PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934606

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934606

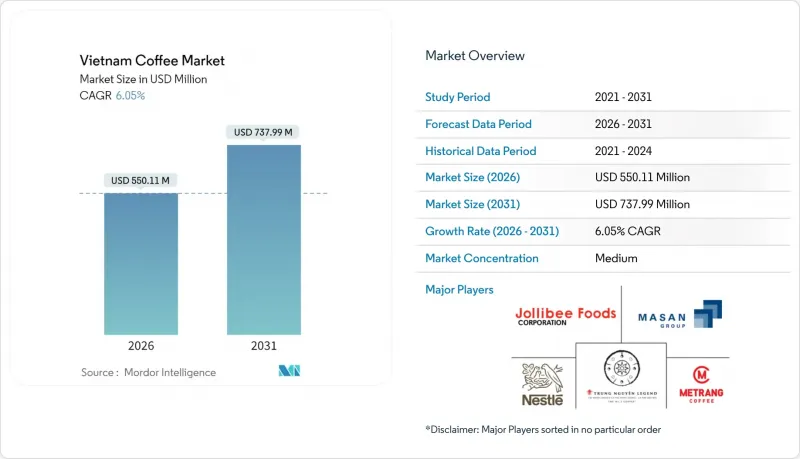

Vietnam Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam coffee market size in 2026 is estimated at USD 550.11 million, growing from 2025 value of USD 518.72 million with 2031 projections showing USD 737.99 million, growing at 6.05% CAGR over 2026-2031.

In the first half of the Financial Year 2024/25, the average export price surged to USD 5,630 per ton, a 143% leap from the previous fiscal year, according to the U.S. Department of Agriculture. The Ministry of Agriculture and Rural Development (Vietnam) highlighted that Vietnam's coffee export revenue in 2024 hit around USD 5.5 billion, a notable rise from USD 4.1 billion the prior year. While the total planted area is being adjusted to 610,000-640,000 hectares for a focus on higher-grade output, there's a robust investment push in roasting, soluble, and ready-to-drink capacities. This, coupled with a burgeoning cafe scene, keeps the momentum alive. Global roasters' demand for Robusta, a domestic tilt towards premium beverages, and the European Union's stringent traceability mandates are collectively elevating quality and fostering vertical integration in Vietnam's coffee landscape. Furthermore, companies embracing sustainability and premiumization not only gain enhanced market access and pricing power but also enjoy fatter margins, bolstering the Vietnam coffee market's long-term competitiveness.

Vietnam Coffee Market Trends and Insights

Expansion of Cafe Chains and Franchise Models

Vietnam's cafe chains are shifting their focus from mere coffee sales to creating immersive retail experiences. Highlands Coffee, with 855 stores, boasted a 13% revenue growth in 2024. Meanwhile, Phuc Long made headlines by adding 79 new locations, bringing its total to 237 in 2024. Trung Nguyen Legend is making waves internationally, eyeing 1,000 global stores, with 130 set for China by 2024, showcasing the power of the franchise model. Vietnamese brands are not just stopping at home; they're making strategic moves into billion-dollar markets like the UAE, India, and Qatar. This is in line with the global franchising industry's bullish growth projections. Such strategies not only anchor Vietnamese coffee culture in upscale international arenas but also bolster brand recognition, aiding export endeavors. The triumph of local chains over global giants is evident. Starbucks, with its 127 outlets, pales in comparison to Highlands' 855, underscoring the edge of cultural resonance and strategic pricing.

Product Innovation with Functional Blends

Vietnamese coffee companies are innovating by turning traditional waste into premium exports, marking a shift from mere commodity production. Viet Thao Nhien has made waves by exporting coffee husk tea to Japan, a move that underscores the potential of the circular economy. By repurposing discarded Arabica coffee husks, they've crafted a health-benefiting beverage. With a decade of research backing their patented extraction technology, the company eyes expansions into South Korea and Europe. Nestle's NESCAFE Plan, on the other hand, has empowered over 21,000 farmers with high-yield coffee varieties and digital tools, boosting incomes by 30-150% and championing regenerative practices. Meanwhile, Sucafina Instant forecasts a 59% rise in per capita spending on instant coffee by 2029, thanks to its rich flavors and health-focused offerings appealing to both busy professionals and traditionalists. Such strides elevate Vietnamese coffee from basic exports to sought-after, premium products on the global stage.

Smallholder Fragmentation

In Vietnam's coffee sector, smallholder fragmentation poses significant challenges. A staggering 91% of farmers cultivate plots smaller than 2 hectares, leading to inefficiencies that hinder scalability and compliance. Data from Vietnam's General Statistics Office reveals a rise in operational farms, from 24.08 thousand in 2022 to approximately 24.94 thousand in 2023. This fragmentation issue is magnified by the EU's Deforestation Regulation. Individual farmers find it challenging to gather essential traceability data and shoulder compliance costs, a burden more easily managed by larger operations. Furthermore, many farmers depend on middlemen for inputs and financing, which complicates the supply chain and diminishes their market access and price negotiation power. While Vietnam boasted a coffee cultivation area of 720,000 hectares in 2023, projections indicate a reduction to 650,000 hectares by 2030. This shift, driven by government initiatives, aims to concentrate production on higher-standard varieties. The U.S. Department of Agriculture reports targets of 80-90% of newly cultivated areas adopting premium cultivars. Given these challenges, there's a pressing need for cooperative models and technology platforms to unify smallholder production and ensure traceability. However, the uptake of such solutions varies across Vietnam's diverse coffee-growing regions.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and Traceability

- Growth of Specialty and Premium Coffee Culture

- Supply Chain Disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Instant Coffee commands a dominant 37.10% market share, underscoring Vietnam's prowess in catering to convenience-driven consumers and its robust export reach, spanning over 100 countries, with notable brands like G7 and Trung Nguyen. The segment enjoys the advantage of well-established distribution networks and a strong consumer base, especially in rural areas, where adoption stands at 62%, slightly trailing the 72% in urban locales. Meanwhile, the Ready-to-Drink segment is poised as the market's growth engine, boasting a 7.55% CAGR through 2031, fueled by urbanization and shifting preferences among the youth. Ground Coffee and Whole Bean cater to niche markets prioritizing quality and brewing rituals, whereas Coffee Pods and Capsules face challenges in Vietnam, hindered by limited equipment adoption and price sensitivity.

In 2023, Vietnam's instant coffee production hit 171,400 metric tons, as reported by the General Statistics Office of Vietnam, with forecasts suggesting a rise in per capita spending. The segment's shift towards functional blends and health-centric formulations caters to a spectrum of consumers: from busy professionals valuing convenience to traditionalists who savor robust flavors. Westrock Coffee's foray into Ready-to-Drink facilities, highlighted by a new plant in Conway, Arkansas, underscores the global acknowledgment of RTD's growth trajectory and Vietnam's pivotal position in worldwide supply chains. Moreover, the competitive landscape increasingly favors firms with cohesive supply chains and a knack for innovation. As product differentiation gains prominence in the mature instant coffee arena, the RTD sector emphasizes the need for advanced cold-chain logistics and innovative packaging solutions.

In 2025, Robusta coffee holds 81.35% of the market, and Arabica is set to grow at a 6.55% CAGR through 2031, highlighting Vietnam's global coffee dominance. As the top Robusta producer, Vietnam supplies 40% of the global market, supported by favorable Central Highlands conditions, per the World Trade Organization. Improved Robusta quality has driven price premiums, with domestic prices surpassing Arabica for the first time in 2024, reaching VND 131,000 per kilogram. The smaller Arabica segment targets premium export markets and specialty niches like organic and single-origin coffee. Other coffee varieties remain negligible, reflecting Vietnam's focus on Robusta.

Vietnam cultivates Robusta across 716,600 to 730,000 hectares, mainly in Dak Lak, Lam Dong, Dak Nong, Gia Lai, and Kon Tum. The Ministry of Agriculture's replanting program (2021-2025) aims to replant 107,000 hectares, increase productivity to 3.5 tons per hectare, and boost incomes by 1.5-2 times. Global dynamics favor Vietnamese Robusta, as Brazil's reduced production and climate issues create supply gaps. This supports Robusta's growth and positions Vietnam's export revenue to exceed USD 7.5 billion by 2025.

The Vietnam Coffee Market is Segmented Based On Product Type (Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules, and Ready-To-Drink), by Coffee Type (Arabica and Robusta), by Category (Conventional and Speciality), and by Distribution Channel (On-Trade and Off-Trade (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and More)). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle S.A

- Vinacafe Bien Hoa

- Trung Nguy'n Legend

- Highlands Coffee (Jollibee Foods)

- Starbucks Corporation

- Me Trang Coffee

- The Coffee House

- Phuc Long Coffee and Tea

- Caffe Bene

- Len's Coffee

- JDE Peet's

- Masan Group

- Lavazza

- Kido Group (Tiamo Coffee)

- Nguyen Chat Coffee

- Copper Cow Coffee

- Anni Coffee

- Gloria Jean's Coffees

- Metrang Coffee

- Bosgaurus Coffee Roasters

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Cafe Chains and Franchise Models

- 4.2.2 Product Innovation with functional blends

- 4.2.3 Sustainability and Traceability

- 4.2.4 Growth of Specialty and Premium Coffee Culture

- 4.2.5 Rise of Home Brewing and Convenience Formats

- 4.2.6 Tech-Enabled Customer Experience

- 4.3 Market Restraints

- 4.3.1 Smallholder Fragmentation

- 4.3.2 Supply Chain Disruptions

- 4.3.3 Price Volatility and Market Uncertainty

- 4.3.4 Regulatory Uncertainty and Trade Barriers

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Coffee Pods and Capsules

- 5.1.5 Ready-to-Drink

- 5.2 By Coffee Type

- 5.2.1 Arabica

- 5.2.2 Robusta

- 5.2.3 Others

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Speciality (Organic/Single-Origin)

- 5.4 By Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Specialty Stores

- 5.4.2.4 Online Retail

- 5.4.2.5 Other Off-trade channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A

- 6.4.2 Vinacafe Bien Hoa

- 6.4.3 Trung Nguy'n Legend

- 6.4.4 Highlands Coffee (Jollibee Foods)

- 6.4.5 Starbucks Corporation

- 6.4.6 Me Trang Coffee

- 6.4.7 The Coffee House

- 6.4.8 Phuc Long Coffee and Tea

- 6.4.9 Caffe Bene

- 6.4.10 Len's Coffee

- 6.4.11 JDE Peet's

- 6.4.12 Masan Group

- 6.4.13 Lavazza

- 6.4.14 Kido Group (Tiamo Coffee)

- 6.4.15 Nguyen Chat Coffee

- 6.4.16 Copper Cow Coffee

- 6.4.17 Anni Coffee

- 6.4.18 Gloria Jean's Coffees

- 6.4.19 Metrang Coffee

- 6.4.20 Bosgaurus Coffee Roasters

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK