PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934619

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934619

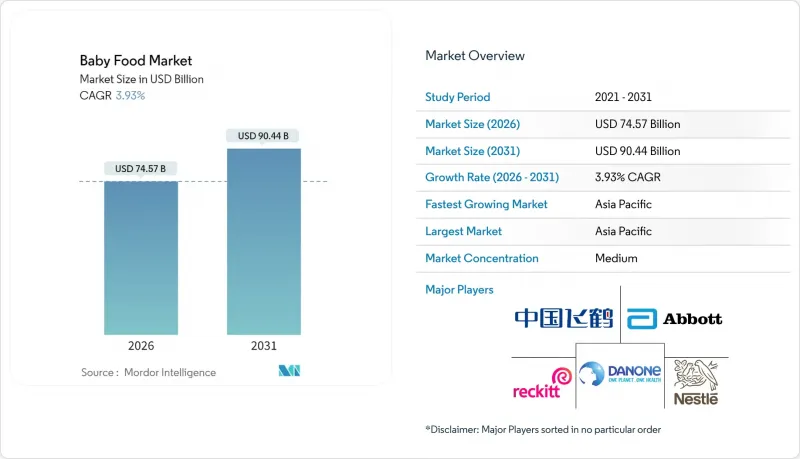

Baby Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Baby food market size in 2026 is estimated at USD 74.57 billion, growing from 2025 value of USD 71.75 billion with 2031 projections showing USD 90.44 billion, growing at 3.93% CAGR over 2026-2031.

This growth is driven by a combination of factors: increasing participation of women in the workforce, a shift towards premium nutrition, and swift innovations in ingredients. The Asia-Pacific region, bolstered by its large infant population and a burgeoning middle class, takes the lead on the global stage. Meanwhile, North America and Europe are banking on premiumization strategies to fuel their revenue growth. Competition intensifies among both global and regional brands, spurred by tech-driven product innovations, most notably human-milk-oligosaccharide (HMO) fortification and novel digital engagement strategies. However, the momentum is tempered by stricter safety regulations and declining birth rates in developed nations.

Global Baby Food Market Trends and Insights

Rising female workforce participation

As more mothers join the workforce, infant feeding patterns are shifting. Working mothers are turning to formula and ready-made baby foods to keep up with feeding schedules. In the U.S., labor force participation rates for mothers with children under three have rebounded to post-pandemic levels. Meanwhile, in India, female workforce participation hit 37% in 2022-23, marking a notable demographic shift, according to the Bureau of Labor Statistics. This trend is especially evident in urban areas, where dual-income households are increasingly common, driving a consistent demand for convenient feeding solutions. In markets with limited maternity leave policies, the link between maternal employment and formula use is particularly strong. Here, the need for supplemental feeding options arises from an earlier return to work. Furthermore, government initiatives, such as extended childcare benefits and workplace lactation support, are shaping regional demand patterns. These efforts are steering preferences towards premium and convenient baby food options.

Premiumisation in upper-middle-income households

Upper-middle-income households are increasingly opting for premium baby food products. Organic and functional nutrition segments now command a price premium of 30-50% over their conventional counterparts. This trend towards premiumization underscores a shift in parental priorities, emphasizing ingredient transparency, nutritional value, and brand trust. This is especially pronounced among millennial and Gen Z parents, who often prioritize quality over cost. In developed markets, where disposable income growth outstrips inflation, there's a notable willingness to invest in what are perceived as superior nutrition options. Organic baby food sales are surging, outpacing conventional products, as parents come to equate organic certification with enhanced safety and nutrition. This shift is paving the way for smaller, specialized brands to seize market share, leveraging targeted positioning and direct-to-consumer distribution strategies.

Breast-feeding promotion and stringent marketing codes

As WHO marketing codes tighten and national campaigns bolster breastfeeding, formula marketing faces mounting challenges. According to the WHO, its Member States are pushing for broader digital marketing regulations, especially targeting social media and influencers, key platforms for millennial parents. Globally, the regulatory landscape is becoming more stringent, with advanced enforcement mechanisms and harsher penalties for violations. Strategies that engage healthcare professionals are under heightened scrutiny, curbing the traditional relationship-building tactics once favored by formula companies for market entry. In response, these companies are shifting towards educational content and indirect marketing, a move that's driving up customer acquisition costs and dampening conversion rates.

Other drivers and restraints analyzed in the detailed report include:

- Commercialisation of human-milk-oligosaccharide (HMO) fortification

- Plant-based and hybrid formulas

- Declining birth rates in developed economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, milk formula commands a dominant 46.85% market share, solidifying its role as the go-to substitute for working mothers and a primary choice in supplemental feeding. Meanwhile, prepared baby food is on a rapid ascent, projected to grow at a 6.17% CAGR through 2031. This surge underscores a notable shift towards convenience, catering to the fast-paced lifestyles of today's parents. Innovations in packaging and technologies extending shelf life are propelling ready-to-feed baby food, allowing parents to opt for on-the-go consumption without any prep. Dried baby food remains in steady demand, especially in emerging markets with limited refrigeration, thanks to its cost-effectiveness and storage benefits.

As infants typically transition from a milk-centric diet to complementary foods around the 6-month mark, the product type segmentation mirrors these changing feeding patterns. Recent launches highlight a wave of innovation: Amara rolled out organic smoothie melts, while Sprout Foods debuted plant-based protein purees in January 2025. Additionally, other categories are gaining momentum. Products like Inspired Start's 8-allergen system, designed for allergen introduction, and specialized therapeutic formulas are resonating with health-conscious parents keen on proactive nutrition. This shift towards functional nutrition underscores a broader trend: prepared foods are increasingly seen as tools for delivering specific health benefits, moving beyond mere sustenance.

In 2025, conventional baby food products command a dominant 64.05% market share, leveraging established distribution networks, competitive pricing, and widespread acceptance across various economic segments. Meanwhile, the organic segment, though smaller, is surging ahead with a robust 7.36% CAGR, underscoring a shift in consumer preferences towards cleaner and safer nutrition. This pronounced growth in the organic sector indicates a pivotal change in parental priorities, with organic offerings gaining traction as a hallmark for premium brand differentiation and an avenue for capturing greater market share.

Organic certification not only sets high standards but also acts as a gatekeeper, creating barriers to entry and allowing for substantial price premiums. Typically, organic products command a price that's 30-50% higher than their conventional counterparts. The organic sector's growth is bolstered by a more accessible supply of organic ingredients and a maturing supply chain, which have alleviated some of the cost challenges that once hindered organic adoption. In Spain, companies like Smileat are centering their entire business models around a 100% organic ethos. At the same time, established brands are broadening their organic product lines, eager to seize the burgeoning opportunities. Globally, as regulatory frameworks for organic agriculture and certification processes move towards standardization, they pave the way for organic-centric brands to expand internationally.

The Baby Food Market Report is Segmented by Product Type (Milk Formula, Ready To Feed Baby Food, and More), Category (Organic, Conventional), Product Format (Powder, Liquid Concentrate, and More), Age Group (0-6 Months, 6-12 Months, and More), Distribution Channel (Supermarkets/Hypermarkets, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region commands a dominant 44.40% market share and boasts the highest growth rate at 6.82% CAGR through 2031. This growth is fueled by demographic advantages and a burgeoning middle class with increasing purchasing power. While China's market remains pivotal despite declining birth rates, India and Indonesia are on an upswing, driven by rising disposable incomes and urbanization. The Bureau of Labor Statistics highlights that as female workforce participation rates rise, reaching 37% in India for the 2022-23 period, demand for convenient feeding solutions increases. Rapidly evolving regulatory frameworks are seeing China's FSMP registration system greenlight 206 products, and India's FSSAI aligning sugar content norms with global health standards. The competitive arena heats up as local entities, such as Feihe International and Yili Group, vie for dominance against global giants.

North America stands as a mature market, leaning into premiumization and organic product adoption over sheer volume growth. With fertility rates projected by the US Congressional Budget Office to decline from 1.62 to 1.60 births per woman by 2030, according to OECD data, the region faces structural volume constraints. Yet, buoyed by high disposable incomes and a health-centric consumer base, there's a pronounced tilt towards premium product positioning, unlocking margin expansion avenues. The FDA's January 2025 tightening of infant formula safety regulations reshapes the competitive landscape, with compliance costs likely benefiting larger manufacturers boasting established quality systems. North American firms, leading in HMO fortification and plant-based formulations, are setting the pace in global product development.

Europe grapples with moderate growth, hampered by some of the globe's lowest fertility rates, Germany at 1.35 and the UK at 1.49, as per OECD. Yet, the region shines in organic product leadership and stringent quality standards, securing a premium global stance. Companies like Smileat champion 100% organic models, and regulatory frameworks bolstering sustainable agriculture offer a leg up to eco-conscious brands. Europe's focus on sustainability and clean-label products is reshaping global product trends, with its standards often becoming international benchmarks. However, navigating the complexities of Brexit-related trade shifts and diverse national regulations within the EU demands adept regulatory navigation skills for market access strategies.

- Nestle SA

- Danone SA

- Reckitt Benckiser

- Abbott Laboratories

- Feihe International

- Royal FrieslandCampina

- Junlebao Dairy

- Ausnutria Dairy

- Yili Group

- HiPP GmbH

- Perrigo Company

- Bellamy's Organic

- Hero Group

- Arla Foods

- Bubs Australia

- Beingmate Co.

- Bobbie Baby Inc.

- Hain Celestial Group

- Kendal Nutricare

- Meiji Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising female workforce participation

- 4.2.2 Premiumisation in upper-middle-income households

- 4.2.3 Commercialisation of human-milk-oligosaccharide (HMO) fortification

- 4.2.4 Plant-based and hybrid formulas

- 4.2.5 Functional nutrition and immunity support

- 4.2.6 Ready-to-eat and portable formats

- 4.3 Market Restraints

- 4.3.1 Breast-feeding promotion and stringent marketing codes

- 4.3.2 Declining birth rates in developed economies

- 4.3.3 Stringent Regulations and product safety concerns

- 4.3.4 Reformulation costs from looming global sugar-reduction mandates

- 4.4 Consumer Demand Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Milk Formula

- 5.1.2 Ready to Feed Baby Food

- 5.1.3 Dried Baby Food

- 5.1.4 Other Product Type

- 5.2 By Category

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Product Format

- 5.3.1 Powder

- 5.3.2 Liquid Concentrate

- 5.3.3 Ready-to-Feed

- 5.4 By Age Group

- 5.4.1 0-6 Months

- 5.4.2 6-12 Months

- 5.4.3 12-24 Months

- 5.4.4 24-36 Months

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Drugstores/Pharmacies

- 5.5.3 Convenience Stores

- 5.5.4 Online Retail Stores

- 5.5.5 Other Distribution Channel

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Danone SA

- 6.4.3 Reckitt Benckiser

- 6.4.4 Abbott Laboratories

- 6.4.5 Feihe International

- 6.4.6 Royal FrieslandCampina

- 6.4.7 Junlebao Dairy

- 6.4.8 Ausnutria Dairy

- 6.4.9 Yili Group

- 6.4.10 HiPP GmbH

- 6.4.11 Perrigo Company

- 6.4.12 Bellamy's Organic

- 6.4.13 Hero Group

- 6.4.14 Arla Foods

- 6.4.15 Bubs Australia

- 6.4.16 Beingmate Co.

- 6.4.17 Bobbie Baby Inc.

- 6.4.18 Hain Celestial Group

- 6.4.19 Kendal Nutricare

- 6.4.20 Meiji Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS