PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934593

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934593

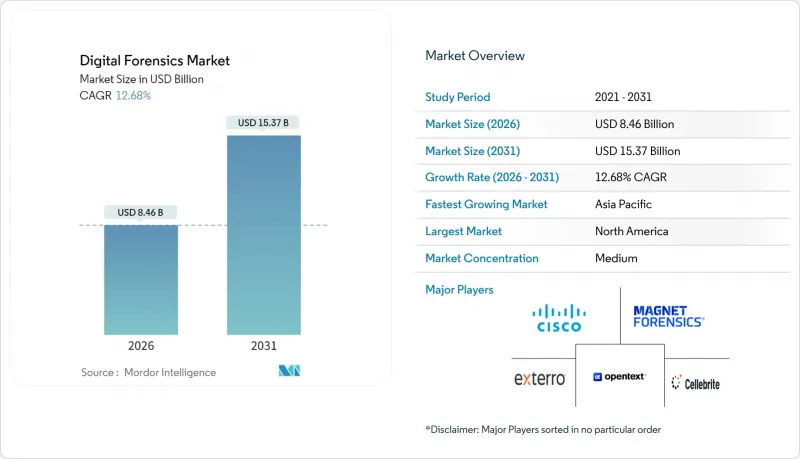

Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Digital forensics market size in 2026 is estimated at USD 8.46 billion, growing from 2025 value of USD 7.51 billion with 2031 projections showing USD 15.37 billion, growing at 12.68% CAGR over 2026-2031.

Growth pivots on cloud-native Software-as-a-Service investigations, deepfake countermeasures, and the integration of digital forensics within Extended Detection and Response platforms. Legislated mobile device extraction mandates and steady public-sector investments further underpin demand. Conversely, encryption-by-default and examiner shortages introduce operational friction yet also spur innovation in automated, cloud-based evidence preservation. Competitive dynamics remain moderately fragmented as established vendors embed artificial intelligence and blockchain-enabled chain-of-custody features to secure differentiation.

Global Digital Forensics Market Trends and Insights

Rapid Proliferation of Cloud-Native SaaS Creating Demand for Cloud Forensics

Cloud migrations are displacing traditional disk imaging, prompting the deployment of forensic platforms that capture volatile data across distributed, multi-tenant environments while meeting ISO/IEC 27035-4:2024 admissibility standards. Evidence isolation requirements and automated chain-of-custody tracking elevate demand for solutions pre-integrated with hyperscaler security services. As a result, vendors offering cloud-native acquisition APIs experience accelerated adoption among enterprises, particularly multinational corporations that navigate complex jurisdictional boundaries.

Surge in Deepfake-Enabled Fraud Driving Advanced Multimedia Analysis Needs

Machine-generated audio and video fraud now penetrates live interactions, forcing laboratories to replace legacy authentication with neural detection algorithms that achieve 91.82% accuracy on low-resolution content. BFSI institutions integrate blockchain provenance schemes to secure high-value transactions, while law-enforcement agencies invest in real-time screening tools to preserve evidentiary integrity during investigative interviews.

Encryption-by-Default on iOS/Android Elevating Acquisition Complexity and Cost

Hardware-backed encryption reduces extraction success to below 40% on recent devices, forcing reliance on premium decryption utilities and cloud-based evidence substitutes. Small agencies face budgetary barriers, widening investigative disparity and prompting policy debate on lawful access collaboration.

Other drivers and restraints analyzed in the detailed report include:

- Extended Detection and Response Adoption Necessitating Integrated DFIR Platforms

- Legislated Mobile Device Extraction Mandates in U.S. and EU Law-Enforcement

- Shortage of Court-Certified Examiners Outside Tier-1 Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 44.62% of the digital forensics market share in 2025, underpinned by advanced analytics for encrypted and cloud evidence. Hardware usage remains niche for physical acquisitions, yet decryption accelerators support investigative throughput. Managed offerings capture enterprises seeking turnkey scalability, while professional services climb 14.43% CAGR as talent shortages persist.

Service providers capitalize on forensic-as-a-service adoption among SMEs, bundling incident response and expert testimony. Vendors integrate blockchain lineage and AI triage to compress analysis cycles, reinforcing software primacy. The strategic interplay between platform licensing and recurring services broadens revenue predictability, positioning vendors for cross-sell of adjacent security capabilities.

Computer forensics controlled 36.55% of 2025 revenue; however, cloud forensics now logs the fastest 12.96% CAGR amid multi-cloud enterprise workloads. Mobile forensics sustains growth despite encryption headwinds, supported by evolving bypass toolkits. Network, database, and IoT investigations expand as zero-trust architectures and connected devices generate diversified evidence streams.

Regulatory audits in BFSI amplify demand for continuous cloud evidence readiness, widening opportunities for specialized cloud-native vendors. Digital forensics market size for cloud investigations is poised to narrow the gap with computer forensics by 2031 as SaaS reliance deepens. Tool vendors therefore prioritize API-based collection, volatility preservation, and jurisdictional segmentation to boost adoption.

The Digital Forensics Market Report is Segmented by Component (Hardware, Software, and More), Type (Computer Forensics, Mobile Device Forensics, and More), Tool (Data Acquisition and Preservation, Forensic Data Analysis, and More), Organization Size (Large Enterprises, and Small and Medium Enterprises), End-User Vertical (BFSI, IT and Telecom and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 34.65% of 2025 revenue, aided by Executive Order 14144 and robust federal budgets that accelerate AI-driven investigative adoption. Public-sector platform procurements, exemplified by Palantir's USD 1.20 billion government revenue, cascade into broader ecosystem modernization.

Asia Pacific leads in growth at 13.16% CAGR, reflecting e-commerce expansion and rising cybercrime costs forecast at USD 3.3 trillion by 2025. Regulatory refinements, such as China's eased cross-border transfer exemptions, gradually reduce investigative friction for multinational forensics providers.

Europe sustains balanced expansion through the EU AI Act and data-privacy mandates driving privacy-preserving forensic tool demand. Middle East and Africa allocate cybersecurity budgets to defend energy and financial corridors, while Latin America shows incremental progress constrained by skill shortages yet supported by regional digitalization policies.

- OpenText Corporation

- Cellebrite DI Ltd.

- Exterro Inc.

- Magnet Forensics Inc.

- Cisco Systems Inc.

- FireEye Inc. (Mandiant)

- LogRhythm Inc.

- KLDiscovery Inc.

- Paraben Corporation

- MSAB AB

- Oxygen Forensics Inc.

- Kroll LLC

- Hexagon AB (Qognify)

- ADF Solutions Inc.

- BAE Systems plc

- Broadcom Inc. (Symantec Enterprise DFIR Tools)

- Micro Systemation AB

- Digital Detective Group

- Nuix Pty Ltd

- Passware Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Proliferation of Cloud-Native SaaS Creating Demand for Cloud Forensics

- 4.2.2 Surge in Deepfake-Enabled Fraud Driving Advanced Multimedia Analysis Needs

- 4.2.3 Extended Detection and Response (XDR) Adoption Necessitating Integrated DFIR Platforms

- 4.2.4 Legislated Mobile Device Extraction Mandates in U.S. and EU Law-Enforcement

- 4.2.5 Blockchain-Based Evidence Chain-of-Custody Pilots Boosting Forensic Software Upgrades

- 4.2.6 Federal Cybersecurity Investments and Regulatory Compliance Requirements Expanding Forensic Deployments

- 4.3 Market Restraints

- 4.3.1 Encryption-by-Default on iOS/Android Elevating Acquisition Complexity and Cost

- 4.3.2 Shortage of Court-Certified Examiners Outside Tier-1 Cities

- 4.3.3 Fragmented Tool Inter-Operability Increasing Total Cost of Ownership for SMEs

- 4.3.4 Data-Residency Rules Limiting Cross-Border Evidence Transfers (e.g., China CSL)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Forensic Systems, Devices and Write Blockers

- 5.1.1.2 Imaging and Duplication Devices

- 5.1.1.3 Other Hardware

- 5.1.2 Software

- 5.1.2.1 Forensic Data Analysis and Visualization

- 5.1.2.2 Review and Reporting

- 5.1.2.3 Forensic Decryption

- 5.1.2.4 Other Software Modules

- 5.1.3 Services

- 5.1.3.1 Professional Services

- 5.1.3.1.1 Incident Response and Breach Analysis

- 5.1.3.1.2 Consulting and Training

- 5.1.3.2 Managed Forensic Services

- 5.1.3.1 Professional Services

- 5.1.1 Hardware

- 5.2 By Type

- 5.2.1 Computer Forensics

- 5.2.2 Mobile Device Forensics

- 5.2.3 Network Forensics

- 5.2.4 Cloud Forensics

- 5.2.5 Database Forensics

- 5.2.6 IoT and Embedded Device Forensics

- 5.3 By Tool

- 5.3.1 Data Acquisition and Preservation

- 5.3.2 Data Recovery and Reconstruction

- 5.3.3 Forensic Data Analysis

- 5.3.4 Review and Reporting

- 5.3.5 Forensic Decryption and Password Cracking

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Vertical

- 5.5.1 Government and Law Enforcement Agencies

- 5.5.2 BFSI

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Retail and E-commerce

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing

- 5.5.8 Transportation and Logistics

- 5.5.9 Defense and Aerospace

- 5.5.10 Education

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Kenya

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 OpenText Corporation

- 6.4.2 Cellebrite DI Ltd.

- 6.4.3 Exterro Inc.

- 6.4.4 Magnet Forensics Inc.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 FireEye Inc. (Mandiant)

- 6.4.7 LogRhythm Inc.

- 6.4.8 KLDiscovery Inc.

- 6.4.9 Paraben Corporation

- 6.4.10 MSAB AB

- 6.4.11 Oxygen Forensics Inc.

- 6.4.12 Kroll LLC

- 6.4.13 Hexagon AB (Qognify)

- 6.4.14 ADF Solutions Inc.

- 6.4.15 BAE Systems plc

- 6.4.16 Broadcom Inc. (Symantec Enterprise DFIR Tools)

- 6.4.17 Micro Systemation AB

- 6.4.18 Digital Detective Group

- 6.4.19 Nuix Pty Ltd

- 6.4.20 Passware Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment