PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934659

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934659

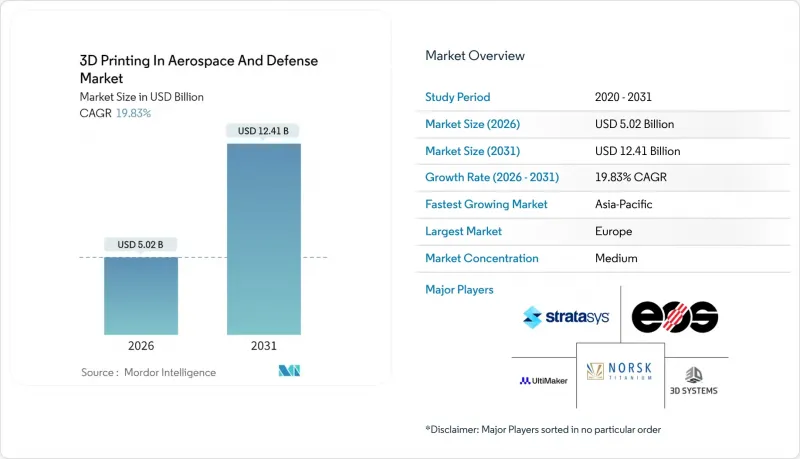

3D Printing In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

3D printing in aerospace and defense market size in 2026 is estimated at USD 5.02 billion, growing from 2025 value of USD 4.19 billion with 2031 projections showing USD 12.41 billion, growing at 19.83% CAGR over 2026-2031.

Rapid escalation in fuel-efficiency mandates, the need for resilient supply chains, and the maturation of next-generation manufacturing platforms propel adoption across civil, defense, and space programs. Weight-sensitive propulsion systems, serial production of cabin and structural parts, and faster qualification pathways enabled by artificial intelligence (AI) now converge to shorten time-to-market and compress development costs. Robust public funding, exemplified by the US Air Force Research Laboratory's USD 235 million additive manufacturing (AM) innovation tranche in 2024 and NASA's Artemis demand pull to keep North America in a leadership position. Material supply agreements focused on titanium, nickel, and aluminum powders underpin ecosystem stability, while falling printer prices open participation to hundreds of tier-2 and tier-3 suppliers. Strategic equipment mergers, notably Nikon's USD 622 million purchase of SLM Solutions, signal a shift from prototyping toward high-volume production readiness.

Global 3D Printing In Aerospace And Defense Market Trends and Insights

Weight-Reduction Mandate for Fuel-Efficient Fleets

Global aviation faces intensifying carbon goals under ICAO's CORSIA and the European Union's (EU's) Fit for 55 package, spurring manufacturers to cut airframe mass wherever possible. AM enables 40-60% weight reduction while consolidating multipart assemblies, as evidenced by GE Aerospace's LEAP fuel nozzle, which merges 20 pieces into one and trims 25% of the mass. The B787 program already flies over 300 printed parts, supporting a 20% fuel-burn improvement relative to previous-generation widebodies. Complex lattice structures and internal cooling channels, impossible to machine conventionally, now pass stringent static and fatigue tests, allowing OEMs to push weight targets without compromising safety. Military programs add a tactical dimension because lighter aircraft extend range and loiter time, which is critical for next-generation fighters and long-endurance UAVs.

Falling Metal-Printer and Powder Prices

Average selling prices for production-grade metal printers fell 25-30% between 2022 and 2024, driven by competitive intensity and scaling benefits. Desktop Metal's Shop System, priced at USD 420,000, comes roughly 40% below 2023 equivalents yet maintains AS9100-ready repeatability for steel, nickel, and titanium parts. Parallel gains in powder recycling push reuse rates to 95-98%, slicing material spend by double-digit percentages. Hoganas AB's Swedish capacity expansion, online since late 2024, adds thousands of metric tons of aerospace-grade titanium powder per year and narrows spot-price volatility. Lower capital thresholds enable smaller suppliers to justify AM investments for low-volume, high-mix contracts, especially in the UAV arena, where component variety is high and production runs remain modest.

High Capital and Powder Costs for Production-Grade Metal AM

Even after price rationalization, turnkey systems capable of flight-hardware tolerances still cost USD 500,000-2 million, while aerospace-grade titanium or nickel powders run USD 150-300 per kg, about 30% above industrial varieties. Clean-room storage, inert-gas handling, and hot isostatic pressing double the sticker price once facilities and post-processing are counted. For suppliers in South America, Southeast Asia, and Africa, scarce financing options magnify the hurdle. The cost burden curbs expansion in regions that otherwise offer competitive labor and proximity to airframe final assembly lines, moderating the growth of the aerospace 3D printing market.

Other drivers and restraints analyzed in the detailed report include:

- Defense AM-Forward Funding Lifts SME Adoption

- AI-Driven Qualification Slashes Certification Lead-Times

- Stringent Aerospace Qualification Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aircraft applications generated 64.95% of the aerospace 3D printing market revenue in 2025, reflecting deep penetration into cabin brackets, environmental-control ducting, and engine subassemblies. In civil fleets, every kilogram saved cuts fuel burn by roughly 0.03%, so operators welcome components that deliver double-digit weight relief while holding strength margins. The aerospace 3D printing market size for aircraft parts is projected to climb at 18.2% CAGR as single-aisle production rises above 70 aircraft per month and wide-body programs rebound. Retrofit opportunities also abound because printed replacements can match legacy form factors yet weigh considerably less, extending the lifespan of in-service fleets without extensive recertification. Airlines increasingly contract large quantities of printed cabin parts to minimize spares inventory, a practice enabled by distributed digital warehouses that store CAD files rather than physical stock.

UAVs will outpace manned platforms, expanding 26.10% annually through 2031 as defense ministries seek attritable platforms for contested environments. Short development cycles favor AM because tooling investments across several small production batches are uneconomical. Civil UAV adoption for logistics and aerial inspection also benefits; printed airframes allow rapid customization for sensor payloads or cargo bays. Together, these drivers push UAVs to deliver the most incremental revenue across the aerospace 3D printing market between 2026 and 2031.

Metal alloys held 60.05% of 2025 revenue, underscoring titanium's essential role in high-temperature zones such as combustor liners and turbine blades. AM slashes titanium buy-to-fly ratios from 15:1 to nearly 1:1, cutting raw-material waste and part cost, an unmatched advantage in metals that trade above USD 20 per kg. Stringent mechanical demands and mature qualification data sets defend the aerospace 3D printing market share for metal alloys. Nickel-based superalloys like Inconel 718 grow steadily for exhaust nozzles and hypersonic vehicle parts where creep resistance at 1,000 °C is mandatory.

Specialty and refractory metals, including niobium C103, tantalum alloys, and rhenium blends, will post a 24.95% CAGR as next-generation rocket engines and scramjets require temperature ceilings above 1,500 °C. Due to flame-smoke-toxicity compliance, high-performance polymers such as PEEK and PEI retain relevance for non-load-bearing interior parts. Still, metals dominate in any zone exposed to continuous loads or thermal cycles. Composite powders that combine aluminum with ceramic nanophases are on the horizon, yet remain a tiny share of the aerospace 3D printing market size, pending broader fatigue-data validation.

The 3D Printing in Aerospace and Defense Market Report is Segmented by Application (Aircraft, Unmanned Aerial Vehicles, and Spacecraft and Launch Vehicles), Material (Metal Alloys, Specialty and Refractory Metals, and More), Printer Technology (Powder-Bed Fusion, and More), End Product (Engine Components, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 43.10% of global revenue in 2025, buoyed by the presence of Boeing, Lockheed Martin, GE, and an unrivaled pipeline of defense funding. FAA Advisory Circular AC 20-170A now recognizes process simulation instead of some destructive tests, removing a major certification bottleneck. Canada's Bombardier exploits printed interior parts to keep Learjet and Challenger cabins competitive. Mexico's Baja California cluster leverages cost-effective labor to run powder-bed fusion lines for bracket production. US Defense AM Forward programs ensure domestic suppliers absorb early development risk, cementing regional leadership in the aerospace 3D printing market.

Europe ranks second, energized by Airbus, Rolls-Royce, Safran, and a vibrant materials-science community centered in Germany and Sweden. Europe's aerospace 3D printing market benefits from the EU Green Deal, which ties environmental targets to aircraft weight, effectively subsidizing AM adoption. EASA's digital-thread initiatives shorten structural approvals, encouraging Lilium and Vertical Aerospace to print eVTOL airframes. France's Toulouse cluster rallies around the R&D tax credit, seeding start-ups tackling high-temperature alloys. Meanwhile, Germany's Fraunhofer institutes pioneer multi-laser calibration protocols that could set global PBF benchmarks.

Asia-Pacific is the fastest-growing geography at 25.95% CAGR, powered by China's C919 ramp-up, India's indigenization push, and Japan's metallurgical depth. The EOS-Godrej aerospace joint venture has printed flight-qualified fuel manifolds for export-grade engines. China's state plan earmarks AM lines for 70% of its next-generation turbofan components by 2030, establishing a formidable domestic supply chain. Mitsubishi Heavy Industries installs DED heads on five-axis mills, blending additive and subtractive steps for bulkhead repairs. South Korea's KF-21 fighter features printed titanium bulkheads to shave structural mass. These moves anchor Asia-Pacific as a critical engine of demand in the aerospace 3D printing market.

- Stratasys Ltd.

- 3D Systems Corporation

- General Electric Company

- EOS GmbH

- Renishaw plc

- Velo3D, Inc.

- Desktop Metal, Inc.

- Nikon SLM Solutions AG (Nikon Corporation)

- MATERIALISE NV

- TRUMPF SE + Co. KG.

- Norsk Titanium AS

- Ultimaker B.V.

- OC Oerlikon Corporation AG

- Hoganas AB

- AddUp SAS

- GKN Aerospace Services Limited (Melrose Industries plc)

- Rocket Lab Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Weight-reduction mandate for fuel-efficient fleets

- 4.2.2 Falling metal-printer and powder prices

- 4.2.3 Defense AM-Forward funding lifts SME adoption

- 4.2.4 AI-driven qualification slashes certification lead-times

- 4.2.5 In-orbital printing demand for military space assets

- 4.2.6 Sustainability mandates driving engine retrofits

- 4.3 Market Restraints

- 4.3.1 High capital and powder costs for production-grade metal AM

- 4.3.2 Stringent aerospace qualification timelines

- 4.3.3 Titanium-powder supply-chain disruptions

- 4.3.4 Cyber/IP risks from weapon-system build files

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Aircraft

- 5.1.2 Unmanned Aerial Vehicles (UAVs)

- 5.1.3 Spacecraft and Launch Vehicles

- 5.2 By Material

- 5.2.1 Metal Alloys (Ti, Ni, Al)

- 5.2.2 Specialty and Refractory Metals

- 5.2.3 High-performance Polymers and Composites

- 5.3 By Printer Technology

- 5.3.1 Powder Bed Fusion

- 5.3.2 Directed Energy Deposition

- 5.3.3 Material Extrusion

- 5.3.4 Others

- 5.4 By End Product

- 5.4.1 Engine Components

- 5.4.2 Structural Components

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 Israel

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Stratasys Ltd.

- 6.4.2 3D Systems Corporation

- 6.4.3 General Electric Company

- 6.4.4 EOS GmbH

- 6.4.5 Renishaw plc

- 6.4.6 Velo3D, Inc.

- 6.4.7 Desktop Metal, Inc.

- 6.4.8 Nikon SLM Solutions AG (Nikon Corporation)

- 6.4.9 MATERIALISE NV

- 6.4.10 TRUMPF SE + Co. KG.

- 6.4.11 Norsk Titanium AS

- 6.4.12 Ultimaker B.V.

- 6.4.13 OC Oerlikon Corporation AG

- 6.4.14 Hoganas AB

- 6.4.15 AddUp SAS

- 6.4.16 GKN Aerospace Services Limited (Melrose Industries plc)

- 6.4.17 Rocket Lab Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment