PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934630

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934630

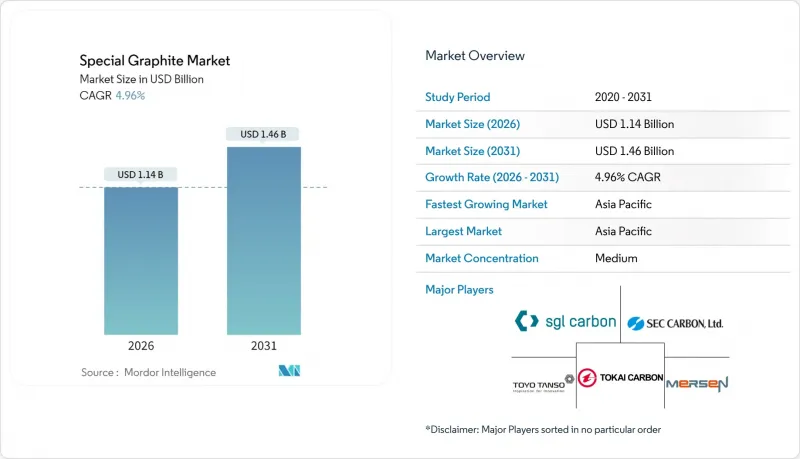

Special Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Special Graphite Market was valued at USD 1.09 billion in 2025 and estimated to grow from USD 1.14 billion in 2026 to reach USD 1.46 billion by 2031, at a CAGR of 4.96% during the forecast period (2026-2031).

Decarbonization policies, solar-wafer build-outs, and Western battery-anode localization are expanding high-purity isotropic and molded grades beyond traditional steel electrodes. China's 2024 export-license regime for natural flake and the 25% United States tariff set for 2026 are accelerating the qualification of non-Chinese feedstocks and the restarts of dormant Western capacity. Foundry migration from metal to graphite molds in complex-alloy casting, semiconductor crucible demand, and photovoltaic hot-zone consumption underpin resilient end-market diversity, while substitution risks from sodium-ion chemistries temper longer-range volume expectations. Competitive dynamics favor suppliers who can certify sub-10-ppm impurity levels and offer ISO 9001 and ISO 14001 compliance, as buyers increasingly emphasize provenance over the lowest cost. Overall, the special graphite market remains moderately consolidated yet technically differentiated, giving Western and Japanese incumbents scope to defend high-margin niches.

Global Special Graphite Market Trends and Insights

Government Decarbonization Policies Boosting Solar Wafer Demand

Net-zero roadmaps are translating into gigawatt-scale photovoltaic expansions that consume high-purity graphite crucibles and hot-zone parts at 180-220 t per installed gigawatt. The European Union targets 750 GW by 2030, adding more than 30,000 t of graphite annually, while China's 14th Five-Year Plan mandates 1,200 GW of combined wind and solar capacity by the same year. India's 2024 production-linked incentive for solar modules further amplifies localized consumable demand. Policy-locked procurement cycles give suppliers multi-year volume visibility and justify capacity investments, insulating this driver from typical steel-cycle volatility.

EV Battery Localization in United States and European Union Sparking Specialty Graphite Offtake

Inflation Reduction Act rules phasing out Chinese battery materials from subsidies by 2027 have triggered non-Chinese graphite projects. Nouveau Monde Graphite secured USD 50 million from General Motors and Panasonic Energy to supply 36,000 t/yr of flake from Quebec, and Panasonic additionally contracted 10,000 t/yr of synthetic graphite from Novonix's Tennessee plant. Europe's Critical Raw Materials Act, effective 2023, compels 40% domestic processing by 2030, prompting Mersen to raise US isotropic capacity to 16,000 t/yr. Western cell makers now accept 20-30% price premiums for traceable feedstocks, shifting margin to certified suppliers.

Sino-Centric Raw-Flake Supply Concentration Raising Procurement Risk

China mined 77% of global natural graphite and refined over 90% of anode-grade output in 2024. December 2023 export license controls briefly curbed shipments, revealing supply chain fragility. Non-Chinese projects-from Mozambique's Balama to Canada's Lac des Iles-face financing challenges and 12-18-month customer-qualification cycles, which embed a 15-20% risk premium into Western pricing and incentivize inventory stockpiling.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Large-Format Si-Rich Anodes Requiring Higher-Purity Graphite

- Foundry Migration from Metal Molds to Graphite Molds for Complex Alloys

- Breakthroughs in Lithium Titanium Oxide and Sodium-Ion Chemistries Reducing Graphite Intensity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isotropic graphite held 47.90% of the special graphite market share in 2025 and is growing at a 5.44% CAGR, fueled by semiconductor crucibles, EDM electrodes, and green-hydrogen plates. Mersen lifted US capacity to 16,000 t to serve wafer fabs, and Fraunhofer's bipolar-plate breakthrough could add 30,000 t annual demand. Extruded graphite, used in electrodes and continuous-casting molds, faces structural overcapacity after Tokai Carbon's 50% Japanese and 30% European electrode cuts by July 2025. Molded graphite grows alongside Middle East aluminum smelting, while flexible foils address thermal management gaskets in EVs. Suppliers achieving sub-10-ppm impurity win multiyear offtakes, insulating revenue from cyclical steel swings.

The Special Graphite Market Report is Segmented by Product Type (Extruded Graphite, Isotropic Graphite, Molded Graphite, and Other Types), End-User Industry (Electronics, Photovoltaic, Foundry and Metallurgy, and Other End-Users), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region dominated 45.70% of 2025 revenue and is expected to grow at a rate of 6.42% during the forecast period (2026-2031). China anchors upstream mining and refining, yet Japan shifts focus to fine-carbon parts after domestic electrode cuts, while South Korea secures Mozambican flake via Posco Future M. India's PLI scheme for solar modules stimulates crucible demand and domestic fabricator opportunities.

North America captures a substantial share of the special graphite market. Vidalia's 11,300 t spherical plant and Birla Carbon's USD 1 billion South Carolina project illustrate Inflation Reduction Act tailwinds. Tariffs rising to 25% on Chinese graphite in 2026 and a wave of gigafactory construction underpin regional growth, though 12-18-month qualification timelines remain a hurdle.

Europe's share, driven by semiconductor, automotive, and renewable installations. SGL Carbon's 30% jump in semiconductor sales contrasts with its exit from anode R&D due to Chinese cost pressure. REACH dust rules raise compliance costs, yet the Critical Raw Materials Act pushes domestic processing.

South America and the Middle East & Africa supply raw flake and aluminum-smelting cathodes but face infrastructure gaps that temper near-term expansion.

- Entegris, Inc.

- Fangda Carbon New Material Co. Ltd

- GrafTech International

- Graphite India Limited

- MERSEN PROPERTY

- Morgan Advanced Materials Plc

- Nippon Carbon Co. Ltd

- Pingdingshan City Kaiyuan Specialty Graphite Ltd

- Schunk Carbon Technology

- SEC CARBON, Limited

- SGL Carbon

- Tokai Carbon Co., Ltd.

- Toyo Tanso Co., Ltd.

- Yichang Xincheng Graphite Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government decarbonisation policies boosting solar wafer demand

- 4.2.2 EV-battery supply-chain localisation in United States and European Union sparking specialty graphite offtake

- 4.2.3 Shift to large-format Si-rich anodes that require higher-purity graphite

- 4.2.4 Foundry migration from metal molds to graphite molds for complex alloys

- 4.2.5 Rapid expansion of green-hydrogen electrolyser plates using isostatic graphite

- 4.3 Market Restraints

- 4.3.1 Sino-centric raw-flake supply concentration raises procurement risk

- 4.3.2 Breakthroughs in Lithium Titanium Oxide (LTO ) and sodium-ion chemistries reducing graphite intensity

- 4.3.3 Stricter EU REACH limits on graphite dust emissions increase CAPEX

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Extruded Graphite

- 5.1.2 Isotropic Graphite

- 5.1.3 Molded Graphite

- 5.1.4 Other Types

- 5.2 By End-user Industry

- 5.2.1 Electronics Industry

- 5.2.2 Photovoltaic Industry

- 5.2.3 Foundry and Metallurgy Industry

- 5.2.4 Other End-Users

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 India

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Entegris, Inc.

- 6.4.2 Fangda Carbon New Material Co. Ltd

- 6.4.3 GrafTech International

- 6.4.4 Graphite India Limited

- 6.4.5 MERSEN PROPERTY

- 6.4.6 Morgan Advanced Materials Plc

- 6.4.7 Nippon Carbon Co. Ltd

- 6.4.8 Pingdingshan City Kaiyuan Specialty Graphite Ltd

- 6.4.9 Schunk Carbon Technology

- 6.4.10 SEC CARBON, Limited

- 6.4.11 SGL Carbon

- 6.4.12 Tokai Carbon Co., Ltd.

- 6.4.13 Toyo Tanso Co., Ltd.

- 6.4.14 Yichang Xincheng Graphite Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment