PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934597

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934597

United States Dental Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

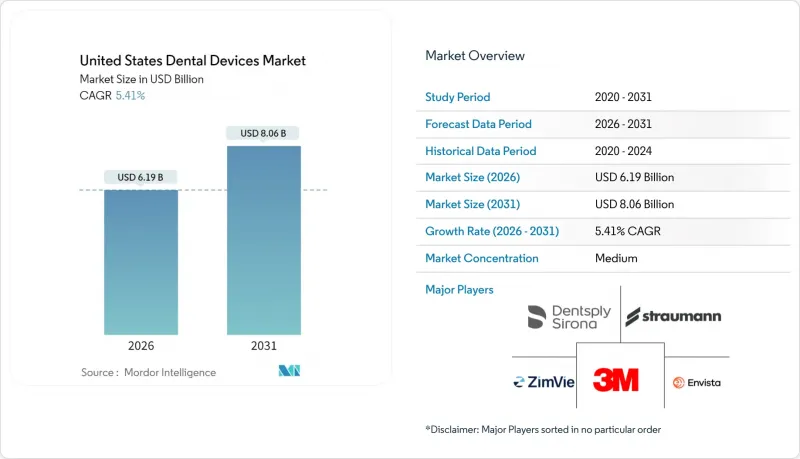

The United States Dental Devices Market is expected to grow from USD 5.87 billion in 2025 to USD 6.19 billion in 2026 and is forecast to reach USD 8.06 billion by 2031 at 5.41% CAGR over 2026-2031.

Expansion of multi-location Dental Service Organizations (DSOs), widening Medicare coverage for medically necessary dentistry, and rapid integration of artificial-intelligence (AI) imaging platforms are reshaping purchasing priorities. Clinics are moving toward end-to-end digital workflows that link intraoral scanning, AI-assisted radiography, in-office CAD/CAM milling, and cloud-based treatment planning. DSOs use bulk-buy agreements to standardize these systems across hundreds of operatories, driving unit demand while creating a two-tier environment in which independent offices face steeper capital hurdles. Simultaneously, patient demand for minimally invasive and cosmetic procedures is increasing the use of dental lasers, bioactive ceramics, and regenerative materials, all of which must be interoperable with the expanding digital ecosystem.

United States Dental Devices Market Trends and Insights

Expansion of Dental Support Organizations (DSOs) Accelerating Bulk Equipment Purchases

Private-equity-backed DSOs are expanding at a rate of 17.6% annually and negotiating national contracts that bundle AI-ready sensors, chairside mills, and cloud subscriptions into multi-year packages. Standardized rollouts create predictable feedback loops for manufacturers, encouraging platform-based rather than device-specific product roadmaps. Independent practices, which still make up over 75% of offices, struggle to match these investments, thereby widening the digital divide within the United States dental device market.

Increased Medicare Advantage Dental Benefits Stimulating Advanced Imaging Demand

Starting in 2025, Medicare will reimburse dental examinations linked to dialysis for end-stage renal disease, triggering clinics to acquire cone-beam CT and high-resolution panoramic units capable of documenting oral-systemic links for claim justification. States with older demographics, such as Florida and Pennsylvania, are reporting early spikes in imaging equipment orders.

Excessive Costs Involved in Private Health Insurance

Dental services account for 11% of the medical-care component in the 2024 Consumer Price Index, underscoring affordability challenges that dampen patient uptake of advanced procedures requiring premium equipment [1].

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Minimally Invasive Laser Dentistry in Cosmetic Procedures

- Rising Integration of AI-Enhanced Digital Radiography for Precision Diagnostics

- Up-Front Capital Expenditure Barrier for Small Independent Practices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental Equipment held 44.05% of the United States dental device market in 2025, as DSOs bulk-purchased fully digital operatories. Intraoral scanners, now equipped with continuous-capture optics, serve as entry points to cloud-based CAD workflows. Dental Consumables, projected at a 6.5% CAGR, are benefiting from on-demand resins, bioactive cements, and chairside printable materials.

Therapeutic lasers are gaining traction for hard and soft tissue procedures, and cloud-connected milling units enable remote design collaboration. CAD/CAM vendors emphasize ecosystem lock-in: Dentsply Sirona's DS Core platform synchronizes imaging, planning, and fabrication data streams, underpinning subscription revenues. Equipment service bundles offset up-front costs, enabling clinics to access premium technology without significant capital outlays-an approach increasingly popular across the United States dental device market.

The United States Dental Devices Market Report is Segmented by Product (General Diagnostics Equipment, Therapeutic Equipment, Dental Consumables, and Other Dental Device), Treatment (Orthodontic, Endodontic, Periodontic, and Prosthodontic), and End User (Hospitals, Clinics, and Other End Users). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Dentsply Sirona

- Envista

- Align Technology

- Henry Schein

- Straumann Group

- A-dec

- 3 Shape

- Planmeca

- Carestream Dental

- Patterson Companies

- GC Corporation

- OverJet Inc.

- Ivoclar Vivadent

- Midmark

- ZimVie

- Ultradent Products

- Young Innovations

- Air Techniques Inc.

- DEXIS

- Hu-Friedy Group (Cantel)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Dental Support Organizations (DSOs) Accelerating Bulk Equipment Purchases

- 4.2.2 Increased Medicare Advantage Dental Benefits Stimulating Advanced Imaging Demand

- 4.2.3 Growing Demand for Minimally-Invasive Laser Dentistry in Cosmetic Procedures

- 4.2.4 Rising Integration of AI-Enhanced Digital Radiography for Precision Diagnostics

- 4.2.5 Rapid Adoption of Chairside CAD/CAM Systems Among U.S. Private Practices

- 4.2.6 State-Level Infection-Control Mandates Fueling Sterilization Equipment Replacement

- 4.3 Market Restraints

- 4.3.1 Excessive Costs Involved in Private Health Insurance

- 4.3.2 Up-Front Capital Expenditure Barrier for Small Independent Practices

- 4.3.3 High Learning Curve & Workflow Disruption Hindering Full-Suite Digital Adoption

- 4.3.4 Supply-Chain Volatility for Electronic Components Lengthening Lead Times

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Product

- 5.1.1 Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.2 Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.1.4 Therapeutic Equipment

- 5.1.1.4.1 Dental Hand Pieces

- 5.1.1.4.2 Electrosurgical Systems

- 5.1.1.4.3 CAD/CAM Systems

- 5.1.1.4.4 Milling Equipment

- 5.1.1.4.5 Casting Machine

- 5.1.1.4.6 Other Therapeutic Equipments

- 5.1.1.5 Dental Consumables

- 5.1.1.5.1 Dental Biomaterial

- 5.1.1.5.2 Dental Implants

- 5.1.1.5.3 Crowns and Bridges

- 5.1.1.5.4 Other Dental Consumables

- 5.1.1.6 Other Dental Devices

- 5.1.2 By Treatment

- 5.1.2.1 Orthodontic

- 5.1.2.2 Endodontic

- 5.1.2.3 Peridontic

- 5.1.2.4 Prosthodontic

- 5.1.3 By End User

- 5.1.3.1 Dental Hospitals

- 5.1.3.2 Dental Clinics

- 5.1.3.3 Academic & Research Institutes

- 5.1.1 Diagnostics Equipment

6 Competitive Landscape

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.2.1 Dentsply Sirona Inc.

- 6.2.2 Envista Holdings Corporation

- 6.2.3 Align Technology Inc.

- 6.2.4 Henry Schein Inc.

- 6.2.5 Institut Straumann AG

- 6.2.6 A-dec Inc.

- 6.2.7 3Shape A/S

- 6.2.8 Planmeca Oy

- 6.2.9 Carestream Dental LLC

- 6.2.10 Patterson Companies Inc.

- 6.2.11 GC America Inc.

- 6.2.12 OverJet Inc.

- 6.2.13 Ivoclar Vivadent AG

- 6.2.14 Midmark Corporation

- 6.2.15 ZimVie Inc.

- 6.2.16 Ultradent Products Inc.

- 6.2.17 Young Innovations Inc.

- 6.2.18 Air Techniques Inc.

- 6.2.19 DEXIS

- 6.2.20 Hu-Friedy Group (Cantel)

- 6.3 Market Opportunities & Future Outlook

- 6.3.1 White-Space & Unmet-Need Assessment