PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911811

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911811

Europe Tumble Dryers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

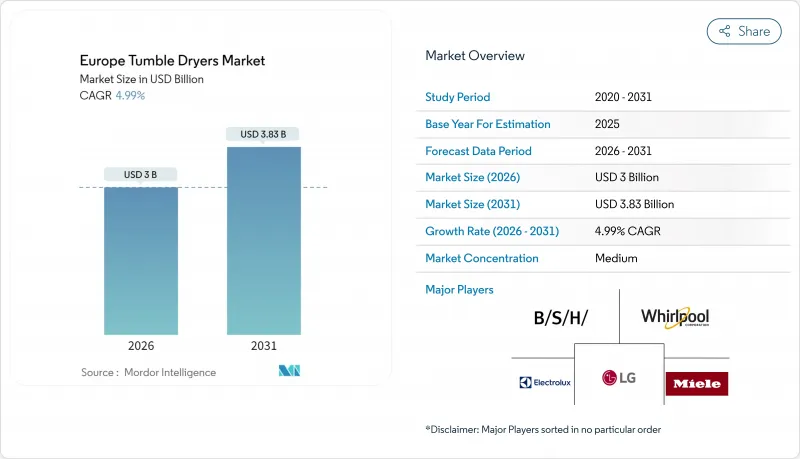

The European tumble dryer market was valued at USD 2.86 billion in 2025 and estimated to grow from USD 3.00 billion in 2026 to reach USD 3.83 billion by 2031, at a CAGR of 4.99% during the forecast period (2026-2031).

In absolute terms, the European tumble dryer market is evolving from a mature replacement-driven appliance category to a technology-led upgrade cycle triggered by the European Union's ecodesign mandate that bans vented and entry-level condenser units from July 2025. . Heat-pump innovation, the rising cost of household energy, and a post-pandemic focus on sustainability jointly underpin healthy demand momentum despite lingering macro volatility. Competitive strategies now hinge on regulatory compliance, premium positioning, and rapid portfolio renewal, while regional disparities remain pronounced as Germany maintains a lead in unit penetration but Spain posts the fastest incremental growth. Price sensitivity in Eastern and parts of Southern Europe tempers immediate heat-pump uptake, yet supportive financing schemes and bulk-procurement programs in social housing are widening the addressable base. Simultaneously, omnichannel distribution, especially via online marketplaces, is remolding customer acquisition economics and favoring brands with direct-to-consumer capabilities. Supply chain friction linked to R290 refrigerant and continued fire-safety scrutiny highlight the market's operational risks, but IoT-ready models and utility demand-response pilots represent adjacent revenue pools that will mature during the outlook period.

Europe Tumble Dryers Market Trends and Insights

EU Energy-Efficiency Mandates Accelerating Heat-Pump Adoption

The July 2025 ecodesign regulation compels manufacturers to eliminate non-heat-pump technology from their European portfolios, instantly transforming the Europe tumble dryer market into a single-technology contest. This rule alone is expected to save 15 TWh of electricity and 1.7 Mt CO2-equivalent by 2040, generating USD 2.8 billion in cumulative consumer savings. A-class ratings now appear exclusively on heat-pump models, effectively relegating vented or basic condenser dryers to non-compliant status. Premium brands such as Miele responded early, unveiling the T2 Nova Edition with InfinityCare drums and wool-specific cycles that showcase fabric-care benefits beyond raw energy efficiency. BSH capitalized on the transition by re-balancing production toward heat-pump units, thereby sustaining profit margins while meeting compliance. The regulation simultaneously introduces a two-tier pricing environment in which premium manufacturers can defend value, whereas value-oriented firms face intense margin pressure. Compliance audits based on ISO 14001 sustainability credentials are becoming procurement prerequisites, further raising competitive barriers for late adopters.

Rising Disposable Income & Replacement Cycles in Western Europe

Improved macro conditions and subdued inflation are rekindling discretionary spending, with EU consumer-durables sales swinging from a 2.90% decline in 2023 to a 2.80% upswing in 2025. Replacement cycles average 8-10 years, and rising electricity tariffs push households to prioritize life-cycle cost over sticker price, favoring heat-pump solutions despite a 2-3X upfront premium. Germany and the Netherlands reinforce adoption via cash-back schemes, while southern markets remain more price sensitive. The European household appliance market is projected to grow from USD 38.48 billion to USD 42.40 billion by 2027, with smart appliances experiencing 26% growth as consumers demand energy efficiency and convenience features. Survey data reveal 80% of UK respondents worried about utility bills, translating into a higher willingness to invest in efficient dryers. Established brands exploit loyalty advantages, as 35% of global consumers list brand reputation as a decisive factor. Altogether, income growth plus replacement urgency contribute a 1.2-percentage-point tailwind to the Europe tumble dryer market CAGR.

High Upfront Price Premium of Heat-Pump Models

Heat-pump dryers often retail for EUR 1,000 (USD 1,090) or more versus EUR 300-400 (USD 327-436) for vented alternatives, creating a steep affordability hurdle. Although lifetime energy savings can exceed USD 500, the payback horizon discourages adoption among lower-income households in Eastern Europe. Financing schemes and government rebates partially bridge the gap, but penetration lags until economies of scale lower unit costs. Samsung and LG are testing entry-level heat-pump SKUs with AI-driven optimization at sub-EUR 800 (USD 872) price points, potentially resetting market expectations. European incumbents must choose between defending margin or sacrificing ASP to accelerate conversion, with each approach influencing brand equity and installed-base economics. In the near term, price barriers shave roughly 1.4 percentage points off the CAGR of the Europe tumble dryer market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-Commerce Channels for MDA Purchases

- Social-Housing Retrofit Programs Specifying Heat-Pump Dryers

- Market Saturation in Core EU-5 Residential Segment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heat-pump models entered 2025 with a 35.44% contribution to the Europe tumble dryer market size and are advancing at a 13.10% CAGR, bolstered by the regulatory ban on vented and basic condenser units effective mid-2025. Condenser dryers, once dominant, still held 50.92% of Europe tumble dryer market share in 2025, yet they face an unavoidable sunset, funneling demand into compliant alternatives. Premium positioning hinges on 70% lower energy consumption and fabric-care advantages, allowing manufacturers to defend pricing even as entry-level SKUs emerge. Samsung's Bespoke AI Laundry Combo illustrates the convergence of large-capacity engineering and machine-learning-based cycle optimization. LG counters with a fully heat-pump Signature stack that reduces power draw to 570 W, demonstrating differing technological bets. Over the forecast horizon, product differentiation will increasingly rely on connectivity, environmental certifications, and after-sales services rather than core mechanical performance alone.

The Europe tumble dryer market also witnesses a gradual fadeout of vented designs, historically popular in the UK due to easy exterior venting in single-family homes. Landlord refurbishments and changing building codes shift those installations toward closed-cycle condensers or heat-pump units. Manufacturers retool factories accordingly, with BSH reallocating production lines to higher-margin heat-pump families. Component suppliers adapt by phasing out resistive heaters and scaling up R290 compressor output. The impending cliff on non-compliant stock encourages retailers to clear inventories through discounting, temporarily distorting average selling prices. Yet post-2025, category revenues rebound as the Europe tumble dryer market pivots to all-heat-pump portfolios linked with bundled service contracts that protect margins.

The Europe Tumble Dryer Market Report is Segmented by Product Type (Heat Pump Tumble Dryer, Condenser Tumble Dryer, Vented Tumble Dryer), End-User (Residential, Commercial), Distribution Channel (Offline, Online), and Geography (United Kingdom, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- BSH Hausgerate GmbH (Bosch/Siemens)

- Whirlpool Corp.

- Electrolux AB

- Miele & Cie. KG

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Candy Hoover Group (Haier Europe)

- Gorenje (Hisense Europe)

- Indesit

- Beko

- Hotpoint

- AEG

- Zanussi

- Teka Group

- Blomberg

- Asko Appliances

- Smeg S.p.A.

- Vestel

- Sharp Corp.

- Grundig

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU energy-efficiency mandates accelerating heat-pump adoption

- 4.2.2 Rising disposable income & replacement cycles in Western Europe

- 4.2.3 Growth of e-commerce channels for MDA purchases

- 4.2.4 Social-housing retrofit programs specifying heat-pump dryers

- 4.2.5 Hospitality ESG targets driving high-efficiency fleet upgrades

- 4.2.6 IoT-ready dryers for utility demand-response pilots

- 4.3 Market Restraints

- 4.3.1 High upfront price premium of heat-pump models

- 4.3.2 Market saturation in core EU-5 residential segment

- 4.3.3 Fire-safety recall incidents denting consumer trust

- 4.3.4 R290 refrigerant supply-chain volatility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Heat Pump Tumble Dryer

- 5.1.2 Condenser Tumble Dryer

- 5.1.3 Vented Tumble Dryer

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Offline

- 5.3.2 Online

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX

- 5.4.6.1 Belgium

- 5.4.6.2 Netherlands

- 5.4.6.3 Luxembourg

- 5.4.7 NORDICS

- 5.4.7.1 Denmark

- 5.4.7.2 Finland

- 5.4.7.3 Iceland

- 5.4.7.4 Norway

- 5.4.7.5 Sweden

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BSH Hausgerate GmbH (Bosch/Siemens)

- 6.4.2 Whirlpool Corp.

- 6.4.3 Electrolux AB

- 6.4.4 Miele & Cie. KG

- 6.4.5 LG Electronics Inc.

- 6.4.6 Samsung Electronics Co. Ltd.

- 6.4.7 Candy Hoover Group (Haier Europe)

- 6.4.8 Gorenje (Hisense Europe)

- 6.4.9 Indesit

- 6.4.10 Beko

- 6.4.11 Hotpoint

- 6.4.12 AEG

- 6.4.13 Zanussi

- 6.4.14 Teka Group

- 6.4.15 Blomberg

- 6.4.16 Asko Appliances

- 6.4.17 Smeg S.p.A.

- 6.4.18 Vestel

- 6.4.19 Sharp Corp.

- 6.4.20 Grundig

7 Market Opportunities & Future Outlook

- 7.1 Demand-response-ready heat-pump dryers integrated into home-energy-management systems

- 7.2 Subscription-based "laundry-appliance-as-a-service" models for urban micro-apartments