PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911800

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911800

Middle East Mareketing And Advertising Agency Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

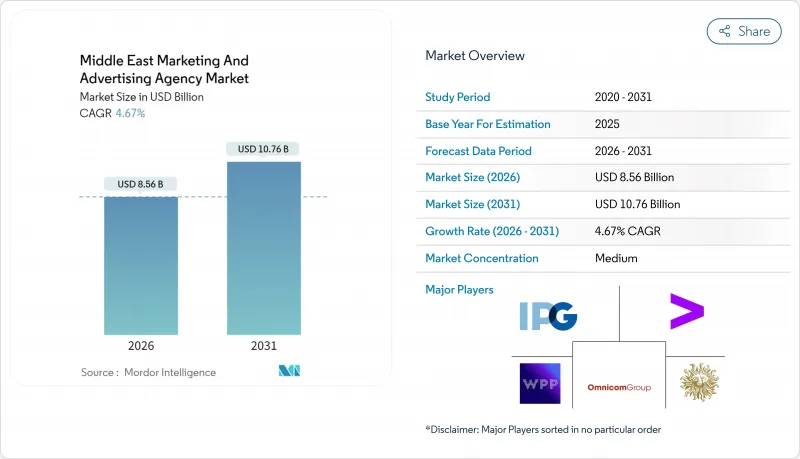

The Middle East marketing and advertising agency market was valued at USD 8.18 billion in 2025 and estimated to grow from USD 8.56 billion in 2026 to reach USD 10.76 billion by 2031, at a CAGR of 4.67% during the forecast period (2026-2031).

Growth is rooted in economic-diversification agendas led by Saudi Arabia and the UAE, mega-projects such as NEOM and Riyadh Expo 2030, and rapid digital-media adoption that is reshaping spend across traditional and online channels. Gaming's 89% participation rate and the emergence of an esports ecosystem are widening revenue streams, while 75% of GCC enterprises already deploy generative-AI tools that could add USD 21-35 billion in yearly economic output. Consolidation among global holding companies, combined with double-digit growth at regional independents, is intensifying competitive dynamics and accelerating technology investment. At the same time, SME budget limits and rising in-house teams temper near-term agency billings, creating a mixed but opportunity-rich landscape for service providers that can demonstrate cultural fluency and measurable ROI.

Middle East Marketing And Advertising Agency Market Trends and Insights

Rising digital-ad spend among GCC corporates

GCC companies invested USD 5.5 billion in digital advertising during 2022 and are on track to reach USD 25.5 billion by 2024, with Saudi Arabia contributing 58% of the incremental spend. Agencies respond by scaling programmatic buying and connected-TV propositions; Dentsu's region-first curated CTV marketplace improved attention scores by 18% and viewability by 17% compared with open exchanges. Streaming adoption is mainstream, as 65% of UAE residents view connected-TV daily, prompting marketers to overhaul cross-platform attribution. First-party data is becoming agency currency because privacy rules devalue third-party cookies. Collectively, these factors push clients to prioritize digital specialists capable of delivering measurable outcomes linked to sales lift.

Government diversification (Saudi and UAE Visions 2030)

Saudi Vision 2030 generated SAR 457 billion in non-oil revenue in 2023 and earmarks USD 1 trillion for tourism aimed at 100 million annual visitors by 2030. Marketing communications promote giga-projects such as NEOM's USD 500 billion city and Riyadh Expo 2030, placing sustained demand on agencies for destination branding, international media, and cultural storytelling. AlUla's tourism drive, which targets 2 million annual visitors and USD 31.9 billion GDP contribution, showcases how niche cultural positioning can unlock global awareness. Parallel UAE programs around Dubai Expo bids and Abu Dhabi culture hubs amplify experiential and digital storytelling spend. Long contractual timelines and budget certainty make government diversification a structural, high-impact driver through 2030.

SME budget constraints

Roughly 43% of regional SMEs trimmed marketing outlays in the last fiscal cycle despite digital imperatives. A UAE study shows SMEs connect with customers frequently yet rank marketing below operational spending priorities. Spend-management fintechs, such as Pemo, automate expense tracking, offering agencies a foothold to demonstrate ROI, though uptake remains limited among traditional owners. Inflation and supply-chain volatility push small firms toward near-term sales promotions over sustained brand building. Agencies therefore experiment with subscription packages and self-service dashboards to keep SME clients engaged during budget squeezes.

Other drivers and restraints analyzed in the detailed report include:

- Social-media and mobile penetration surge

- E-commerce performance-marketing boom

- In-housing of marketing functions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Middle East marketing and advertising agency market size for Digital-Only Agencies stood at 45.80% of 2025 billings, underscoring how data-driven media, social commerce, and programmatic buying now anchor most campaign briefs. In the same year, AI-Driven Creative Studios contributed a modest revenue base yet are projected to expand at a 12.15% CAGR to 2031 as generative-AI tools automate ideation, versioning, and performance optimization. Full-Service Agencies keep a powerful foothold by orchestrating omni-channel programs for giga projects such as NEOM and Abu Dhabi's cultural districts. Media Buying and Planning specialists ride the connected-TV wave now that 65% of UAE residents consume streaming daily, while Creative and Branding Boutiques monetize luxury tourism and heritage campaigns linked to Vision 2030. PR and Reputation shops remain vital whenever public-sector entities require stakeholder alignment on diversification narratives. The diversity of mandates means a single holding company may operate multiple labels in the same pitch, illustrating the fluid boundaries between integrated and specialist models. Tech investments matter: Publicis committed USD 300 million for AI tooling over three years, while WPP earmarked USD 250 million annually, reinforcing a regional arms race for proprietary MarTech. Over the forecast horizon, AI-aided workflow efficiencies could compress unit margins yet enlarge the overall fee pool by unlocking previously cost-prohibitive micro-campaigns at scale.

The historical trajectory shows Digital-Only players evolving from social-media community managers into end-to-end growth partners that advise on customer data platforms, server-side tagging, and privacy-safe targeting. Compliance pressures grow alongside opportunity: UAE's National Media Council insists on transparent creator disclosure, and Saudi regulators forbid imagery misaligned with Islamic principles, making bilingual cultural competence a strategic differentiator. Players that hard-wire governance into creative processes convert regulatory hurdles into retention advantages, particularly when multinational advertisers fear reputational risk.

Large Enterprises captured 56.30% of the Middle East marketing and advertising agency market share in 2025 thanks to mega-budget tourism, telecom, and finance accounts. Their complex compliance needs and cross-border footprints favour full-service, one-throat-to-choke relationships, often signed as multi-year master services agreements. Yet SMEs are expected to clock a 8.96% CAGR through 2031 as fintech-enabled expense automation and self-serve ad platforms lower entry barriers. Subscription retainers, outcome-based payment models, and white-labelled dashboards are emerging to court founders wary of opaque retainers. Agencies that pre-integrate with spend-management tools like Pemo demonstrate real-time ROI and defend their fee line. The greatest upside appears in lifestyle, F&B, and creator-commerce categories where localized storytelling delivers outsized sales lift even on budgets below USD 50,000. Conversely, inflation and supply-chain uncertainty still drive 43% of SMEs to defer brand-building in favour of quick-turn promotions, meaning agencies must prove elasticity between tactical and strategic scopes.

Over time, Vision 2030 supplier-development funds and Bahrain's Tamkeen grants should expand the capital available for marketing, particularly when public-sector anchor projects demand local supply-chain participation. This dynamic transforms SMEs from risk-averse price negotiators into ecosystem partners that co-innovate formats and test beds an evolution that could shift wallet share away from B2C consumer products toward B2B technology services.

The Middle East Marketing and Advertising Agency Market Report is Segmented by Service Type (Full-Service Agencies, Digital-Only Agencies, and More), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), Coverage Model (Full-Service Mandates, Specialized Engagements), End-User Sector (Public and Institutional, Private Enterprises), Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- WPP plc

- Publicis Groupe

- Omnicom Group Inc.

- Interpublic Group (IPG)

- Accenture Song

- Dentsu Group Inc.

- Havas Middle East (Vivendi)

- Creative Waves

- Extend The Ad Network

- Creative Habbar

- Advertising Ways Co.

- FP7 McCann

- Memac Ogilvy

- Horizon FCB

- TBWA\RAAD

- Impact BBDO

- Leo Burnett KSA

- UM MENA

- Starcom MENA

- Mindshare MENA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising digital-ad spend among GCC corporates

- 4.2.2 Government diversification (Saudi and UAE Visions 2030)

- 4.2.3 Social-media and mobile penetration surge

- 4.2.4 E-commerce performance-marketing boom

- 4.2.5 Esports and gaming sponsorship uptake (under-radar)

- 4.2.6 Mega-events tourism (Neom, Expo 2030) (under-radar)

- 4.3 Market Restraints

- 4.3.1 SME budget constraints

- 4.3.2 In-housing of marketing functions

- 4.3.3 Bilingual data-driven-creative talent gap (under-radar)

- 4.3.4 Strict cultural-content regulations (under-radar)

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI-creative, MarTech, CDPs)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Full-Service Agencies

- 5.1.2 Digital-Only Agencies

- 5.1.3 Media Buying and Planning

- 5.1.4 Creative and Branding Boutiques

- 5.1.5 PR and Reputation Management

- 5.2 By Organization Size

- 5.2.1 Small and Medium-sized Enterprises (Less than equal to 250 employees)

- 5.2.2 Large Enterprises (More than 250 employees)

- 5.3 By Coverage Model

- 5.3.1 Full-Service Mandates

- 5.3.2 Specialized/Best-of-Breed Engagements

- 5.4 By End-user Sector

- 5.4.1 Public and Institutional

- 5.4.2 Private Enterprises

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.1.1 Riyadh

- 5.5.1.2 Jeddah

- 5.5.1.3 Dammam

- 5.5.2 United Arab Emirates

- 5.5.2.1 Dubai

- 5.5.2.2 Abu Dhabi

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Bahrain

- 5.5.6 Oman

- 5.5.1 Saudi Arabia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes global overview, market level overview, core segments, financials as available, strategic information, market rank/share, products and services, recent developments)

- 6.4.1 WPP plc

- 6.4.2 Publicis Groupe

- 6.4.3 Omnicom Group Inc.

- 6.4.4 Interpublic Group (IPG)

- 6.4.5 Accenture Song

- 6.4.6 Dentsu Group Inc.

- 6.4.7 Havas Middle East (Vivendi)

- 6.4.8 Creative Waves

- 6.4.9 Extend The Ad Network

- 6.4.10 Creative Habbar

- 6.4.11 Advertising Ways Co.

- 6.4.12 FP7 McCann

- 6.4.13 Memac Ogilvy

- 6.4.14 Horizon FCB

- 6.4.15 TBWA\RAAD

- 6.4.16 Impact BBDO

- 6.4.17 Leo Burnett KSA

- 6.4.18 UM MENA

- 6.4.19 Starcom MENA

- 6.4.20 Mindshare MENA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment