PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934591

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934591

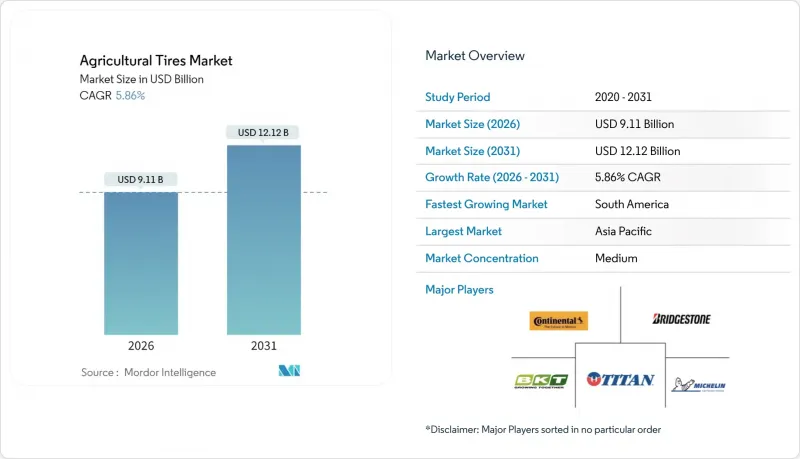

Agricultural Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Agricultural Tires market is expected to grow from USD 8.61 billion in 2025 to USD 9.11 billion in 2026 and is forecast to reach USD 12.12 billion by 2031 at 5.86% CAGR over 2026-2031.

The Agricultural Tires market is benefiting from sustained mechanization demand, rapid radialization, and the commercialization of IF/VF technologies that improve load capacity while reducing soil compaction. Growth momentum is further reinforced by farmers' steady shift toward precision farming, swelling replacement demand from aging tractor fleets, and a widening preference for Central Tire Inflation Systems that lower operating costs. Competitive intensity is mounting as incumbents and regional challengers upgrade product lines, invest in smart-tire platforms, and pursue vertical integration to mitigate raw-material price volatility. Supply-chain recalibration, particularly around natural rubber sources, remains an important theme shaping the Agricultural Tires market through 2030.

Global Agricultural Tires Market Trends and Insights

Rapid Mechanization & Fleet Renewal In Emerging Markets

Emerging economies are in the midst of pronounced fleet modernization. Argentina anticipates growth in tractor, harvesters, and sprayers sales during 2025, underpinned by policy-backed financing and local-content incentives that reduce import-cost exposure. Rising preference for 30-70 HP machines underscores opportunities for specialized mid-range tires, while >150 HP equipment accelerates the push toward VF specifications. Industry participants including Case IH are expanding Asian footprints, highlighting the magnetic pull of high-growth markets despite infrastructure bottlenecks such as limited rural internet. These dynamics collectively bolster the Agricultural Tires market outlook.

Shift From Bias To Radial / If-Vf Low-Compaction Tires

The cost-benefit rationale for radialization is compelling: IF designs allow one-fifth higher load at identical pressure, and VF designs expand the margin to two-fifth. Michelin's CEREXBIB 2 line for New Holland's CR11 combine, accommodating 19 ton loads with a wider footprint, illustrates manufacturers' commitment to soil preservation. Standards codified by the Tire & Rim Association have harmonized inflation protocols, accelerating global adoption. Expedited product launches from BKT, CEAT, and Yokohama further diversify VF offerings across both OEM and replacement channels. As more farms prioritize fuel efficiency and soil health, the Agricultural Tires market is witnessing rapid technology diffusion from bias to advanced radial products.

Fluctuating Agricultural Commodity Prices

Commodity price cycles shape farmers' capital-spending capacity. Brazil's agricultural machinery sales fell slightly in 2024 to close to half a lakh units amid a uptick Selic rate that inflated borrowing costs. Argentina's equipment registrations showed early-2025 month-on-month declines despite annual improvements, underlining persistent caution. When cash flows tighten, OEM demand softens and factory scheduling becomes erratic, challenging tire suppliers. Conversely, replacement needs remain steadier, cushioning revenue dips. This dichotomy reinforces why the aftermarket anchors baseline demand across the Agricultural Tires market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Global Population & Food-Security Pressure

- Surging Replacement Demand From Aging Tractor Fleet

- Natural-Rubber & Petrochemical Cost Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Agricultural Tires market size attributed to the aftermarket accounts for 70.74% of market share in 2025. Farmers' strong inclination to extend equipment lifespan, particularly during high interest-rate periods, reinforces this dominance. OEM channels are on a 5.91% CAGR path through 2031, buoyed by Ukraine reconstruction and policy-supported fleet renewal in Latin America.

Bridgestone's August 2024 U.S. introduction of VX-TRACTOR, VT-TRACTOR, and VX-R TRACTOR portfolios illustrates the pursuit of premiumization, promising longer wear life and 40% higher load capacity. Parallel OEM momentum stems from Trelleborg's agreement with John Deere, granting access to more than 300 Brazilian dealerships and positioning CTIS-ready tires for new tractor deliveries. The interplay between defensive aftermarket strength and revitalized OEM orders underscores balanced growth drivers across the Agricultural Tires market.

Tractors generated 56.12% of the Agricultural Tires market in 2025, cementing their centrality in daily farm tasks. Sprayers, although representing a smaller base, are forecast for 5.95% CAGR through 2031, sharpening demand for narrow-section VF tires compatible with high-clearance machinery. Combine harvesters and trailers capture residual shares yet set distinct performance benchmarks that shape tread design and carcass rigidity.

Apollo's Vredestein Traxion CropCare series grants 30% higher lateral stability for sprayers, reflecting an engineering push tailored to crop-protection equipment. Michelin's VF 900/65R46 CFO tire, boasting a 2.32 m diameter and 19 ton load rating for New Holland's CR11 harvester, mirrors a trend toward oversized, heavy-duty solutions. These innovations broaden performance envelopes and enlarge the value proposition of the Agricultural Tires market.

The Agricultural Tires Market Report is Segmented by Sales Channel (OEM and Replacement/Aftermarket), Application (Tractors, Combine Harvesters, and More), Tire Construction (Bias, Radial, and IF/VF Radial), Rim-Size (Less Than 20 Inch and More), Equipment Horse-Power Class (Less Than 30 HP and More), Inflation-Technology Compatibility, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 37.41% of Agricultural Tires market share in 2025, propelled by China and India, which together delivered more than two-fifth of global equipment growth. Many provincial subsidies address labor scarcity by encouraging VF-equipped tractors that protect increasingly valuable arable land. Japan's radial-tire uptake underscores the region's technological maturity, supported by advanced R-&-D clusters and stringent sustainability standards.

South America is projected as the fastest-growing region with 6.09% CAGR between 2026 and 2031. Following a contraction in Brazil's machinery sales during 2024, policy steps such as Moderfrota coupled with Argentina's domestic manufacturing content are revitalizing demand. Strategic collaborations, exemplified by Trelleborg's tie-up with John Deere's extensive dealership grid, channel advanced low-compaction tires to small and mid-sized growers.

Europe and North America exhibit high replacement ratios. EU machinery regulations effective January 2027 will elevate compliance thresholds for digital readiness and safety, favoring CTIS and sensor-equipped tires. Ukraine reconstruction plans could spark an OEM spike as farming equipment stocks are replenished. Middle East and Africa remain under-mechanized yet display gradual uptake, notably in irrigation-dependent cereals where radial flotation tires provide clear agronomic benefits. Overall, regional heterogeneity accentuates multiple demand pockets, solidifying the growth arc of the Agricultural Tires market through 2031.

- Bridgestone Corporation

- Michelin

- Continental AG

- Balkrishna Industries Ltd (BKT)

- Titan International Inc.

- Trelleborg AB

- Yokohama Rubber Co. Ltd. (ATG)

- Nokian Tyres plc

- Apollo Tyres Ltd.

- Prometeon Tyre Group

- CEAT Ltd.

- Mitas a.s.

- Goodyear Tire & Rubber Co.

- Hankook Tire & Technology

- GRI Tires

- Maxam Tire International

- Specialty Tires of America

- Magna Tyres Group

- Petlas Tire Industry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Mechanization & Fleet Renewal In Emerging Markets

- 4.2.2 Shift From Bias To Radial / If-Vf Low-Compaction Tires

- 4.2.3 Growing Global Population & Food-Security Pressure

- 4.2.4 Surging Replacement Demand From Aging Tractor Fleet

- 4.2.5 Real-Time Tire-Pressure & Ctis Adoption Accelerating Upgrades

- 4.2.6 EU-Ukraine Reconstruction Triggering Oem Demand Spike

- 4.3 Market Restraints

- 4.3.1 Fluctuating Agricultural Commodity Prices

- 4.3.2 Natural-Rubber & Petrochemical Cost Volatility

- 4.3.3 Supplier Exits Limiting Choice & Raising Prices

- 4.3.4 Rubber-Leaf Disease Constraining Raw-Material Supply

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Sales Channel

- 5.1.1 OEM

- 5.1.2 Replacement / Aftermarket

- 5.2 By Application

- 5.2.1 Tractors

- 5.2.2 Combine Harvesters

- 5.2.3 Sprayers

- 5.2.4 Trailers

- 5.2.5 Loaders & Telehandlers

- 5.2.6 Other Implements

- 5.3 By Tire Construction

- 5.3.1 Bias

- 5.3.2 Radial

- 5.3.3 IF / VF Radial

- 5.4 By Rim-Size

- 5.4.1 Less than 20 inch

- 5.4.2 20 - 30 inch

- 5.4.3 30 - 40 inch

- 5.4.4 More than 40 inch

- 5.5 By Equipment Horse-Power Class

- 5.5.1 Less than 30 HP

- 5.5.2 30 - 70 HP

- 5.5.3 71 - 150 HP

- 5.5.4 More than 150 HP

- 5.6 By Inflation-Technology Compatibility

- 5.6.1 Standard Tires

- 5.6.2 CTIS-Ready / Smart Tires

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Australia

- 5.7.4.6 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Turkey

- 5.7.5.4 Egypt

- 5.7.5.5 South Africa

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Bridgestone Corporation

- 6.4.2 Michelin

- 6.4.3 Continental AG

- 6.4.4 Balkrishna Industries Ltd (BKT)

- 6.4.5 Titan International Inc.

- 6.4.6 Trelleborg AB

- 6.4.7 Yokohama Rubber Co. Ltd. (ATG)

- 6.4.8 Nokian Tyres plc

- 6.4.9 Apollo Tyres Ltd.

- 6.4.10 Prometeon Tyre Group

- 6.4.11 CEAT Ltd.

- 6.4.12 Mitas a.s.

- 6.4.13 Goodyear Tire & Rubber Co.

- 6.4.14 Hankook Tire & Technology

- 6.4.15 GRI Tires

- 6.4.16 Maxam Tire International

- 6.4.17 Specialty Tires of America

- 6.4.18 Magna Tyres Group

- 6.4.19 Petlas Tire Industry

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment