PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934651

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934651

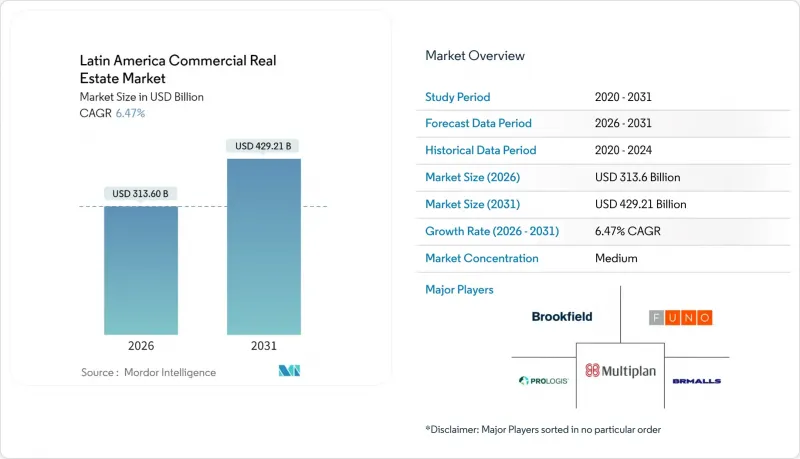

Latin America Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Latin America Commercial Real Estate Market size in 2026 is estimated at USD 313.6 billion, growing from 2025 value of USD 294.54 billion with 2031 projections showing USD 429.21 billion, growing at 6.47% CAGR over 2026-2031.

Strong tenant appetite for Grade-A logistics parks, deepening digital commerce penetration, and steady institutional capital inflows have created a clear runway for expansion. Nearshoring has intensified demand along Mexico's Bajio and northern border corridors, while Brazil's intermodal hubs continue to attract modern distribution assets. Corporates appear more willing to lease than to buy, which keeps vacancy tight in prime submarkets and lifts effective rents despite construction-cost pressure. At the same time, mixed-use redevelopments in Sao Paulo, Mexico City, Bogota, and Santiago are drawing lifestyle-driven foot traffic, helping landlords diversify income streams and hedge against single-asset downturns. Capital markets activity remains supportive as regional REITs, FIBRAs, and FIIs recycle assets to fund new pipelines and as global investors hunt for cash-flow visibility at yields well above advanced-economy benchmarks.

Latin America Commercial Real Estate Market Trends and Insights

Nearshoring And "Mexico+" Manufacturing Wave Boosting Industrial Parks And Logistics Demand

Near-term leasing momentum is strongest where electronics, automotive, and appliance producers relocate capacity to sidestep tariff risk. Plants cluster along Mexico's Bajio spine and the northern border, pushing vacancy for Class-A sheds below 3% in some submarkets. Vesta has added land in Guadalajara and Monterrey to ensure it can pre-lease buildings before slab pour, a tactic that anchors cash flow early in the development cycle. FIBRA Prologis financed its expansion through a 100 million-certificate issuance, confirming institutional conviction in USMCA-linked growth. Colombia's free-trade zones are following a similar script, positioning Bogota and Medellin as secondary embassies for light assembly. The overall effect is a structural shift that favors logistics as the largest and fastest-growing slice of the Latin America commercial real estate market.

E-Commerce Penetration Rising, Driving Modern Warehousing, Last-Mile Hubs, And Cold Chain

Online retail volumes did not retreat after the pandemic, pressing occupiers to secure urban cross-dock sites and temperature-controlled space. The USD 34.8 million purchase of a Vallejo facility by FIBRA Macquarie exemplifies the pricing premium for last-mile proximity in Mexico City, where embedded rent reversion exceeds 20% at lease rollover. Prologis disclosed USD 38 million in quarterly NOI from its "Other Americas" portfolio, evidence that click-to-doorstep supply chains rely on large-scale distribution nodes. Yet refrigerated stock remains sparse outside Sao Paulo, Mexico City, and Santiago, leaving perishables at risk and creating an investable gap for build-to-suit developers. The World Bank ranks Latin America below the OECD average on logistics efficiency, underlining the upside for sponsors who can integrate real-time tracking, energy-efficient systems, and accredited food-safety protocols. Investor appetite for such assets remains robust given the stickiness of tenants once mission-critical cold chains come on-line.

Macroeconomic Volatility And FX Risk Complicating Funding And Underwriting

Currency swings and policy shifts can erase underwriting buffers overnight. Argentina's peso fell 11% before stabilizing at 1,195 per dollar following April 2025 liberalization, prompting sponsors to hedge or price deals in hard currency. Mexico's rate cuts to 7.25% eased debt service but did not halt a Q3 construction dip triggered by U.S. tariff uncertainty. Brazil's real has traded within a 15% band for 18 months, forcing foreign investors to weigh costly hedges against potential translation losses. Even Prologis notes that a 10% adverse FX move could trigger USD 152 million in derivative settlements, underlining exposure for the most sophisticated players. As a result, lenders demand wider spreads or additional equity, raising total project costs and thinning achievable leverage.

Other drivers and restraints analyzed in the detailed report include:

- Tourism Rebound And Experiential Retail Lifting Hospitality And Mixed-Use Projects

- Infrastructure Upgrades Creating New Development Corridors

- Regulatory, Permitting, And Land-Title Complexity Varying Widely By Country And City

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Logistics held 30.78% of the Latin America commercial real estate market share in 2025, cementing its status as the largest property segment. Occupancy for Class-A industrial space in Mexico's border zones slipped below 3%, pushing effective rents to record highs. The category is forecast to post a 7.05% CAGR through 2031, comfortably ahead of office and retail growth rates.

Persistent reshoring by electronics and auto assemblers underpins forward leasing, encouraging landlords such as Vesta to amass 148 acres of ready-to-build land in Guadalajara and Monterrey. FIBRA Macquarie's Vallejo acquisition, complete with 6.9% annual rent step-ups, shows how last-mile footprints in land-scarce capitals command pricing power. Prologis reports USD 38 million in quarterly NOI from "Other Americas," validating the thesis that global supply chains require scalable, modern logistics networks. Offices remain vital for finance and tech clusters in Sao Paulo, Mexico City, Santiago, and Bogota, though hybrid work compresses space per employee. Prime towers with LEED badges and wellness amenities enjoy firm demand, while Class-B assets see double-digit vacancy and flat rents. Retail is split between struggling secondary malls and outperforming open-air lifestyle centers, with Parque Arauco achieving 96.4% occupancy across a 1.18 million-square-meter regional portfolio. Hospitality assets benefit from the tourism rebound, and data centers attract fresh capital as cloud providers expand Latin American nodes, highlighted by Brookfield's search for a partner in Ascenty.

The Latin America Commercial Real Estate Market Report is Segmented by Property Type (Offices, Retail, Logistics, Others), by Business Model (Sales, Rental), by End-User (Individuals/Households, Corporates & SMEs, Others), and by Geography (Brazil, Argentina, Mexico, Chile, Colombia, Peru, Rest of Latin America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Brookfield Asset Management

- Fibra Uno (FUNO)

- Prologis

- BR Malls Participacoes

- Multiplan Empreendimentos

- LOG Commercial Properties

- Vesta

- Parque Arauco

- PLAZA S.A.

- Grupo Patio

- Fibra Macquarie

- GICSA

- JHSF Participacoes

- Cyrela Commercial Properties

- Sonae Sierra Brasil

- Iguatemi S.A.

- Terranum (PEI)

- Inversiones Centenario

- VivoCorp

- Fibra Shop

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Nearshoring and "Mexico+" manufacturing wave boosting industrial parks and logistics demand.

- 4.2.2 E-commerce penetration rising, driving modern warehousing, last-mile hubs, and cold chain.

- 4.2.3 Tourism rebound and experiential retail lifting hospitality and mixed-use projects.

- 4.2.4 Infrastructure upgrades (ports, metros, highways) unlocking new development corridors.

- 4.2.5 Institutionalization-REITs/FIBRAs/FIIs and global capital targeting Grade-A assets.

- 4.3 Market Restraints

- 4.3.1 Macroeconomic volatility and FX risk complicating funding and underwriting.

- 4.3.2 Regulatory, permitting, and land-title complexity varying widely by country and city.

- 4.3.3 Construction inflation, high financing costs, and uneven power/logistics reliability squeezing feasibility.

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Property Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Logistics

- 5.1.4 Others (Industrial, Hospitality, etc.)

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Mexico

- 5.4.4 Chile

- 5.4.5 Colombia

- 5.4.6 Peru

- 5.4.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Brookfield Asset Management

- 6.4.2 Fibra Uno (FUNO)

- 6.4.3 Prologis

- 6.4.4 BR Malls Participacoes

- 6.4.5 Multiplan Empreendimentos

- 6.4.6 LOG Commercial Properties

- 6.4.7 Vesta

- 6.4.8 Parque Arauco

- 6.4.9 PLAZA S.A.

- 6.4.10 Grupo Patio

- 6.4.11 Fibra Macquarie

- 6.4.12 GICSA

- 6.4.13 JHSF Participacoes

- 6.4.14 Cyrela Commercial Properties

- 6.4.15 Sonae Sierra Brasil

- 6.4.16 Iguatemi S.A.

- 6.4.17 Terranum (PEI)

- 6.4.18 Inversiones Centenario

- 6.4.19 VivoCorp

- 6.4.20 Fibra Shop

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment