PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911829

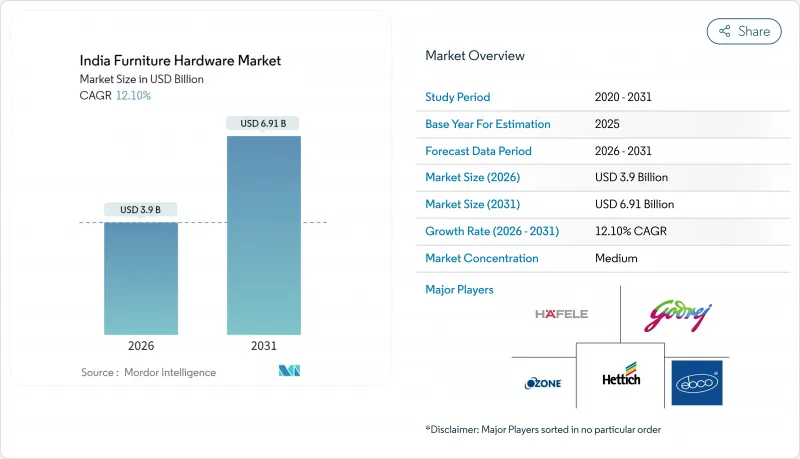

India Furniture Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India furniture hardware market size in 2026 is estimated at USD 3.90 billion, growing from 2025 value of USD 3.48 billion with 2031 projections showing USD 6.91 billion, growing at 12.1% CAGR over 2026-2031.

Demand momentum is anchored in rapid urban housing creation, swelling organized retail footprints, and digital channel adoption that keep the India furniture hardware market on a double-digit growth curve. Rising disposable incomes promote premium fittings and soft-close systems, while government quality mandates steer buyers toward certified products. Global brands safeguard share with design differentiation, whereas nimble regional firms battle on price, sustaining a fragmented competitive field. Near-term upside stems from a strong residential pipeline, expanding commercial interiors, and online penetration that moves both consumer and small-contractor purchases to click-based journeys.

India Furniture Hardware Market Trends and Insights

Rapid residential build-out and urbanization

India must add roughly 100 million homes this decade, and metros such as Mumbai, Pune and Chennai account for a large share of that pipeline, directly lifting demand for hinges, runners and architectural fittings. Modernization of aging housing stock further multiplies retrofit volumes as owners swap legacy hinges for soft-close or corrosion-resistant versions. Developers in coastal belts increasingly specify stainless-steel grades to withstand humidity, nudging average selling prices higher. Construction clusters around industrial nodes, especially Maharashtra's manufacturing belts, create localized demand pockets that favor nearby suppliers. Together, greenfield projects and replacements underpin a robust, geographically diversified base for the India furniture hardware market.

E-commerce acceleration in modular and RTA furniture

Ready-to-assemble wardrobes and kitchen modules now ship in flat-packs bundled with screws, cams and runners that must meet tight tolerances. Online buyers install fittings themselves, so brands emphasize intuitive designs, QR-code video guides and complete fastener kits. Rapid product cycles on leading marketplaces force hardware suppliers to synchronize SKUs with furniture makers' refresh calendars, deepening collaboration along the value chain. Customer-review data reveal hinge failures as a leading cause of returns, making quality consistency a vital differentiator. The 14.36% CAGR logged by digital channels thus converts directly into incremental standardized-hardware sales while injecting pricing transparency into the India furniture hardware market.

Price pressure from the unorganized sector plus logistics hurdles

Thousands of small workshops clustered in Rajkot and Moradabad undercut branded players by up to 30% because they sidestep certification costs and sell direct to local carpenters. Their agility in copying popular SKUs squeezes margins on entry-level lines within the India furniture hardware market. Bulky metal slides and baskets suffer unfavorable weight-to-value ratios, inflating freight costs when shipped to distant regions. Poor connectivity in the North-East lengthens lead times and forces distributors to hold larger safety stocks, raising working capital. Although BIS mandates aim to weed out sub-par goods, patchy enforcement outside major ports allows price-led competition to persist.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization, design focus and regulatory quality cues

- Rise of organized retail, DIY and accessibility needs

- Raw-material and compliance cost volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lift systems captured only modest revenue in 2025 but are forecast to grow at a 12.62% CAGR, the quickest pace among categories, as urban kitchens seek overhead cabinets that open upwards for space efficiency. Hinges remained the workhorse with 26.88% of the India furniture hardware market share, yet value migration favors concealed and soft-close variants that attract price premiums. Runner systems continue to gain traction in modular kitchens whose drawers require silent, full-extension slides. Handles, pulls and knobs benefit from design-led demand, supporting color-matched collections that complement interior themes. Fasteners are the highest-volume SKU yet face margin erosion from unorganized players; still, BIS standards could lift quality-conscious buyers toward branded options. Specialized sub-categories such as sliding-door systems and wire baskets broaden functionality choices, reinforcing product breadth as a competitive lever across the India furniture hardware market.

Second-order effects shape competitive investments across product verticals. Lift-assist dampers and servo-driven openers rely on precise gas-spring calibration, encouraging automation in local factories. Concealed hinges require micron-level stamping dies that smaller shops struggle to maintain, widening the capability gap between organized and informal producers. Growth in premium box systems aligns with rising wardrobe modularization, prompting suppliers to bundle runners, brackets and handles as integrated kits. Sliding mechanisms designed for floor-to-ceiling glass panels tap into premium residential and office interiors, where minimal frame thickness is prized. Together these trends shift revenue mix toward engineered mechanisms, expanding the value pool of the India furniture hardware market.

Steel delivered 41.88% of the India furniture hardware market size in 2025 thanks to its durability and low unit cost. Zinc alloy follows in coastal and high-humidity zones for its corrosion resistance, while aluminum's light weight attracts premium applications such as lift systems. Plastic and other polymer-based fittings, however, clock the fastest 12.33% CAGR as makers exploit injection-mold flexibility to create complex geometries and integrate damping functions. Brass serves niche decor roles in luxury hospitality where patina aesthetics justify higher price points.

Material selection now incorporates recyclability, with urban consumers querying environmental credentials before purchase. Advanced glass-fiber-reinforced nylon grades rival metal strength at lower weights, slashing freight costs for e-commerce shipments. Injection-molding investments also reduce per-unit cycle time, allowing rapid ramp-up to serve flash sale spikes online. Conversely, high-grade stainless variants such as SS-304 and SS-316 earn share in premium kitchens where ease of cleaning and long life matter. The simultaneous rise of advanced plastics and stainless alloys signals bifurcation toward both lightweight economy and high-end performance within the India furniture hardware market.

The India Furniture Hardware Market Report is Segmented by Product Type (Hinges, Runner Systems, Lift Systems, Box Systems, Wire Baskets, and More), Material (Steel, Zinc Alloy, Aluminium, and More), End-User (Residential, Office, Hospitality & Retail, Institutional), Distribution Channel (Offline, Online), and Geography (North, West, South, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hettich India Pvt. Ltd.

- Hafele India Pvt. Ltd.

- Godrej Locks & Architectural Fittings & Systems

- Ebco Pvt. Ltd.

- Ozone Overseas Pvt. Ltd.

- Dorset Industries Pvt. Ltd.

- Blum India

- Sugatsune Kogyo India

- H Hafele (Hafele brand stores)

- Hettich PODs & Studio Partners

- Kich Architectural Products

- PEGO Hardware

- Quba Group

- Vinay Wire & Polyproduct Pvt. Ltd.

- Dorset Smart Locks

- Ozone Securitas

- Evershine Appliances (Oliveworld)

- Italik Metalware Pvt. Ltd.

- DP Garg & Company (Garg Hinges)

- SIFON Hardware

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - India Furniture Hardware Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rapid growth in residential real-estate & urbanisation

- 5.2.2 Surge in modular/RTA furniture bought online

- 5.2.3 Premiumisation & design-driven demand for high-quality fittings

- 5.2.4 Expanding organised retail & DIY channels

- 5.2.5 BIS quality-control orders upgrading performance standards

- 5.2.6 Accessibility standards for PwD driving ergonomic hardware

- 5.3 Market Restraints

- 5.3.1 Fragmented unorganised sector & intense price competition

- 5.3.2 Volatile steel/zinc/polymer costs

- 5.3.3 Logistics inefficiencies for bulky, weighty fittings

- 5.3.4 Compliance costs for new sustainability & accessibility norms

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Suppliers

- 5.5.3 Bargaining Power of Buyers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

- 5.6 Insights into the Latest Trends and Innovations in the Market

- 5.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 5.8 Insights on Regulatory Framework and Industry Standards for the Hardware Industry

6 Market Size & Growth Forecasts (Value, 2020-2030)

- 6.1 By Product Type

- 6.1.1 Hinges

- 6.1.2 Runner Systems

- 6.1.3 Lift Systems

- 6.1.4 Box Systems

- 6.1.5 Wire Baskets

- 6.1.6 Sliding Door Systems

- 6.1.7 Handles, Pulls, and Knobs

- 6.1.8 Fasteners (Screw, Bolts, Nuts, etc.)

- 6.1.9 Others

- 6.2 By Material

- 6.2.1 Steel

- 6.2.2 Zinc Alloy

- 6.2.3 Aluminium

- 6.2.4 Plastic & Polymer-based

- 6.2.5 Brass & Other Metals

- 6.3 By End-user

- 6.3.1 Residential Furniture

- 6.3.2 Office Furniture

- 6.3.3 Hospitality & Retail Fixtures

- 6.3.4 Institutional (Healthcare, Education)

- 6.4 By Distribution Channel

- 6.4.1 Offline - Dealer & Retail

- 6.4.2 Online - E-commerce & Brand D2C

- 6.5 By Region (India)

- 6.5.1 North India

- 6.5.2 West India

- 6.5.3 South India

- 6.5.4 East & North-East India

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 Hettich India Pvt. Ltd.

- 7.4.2 Hafele India Pvt. Ltd.

- 7.4.3 Godrej Locks & Architectural Fittings & Systems

- 7.4.4 Ebco Pvt. Ltd.

- 7.4.5 Ozone Overseas Pvt. Ltd.

- 7.4.6 Dorset Industries Pvt. Ltd.

- 7.4.7 Blum India

- 7.4.8 Sugatsune Kogyo India

- 7.4.9 H Hafele (Hafele brand stores)

- 7.4.10 Hettich PODs & Studio Partners

- 7.4.11 Kich Architectural Products

- 7.4.12 PEGO Hardware

- 7.4.13 Quba Group

- 7.4.14 Vinay Wire & Polyproduct Pvt. Ltd.

- 7.4.15 Dorset Smart Locks

- 7.4.16 Ozone Securitas

- 7.4.17 Evershine Appliances (Oliveworld)

- 7.4.18 Italik Metalware Pvt. Ltd.

- 7.4.19 DP Garg & Company (Garg Hinges)

- 7.4.20 SIFON Hardware

8 Market Opportunities & Future Outlook

- 8.1 Organized Retail Expansion Boosting Branded Hardware

- 8.2 Smart Mechanisms Transforming Modular Furniture Systems