PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911798

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911798

India Lathe Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

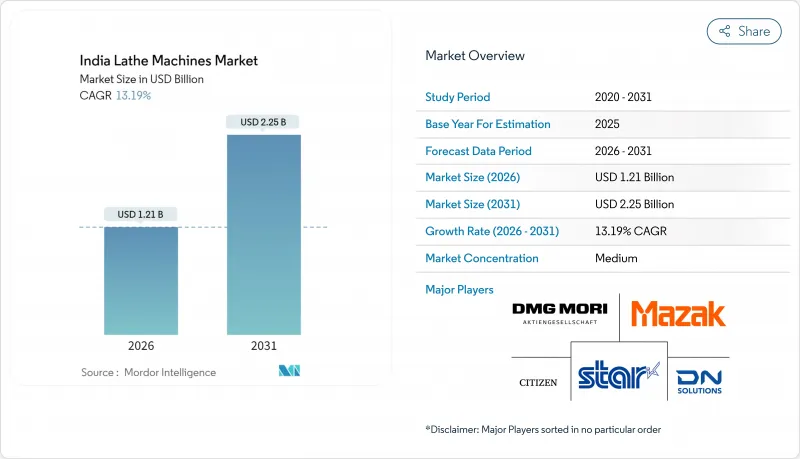

The India Lathe Machines market was valued at USD 1.07 billion in 2025 and estimated to grow from USD 1.21 billion in 2026 to reach USD 2.25 billion by 2031, at a CAGR of 13.19% during the forecast period (2026-2031).

The acceleration is fueled by Production Linked Incentive (PLI) allocations, the electric-vehicle manufacturing surge, and widespread automation adoption among micro-, small-, and medium-enterprises (MSMEs). Growing demand from aerospace, defense, and medical-device clusters is broadening the end-user base and reducing historical reliance on automotive machining. Competition is intensifying as Industry 4.0 retrofit kits lower upgrade costs, enabling tier-2 manufacturers to access advanced capabilities. Meanwhile, global and domestic players are racing to embed Internet of Things (IoT) connectivity, predictive maintenance, and multi-axis precision to win high-margin orders. These converging forces promise sustained momentum for the India Lathe Machines market through 2030.

India Lathe Machines Market Trends and Insights

Government PLI Incentives Accelerate Domestic Capital Goods Production

The INR 1.97 lakh-crore PLI program has set minimum investment thresholds that compel beneficiaries to procure precision CNC lathes during plant build-outs. Dedicated Smart Advanced Manufacturing hubs in Pune, Delhi, Bengaluru, and Bengaluru's CMTI offer technical guidance, ensuring sustained rather than one-off equipment purchases. Domestic content conditions under PLI further push manufacturers toward locally sourced India Lathe Machines market solutions that meet stringent value-addition norms.

EV Power-train Manufacturing Drives Precision Demand

India assembled 1.5 million electric vehicles in 2024, and rotor concentricity requirements below 0.01 mm have accelerated the adoption of Swiss-type automatic lathes in Tamil Nadu's rapidly growing EV corridor. Localization targets of 70% by 2030 guarantee steady domestic machining volumes and limit import substitution, further enlarging the India Lathe Machines market.

Capital Expenditure Barriers Limit Multi-Axis Adoption

Swiss-type models priced at Rs 50 lakh-Rs 5 crore cost three to five times more than conventional units, stretching MSME budgets. Tooling, fixtures, and CAM software add 20-30% to acquisition cost, while collateral-heavy bank lending limits uptake despite partial guarantees under CGTMSE.

Other drivers and restraints analyzed in the detailed report include:

- MSME Automation Adoption Accelerates Across Industrial Clusters

- Medical-Device Clusters Create High-Precision Opportunities

- Skills Shortage Constrains Automation Rollout

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CNC platforms captured 53.05% of 2025 revenue in the India Lathe Machines market, substantiating decades of programmable machining adoption. Swiss-type automatic models are on track for a 14.02% CAGR through 2031 as EV, aerospace, and medical-device customers demand complex multi-axis capability. The India Lathe Machines market size for Swiss-type solutions could surpass USD 0.47 billion by 2031, while conventional units decline as retrofit kits bridge affordability gaps. Global firms such as Nidec Machine Tool are ramping up tool-factory projects in Tamil Nadu to serve this precision demand.

The performance gap between conventional and CNC machines is narrowing in cost terms as retrofit packages extend equipment life cycles. As a result, small job shops can compete for high-tolerance contracts previously reserved for large OEM suppliers, accelerating diffusion of quality standards across the India Lathe Machines market.

Semi-automatic systems held 51.20% of revenue in 2025; however, automatic units are forecast to command 38.20% of value by 2031 on a 14.08% CAGR. The India Lathe Machines market share for automatic control jumps whenever firms face skilled-labor shortages or stringent traceability norms. Remote spindle monitoring and digital logbooks support regulatory compliance in medical and aerospace verticals, tipping investment decisions toward full automation.

Meanwhile, manual platforms still populate training centers and low-volume shops but are expected to fall below 9.60% by 2031 as digital literacy improves. The hybrid strategy of starting with semi-automatic machines then layering Industry 4.0 modules remains a cost-effective path for MSMEs seeking incremental change.

The India Lathe Machines Market Report is Segmented by Product Type (CNC Lathe, Conventional Lathe, and Swiss-Type Automatic Lathe), Control Type (Manual, Semi-Automatic, and Automatic), Operation (Turning, Facing, and More), End-User Industry (Automotive, Aerospace and Defence, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Yamazaki Mazak Corporation

- DMG MORI Aktiengesellschaft

- Doosan Machine Tools Co. Ltd. (DN Solutions)

- Citizen Machinery Co. Ltd.

- Star Micronics Co. Ltd.

- Okuma Corporation

- Haas Automation Inc.

- Tsugami Corporation

- Tornos Group SA

- Bharat Fritz Werner Ltd.

- Lakshmi Machine Works Ltd.

- Ace Micromatic Group (Ace Designers Ltd.)

- Jyoti CNC Automation Ltd.

- HMT Machine Tools Ltd.

- Galaxy-Tajmac India Pvt Ltd.

- Laxmi Metal AND Machines

- Arrow Machine Tools Pvt Ltd.

- Micromatic Machine Tools Pvt Ltd.

- Emag India Pvt Ltd.

- Murata Machinery Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated automation adoption in Indian MSME manufacturing

- 4.2.2 Government PLI incentives for domestic capital-goods production

- 4.2.3 Surge in EV power-train machining demand

- 4.2.4 Rapid rise of medical-device clusters (Tamil Nadu, Telangana)

- 4.2.5 Industry 4.0 retro-fit kits lowering upgrade costs

- 4.2.6 Local sourcing mandates in defence offset contracts

- 4.3 Market Restraints

- 4.3.1 High upfront capex for multi-axis CNC systems

- 4.3.2 Inadequate nationwide machine-tool financing instruments

- 4.3.3 Shortage of trained CNC programmers and operators

- 4.3.4 Persistent power-quality issues in tier-2 industrial hubs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 CNC Lathe

- 5.1.2 Conventional Lathe

- 5.1.3 Swiss-type Automatic Lathe

- 5.2 By Control Type

- 5.2.1 Manual

- 5.2.2 Semi-automatic

- 5.2.3 Automatic

- 5.3 By Operation

- 5.3.1 Turning

- 5.3.2 Facing

- 5.3.3 Boring

- 5.3.4 Cutting / Parting

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defence

- 5.4.3 General Manufacturing

- 5.4.4 Metal Industry

- 5.4.5 Other End-user Industries

- 5.5 By Region

- 5.5.1 North India

- 5.5.2 West India

- 5.5.3 South India

- 5.5.4 East India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Yamazaki Mazak Corporation

- 6.4.2 DMG MORI Aktiengesellschaft

- 6.4.3 Doosan Machine Tools Co. Ltd. (DN Solutions)

- 6.4.4 Citizen Machinery Co. Ltd.

- 6.4.5 Star Micronics Co. Ltd.

- 6.4.6 Okuma Corporation

- 6.4.7 Haas Automation Inc.

- 6.4.8 Tsugami Corporation

- 6.4.9 Tornos Group SA

- 6.4.10 Bharat Fritz Werner Ltd.

- 6.4.11 Lakshmi Machine Works Ltd.

- 6.4.12 Ace Micromatic Group (Ace Designers Ltd.)

- 6.4.13 Jyoti CNC Automation Ltd.

- 6.4.14 HMT Machine Tools Ltd.

- 6.4.15 Galaxy-Tajmac India Pvt Ltd.

- 6.4.16 Laxmi Metal AND Machines

- 6.4.17 Arrow Machine Tools Pvt Ltd.

- 6.4.18 Micromatic Machine Tools Pvt Ltd.

- 6.4.19 Emag India Pvt Ltd.

- 6.4.20 Murata Machinery Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment