PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911809

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911809

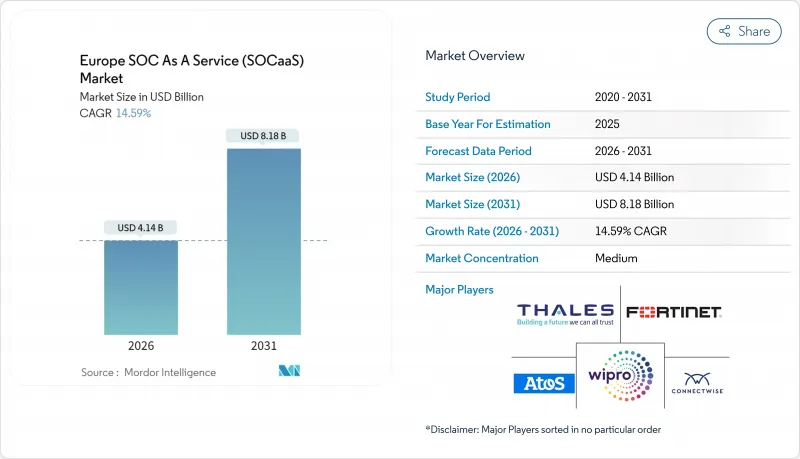

Europe SOC As A Service (SOCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Security Operations Center as a Service (SOCaaS) market size in 2026 is estimated at USD 4.14 billion, growing from 2025 value of USD 3.61 billion with 2031 projections showing USD 8.18 billion, growing at 14.59% CAGR over 2026-2031.

This strong trajectory reflects rapid digitization across critical sectors, the tightening grip of the EU NIS2 Directive, and the growing appeal of flexible pay-per-use models that shift spending from capital budgets to operating expenses. Adoption accelerates as generative-AI analytics shorten detection times, cloud-first architectures simplify cross-border deployment, and telecom-security partnerships bundle connectivity with 24X7 monitoring. At the same time, regional talent shortages and fragmented data-sovereignty rules temper scale advantages for service providers, keeping competition balanced between global giants and European specialists. Heightened cyber-insurance prerequisites, rising operational technology exposure, and persistent ransomware incidents keep board-level attention firmly on outsourced security operations, amplifying demand across industries.

Europe SOC As A Service (SOCaaS) Market Trends and Insights

Rise in Adoption of Pay-per-Use Opex Model

European organizations are shifting security spending from capital budgets to elastic operating models that bill by events or assets monitored, allowing real-time alignment of cost with business demand. The approach lowers upfront barriers for SMEs and frees large enterprises from periodic hardware refresh cycles, accelerating migration toward outsourced operations. Pay-per-use also helps multinational firms tune coverage per jurisdiction, a feature that resonates in the Europe SOC as a Service market where regulatory obligations diverge by country. Service providers respond by offering tiered packages that bundle threat intelligence, response orchestration, and compliance dashboards under a single invoice. Over the medium term, the pricing shift reshapes vendor selection criteria, making transparency and consumption analytics as important as detection accuracy.

Rapid Cloud Migration Among SMEs

Seventy-eight percent of European SMEs moved critical workloads to public clouds during 2024, exposing fresh threat surfaces that legacy point tools cannot secure. These companies now look to cloud-native SOC platforms that plug directly into hyperscaler APIs and deliver instant telemetry without costly appliance rollouts. Nordic SMEs lead adoption, benefiting from mature broadband infrastructure and national digital agendas. As the Digital Decade sets a 75% cloud-adoption target by 2030, the Europe SOC as a Service market gains a long runway for expansion. Providers differentiate through curated playbooks for Microsoft 365, Google Workspace, and multi-cloud scenarios, easing the skills burden for smaller IT teams.

Data Residency and Sovereignty Complexities

Fragmented national rules require separate storage, processing, and log-retention footprints, driving structural cost into multi-tenant operations. France's SecNumCloud and Germany's C5 certifications illustrate divergent frameworks that SOC vendors must satisfy in parallel, often maintaining duplicate infrastructure. Pending legislation such as the EU Data Act adds uncertainty on future cross-border flows, prolonging investment payback periods. Smaller providers face disproportionate burdens, potentially slowing market consolidation and sustaining price competition.

Other drivers and restraints analyzed in the detailed report include:

- EU NIS2 Directive Amplifying Compliance Demand

- Generative-AI Powered Threat Hunting Capabilities

- Scarcity of European SOC-Grade Cyber Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises commanded 62.70% of revenue in 2025, underpinning the Europe SOC as a Service market size for high-complexity, multi-jurisdiction monitoring. Their needs span operational technology, supply-chain telemetry, and dedicated incident response, fostering premium contracts with custom service-level agreements. Yet SMEs, growing at a 16.75% CAGR, inject the greatest volume upside as simplified cloud portals package advanced analytics into digestible bundles. Consumption pricing and native integration with Microsoft 365 accelerate SME onboarding, making onboarding time a key performance metric for providers.

The bifurcated trajectory places pressure on vendors to balance scale with specialization. Platforms tuned for large-enterprise complexity must also present easy paths for smaller customers, leading to modular architectures. Training, customer-success resources, and multilinguistic interfaces become competitive levers, especially in Central and Eastern Europe where English fluency varies. As compliance thresholds creep downward through regulations such as NIS2, SMEs will account for a rising portion of the Europe SOC as a Service market, redistributing revenue toward volume-oriented service tiers.

Banking, financial services, and insurance retained a 26.73% share in 2025, reflecting decades-long investment in security operations and stringent audit obligations. Regulatory alignment with the Digital Operational Resilience Act further cements demand for advanced playbooks and real-time reporting. Healthcare, advancing at a 15.30% CAGR, shifts the spotlight as connected medical devices, telehealth, and electronic records expand attack surfaces. The European Medicines Agency's 2024 guidance on device cybersecurity mandates ongoing monitoring, prompting hospitals to outsource round-the-clock oversight.

Manufacturing embraces SOC-enabled monitoring of industrial control systems, while retail focuses on payment security and customer-data integrity. Government programs such as the EU Cyber Package allocate funding to public-sector SOCs, often delivered in partnership with national telecoms. Overall, sector-specific regulation and unique asset profiles shape tailored detection-engineering and incident-response runbooks, strengthening barriers to entry for generic service models.

The Europe SOC As A Service Market Report is Segmented by Organization Size (Small and Medium-Sized Enterprises, and Large Enterprises), End User (IT and Telecom, BFSI, Healthcare, Manufacturing, Government, and More), Service Type (Managed Detection and Response, and More), Deployment Mode (Cloud, and More), Security Type (Network, Endpoint, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IBM Corporation

- SecureWorks Inc.

- Fortinet Inc.

- Atos SE

- Thales Group

- Wipro Limited

- Cloudflare Inc.

- ConnectWise LLC

- Sophos Limited

- Ontinue Inc.

- PlusServer GmbH

- Teceze Limited

- Arctic Wolf Networks Inc.

- Rapid7 Inc.

- Orange Cyberdefense SA

- NTT Security Holdings Corporation

- Accenture PLC

- Telefonica Tech S.L.U.

- Deloitte Touche Tohmatsu Limited

- KPMG International Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Industry Value-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Market Drivers

- 4.7.1 Rise in Adoption of Pay-per-Use Opex Model

- 4.7.2 Rapid Cloud Migration Among SMEs

- 4.7.3 Mounting Cyber-Insurance Prerequisites for 24x7 Monitoring

- 4.7.4 EU NIS2 Directive Amplifying Compliance Demand

- 4.7.5 Generative AI-Powered Threat Hunting Capabilities

- 4.7.6 Surge in Managed XDR Bundling by Telcos and MSPs

- 4.8 Market Restraints

- 4.8.1 Data Residency and Sovereignty Complexities

- 4.8.2 Scarcity of European SOC-Grade Cyber Talent

- 4.8.3 Hidden Long-Term TCO in Multi-Tenant SIEM

- 4.8.4 Integration Friction with Legacy OT Environments

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization Size

- 5.1.1 Small and Medium-sized Enterprises

- 5.1.2 Large Enterprises

- 5.2 By End User

- 5.2.1 IT and Telecom

- 5.2.2 BFSI

- 5.2.3 Retail and Consumer Goods

- 5.2.4 Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Government

- 5.2.7 Other End Users

- 5.3 By Service Type

- 5.3.1 Managed Detection and Response

- 5.3.2 Security Monitoring

- 5.3.3 Vulnerability Assessment

- 5.3.4 Incident Response

- 5.3.5 Threat Intelligence

- 5.3.6 Managed SIEM

- 5.3.7 Other Service Types

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-Premise

- 5.4.3 Hybrid

- 5.5 By Security Type

- 5.5.1 Network Security

- 5.5.2 Endpoint Security

- 5.5.3 Application Security

- 5.5.4 Cloud Security

- 5.5.5 Other Security Types

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Austria

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Denmark

- 5.6.11 Poland

- 5.6.12 Czechia

- 5.6.13 Slovenia

- 5.6.14 Croatia

- 5.6.15 Bulgaria

- 5.6.16 Belarus

- 5.6.17 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 SecureWorks Inc.

- 6.4.3 Fortinet Inc.

- 6.4.4 Atos SE

- 6.4.5 Thales Group

- 6.4.6 Wipro Limited

- 6.4.7 Cloudflare Inc.

- 6.4.8 ConnectWise LLC

- 6.4.9 Sophos Limited

- 6.4.10 Ontinue Inc.

- 6.4.11 PlusServer GmbH

- 6.4.12 Teceze Limited

- 6.4.13 Arctic Wolf Networks Inc.

- 6.4.14 Rapid7 Inc.

- 6.4.15 Orange Cyberdefense SA

- 6.4.16 NTT Security Holdings Corporation

- 6.4.17 Accenture PLC

- 6.4.18 Telefonica Tech S.L.U.

- 6.4.19 Deloitte Touche Tohmatsu Limited

- 6.4.20 KPMG International Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment