PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934590

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934590

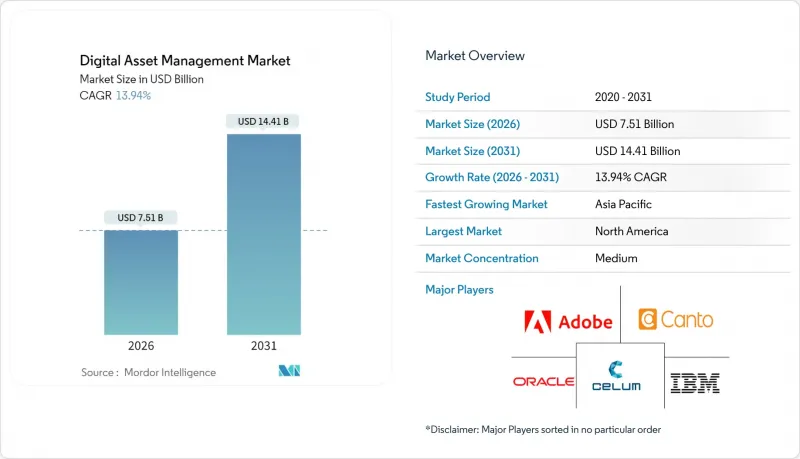

Digital Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Digital Asset Management market was valued at USD 6.59 billion in 2025 and estimated to grow from USD 7.51 billion in 2026 to reach USD 14.41 billion by 2031, at a CAGR of 13.94% during the forecast period (2026-2031).

Demand is accelerating as enterprises reposition DAM from a cost center to a core pillar of omnichannel content strategy. Solution providers now embed AI for auto-tagging, rights management, and dynamic delivery, helping brands reduce asset search time by up to 40%. Generative AI pilots are already underway at 66% of large organizations, boosting personalization at scale. Regulatory change is another growth catalyst. Europe's Accessibility Act, effective June 2025, requires richer metadata and alt-text, pushing companies to upgrade legacy systems. North America leads the adoption of cloud-native architectures, while the Asia-Pacific region is experiencing the fastest expansion, driven by the surge in mobile video streaming. At the same time, the high total cost of ownership and tightening data-sovereignty rules restrain smaller firms and heavily regulated sectors.

Global Digital Asset Management Market Trends and Insights

Growing Volume and Velocity of Rich Media Assets in Omnichannel Commerce

Marketing teams now devote 39% of budgets to content creation, much of it short-form video and interactive formats that require sophisticated metadata, rights tracking, and rendition management. Organizations that integrate Product Information Management with DAM repurpose assets across storefronts, social commerce, and marketplaces, maximizing ROI while protecting brand integrity. Coca-Cola links SKU-level data with creative files to drive real-time personalization across e-commerce sites. Companies without a robust DAM struggle with duplicate production and inconsistent messaging, eroding campaign effectiveness.

Rapid Shift to Cloud-Native AI-Enhanced DAM Platforms in North America

Enterprises such as T-Mobile decreased creative cycle times after moving from on-premise repositories to Adobe Experience Manager Assets, which uses AI for bulk tagging and rendition generation. SaaS delivery eliminates costly upgrades and supports distributed teams that need instant access. Early adopters report measurable OPEX savings and faster campaign launches, prompting competitors to accelerate migrations.

High Total Cost of Ownership for Enterprise-Grade DAM Suites in SMEs

Licensing fees, integration work, and the need for DAM specialists deter many smaller firms from enterprise platforms. Departments often adopt lightweight tools, creating silos that inflate support overhead and complicate consolidation efforts. Service providers now bundle change-management workshops and migration accelerators to close this adoption gap.

Other drivers and restraints analyzed in the detailed report include:

- Surging Demand for Personalised Video Streaming Assets in Asia

- Integration of DAM with Headless CMS for Real-Time Content Syndication

- Data-Sovereignty and Residency Mandates Limiting Cross-Border Asset Storage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Solutions segment captured a 71.90% share, establishing a baseline for enterprise adoption. Platforms now bundle AI transcription, color correction, and rights clearance, making the Digital Asset Management market an integral part of broader digital-experience stacks. Large brands utilize orchestration rules to automatically assemble campaign kits, ensuring the creation of regulatory-ready content sets.

Meanwhile, Services revenue is forecast to outpace software at a 17.35% CAGR as firms rely on partners for taxonomy design, migration from fragmented archives, and user-training programs. Managed-service engagements that wrap governance dashboards and KPI tracking are becoming standard. Implementations supported by specialists demonstrate a 196% ROI through faster retrieval and compliance savings.

Cloud installations account for 63.40% of 2025 revenue, as updates flow seamlessly and the total cost per asset decreases as storage tiers are automatically scaled. Clients integrate AI Video Intelligence entirely through SaaS APIs, expanding their digital presence across new channels without downtime.

On-premise installations persist in defense, government, and healthcare, but hybrid patterns are gaining traction, where sensitive master files remain behind the firewall while derivatives are streamed from regional clouds. Continuous delivery of features such as semantic search keeps the cloud model ahead, fueling a 15.53% CAGR and reinforcing the primacy of the Digital Asset Management market in modern tech stacks.

The Digital Asset Management Market is Segmented by Component (Solutions, and Services), Deployment (On-Premise, and Cloud), Organization Size (SMEs, and Large Enterprises), Application (Sales and Marketing Enablement, Broadcast and Publishing Workflows, and More), End-User (Media and Entertainment, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 37.70% share in 2025, as enterprises adopted AI-rich cloud suites and hyperscale providers enhanced their compliance certifications. DeFi Technologies projected USD 201.07 million in revenue from Solana-based products, illustrating deep regional expertise in tokenized asset management, and the region's mature ad-tech ecosystem drives higher per-user content spend, solidifying its leadership in the Digital Asset Management market. The region's mature ad-tech ecosystem drives higher per-user content spend, solidifying its leadership in the Digital Asset Management market.

Asia-Pacific is forecast to post a 17.02% CAGR through 2031. The DAM Sydney 2025 conference highlighted the growing demand for multilingual asset orchestration across FMCG, healthcare, and government programs. Rising smartphone penetration and social commerce are expanding the use cases for instant video personalization at scale. Government smart-city initiatives also encourage the development of unified content hubs to power public-service apps.

Europe's growth is anchored in accessibility mandates and strict privacy frameworks. The Digital Asset Management market size for compliance-ready solutions is expanding as firms retrofit their heritage collections with alt-text and granular consent tracking. Vendors differentiate on advanced metadata, versioning, and anonymization features to satisfy GDPR and regional localization laws. Osborne Clarke advises that early conformance with the European Accessibility Act enhances brand reputation and mitigates legal risk

- Adobe Inc.

- OpenText Corp.

- Bynder BV

- Aprimo LLC

- Oracle Corp.

- Cloudinary Ltd.

- IBM Corp.

- Canto Inc.

- Widen Enterprises (Acquia)

- CELUM GmbH

- MediaBeacon Inc.

- Nuxeo (Hyland)

- Extensis

- Digizuite A/S

- MediaValet Inc.

- Brandfolder (Smartsheet)

- Sitecore

- Northplains Systems

- Tenovos

- Amplifi.io

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Volume and Velocity of Rich Media Assets in Omnichannel Commerce

- 4.2.2 Rapid Shift to Cloud-Native AI-Enhanced DAM Platforms in North America

- 4.2.3 Surging Demand for Personalised Video Streaming Assets in Asia

- 4.2.4 Integration of DAM with Headless CMS for Real-Time Content Syndication

- 4.2.5 Regulatory Push for Accessibility (WCAG-2.2) Elevating Metadata Standards in Europe

- 4.2.6 Emergence of Generative-AI-Powered Auto-Tagging Reducing TTM for Brand Launches

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership for Enterprise-Grade DAM Suites in SMEs

- 4.3.2 Data-Sovereignty and Residency Mandates Limiting Cross-Border Asset Storage

- 4.3.3 Fragmented Legacy Repositories Hindering Seamless Migration

- 4.3.4 Limited Skilled Workforce for AI-based Metadata Governance

- 4.4 Technological Outlook

- 4.5 Macroeconomic Factors Impact Assessment

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis (Funding, M&A, VC Activity)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud (SaaS)

- 5.3 By Organisation Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprises

- 5.4 By Application

- 5.4.1 Sales and Marketing Enablement

- 5.4.2 Broadcast and Publishing Workflows

- 5.4.3 Product and E-commerce Management

- 5.4.4 Photography, Graphics and Design Repositories

- 5.4.5 Document and Knowledge Management

- 5.5 By End-User Industry

- 5.5.1 Media and Entertainment

- 5.5.2 BFSI

- 5.5.3 Government and Public Sector

- 5.5.4 Healthcareand Life Sciences

- 5.5.5 Retail and CPG

- 5.5.6 Manufacturing

- 5.5.7 IT and Telecom

- 5.5.8 Others (Education, Non-Profit)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Kenya

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Adobe Inc.

- 6.3.2 OpenText Corp.

- 6.3.3 Bynder BV

- 6.3.4 Aprimo LLC

- 6.3.5 Oracle Corp.

- 6.3.6 Cloudinary Ltd.

- 6.3.7 IBM Corp.

- 6.3.8 Canto Inc.

- 6.3.9 Widen Enterprises (Acquia)

- 6.3.10 CELUM GmbH

- 6.3.11 MediaBeacon Inc.

- 6.3.12 Nuxeo (Hyland)

- 6.3.13 Extensis

- 6.3.14 Digizuite A/S

- 6.3.15 MediaValet Inc.

- 6.3.16 Brandfolder (Smartsheet)

- 6.3.17 Sitecore

- 6.3.18 Northplains Systems

- 6.3.19 Tenovos

- 6.3.20 Amplifi.io

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment