PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911821

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911821

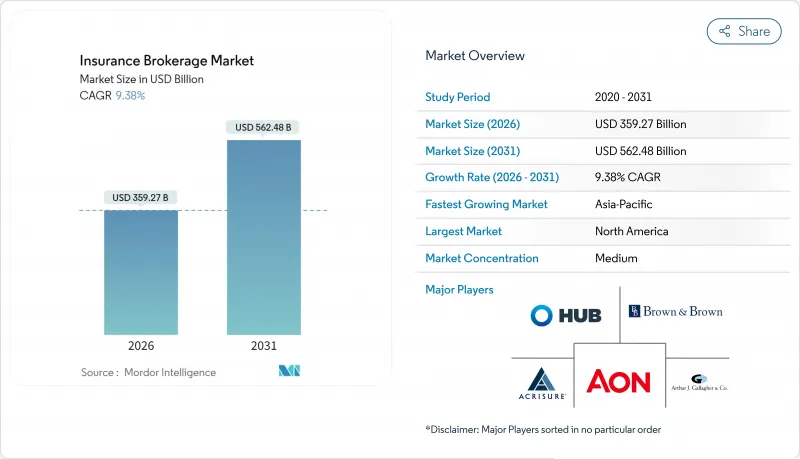

Insurance Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The insurance brokerage market is expected to grow from USD 328.47 billion in 2025 to USD 359.27 billion in 2026 and is forecast to reach USD 562.48 billion by 2031 at 9.38% CAGR over 2026-2031.

Accelerated demand for cyber, catastrophe-related, and embedded-finance solutions underpins this expansion, while the sector's deep digital investments compress placement cycles and broaden client reach. A pronounced shift toward excess-and-surplus (E&S) lines, now handling 34% of US commercial business, reconfigures risk distribution and favors brokers with specialized market access. Meanwhile, public-sector carriers still dominate premiums, yet private-sector capacity is growing faster as institutional investors funnel capital into alternative risk vehicles. Heightened consolidation, evidenced by multibillion-dollar acquisitions in 2024-2025, delivers scale advantages but intensifies margin pressure as embedded channels threaten to redirect up to USD 50 billion in auto premiums away from traditional intermediaries.

Global Insurance Brokerage Market Trends and Insights

Rising Demand for Life Policies in Emerging Markets

Life insurance appetite in India, China, and Southeast Asia is shifting from investment-linked to protection-focused solutions, propelled by post-pandemic risk awareness and simplified "use-and-file" product approvals. In India, gross written premiums climbed to USD 31.4 billion in FY 2023 after regulators eliminated product-wise commission caps, streamlining broker revenue models. Relaxed foreign ownership rules across multiple APAC jurisdictions attract global expertise and position brokers as key advisers on product localization and regulatory compliance. Penetration remains below 1% of GDP, indicating vast headroom even before demographic tailwinds accelerate household savings reallocation. Brokers that bundle term coverage with micro-savings products are already reporting double-digit client-retention uplifts, underscoring advisory relevance within the global insurance brokerage market.

Rapid Digitalisation / InsurTech Partnerships

Broker-carrier alliances now integrate artificial intelligence agents into underwriting and claims workflows, enabling real-time pricing and policy customization. McGill & Partners' collaboration with AXA XL applied AI to auto-follow renewable energy risks, cutting quote-to-bind timelines by up to 75%. Cloud and AI investments each absorb nearly 30% of broker IT budgets, signaling board-level endorsement of digital differentiation. Early adopters are monetizing behavioral data insights through parametric triggers that pay claims within minutes, further shortening the customer experience loop. As embedded finance APIs proliferate, leading brokers are launching white-label portals that let fintech partners quote commercial coverage inside small-business banking apps, capturing fee income that offsets shrinking traditional commissions.

Commission Compression & Rising Operating Costs

In 2023, as tech spending continued its upward trajectory, competitive cyber premiums took a notable dip of 17%, putting pressure on gross margins. In response, many commercial producers are shifting towards fee-based compensation models. Meanwhile, mid-sized brokers find themselves at a crossroads: they either need to scale up or consider mergers to finance essential digital upgrades. Adding to the challenge, inflationary pressures introduce another layer of costs. It has led firms to either automate low-value tasks or grapple with reduced profitability, stalling the global insurance brokerage market's near-term expansion. While shared services centers in cost-effective regions are becoming the norm, regulatory mandates on data sovereignty often hinder offshoring efforts, limiting firms' ability to cut costs.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Complexity Raises Advisory Need

- Explosive Cyber-Insurance Placement Demand

- Disintermediation by Direct / Embedded Channels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Property & Casualty held 55.62% of the global insurance brokerage market share in 2025, underscoring its anchor role in enterprise risk programs. Specialty Lines, however, are forecast to advance at an 8.22% CAGR, fueled by cyber, marine, and aviation risks that demand bespoke structuring. The global insurance brokerage market benefits as brokers monetize specialized placement expertise, particularly where reinsurance capacity and advanced analytics converge. Within Specialty Lines, cyber premiums are set to rise, expanding the global insurance brokerage market size for advisory and placement fees connected to digital-risk cover. Emerging niches such as space-launch liability and green-hydrogen property insurance are also opening incremental brokerage revenue streams.Sophisticated modeling tools and capital-market solutions, such as insurance-linked securities, enhance brokers' ability to align coverage with evolving exposures. Life insurance brokerage faces headwinds from direct channels yet persists where estate-planning or high-net-worth needs warrant human counsel. Health-insurance brokerage remains resilient because employers require turnkey compliance and benefits administration. Each sub-segment, therefore, shapes the broader global insurance brokerage industry by dictating resource allocation, talent specialization, and technology investment priorities. As Specialty Lines mature, cross-selling between casualty and cyber is driving multi-line retention rates above 92%.

The Global Insurance Brokerage Market is Segmented by Insurance Type (Life Insurance, Property & Casualty Insurance, Health Insurance, and More), Brokerage Type (Retail Brokerage, Wholesale Brokerage, and Other Brokerage), Insurers (Private Sector and Public Sector / Non-Profits), and Geography. The Market Forecasts are Provided in Value (USD).

Geography Analysis

North America commanded 37.42% of premium intermediated in 2025, leveraging deep capital markets, sophisticated surplus-lines frameworks, and a mature technology ecosystem. Growth, however, moderates as consumer segments migrate toward embedded offerings while commercial buyers increasingly self-insure through captives and alternative risk structures. The United States USD 115.6 billion surplus-lines volume and Canada's steady pricing discipline demonstrate the region's adaptive capacity, keeping the global insurance brokerage market anchored in risk-transfer innovation. Ongoing wildfire and hurricane losses are intensifying demand for parametric triggers, with broker-led facilities now covering multiple perils in single contracts.

Asia-Pacific will deliver the fastest growth at 7.12% CAGR by 2031. India's liberalized commission regime and China's loosening foreign ownership limits invite global entrants and raise professional standards expectations. Cyber insurance premiums in the region are rising 50% annually yet represent only 7% of the global total, providing a sizeable whitespace. Successful broker strategies hinge on local partnerships, culturally attuned advisory, and investment in multilingual digital platforms, factors that collectively expand the global insurance brokerage market in emerging economies. Thailand's new risk-based capital framework and Indonesia's InsurTech sandbox pilots exemplify regulatory tailwinds that foster brokerage growth.

Europe presents mixed conditions. Regulatory divergence post-Brexit complicates cross-border placements, yet Solvency II reforms unlock fresh investment channels requiring complex advisory input. UK Matching Adjustment changes allow broader asset classes, demanding sophisticated broker guidance. While macroeconomic softness tempers premium growth, consolidation among specialty brokers and managing general agents drives operational efficiency. Climate-adaptation funding from the EU Green Deal is spurring demand for construction and renewable-energy cover, areas where brokers with engineering expertise can secure fee premiums. Consequently, the region remains essential to the global insurance brokerage market's diversified revenue base, albeit with lower growth velocity than APAC.

- Acrisure LLC

- Aon plc

- Arthur J. Gallagher & Co.

- Brown & Brown Inc.

- HUB International Ltd.

- Lockton Companies

- Marsh McLennan Companies Inc.

- Truist Insurance Holdings

- USI Insurance Services LLC

- Willis Towers Watson plc

- Ryan Specialty Holdings Inc.

- Howden Group Holdings

- Alliant Insurance Services Inc.

- Edgewood Partners Insurance Center (EPIC)

- BMS Group Ltd.

- Miller Insurance Services LLP

- Goosehead Insurance Inc.

- NFP Corp.

- Gallagher Re

- Ardonagh Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for life policies in emerging markets

- 4.2.2 Rapid digitalisation / InsurTech partnerships

- 4.2.3 Regulatory complexity raises advisory need

- 4.2.4 Explosive cyber-insurance placement demand

- 4.2.5 CAT-driven E&S market expansion

- 4.2.6 Embedded-finance APIs opening new broker revenue

- 4.3 Market Restraints

- 4.3.1 Commission compression & rising operating costs

- 4.3.2 Disintermediation by direct / embedded channels

- 4.3.3 Global broker talent shortage & aging workforce

- 4.3.4 Emerging caps on broker commissions (e.g., India)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.2 Property & Casualty Insurance

- 5.1.3 Health Insurance

- 5.1.4 Specialty Lines (Marine, Aviation, Cyber)

- 5.1.5 Reinsurance Brokerage

- 5.2 By Brokerage Type

- 5.2.1 Retail Brokerage

- 5.2.2 Wholesale Brokerage

- 5.2.3 Other Brokerage

- 5.3 By Insurers

- 5.3.1 Private Sector

- 5.3.2 Public Sector / Non-Profits

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 Nordics (Sweden, Norway, Denmark, Finland)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South East Asia

- 5.4.4.7 Indonesia

- 5.4.4.8 Rest of Asia

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Acrisure LLC

- 6.4.2 Aon plc

- 6.4.3 Arthur J. Gallagher & Co.

- 6.4.4 Brown & Brown Inc.

- 6.4.5 HUB International Ltd.

- 6.4.6 Lockton Companies

- 6.4.7 Marsh McLennan Companies Inc.

- 6.4.8 Truist Insurance Holdings

- 6.4.9 USI Insurance Services LLC

- 6.4.10 Willis Towers Watson plc

- 6.4.11 Ryan Specialty Holdings Inc.

- 6.4.12 Howden Group Holdings

- 6.4.13 Alliant Insurance Services Inc.

- 6.4.14 Edgewood Partners Insurance Center (EPIC)

- 6.4.15 BMS Group Ltd.

- 6.4.16 Miller Insurance Services LLP

- 6.4.17 Goosehead Insurance Inc.

- 6.4.18 NFP Corp.

- 6.4.19 Gallagher Re

- 6.4.20 Ardonagh Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment