PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911812

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911812

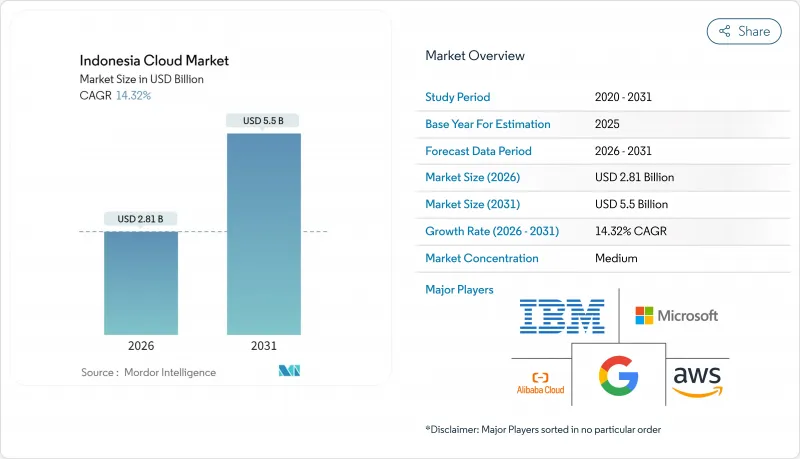

Indonesia Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia cloud market is expected to grow from USD 2.46 billion in 2025 to USD 2.81 billion in 2026 and is forecast to reach USD 5.5 billion by 2031 at 14.32% CAGR over 2026-2031.

This expansion is propelled by sustained enterprise digital-transformation spending, large-scale hyperscaler capital expenditure, and government mandates under the Digital Indonesia 2025 framework. Public cloud retains leadership on the back of Java-centric infrastructure density, while hybrid architectures gain momentum as regulators tighten data-sovereignty rules. Sector-specific cloud platforms that combine AI and compliance functionality differentiate providers, and rising ESG targets push demand for renewable-powered data centers. Talent scarcity and escalating cyber-attack losses temper adoption velocity, but overall growth prospects remain intact as providers embed security-by-design and training initiatives into service portfolios.

Indonesia Cloud Market Trends and Insights

Rapid digital-transformation spend by enterprises

Large corporations modernize core systems to defend market share against digital-native rivals. Microsoft's USD 1.7 billion regional cloud plan and Oracle's USD 6.5 billion Batam campus validate long-term demand. Multi-cloud adoption accelerates as GoTo partners concurrently with Alibaba Cloud and Tencent Cloud to balance pricing and resilience. Telkom Indonesia's alliance with Reka AI shows traditional firms embedding language-aware AI through Platform as a Service to improve customer interactions. Continuous innovation cycles elevate spend beyond one-off migrations, sustaining uptake of higher-margin cloud offerings. This dynamic cements SaaS leadership while igniting demand for DevOps-ready PaaS stacks.

Hyperscaler CAPEX on Indonesian data-center regions

Amazon's USD 5 billion AI-cloud pledge, alongside Digital Realty's USD 499 million Jakarta JV, reinforces confidence in multiyear workload growth. Investment clusters around low-latency corridors in Greater Jakarta and Batam, with renewable power procurement aligning ESG goals. Google Cloud's BerdAIa program illustrates how regional capacity underpins ecosystem building for industry-specific AI. Hyperscalers accept decade-long payback profiles, signaling belief in Indonesia's macro stability and regulatory clarity. Local colocation providers benefit via anchor-tenant demand, catalyzing secondary market development in second-tier cities.

Escalating cybersecurity-breach costs

A USD 8 million ransomware demand on the National Data Center shook enterprise confidence, pushing risk-averse sectors to delay migrations. New child online protection rules add additional security layers, increasing provider overhead. Financial institutions face punitive fines and reputational harm, tilting the market toward vendors with proven zero-trust frameworks. Heightened scrutiny may short-term curb Indonesia's cloud market uptake among late-adopting firms until providers showcase certified resilience programs.

Other drivers and restraints analyzed in the detailed report include:

- Government Digital Indonesia 2025 and e-Gov push

- Surge in e-commerce/fintech cloud workloads

- Complex data-localization and sectoral compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software as a Service accounted for 44.62% of the Indonesian cloud market in 2025 as firms opted for ready-to-run business applications with predictable OPEX. PaaS follows with the fastest 15.42% CAGR, reflecting developer demand for micro-services and container orchestration. Infrastructure as a Service underpins both, supplying elastic compute that smaller SaaS players lease rather than own. Disaster Recovery as a Service uptake spikes after high-profile outages, embedding resiliency into board-level risk agendas.

The Indonesian cloud market size for SaaS will widen as compliance-ready solutions gain traction in BFSI and healthcare. PaaS vendors differentiate on domain-specific APIs, such as Telkom DWS's multimedia CPaaS suite. Local provider Lintasarta bundles OpenShift-based PaaS with backup vaults, meeting stringent localization rules. These integrated stacks protect margins against hyperscale price cuts, stabilizing competitive equilibrium.

Public deployments captured 66.05% Indonesia cloud market share in 2025 due to immediate scalability and cost visibility. Hybrid architectures, however, post a 15.21% CAGR as firms blend on-premise or colocation nodes for latency-sensitive or regulated workloads. Private clouds remain niche, reserved for ultra-regulated setups in defense or critical infrastructure.

Hybrid growth stems from GoTo's dual-provider play and Singtel-GMI's pooled GPU project that share capacity across borders. Rollout of Wi-Fi 6E/7 enables site-to-cloud throughput up to 46 Gbps, supporting distributed architectures. The Indonesian cloud market size for hybrid solutions is forecast to compound as regulators mandate in-country data copies while boards demand multicloud resilience.

The Indonesia Cloud Market Report is Segmented by Service Model (Software As A Service, Platform As A Service, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Small and Medium Enterprises and Large Enterprises), and End-Use Industry (IT and Telecom, BFSI, Retail and Consumer Goods, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Alibaba Cloud (Alibaba Group Holding Limited)

- IBM Corporation

- Tencent Cloud Computing (Beijing) Co., Ltd.

- Oracle Corporation

- Huawei Technologies Co., Ltd.

- Salesforce, Inc.

- OVH Groupe SAS

- DigitalOcean Holdings, Inc.

- Rackspace Technology, Inc.

- Linode LLC (Akamai Technologies Inc.)

- Vultr Holdings Corporation, LLC

- Hetzner Online GmbH

- PT DCI Indonesia Tbk

- PT Telekomunikasi Indonesia (Persero) Tbk

- PT Indosat Tbk (Indosat Ooredoo Hutchison)

- PT XL Axiata Tbk

- PT Biznet Gio Nusantara

- PT Indonesian Cloud

- Princeton Digital Group Pte. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid digital-transformation spend by enterprises

- 4.2.2 Hyperscaler CAPEX on Indonesian data-centre regions

- 4.2.3 Government "Digital Indonesia 2025" and e-Gov push

- 4.2.4 Surge in e-commerce / fintech cloud workloads

- 4.2.5 National Data Centre (PDN) enabling sovereign cloud

- 4.2.6 Renewable-powered 'green-cloud' demand from ESG-focused firms

- 4.3 Market Restraints

- 4.3.1 Escalating cybersecurity-breach costs

- 4.3.2 Complex data-localisation and sectoral compliance

- 4.3.3 Shortage of cloud-skilled talent and high wage inflation

- 4.3.4 Inter-island power and fibre reliability gaps

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Use Cases

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Model

- 5.1.1 Software as a Service (SaaS)

- 5.1.2 Platform as a Service (PaaS)

- 5.1.3 Infrastructure as a Service (IaaS)

- 5.1.4 Disaster-Recovery as a Service (DRaaS)

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organisation Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-Use Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Retail and Consumer Goods

- 5.4.4 Manufacturing

- 5.4.5 Healthcare and Life Sciences

- 5.4.6 Government and Public Sector

- 5.4.7 Transportation and Logistics

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-Use Industries

- 5.5 By Region

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Kalimantan

- 5.5.4 Sulawesi

- 5.5.5 Bali and Nusa Tenggara

- 5.5.6 Papua and Maluku

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 Alibaba Cloud (Alibaba Group Holding Limited)

- 6.4.5 IBM Corporation

- 6.4.6 Tencent Cloud Computing (Beijing) Co., Ltd.

- 6.4.7 Oracle Corporation

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 Salesforce, Inc.

- 6.4.10 OVH Groupe SAS

- 6.4.11 DigitalOcean Holdings, Inc.

- 6.4.12 Rackspace Technology, Inc.

- 6.4.13 Linode LLC (Akamai Technologies Inc.)

- 6.4.14 Vultr Holdings Corporation, LLC

- 6.4.15 Hetzner Online GmbH

- 6.4.16 PT DCI Indonesia Tbk

- 6.4.17 PT Telekomunikasi Indonesia (Persero) Tbk

- 6.4.18 PT Indosat Tbk (Indosat Ooredoo Hutchison)

- 6.4.19 PT XL Axiata Tbk

- 6.4.20 PT Biznet Gio Nusantara

- 6.4.21 PT Indonesian Cloud

- 6.4.22 Princeton Digital Group Pte. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment