PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911786

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911786

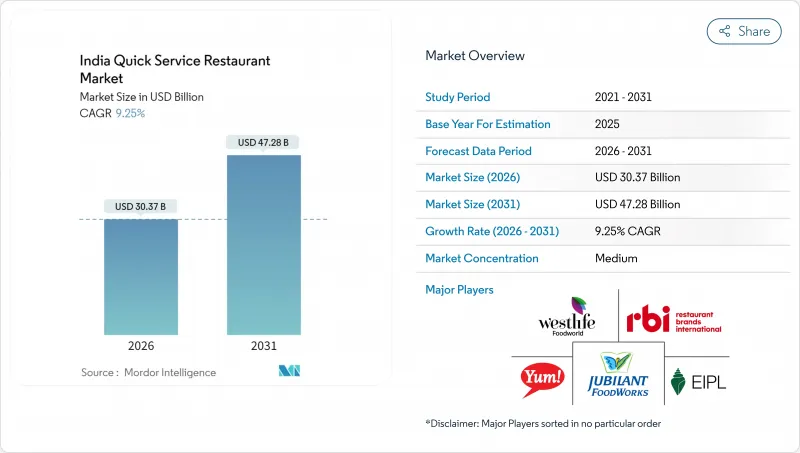

India Quick Service Restaurant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India quick service restaurant market size in 2026 is estimated at USD 30.37 billion, growing from 2025 value of USD 27.80 billion with 2031 projections showing USD 47.28 billion, growing at 9.25% CAGR over 2026-2031.

This growth is driven by increasing disposable incomes in metropolitan and tier-1 cities, as well as the widespread adoption of food delivery applications. The rise of asset-light cloud-kitchen models has significantly shifted consumer preferences from traditional home-cooked meals to branded, convenient food options. The growing reliance on digital ordering platforms has enabled quick service restaurants to gather detailed transaction data, which is often unavailable in dine-in formats. This data facilitates targeted marketing strategies, precision-based promotions, and dynamic pricing models. The India quick service restaurant market demonstrates moderate consolidation, with key players leveraging technology and evolving consumer trends to maintain competitiveness and expand their market presence.

India Quick Service Restaurant Market Trends and Insights

Popularity of online food-delivery apps and digital ordering platforms

The growing use of online food-delivery apps and digital ordering platforms is significantly driving the quick service restaurant (QSR) market in India. As of March 2024, India had 954.40 million internet subscribers, according to India Brand Equity Foundation, which has greatly expanded the reach of platforms like Zomato and Swiggy. These platforms collectively handle billions of orders annually and have contributed to a delivery growth rate of approximately 30%. By managing customer data and payment systems, these aggregators have also launched their own private-label brands, creating direct competition with the restaurants they partner with. Meanwhile, QSR operators are increasingly adopting advanced technologies such as self-order kiosks and AI-powered menu optimization.

Growing cafe and snacking culture

With rising disposable incomes and a strengthening economy, consumers are increasingly spending on premium beverages and casual snacks. According to the International Monetary Fund, India's GDP is projected to reach USD 4,150 billion in 2025, reflecting the country's improving financial position. This economic growth is encouraging people to indulge in high-quality cafe experiences. Popular brands like Starbucks and Barista are transforming cafe formats by offering premium products and creating experience-focused spaces. At the same time, quick-snack chains such as Wow! Momo is catering to the fast-paced lifestyles of consumers who prefer convenient, on-the-go options. High-margin items, such as cold brews and single-origin coffees, are helping cafes boost their profitability.

Stringent food-safety, licensing, and regulatory compliance requirements

Strict food safety, licensing, and regulatory requirements continue to pose significant hurdles to the growth and flexibility of India's restaurant sector. For example, the introduction of the 14-digit Food Safety and Standards Authority of India (FSSAI) license requires each restaurant outlet to register separately, which increases compliance costs for individual locations. Restaurants must also comply with hygiene ratings, undergo regular inspections, and adhere to updated labeling regulations. These rules include displaying calorie counts, allergen information, and full ingredient lists, often necessitating costly updates to packaging and menu designs. Restaurant operators must obtain multiple approvals, including health trade licenses, fire safety clearances, pollution control permits, shop and establishment registrations, and excise permits for serving alcohol in applicable states.

Other drivers and restraints analyzed in the detailed report include:

- Exposure to global cuisines and western food habits

- Increasing youth population and social-media influence

- Intense competition from delivery-only cloud kitchens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dine-in formats accounted for 45.10% of the India quick service restaurant market in 2025, driven by their appeal for social gatherings and group outings. Consumers continue to prefer dine-in options for the ambiance, quick table service, and familiarity with menus. These formats excel in high-traffic areas, such as malls, transit hubs, and food courts, where convenience and accessibility draw customers. To enhance efficiency, brands are incorporating compact seating arrangements and self-order kiosks. Despite the growing popularity of delivery services, dine-in remains important for those who value fresh food, immediate service, and shared dining experiences.

Delivery services are expected to grow at a 12.33% CAGR through 2031, nearly three times faster than dine-in formats, as convenience and speed redefine consumer habits. The rise of ultra-fast delivery models, such as 15-minute fulfillment, is setting new standards for reliability and efficiency across various cuisines. Restaurants are adapting by improving packaging, creating delivery-specific menu items, and partnering with aggregators to expand their reach. With more consumers, especially younger, tech-savvy ones, opting for at-home dining, delivery is poised to become the main growth driver for quick service restaurants while still complementing in-store dining traffic.

Bakeries accounted for 18.42% of the India quick service restaurant market in 2025, driven by the presence of well-established chains, local patisseries, and a strong preference for freshly baked snacks. Their popularity stems from affordable pricing, a wide range of products, and easy accessibility in neighborhoods. Bakeries also benefit from frequent purchases, as they cater to common habits like breakfast and evening snacking. The introduction of innovative products such as artisanal breads, fusion pastries, and festive-themed assortments ensures their continued relevance in both metropolitan and smaller cities.

The pizza segment is expected to grow at a CAGR of 11.52% through 2031, making it one of the fastest-growing categories in the quick service restaurant market. Pizza chains are increasingly adopting AI-based tools to forecast demand, minimize dough wastage, and optimize inventory management, which helps improve profitability. The trend of premiumization, including gourmet crusts, high-quality cheeses, and diverse topping options, is driving higher average spending per order. With its suitability for both dine-in and delivery formats, the pizza category is well-positioned to capture a larger share of the market, especially among urban consumers and younger demographics.

The India Quick Service Restaurant Market Report is Segmented by Service Type (Dine-In, Delivery, and More), Cuisine (Asian, European, and More), Outlet (Chained Outlets and Independent Outlets), and Location (Leisure, Travel, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cafe Coffee Day Enterprises Ltd

- Eversub India Pvt. Limited (Subway)

- Graviss Foods Pvt Ltd (Baskin Robbins)

- Jubilant FoodWorks Ltd

- McDonald's Corp. (Westlife Foodworld)

- Restaurant Brands Asia Ltd

- Starbucks Corporation

- Wow! Momo Foods Pvt Ltd

- Yum! Brands Inc.

- Devyani International Ltd

- Rebel Foods Pvt Ltd

- Barbeque Nation Hospitality Ltd

- Haldiram Snacks Food Pvt Ltd

- Sunshine Teahouse Private Limited

- Mountain Trail Foods Pvt. Ltd

- Goli Vada Pav Pvt Ltd

- Burger Singh (Tipping Mr Pink Pvt Ltd)

- Bikanervala Foods Pvt Ltd

- Saravana Bhavan Private Limited

- Sagar Ratna Restaurants Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Trend Analysis

- 4.2.1 Number of Outlets

- 4.2.2 Average Order Value

- 4.2.3 Menu Analysis

- 4.3 Market Drivers

- 4.3.1 Popularity of online food delivery apps and digital ordering platforms

- 4.3.2 Changing consumer tastes and menu localisation by brands

- 4.3.3 Increasing youth population and social media influence

- 4.3.4 Exposure to global cuisines and western food habits

- 4.3.5 Strategic partnerships between QSRs and delivery aggregators

- 4.3.6 Growing cafe and snacking culture

- 4.4 Market Restraints

- 4.4.1 High rental and real-estate costs

- 4.4.2 Rising raw material and commodity inflation

- 4.4.3 Stringent food-safety, licensing and regulatory compliance requirements

- 4.4.4 Intense competition from delivery-only cloud kitchens

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Dine-In

- 5.1.2 Takeaway

- 5.1.3 Delivery

- 5.2 By Cuisine

- 5.2.1 Bakeries

- 5.2.2 Burger

- 5.2.3 Ice Cream

- 5.2.4 Meat-Based Cuisines

- 5.2.5 Pizza

- 5.2.6 Other QSR Cuisines

- 5.3 By Outlet

- 5.3.1 Chained Outlets

- 5.3.2 Independent Outlets

- 5.4 By Location

- 5.4.1 Leisure

- 5.4.2 Lodging

- 5.4.3 Retail

- 5.4.4 Standalone

- 5.4.5 Travel

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cafe Coffee Day Enterprises Ltd

- 6.4.2 Eversub India Pvt. Limited (Subway)

- 6.4.3 Graviss Foods Pvt Ltd (Baskin Robbins)

- 6.4.4 Jubilant FoodWorks Ltd

- 6.4.5 McDonald's Corp. (Westlife Foodworld)

- 6.4.6 Restaurant Brands Asia Ltd

- 6.4.7 Starbucks Corporation

- 6.4.8 Wow! Momo Foods Pvt Ltd

- 6.4.9 Yum! Brands Inc.

- 6.4.10 Devyani International Ltd

- 6.4.11 Rebel Foods Pvt Ltd

- 6.4.12 Barbeque Nation Hospitality Ltd

- 6.4.13 Haldiram Snacks Food Pvt Ltd

- 6.4.14 Sunshine Teahouse Private Limited

- 6.4.15 Mountain Trail Foods Pvt. Ltd

- 6.4.16 Goli Vada Pav Pvt Ltd

- 6.4.17 Burger Singh (Tipping Mr Pink Pvt Ltd)

- 6.4.18 Bikanervala Foods Pvt Ltd

- 6.4.19 Saravana Bhavan Private Limited

- 6.4.20 Sagar Ratna Restaurants Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK