PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934643

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934643

Automotive Bearings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

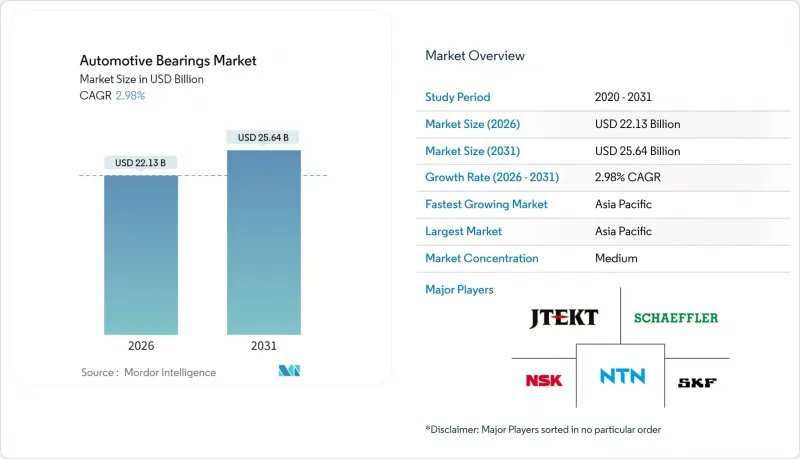

The automotive bearings market is expected to grow from USD 21.49 billion in 2025 to USD 22.13 billion in 2026 and is forecast to reach USD 25.64 billion by 2031 at 2.98% CAGR over 2026-2031.

The expansion sits at the intersection of stabilizing internal-combustion volumes and accelerating electrification, reshaping bearing specifications and reducing the average bearing count per vehicle while driving demand for low-friction, high-efficiency solutions. Rolling-element designs continue to dominate core wheel-end, transmission, and e-powertrain positions. Yet, ceramic hybrids, sensor-integrated units, and additive-manufactured cages carve a premium share as OEMs chase energy savings and compact modular layouts. Asia-Pacific anchors global growth on rising light-vehicle builds and local EV adoption. At the same time, North America and Europe focus on aftermarket upgrades and predictive maintenance enabled by intelligent bearings. Margins remain under pressure from steel volatility, tariff levies, and counterfeit inflows, pushing leading suppliers toward vertical integration, advanced materials, and circular-performance business models.

Global Automotive Bearings Market Trends and Insights

Electrification-Led Demand for Low-Friction E-Powertrain Bearings

Electric vehicles require bearings with ultra-low friction and high electrical insulation, pushing suppliers toward ceramic balls, specialized coatings and new cage geometries that curb energy loss and avert electrical discharge. SKF's ultra-low-friction wheel bearing series targets EV hubs by cutting torque drag, while Schaeffler's centrifugal-disc ball bearing lowers friction by 80% and multiplies service life tenfold, highlighting the performance leap now expected in e-powertrain units. Manufacturers also confront stray-current threats that cause pitting, which makes hybrid silicon-nitride solutions a strategic necessity in high-speed motor shafts . Investment flows into dedicated EV lines, with premium pricing offsetting reduced per-vehicle volume, ensuring the automotive bearings market continues to monetize electrification despite lower component counts

Aftermarket Expansion of Longer Vehicle Service Life

The aging vehicle fleet in the United States prompts longer intervals between component replacements, particularly for hub and drivetrain bearings. Advances in surface treatment technologies are helping extend the lifespan of these parts, allowing owners to maintain safety while reducing service frequency. Fleet operators increasingly use data analytics to anticipate mechanical issues, shifting the aftermarket landscape from reactive repairs to proactive, condition-based purchasing. Streamlined distribution channels and direct-to-consumer models enable high-performance bearing products to retain value beyond their initial installation. This evolving structure is helping stabilize demand across the automotive bearings sector, even as new vehicle sales fluctuate

Counterfeit Low-Cost Bearings Eroding OEM/Aftermarket Revenue

JTEKT testing shows counterfeit hub units failing fatigue tests in one-tenth the life of genuine parts . SKF destroyed 15 tons of seized knock-offs, yet improved holographic labels and blockchain traceability only partially stem the tide. In emerging markets, weak legal penalties allow repeat offenders, forcing legitimate suppliers to finance education campaigns and forensic audits. The reputational and warranty costs weigh on the automotive bearings market's OEM and aftermarket segments.

Other drivers and restraints analyzed in the detailed report include:

- Integrated Sensor Bearings Enabling ADAS and Autonomy

- Additive-Manufactured Cages Improving Custom High-RPM Designs

- Supply-Chain Disruptions from Trade Tensions and Logistics Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rolling-element products generated 53.10% of 2025 revenue, and are forecast to grow at 5.08% CAGR through 2031. Their dominance stems from balanced cost, load, and speed capabilities that suit wheel hubs, transmissions, and e-axles. Cylindrical and tapered rollers serve heavy-duty drivelines, while deep-groove ball bearings excel in high-speed EV motors where low friction and acoustic comfort are paramount. Longer EV warranty terms favor sealed-for-life units, stimulating demand for integrated lubrication and sensor packages.

The plain-bearing niche persists in tight-package combustion engines and HVAC ancillaries where oscillatory motion prevails, yet its share continues to erode. Meanwhile, cross-roller and needle innovations target compact steering columns and electric park brakes, incrementally lifting value density. As hub module designs migrate to third-generation double-row formats with ABS encoders, rolling-element volumes will rise within premium segments, reinforcing their centrality to the automotive bearings market.

Steel accounted for 76.10% of global shipments in 2025, reflecting mature melting routes, proven fatigue life, and favorable cost. The segment expands more slowly as OEMs pursue electrified platforms where stray-current insulation becomes critical. Ceramic and hybrid units advance at 6.02% CAGR.

Polymer and coated-steel variants fill corrosive or noise-sensitive niches, while surface-engineering breakthroughs-diamond-like carbon, plasma nitriding-prolong service intervals without material substitution. Ceramic costs could drop as kiln utilization rises, trimming the price premium and enticing mid-range EV models. Nonetheless, the automotive bearings market share of steel is expected to remain near two-thirds by 2031, sustained by affordable mass-market ICE and hybrid volumes

The Automotive Bearings Market Report is Segmented by Bearing Type (Plain Bearings and Rolling Element Bearings), Material (Steel, Ceramic and Hybrid, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application/Position (Wheel End, Engine and Turbocharger, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owned 43.40% of 2025 revenue and is forecast to grow at a 6.55% CAGR, buoyed by China's scale, India's double-digit assembly additions, and ASEAN's fast-rising supplier networks. Chinese OEMs integrate locally produced hybrid-ceramic hubs to meet EV warranty demands, while India's Make-in-India drive cuts import dependence from 40% toward 25% by mid-decade. Government subsidies for battery electric two-wheelers broaden demand for compact deep-groove products, reinforcing the region's contribution to the automotive bearings market.

North America sustains a sizeable share anchored by high pickup and SUV output plus a mature replacement cycle. The Biden-era tariff landscape adds USD 8 billion in annual components costs, nudging suppliers like Schaeffler to open the USD 230 million Ohio e-axle plant that shortens supply chains and secures OEM approvals. Mexico's cost-effective machining clusters attract ring-forging investments that backfill U.S. shortages, while Canada leverages raw-steel availability. The region's aftermarket remains resilient as average vehicle age climbs past 12.8 years, propping revenue inside the automotive bearings market despite volatile new-car sales.

Europe wrestles with slower light-vehicle production yet accelerates EV mandates that lift demand for sensor-integrated and hybrid-ceramic solutions. Germany leads R&D spending; Sweden-based SKF pilots circular-performance reclad programs that align with EU Green Deal objectives. Schaeffler's consolidation-closing Austria's Berndorf plant while upgrading Slovakia's Kysuce site-highlights ongoing cost realignment. The U.K., France and Italy pursue localized e-axle builds that favor regional bearing sourcing, ensuring the continent holds strategic sway even as its share modestly contracts within the automotive bearings market.

- SKF Ltd.

- Schaeffler AG

- NSK Ltd.

- NTN Corp.

- JTEKT Corp.

- The Timken Company

- MinebeaMitsumi Inc.

- Nachi-Fujikoshi Corp.

- Federal-Mogul (Tenneco)

- Rheinmetall Automotive

- ILJIN Group

- C&U Group

- Wafangdian Bearing Co. (ZWZ)

- ABC Bearings (Timken India)

- Hubei New Torch Science & Tech

- GKN Automotive

- Denso Corp.

- CW Bearing GmbH

- Luoyang LYC Bearing

- SNL Bearings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification-Led Demand for Low-Friction E-Powertrain Bearings

- 4.2.2 Rapid Vehicle Production Growth in Asia Driving Volume Demand

- 4.2.3 Aftermarket Expansion of Longer Vehicle Service Life

- 4.2.4 OEM Focus on Lightweight, Compact Module Integration

- 4.2.5 Integrated Sensor Bearings Enabling ADAS and Autonomy

- 4.2.6 Additive-Manufactured Cages Improving Custom High-RPM Designs

- 4.3 Market Restraints

- 4.3.1 Volatile Alloy and Specialty-Steel Prices Squeezing Margins

- 4.3.2 Counterfeit Low-Cost Bearings Eroding OEM/Aftermarket Revenue

- 4.3.3 Supply-Chain Disruptions from Trade Tensions and Logistics Costs

- 4.3.4 EV Driveline Simplification: Reducing Bearing Count Per Vehicle

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Bearing Type

- 5.1.1 Plain Bearings

- 5.1.2 Rolling Element Bearings

- 5.1.2.1 Ball Bearings

- 5.1.2.2 Roller Bearings

- 5.1.2.2.1 Cylindrical Roller

- 5.1.2.2.2 Tapered Roller

- 5.2 By Material

- 5.2.1 Steel

- 5.2.2 Ceramic & Hybrid

- 5.2.3 Polymer & Others

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles (LCV)

- 5.3.3 Heavy Commercial Vehicles (HCV)

- 5.3.4 Two-Wheelers

- 5.3.5 Off-Highway (Agriculture, Construction, Mining)

- 5.4 By Application / Position

- 5.4.1 Wheel End

- 5.4.2 Engine & Turbocharger

- 5.4.3 Transmission & Driveline

- 5.4.4 Steering & Suspension

- 5.4.5 HVAC, Alternator & Other Accessories

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia & New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle-East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle-East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 SKF Ltd.

- 6.4.2 Schaeffler AG

- 6.4.3 NSK Ltd.

- 6.4.4 NTN Corp.

- 6.4.5 JTEKT Corp.

- 6.4.6 The Timken Company

- 6.4.7 MinebeaMitsumi Inc.

- 6.4.8 Nachi-Fujikoshi Corp.

- 6.4.9 Federal-Mogul (Tenneco)

- 6.4.10 Rheinmetall Automotive

- 6.4.11 ILJIN Group

- 6.4.12 C&U Group

- 6.4.13 Wafangdian Bearing Co. (ZWZ)

- 6.4.14 ABC Bearings (Timken India)

- 6.4.15 Hubei New Torch Science & Tech

- 6.4.16 GKN Automotive

- 6.4.17 Denso Corp.

- 6.4.18 CW Bearing GmbH

- 6.4.19 Luoyang LYC Bearing

- 6.4.20 SNL Bearings Ltd.

7 Market Opportunities & Future Outlook