenges for retailers and manufacturers. This limitation particularly impacts tier-2 and tier-3 cities where cold chain infrastructure coverage remains below 40% and inventory turnover rates lag metropolitan areas by 30-40%. The shorter shelf life increases wastage rates, with retailers reporting 8-12% product losses compared to 2-3% for UHT dairy products, directly impacting profit margins and pricing strategies. Manufacturers invest heavily in packaging innovations and preservative technologies to extend shelf life, but these solutions increase production costs by 15-25% compared to conventional dairy processing. The constraint forces companies to maintain smaller distribution networks and higher inventory turnover requirements, limiting market penetration speed and geographic expansion capabilities.

Other drivers and restraints analyzed in the detailed report include:

- Social Media, Influencers Promote Plant Diets Through Digital Engagement

- Growing Concern Over Dairy Animal Welfare Influences Purchase Decisions

- Taste, Texture Often Inferior to Cow's Milk Affects Consumer Retention

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-dairy milk commands 85.10% market share in 2025, reflecting its fundamental role as a direct dairy substitute across multiple consumption occasions from beverages to cooking applications. The segment's dominance stems from its versatility in traditional Indian preparations like tea, coffee, and desserts, where functional performance closely matches conventional milk. Oat milk emerges as the fastest-growing variant within this category, driven by its superior frothing capabilities and creamy texture that appeals to cafe and foodservice applications. Almond milk maintains strong positioning in health-conscious segments, while coconut milk leverages traditional familiarity in South Indian cuisine. Soy milk, despite being the earliest entrant, faces declining share due to taste preferences and concerns about processing methods.

The fastest-growing segment, non-dairy butter at 9.72% CAGR through 2031, indicates expanding consumer experimentation beyond liquid alternatives into solid dairy replacements. This growth reflects increasing sophistication in plant-based product development and consumer willingness to trial premium alternatives for baking and cooking applications. Non-dairy cheese and yogurt segments remain nascent but demonstrate potential as manufacturers improve texture and flavor profiles through advanced fermentation technologies. The segment expansion creates opportunities for specialized players focusing on specific product categories rather than broad portfolios, enabling targeted innovation and marketing strategies.

The India Dairy Alternatives Market is Segmented by Type (Non-Dairy Desserts, Non-Dairy Cheese, Non-Dairy Milk, Non-Dairy Yogurt, and Others), Packaging Type (PET Bottles, Cans, Cartons, Others), Distribution Channel (Off-Trade, On-Trade). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons)

List of Companies Covered in this Report:

- Blue Diamond Growers, Inc.

- Dabur India Limited

- Danone

- Nestle

- Life Health Foods (India) Pvt. Ltd.

- Wingreens Farms Pvt. Ltd.

- Raw Pressery

- ITC Limited

- Drums Food International Pvt. Ltd.

- Oatly Group AB

- One Good

- Urban Platter

- Arla Foods amba

- Godrej Tyson Foods Ltd

- Body Cupid Pvt. Ltd.

- Hershey India Pvt. Ltd. (The Hershey Company)

- Tata Consumer Products Limited

- Schreiber Foods Inc.

- Kraft Heinz

- Groupe Lactalis S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Presence of lactose intolerance popualtion

- 4.2.2 Youth shifting toward vegan, flexitarian diets

- 4.2.3 Social media, influencers promote plant diets

- 4.2.4 Growing concern over dairy animal welfare

- 4.2.5 Modern retail, cafes expanding product range

- 4.2.6 Preference towards managing managing heart health, diabetes

- 4.3 Market Restraints

- 4.3.1 Shorter shelf life compared to UHT dairy

- 4.3.2 Taste, texture often inferior to cow's milk

- 4.3.3 Labeling laws restrict use of "milk" terms

- 4.3.4 Poor cold chain outside metro cities

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE and VOLUME )

- 5.1 By Type

- 5.1.1 Non-Dairy Milk

- 5.1.1.1 Oat Milk

- 5.1.1.2 Hemp Milk

- 5.1.1.3 Hazelnut Milk

- 5.1.1.4 Soy Milk

- 5.1.1.5 Almond Milk

- 5.1.1.6 Coconut Milk

- 5.1.1.7 Cashew Milk

- 5.1.2 Non-Dairy Cheese

- 5.1.3 Non-Dairy Desserts

- 5.1.4 Non-Dairy Yogurt

- 5.1.5 Others

- 5.1.1 Non-Dairy Milk

- 5.2 Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Cans

- 5.2.3 Cartons

- 5.2.4 Others

- 5.3 Distribution Channel

- 5.3.1 On-trade

- 5.3.2 Off-trade

- 5.3.2.1 Convenience Stores

- 5.3.2.2 Supermarkets and Hypermarkets

- 5.3.2.3 Online Retail Stores

- 5.3.2.4 Other Distribution Channel

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Blue Diamond Growers, Inc.

- 6.4.2 Dabur India Limited

- 6.4.3 Danone

- 6.4.4 Nestle

- 6.4.5 Life Health Foods (India) Pvt. Ltd.

- 6.4.6 Wingreens Farms Pvt. Ltd.

- 6.4.7 Raw Pressery

- 6.4.8 ITC Limited

- 6.4.9 Drums Food International Pvt. Ltd.

- 6.4.10 Oatly Group AB

- 6.4.11 One Good

- 6.4.12 Urban Platter

- 6.4.13 Arla Foods amba

- 6.4.14 Godrej Tyson Foods Ltd

- 6.4.15 Body Cupid Pvt. Ltd.

- 6.4.16 Hershey India Pvt. Ltd. (The Hershey Company)

- 6.4.17 Tata Consumer Products Limited

- 6.4.18 Schreiber Foods Inc.

- 6.4.19 Kraft Heinz

- 6.4.20 Groupe Lactalis S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK