PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934662

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934662

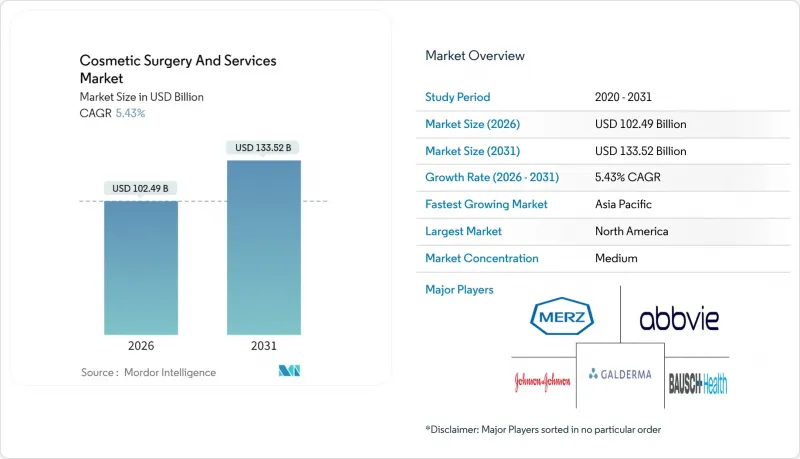

Cosmetic Surgery And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The cosmetic surgery & services market was valued at USD 97.21 billion in 2025 and estimated to grow from USD 102.49 billion in 2026 to reach USD 133.52 billion by 2031, at a CAGR of 5.43% during the forecast period (2026-2031).

Accelerated adoption of minimally invasive technologies, demographic shifts toward aesthetic self-optimization, and widening clinical indications for injectables are anchoring demand across both developed and emerging economies. Volume growth is reinforced by the 300% surge in GLP-1 weight-loss prescriptions that is generating incremental procedure needs, while social-media-mediated beauty standards continue to raise awareness and lower the psychological barrier to first-time treatment uptake. Consolidation among multi-specialty clinic chains is unlocking scale benefits in marketing, procurement, and digital engagement, thereby raising competitive thresholds for smaller providers. Although regulatory tightening around licensing, advertising, and product authentication is elevating compliance costs, the cosmetic surgery & services market remains structurally positioned for sustainable expansion through the decade.

Global Cosmetic Surgery And Services Market Trends and Insights

Growing Demand for Minimally & Non-Invasive Procedures Reshapes Treatment Paradigms

Non-surgical modalities now constitute 80% of all facial plastic procedures, with neurotoxins and dermal fillers favored across every age group. Superior efficacy of fractional lasers, radiofrequency microneedling, and high-intensity focused ultrasound is shortening recovery windows, thereby elevating patient throughput and revenue per clinic hour. Younger consumers regard injectables as preventive care rather than corrective medicine, which is lengthening patient lifecycles and stabilizing recurring revenue streams. The cosmetic surgery & services market is benefiting from regulatory frameworks such as updated FDA guidance that raise quality thresholds and legitimize new treatment indications. Integration of combination protocols-for example toxin-filler pairings followed by light energy resurfacing-is further pushing the non-surgical CAGR beyond its surgical counterpart, reinforcing a structural shift in the procedure mix.

Technological Advances in Energy-Based Devices Create New Revenue Streams

AI-enabled skin analyzers, robotic injectors, and precision energy platforms are delivering outcomes historically limited to operating rooms. Treatment customization driven by software algorithms translates into higher satisfaction scores and word-of-mouth referrals, thus compressing patient acquisition costs. Radiofrequency microneedling and fractional CO2 systems are capturing premium price points due to visible collagen remodeling within abbreviated downtime windows. Device manufacturers are co-developing exosome-enhanced protocols that merge regenerative medicine with energy delivery, producing hybrid treatments that support price differentiation. Asia-Pacific innovation hubs are accelerating iterative product updates, shortening global launch cycles and broadening the cosmetic surgery & services market addressable base.

Regulatory Approval Complexity Creates Market Access Barriers

The United Kingdom's pending licensing overhaul illustrates a global push for stricter credentialing, facility standards, and advertising controls that will raise entry barriers and operational costs. In the United States, extended FDA review periods for new dermal fillers add time-to-market risk for manufacturers and delay revenue realization. Europe's Medical Device Regulation imposes rigorous clinical evidence obligations that smaller firms find onerous, tipping competitive advantage toward well-capitalized incumbents. Collectively, these measures temper the growth trajectory of the cosmetic surgery & services market by slowing product roll-outs and limiting provider expansion.

Other drivers and restraints analyzed in the detailed report include:

- Social Media Influence Drives Unprecedented Procedure Consideration Rates

- GLP-1 Weight-Loss Medications Generate Unexpected Aesthetic Demand

- Safety Concerns and Counterfeit Product Infiltration Threaten Market Confidence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surgical interventions retained a 57.92% cosmetic surgery & services market share in 2025, buoyed by reimbursement support for reconstructive indications and relatively durable outcomes. Yet non-surgical categories are accelerating at 7.28% CAGR, propelled by injectables and energy devices that deliver quasi-surgical results without general anesthesia or extended downtime.

Eyelid surgery and liposuction remain top surgical procedures, but slowing breast augmentation volumes hint at a patient shift toward less invasive enhancement. Conversely, botulinum toxin surpassed 7.9 million sessions and hyaluronic acid fillers reached 6.3 million injections, underlining the momentum that is re-shaping the cosmetic surgery & services market size calculus in favor of quick-turn treatments with subscription-style repeat rates.

Female patients continued to anchor demand at 68.05% of the cosmetic surgery & services market size in 2025. Male participation, however, is climbing with a projected 6.88% CAGR to 2031 as evolving workplace culture normalizes appearance investment among men.

Hair transplantation commands the largest male volume, yet uptake of neurotoxins, fillers, and jawline contouring solutions is expanding as product messaging pivots toward discreet, masculine outcomes. Clinics are retraining staff on male facial anatomy and marketing through professional networking channels to seize this incremental share of the cosmetic surgery & services market.

The Cosmetic Surgery and Services Market Report is Segmented by Procedure Type (Surgical and Non-Surgical), Gender (Female and Male), Age Group (18-34 Years, and More), End User (Hospitals & Specialty Clinics, and More), Body Area (Face & Head, Breast, and Body & Extremities), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.13% share of the cosmetic surgery & services market in 2025 on the back of 6.2 million total procedures and payer support for select reconstructive cases. Clinical research density and a sophisticated regulatory environment stimulate early adoption of advanced devices and injectables, sustaining premium pricing.

Europe presents a fragmented yet significant opportunity set, with Western markets like Germany and France combining stable procedure volumes and growing medical tourism. Upcoming U.K. licensing reforms are poised to elevate operator quality while pressuring under-capitalized clinics. Eastern Europe offers above-average growth as disposable incomes rise and cross-border procedure packages become more accessible.

Asia-Pacific posts the fastest 6.18% CAGR, driven by China's double-digit expansion, Japan's high acceptance of non-surgical treatments, and South Korea's status as a global hub for aesthetic innovation. Domestic device manufacturing advantages reduce input costs, facilitating aggressive price competition and broadening access. Australia's new safety standards are projected to heighten consumer confidence and fortify the cosmetic surgery & services market in Oceania.

South America and the Middle East & Africa are emerging growth engines. Brazil's 2.4 million surgical procedures affirm deep cultural affinity for aesthetic enhancement, while stricter cosmetics registration protocols are improving supply-chain transparency. Gulf economies leverage medical tourism corridors and high per-capita income, although geopolitical uncertainty tempers near-term investment appetites.

- Abbvie

- Bausch Health

- Candela Medical

- Cynosure Technologies

- Cutera

- Daewoong Pharmaceutical

- Evolus Inc.

- Fotona d.o.o.

- Galderma

- GC Aesthetics

- Hugel Inc.

- Ipsen

- Johnson & Johnson (Mentor)

- Lumenis

- Medytox

- Merz Pharma

- Revance Therapeutics

- Sientra

- Sinclair Pharma

- Teoxane Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for minimally & non-invasive procedures

- 4.2.2 Technological advances in energy-based & injectable devices

- 4.2.3 Rising social-media-led beauty consciousness

- 4.2.4 GLP-1 weight-loss drugs boosting post-loss contouring demand

- 4.2.5 Private-equity roll-ups creating clinic capacity & marketing muscle

- 4.2.6 AI-driven outcome simulation increasing first-time conversions

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory approvals & practitioner-licensing gaps

- 4.3.2 Post-procedure side-effects & safety worries

- 4.3.3 Tariff-driven cost spikes for imported injectables/fillers

- 4.3.4 Rising counterfeit product infiltration via e-commerce

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Procedure Type

- 5.1.1 Surgical

- 5.1.2 Non-surgical

- 5.2 By Gender

- 5.2.1 Female

- 5.2.2 Male

- 5.3 By Age Group

- 5.3.1 18-34 years

- 5.3.2 35-50 years

- 5.3.3 51 years and above

- 5.4 By End User

- 5.4.1 Hospitals & Specialty Clinics

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Medical Spas / Aesthetic Clinics

- 5.5 By Body Area

- 5.5.1 Face & Head

- 5.5.2 Breast

- 5.5.3 Body & Extremities

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 AbbVie Inc.

- 6.3.2 Bausch Health Companies Inc.

- 6.3.3 Candela Medical

- 6.3.4 Cynosure Technologies

- 6.3.5 Cutera Inc.

- 6.3.6 Daewoong Pharmaceutical

- 6.3.7 Evolus Inc.

- 6.3.8 Fotona d.o.o.

- 6.3.9 Galderma SA

- 6.3.10 GC Aesthetics

- 6.3.11 Hugel Inc.

- 6.3.12 Ipsen Pharma

- 6.3.13 Johnson & Johnson (Mentor)

- 6.3.14 Lumenis Ltd.

- 6.3.15 Medytox Inc.

- 6.3.16 Merz Pharma GmbH & Co. KGaA

- 6.3.17 Revance Therapeutics

- 6.3.18 Sientra Inc.

- 6.3.19 Sinclair Pharma PLC

- 6.3.20 Teoxane Laboratories

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment