PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934635

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934635

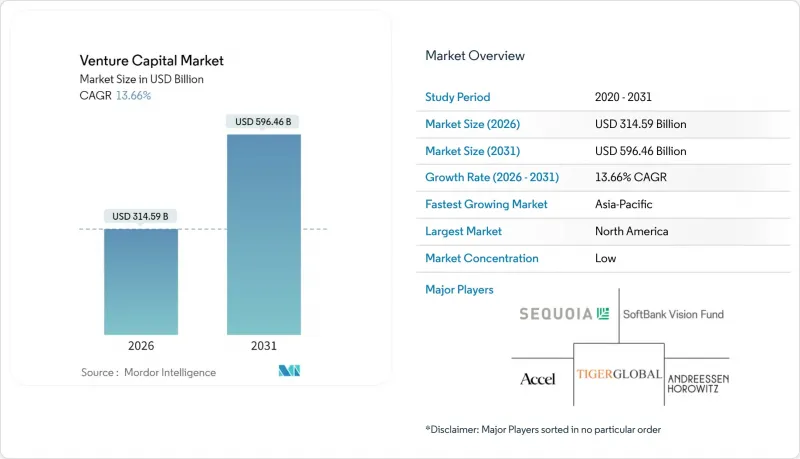

Venture Capital - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The venture capital market is expected to grow from USD 276.79 billion in 2025 to USD 314.59 billion in 2026 and is forecast to reach USD 596.46 billion by 2031 at 13.66% CAGR over 2026-2031.

Investors are chasing artificial-intelligence-native start-ups, sovereign wealth funds are reallocating capital overseas, and corporate venture arms are accelerating deal velocity to secure technological moats. Secondary trading platforms that improve liquidity for limited partners are also sustaining momentum in the venture capital market. Institutional portfolios continue to view the asset class as offering superior risk-adjusted returns over traditional equities and bonds. Competitive intensity is therefore rising as traditional firms contend with sovereign funds, corporate investors, and crypto-native vehicles for premium deal flow.

Global Venture Capital Market Trends and Insights

AI-Native Start-ups Demanding Larger Seed Rounds

Seed-stage rounds for artificial-intelligence companies jumped from USD 2.1 million in 2019 to USD 8.7 million in 2024, reflecting steep compute and talent costs. The venture capital market is bifurcating between AI-first businesses that need USD 5-15 million seed funding and traditional software firms that still operate on USD 1-3 million. Corporate investors such as Google Ventures and Amazon's Alexa Fund collectively deployed more than USD 3.2 billion into AI seeds during 2024. Venture firms are opening offices in Montreal, Tel Aviv, and Singapore to chase localized talent clusters. Fund lifecycles are stretching from 10 to 12 years to accommodate longer AI commercialization timelines, reshaping the venture capital market's return horizon.

Sovereign Wealth Funds Enlarging Non-Domestic VC Allocations

Sovereign wealth funds committed USD 47 billion to overseas technology deals in 2024, a 43% annual jump. Saudi Arabia's Public Investment Fund launched a USD 8 billion vehicle targeting North American and European start-ups, and Singapore's GIC grew its venture team by 65%. Patient capital from these funds is crowding traditional institutional investors out of marquee rounds. Regulatory regimes in recipient countries now balance economic openness with national-security screens for semiconductors and quantum computing deals. Consolidation among fund managers is intensifying because sovereign funds prefer large, multi-vintage platforms in the venture capital market.

Higher Interest-Rate Environment Compressing Valuations

Average late-stage valuations fell 32% from 2021 highs after central banks kept policy rates above 5% through 2024. Down rounds surged 67% during the year, cutting some enterprise-software prices by 25-40%. Venture investors have pivoted to profitability metrics, rewarding firms with durable margins and cash generation. Mark-to-market hits are complicating new fund raises, lengthening the capital-recycling cycle in the venture capital market. Analysts expect only gradual multiple expansion as rates drift lower in 2026.

Other drivers and restraints analyzed in the detailed report include:

- Corporate VC Arms Accelerating Strategic Deal Count

- Secondary Marketplaces Improving Liquidity for LPs

- Exit Drought Extending Fund-Raising Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Scale-up financing is projected to compound at 9.05% through 2031, reflecting the venture capital market size required for USD 50-200 million rounds that propel proven companies to international scale. Early-stage deals still dominate with 48.65% in 2025 because AI innovation pipelines remain robust. Seed rounds have inflated as AI founders demand larger checks to cover compute expenses and elite talent, reshaping expectations across the venture capital market. Breakout deals face tougher diligence as investors prioritize clarity on profitability. Stage distinctions are blurring, with some Series A rounds exceeding USD 100 million when product-market fit is unmistakable.

Early-stage investors are concentrating on capital-efficient models that can weather longer exit horizons without excessive dilution. Scale-up funds hedge risk by co-investing with corporate partners that provide distribution advantages. Seed specialists use rolling-fund structures to lock recurring commitments while remaining agile in the venture capital market. Continuation vehicles now extend fund life for high-performing assets that miss the IPO window. Regulators are updating accredited-investor definitions to reflect a broader pool of sophisticated participants.

The Venture Capital Market Report is Segmented by Stage of Investment (Seed, Early Stage, and More), Industry (Health, Fintech, Enterprise Software, and More), Exit Type (Initial Public Offering, Strategic M&A, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 46.20% venture capital market share in 2025, anchored by Silicon Valley yet increasingly supported by emergent hubs like Austin, Miami, and Toronto. Artificial-intelligence clusters and deep-capital pools continue to draw founders. Canada logged USD 8.3 billion in investments, bolstered by university research commercialization. Mexican fintechs such as Clip attracted multiregional backers as digital payments expanded across Latin America. Regulatory refinements permit innovative fund structures, including rolling funds and DAO-based vehicles.

Asia-Pacific is the fastest-growing region with a 9.92% CAGR, powered by China's hard-tech resurgence and Japan's maturing start-up scene. Chinese funds raised USD 23 billion in 2024 after data-security guidance clarified investment boundaries. Japan's USD 4.7 billion in venture inflows underscores policy success in encouraging entrepreneurship. India's USD 11.8 billion haul reflects continued fintech and SaaS momentum even amid global tightening. Southeast Asian economies such as Indonesia and Vietnam draw capital to e-commerce and logistics arenas.

Europe attracted USD 89 billion despite macro headwinds, consolidating around London, Berlin, and Stockholm. Deep-tech funds target quantum and advanced materials sourced from university spin-offs. Brexit clarity sustains cross-border flows, though many firms maintain dual operating entities. Germany advances industrial-tech leadership by leveraging engineering heritage. EU regulators refine alternative-investment directives to maintain investor safeguards while supporting the venture capital market.

List of Companies Covered in this Report:

- Sequoia Capital

- Andreessen Horowitz

- SoftBank Vision Fund

- Tiger Global Management

- Accel

- Lightspeed Venture Partners

- Insight Partners

- General Catalyst

- Bessemer Venture Partners

- Index Ventures

- Kleiner Perkins

- New Enterprise Associates (NEA)

- GGV Capital

- Y Combinator Continuity

- Balderton Capital

- Northzone

- Khosla Ventures

- Temasek Holdings

- Mubadala Capital

- QED Investors

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-native start-ups demanding larger seed rounds

- 4.2.2 Sovereign wealth funds enlarging non-domestic VC allocations

- 4.2.3 Corporate VC arms accelerating strategic deal count

- 4.2.4 Secondary marketplaces improving liquidity for LPs

- 4.2.5 Token-based fundraising models converging with traditional VC

- 4.2.6 Geopolitical re-shoring incentives for critical tech sectors

- 4.3 Market Restraints

- 4.3.1 Higher interest-rate environment compressing valuations

- 4.3.2 Exit drought extending fund-raising cycles

- 4.3.3 Heightened antitrust scrutiny of tech M&A

- 4.3.4 Limited partner shift toward private credit funds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Investors (LPs)

- 4.7.3 Bargaining Power of Start-ups (Fund-Seekers)

- 4.7.4 Threat of Substitutes (Crowdfunding, ICOs)

- 4.7.5 Competitive Rivalry Among VC Firms

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Stage of Investment

- 5.1.1 Seed

- 5.1.2 Early Stage

- 5.1.3 Breakout Stage

- 5.1.4 Scale-up

- 5.2 By Industry

- 5.2.1 Health

- 5.2.2 Fintech

- 5.2.3 Enterprise Software

- 5.2.4 Energy

- 5.2.5 Transportation

- 5.2.6 Robotics

- 5.2.7 Other Industries

- 5.3 By Exit Type

- 5.3.1 Initial Public Offering (IPO)

- 5.3.2 Strategic M&A

- 5.3.3 Secondary Sale / Buy-out

- 5.3.4 Write-offs

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Sequoia Capital

- 6.4.2 Andreessen Horowitz

- 6.4.3 SoftBank Vision Fund

- 6.4.4 Tiger Global Management

- 6.4.5 Accel

- 6.4.6 Lightspeed Venture Partners

- 6.4.7 Insight Partners

- 6.4.8 General Catalyst

- 6.4.9 Bessemer Venture Partners

- 6.4.10 Index Ventures

- 6.4.11 Kleiner Perkins

- 6.4.12 New Enterprise Associates (NEA)

- 6.4.13 GGV Capital

- 6.4.14 Y Combinator Continuity

- 6.4.15 Balderton Capital

- 6.4.16 Northzone

- 6.4.17 Khosla Ventures

- 6.4.18 Temasek Holdings

- 6.4.19 Mubadala Capital

- 6.4.20 QED Investors

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment