PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934602

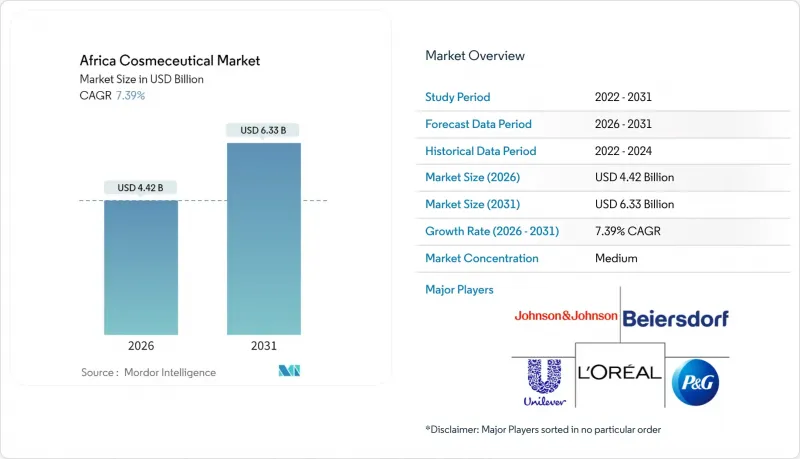

Africa Cosmeceutical - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Africa cosmeceuticals market is expected to grow from USD 4.12 billion in 2025 to USD 4.42 billion in 2026 and is forecast to reach USD 6.33 billion by 2031 at 7.39% CAGR over 2026-2031.

This robust trajectory stems from the region's unique blend of validated indigenous botanicals and modern dermatological science. Zero-tariff trade agreements under the African Continental Free Trade Area (AfCFTA) are cutting raw-material costs, while rising urban pollution is steering consumers toward sophisticated barrier-repair formulations. A sharp uptick in mobile commerce-now 69% of web traffic-has redrawn the path to purchase, empowering direct-to-consumer strategies even in traditionally underserved locales. Competitive intensity remains moderate as multinationals leverage scale and local challengers capitalize on botanical authenticity, enabling price-quality stratification across income tiers.

Africa Cosmeceutical Market Trends and Insights

Zero-tariff trade pacts accelerating raw-material flows

AfCFTA eliminates import duties on biodiversity-based inputs, letting formulators source marula, baobab, and rooibos across borders without cost penalties. Procurement cycles tighten as customs paperwork shrinks, and ingredient diversity rises, supporting quick-turn product launches. Regional economic communities such as SADC have begun harmonizing cosmetic standards, reducing compliance duplication. As a result, brands can scale pilot batches continent-wide, anchoring the African cosmeceuticals market in lean, cross-border supply chains. Cost savings cushion R&D investment in new activities, which in turn widens premium price corridors without eroding margins.

Urban pollution-driven demand for advanced skin care

Particulate levels in Lagos and Johannesburg routinely exceed WHO guidelines, heightening oxidative stress on skin. Consumers are pivoting from basic moisturizers to serums fortified with antioxidants and barrier-repair peptides. Dermatologists cite a 32% rise in clinic visits for pollution-linked dermatitis between 2023 and 2024, nudging retailers to spotlight "anti-pollution" shelves. Formulators are blending indigenous compounds, such as Ximenia americana seed oil, with niacinamide, creating products that claim both natural origin and clinical efficacy. Premium positioning is justified as urban professionals view barrier defense as a wellness essential rather than a discretionary luxury, propelling the Africa cosmeceuticals market toward higher average selling prices.

Fragmented & inconsistent regulatory regimes

Country-specific agencies-SAHPRA, NAFDAC, Ghana FDA-maintain divergent dossier requirements, forcing brands to duplicate stability trials and labeling translations. Mutual recognition under the AU Model Law progresses slowly; only eight states enacted harmonization statutes by mid-2025. The resulting compliance drag inflates launch timelines by an average of nine months. Smaller firms without multi-country regulatory teams defer expansion, narrowing their assortment in secondary markets. Consequently, supply remains sub-optimal relative to latent demand, constraining the Africa cosmeceuticals market despite underlying growth drivers.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of organised retail & e-commerce

- Influence of social media platforms and beauty bloggers

- Counterfeit / grey-market products eroding brand trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Skin care retained a 39.02% share in 2025, equivalent to USD 1.61 billion within the Africa cosmeceuticals market size. Uptake stems from antioxidant-rich serums featuring marula and baobab oils, which scientific panels ranked highly for transepidermal water-loss reduction. Barrier-repair moisturizers command double-digit price premiums as urban dwellers prioritize pollution defense. Hyperpigmentation products leverage Cassipourea flanaganii's IC50 of 1.5 µg/mL against tyrosinase, appealing to consumers tackling post-inflammatory marks. The segment's innovation cadence is bolstered by local R&D partnerships, shortening formulation cycles to under twelve months.

Hair care, although smaller, posts the fastest 9.06% CAGR, reaching an estimated USD 1.12 billion by 2031. Male grooming accounts for 22% of incremental sales as cultural norms shift. Shampoos infused with peppermint oil address scalp sebum balance, while growth serums packed with caffeine and kigelia extract target androgenic alopecia. Digital tutorials on protective styling, fuel conditioner, and leave-in treatment usage among natural-hair communities. Category cross-pollination-such as skin-grade actives in scalp products-broadens premiumization angles, reinforcing value density across the Africa cosmeceuticals market.

The Africa Cosmeceuticals Market is Segmented by Product Type (Skin Care, Hair Care, Oral Care, Lip Care, Others), Category (Conventional, Natural/Organic), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Specialist Beauty Retailers & Pharmacies, Others), and Geography (South Africa, Nigeria, Egypt, Kenya, Morocco, Rest of Africa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal SA

- Unilever PLC

- Johnson & Johnson Inc.

- Beiersdorf AG

- Procter & Gamble Co.

- Groupe Clarins SA

- Bayer AG

- Shiseido Co. Ltd

- Ascendis Health Ltd

- Galderma SA

- Estee Lauder Companies Inc.

- Avon Products Inc.

- Natura &Co

- Edgewell Personal Care

- Amka Products (Pty) Ltd

- Godrej Consumer Africa

- Dabur International

- Fan Milk (Danone) Dermocosmetics

- BeautyClick Kenya

- Miadi (PZ Cussons)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Zero-tariff trade pacts accelerating raw-material flows

- 4.2.2 Urban pollution driven demand for advanced skin care

- 4.2.3 Expansion of organised retail and e-commerce

- 4.2.4 Influence of Social Media Platforms and Beauty Bloggers

- 4.2.5 Validation of indigenous botanicals in dermatology

- 4.2.6 Surge in male-grooming adoption broadens addressable consumer base

- 4.3 Market Restraints

- 4.3.1 Fragmented & inconsistent regulatory regimes

- 4.3.2 Counterfeit / grey-market products eroding brand trust

- 4.3.3 Cultural backlash against controversial skin-lightening actives

- 4.3.4 Dependence on imported active ingredients exposes firms to FX volatility & shipping disruptions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Skin Care

- 5.1.1.1 Anti-ageing

- 5.1.1.2 Hyper-pigmentation / Skin-lightening

- 5.1.1.3 Anti-acne & Blemish Control

- 5.1.1.4 Sun Protection

- 5.1.1.5 Moisturisers & Emollients

- 5.1.1.6 Other Skin-care Types

- 5.1.2 Hair Care

- 5.1.2.1 Shampoos and Conditioners

- 5.1.2.2 Hair-regrowth Tonics and Serums

- 5.1.2.3 Colourants and Dyes

- 5.1.2.4 Other Hair-care Types

- 5.1.3 Oral Care

- 5.1.4 Lip Care

- 5.1.5 Others

- 5.1.1 Skin Care

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Natural/ Organic

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets / Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Online Retailers

- 5.3.4 Specialist Beauty Retailers and Pharmacies

- 5.3.5 Others

- 5.4 By Country

- 5.4.1 South Africa

- 5.4.2 Nigeria

- 5.4.3 Egypt

- 5.4.4 Kenya

- 5.4.5 Morocco

- 5.4.6 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 L'Oreal SA

- 6.4.2 Unilever PLC

- 6.4.3 Johnson & Johnson Inc.

- 6.4.4 Beiersdorf AG

- 6.4.5 Procter & Gamble Co.

- 6.4.6 Groupe Clarins SA

- 6.4.7 Bayer AG

- 6.4.8 Shiseido Co. Ltd

- 6.4.9 Ascendis Health Ltd

- 6.4.10 Galderma SA

- 6.4.11 Estee Lauder Companies Inc.

- 6.4.12 Avon Products Inc.

- 6.4.13 Natura &Co

- 6.4.14 Edgewell Personal Care

- 6.4.15 Amka Products (Pty) Ltd

- 6.4.16 Godrej Consumer Africa

- 6.4.17 Dabur International

- 6.4.18 Fan Milk (Danone) Dermocosmetics

- 6.4.19 BeautyClick Kenya

- 6.4.20 Miadi (PZ Cussons)

7 Market Opportunities and Future Outlook