PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911817

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911817

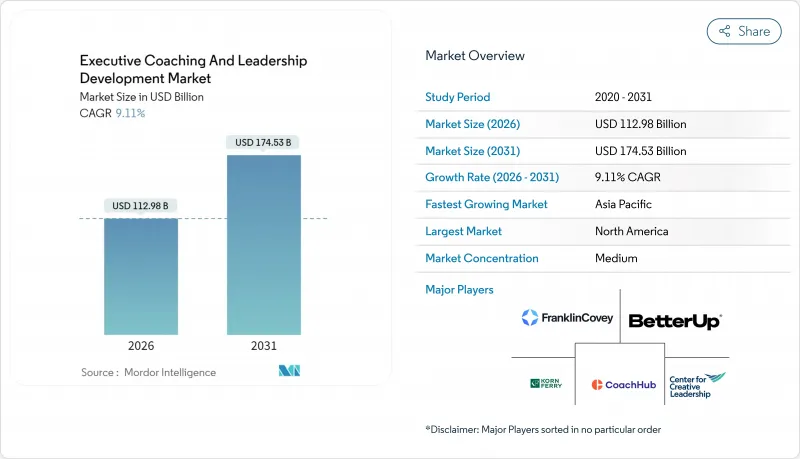

Executive Coaching And Leadership Development - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Executive Coaching and Leadership Development market size in 2026 is estimated at USD 112.98 billion, growing from 2025 value of USD 103.56 billion with 2031 projections showing USD 174.53 billion, growing at 9.11% CAGR over 2026-2031.

Escalating C-suite succession gaps, compressed corporate-strategy cycles, and generative-AI tools that hyper-personalize coaching are stimulating sustained budget growth across the Executive Coaching and Leadership Development market. Corporate spending on leadership development already exceeds USD 366 billion, and 88% of firms intend to upgrade programs to restore trust in senior management after the pandemic. CoachHub's Series C funding round highlights the increasing integration of technology within the Executive Coaching and Leadership Development market. Large enterprises remain the dominant buyers, yet subscription platforms are enabling SMEs to join the Executive Coaching and Leadership Development market at a lower entry price. Fragmented certification frameworks and data-privacy anxieties restrain adoption in some regions even as updated industry ethics codes start to raise confidence.

Global Executive Coaching And Leadership Development Market Trends and Insights

Rapid Digitization of Professional Learning Ecosystems

Corporate learning is migrating from one-off classroom events to cloud-based platforms that blend AI personalization with human expertise. FranklinCovey introduced its AI Coach in March 2025, utilizing proprietary content and sophisticated language models to enhance skill-acquisition efficiency among early adopters. Annual AI adoption in professional learning is climbing 40%, creating a network effect that accelerates digital-first demand across the Executive Coaching and Leadership Development market. Integrated analytics now correlate coaching inputs with revenue, innovation, and retention KPIs, providing proof of impact that traditional workshops lacked. These advances reduce travel costs and scheduling friction yet require investment in change management to weave new tools into everyday workflows. Vendors able to integrate seamlessly with HRIS platforms gain procurement preference over point solutions.

Growing Demand for Measurable ROI in Leadership Programs

Chief financial officers now insist that leadership budgets deliver quantifiable returns. Organizations that embed systematic coaching record 25% stronger business outcomes than peers, according to 2025 benchmarking research. Platforms have responded by embedding dashboards that link coaching moments to productivity, engagement, and project-cycle metrics, increasing transparency for sponsors. North American and Asia-Pacific clients adopt these analytics fastest, reflecting tight budget oversight and tech readiness. Outcome evidence supports larger multiyear contracts, expanding the Executive Coaching and Leadership Development market for providers able to deliver data-rich insights. Traditional consultancies without digital proof points risk renewal erosion as buyers migrate to analytics-enabled platforms.

Fragmented Certification & Quality-Assurance Standards

More than a dozen accreditation bodies overlap without a unified benchmark, sowing confusion for procurement teams. The International Coach Federation's April 2025 ethics update expands coverage to AI platforms yet stops short of creating one global gold standard. Multinational corporations are required to conduct a thorough evaluation of coach credentials on a case-by-case basis. This meticulous vetting process contributes to prolonged deal cycles and marginally impacts the projected CAGR of the Executive Coaching and Leadership Development market. Such detailed assessments are becoming increasingly critical as organizations prioritize quality and alignment with strategic objectives in their leadership development initiatives. Large vendors accumulating multi-credentialed coach pools gain credibility, while smaller players face higher compliance costs. Until outcome-based metrics supplant hours-based certification, fragmentation is likely to persist.

Other drivers and restraints analyzed in the detailed report include:

- Shortened Corporate-Strategy Cycles Driving Continuous Upskilling

- Escalating C-Suite Succession Gaps in Ageing Economies

- Cultural Stigma Toward Coaching in Certain Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Online learning is expected to log an 11.64% CAGR, narrowing the gap with in-person formats that accounted for 56.62 of % Executive Coaching and Leadership Development market share in 2025. Cloud delivery slashes travel and scheduling costs, while AI-driven matchmaking pairs leaders with best-fit coaches. Embedded VR simulations replicate nuanced scenarios, and dashboards provide transparent ROI evidence, reinforcing budget allocation. Yet board-level coaching still leans on face-to-face interaction where trust is paramount. Providers successively blend virtual diagnostics with periodic executive retreats, illustrating hybrid convergence that defines the segment's future trajectory.

In-person programs remain indispensable for immersive experiences, non-verbal communication, and relationship depth. Executive offsites combine strategic planning with leadership coaching, supporting behaviour change at pivotal organizational moments. Sustainability mandates and budget scrutiny, however, encourage companies to shorten onsite durations and replace pre-work and follow-up with digital tools. This hybridization keeps the in-person share substantial while enabling online channels to capture incremental growth across the Executive Coaching and Leadership Development market.

The Executive Coaching and Leadership Development Market Report Segments the Industry Into by Product Type (Online Learning, In-Person Learning), by End User (Management and Leadership, Finance and Accounting, and Other), by Organization Size ( Large Enterprises and Small & Medium-Sized Enterprises (SMEs) )and by Geography (North America, Asia-Pacific, South America, Europe, Middle East & Africa).

Geography Analysis

The Asia-Pacific region is witnessing the fastest growth in the Executive Coaching and Leadership Development market, advancing at a strong CAGR of 11.12% through 2031. This rapid expansion is primarily fueled by the region's booming digital economy and a generational transition in corporate leadership structures. Younger executives across emerging and developed markets are increasingly embracing continuous feedback cultures that prioritize adaptability and soft-skill enhancement. At the same time, multinational corporations are cascading global coaching frameworks and standards into their regional operations, further professionalizing the industry. Domestic technology giants and conglomerates are also investing heavily in leadership development as a critical driver of innovation, resilience, and long-term competitiveness.

Localization has emerged as a defining success factor across Asia-Pacific's executive coaching ecosystem, influencing both adoption and retention rates among clients. Bilingual coaches who can bridge cultural nuances are increasingly in demand, as organizations seek more relevant and relatable leadership insights. Market players are customizing casework and simulations that reflect region-specific business environments, enhancing the authenticity of coaching outcomes. Additionally, the use of local data hosting and regionally compliant platforms has become essential to maintaining trust and meeting data privacy expectations. These adaptive strategies collectively ensure that executive coaching programs resonate deeply with regional management cultures while maintaining global standards of excellence.

North America continues to hold the largest revenue share, commanding 40.88% of the global Executive Coaching and Leadership Development market in 2025. The region benefits from mature corporate governance systems, robust venture capital inflows, and a widespread commitment to measurable, data-driven coaching outcomes. Europe follows closely, where stringent privacy regulations such as GDPR elevate procurement barriers but reward firms offering transparent, algorithm-driven coaching platforms. Meanwhile, the Middle East is aligning its growing coaching demand with national diversification and human capital development agendas. In Africa, early-stage market traction is emerging within rapidly urbanizing hubs, particularly driven by growth in telecommunications and fintech sectors, sustaining overall global market momentum.

- Korn Ferry

- FranklinCovey

- BetterUp

- CoachHub

- Center for Creative Leadership (CCL)

- DDI (Development Dimensions International)

- BTS Group AB

- Gallup Inc.

- PwC (Strategy&)

- Heidrick & Struggles

- Right Management

- Vistage Worldwide Inc.

- Dale Carnegie & Associates

- SHL

- Randstad RiseSmart

- Lee Hecht Harrison (LHH)

- Blanchard

- NeuroLeadership Institute

- GiANT

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid digitisation of professional learning ecosystems

- 4.2.2 Growing demand for measurable ROI in leadership programs

- 4.2.3 Shortened corporate-strategy cycles driving continuous upskilling

- 4.2.4 Escalating C-suite succession gaps in ageing economies

- 4.2.5 AI-assisted coaching analytics unlocking hyper-personalised content

- 4.2.6 Venture-capital funnel into coaching marketplaces

- 4.3 Market Restraints

- 4.3.1 Fragmented certification & quality-assurance standards

- 4.3.2 High average cost per coachee limits SMB adoption

- 4.3.3 Data-privacy anxieties around session recordings

- 4.3.4 Cultural stigma toward coaching in certain emerging markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.1.1 Threat of New Entrants

- 4.7.1.2 Bargaining Power of Suppliers

- 4.7.1.3 Bargaining Power of Buyers

- 4.7.1.4 Threat of Substitutes

- 4.7.1 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Online Learning

- 5.1.2 In-Person Learning

- 5.2 By End User

- 5.2.1 Management and Leadership

- 5.2.2 Finance and Accounting

- 5.2.3 Strategic Leadership and Innovation

- 5.2.4 Marketing and Sales

- 5.2.5 Business Operations and Entrepreneurship

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small & Medium-sized Enterprises (SMEs)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Korn Ferry

- 6.4.2 FranklinCovey

- 6.4.3 BetterUp

- 6.4.4 CoachHub

- 6.4.5 Center for Creative Leadership (CCL)

- 6.4.6 DDI (Development Dimensions International)

- 6.4.7 BTS Group AB

- 6.4.8 Gallup Inc.

- 6.4.9 PwC (Strategy&)

- 6.4.10 Heidrick & Struggles

- 6.4.11 Right Management

- 6.4.12 Vistage Worldwide Inc.

- 6.4.13 Dale Carnegie & Associates

- 6.4.14 SHL

- 6.4.15 Randstad RiseSmart

- 6.4.16 Lee Hecht Harrison (LHH)

- 6.4.17 Blanchard

- 6.4.18 NeuroLeadership Institute

- 6.4.19 GiANT

7 Market Opportunities & Future Outlook

- 7.1 AI-powered personalised coaching at scale

- 7.2 Hybrid-work leadership programs in emerging markets