PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934675

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934675

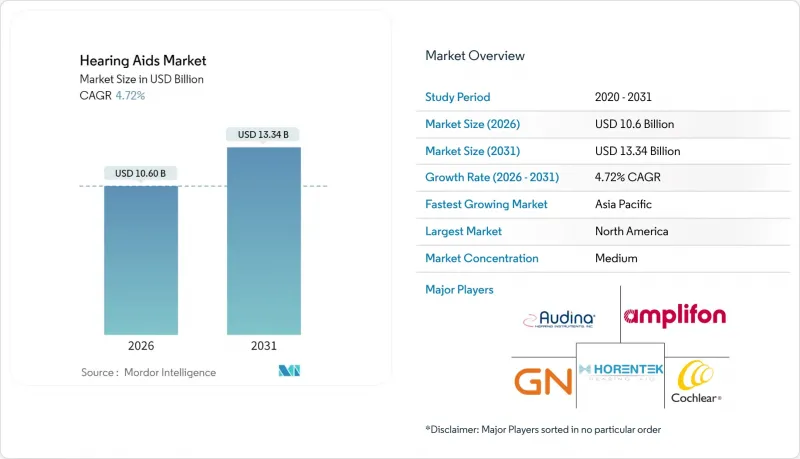

Hearing Aids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The hearing aids market is expected to grow from USD 10.12 billion in 2025 to USD 10.6 billion in 2026 and is forecast to reach USD 13.34 billion by 2031 at 4.72% CAGR over 2026-2031.

Direct-to-consumer access, artificial intelligence sound-processing advances, and the entry of consumer-electronics brands are together redrawing competitive rules. Premium manufacturers now position rechargeable, AI-enabled models as wellness wearables that integrate with smartphones and health platforms, a strategy that both supports higher average selling prices and broadens appeal to tech-savvy users. Meanwhile, U.S. OTC legalization compresses traditional audiology margins yet expands the addressable base among consumers with mild-to-moderate loss. Demographic pressure from longer life expectancy and rising noise exposure sustains a steady replacement cycle and opens opportunities for subscription and service-based revenue models.

Global Hearing Aids Market Trends and Insights

Rising Burden of Hearing Loss

Global prevalence climbed to 430 million people in 2024 and is projected to touch 700 million by 2050, placing sustained upward pressure on demand. Urban noise exposure, ototoxic medication use and chronic diseases such as diabetes amplify lifetime risk, reinforcing the importance of preventive screening and early amplification. Governments now integrate hearing health into healthy-aging policy frameworks, enabling partial reimbursement and tax credits that foster device uptake. Manufacturers respond with value-tier digital models priced below USD 1,000 to reach first-time users in emerging markets. The strategy supports volume expansion without fully cannibalizing premium lines and therefore lifts overall revenue mix.

Aging Population and Prolonged Life Expectancy

Japan, Italy and Germany each report median ages above 45 years, and individuals are living longer with higher expectations for active social participation. Clinical data linking untreated loss to cognitive decline has sparked physician referrals and insurer interest in preventive amplification. Medicare Advantage plans in the United States now bundle hearing benefits in 97% of offerings, creating a reimbursement runway that underpins steady unit growth. Device makers counter longer life spans with more durable housings, moisture protection and software updates that keep older hardware compatible with new phones. These adaptations lengthen product life cycles yet entice upgrades through iterative AI firmware releases.

High Device Cost and Cheaper Substitutes

Traditional prescription pairs retail between USD 2,400 and 6,150, a price band that leaves 85% of adults with hearing difficulty untreated. OTC and personal sound amplification products offer lower-cost entry but often underperform in complex listening environments, leading to early abandonment and negative word-of-mouth. As smart earbuds such as Apple's AirPods Pro 2 receive FDA clearance for hearing aid functionality at USD 250, pricing pressure cascades through mid-tier segments. Manufacturers mitigate erosion by bundling tele-audiology, extended warranties and software upgrades, reframing the sale as an ongoing service rather than a one-time purchase. Emerging market governments explore bulk tenders and local assembly incentives to curb import costs, but semiconductor and lithium-ion inputs limit deep discounts.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Digital, AI and Connectivity

- OTC Legalization and Broader Access

- Patchy Insurance and Reimbursement Coverage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Behind-the-Ear models held 44.88% of hearing aids market share in 2025 because larger casings accommodate multi-core processors, telecoils and high-capacity batteries that extend daily runtime. The form factor also simplifies pediatric fittings due to replaceable ear hooks that adjust with growth. Receiver-in-Canal devices are set to log a 6.98% CAGR through 2031, propelled by slimmer profiles, Bluetooth streaming and color palettes that blend with hair and skin. Users favor the discreet look, while audiologists appreciate easier receiver replacement during maintenance. The hearing aids market sees complementary momentum in In-the-Ear and Completely-in-Canal segments among consumers seeking invisible solutions, though acoustic feedback control remains a design challenge in tiny shells. Cochlear and bone-anchored implants together target severe loss and are projected to reach USD 986.4 million by 2031, corresponding to 9.15% of hearing aids market size within surgical indications.

Innovation revolves around energy management and universal connectivity. Signia's Pure Charge&Go BCT IX combines Bluetooth Classic and LE Audio to ensure compatibility with older smartphones while future-proofing for Auracast broadcasts. The model secures 36 hours of operation on a single charge and implements adaptive beamforming that prioritizes speech from the wearer's focal direction. Competitive products integrate MEMS inertial sensors to trigger automatic program switches when users walk, drive or enter a crowded venue. These enhancements reinforce the transition from single-purpose amplifiers to multifunctional wearables, widening the addressable audience inside the hearing aids market.

Digital architecture already commands 85.10% of 2025 revenue, relegating analog circuits to niche, ultra-low-cost propositions. Layering artificial intelligence onto established DSP creates a premium stratum forecast to expand at a 10.22% CAGR, lifting the overall hearing aids market trajectory. Phonak's Infinio platform integrates a neural accelerator that cuts latency to under 10 milliseconds and delivers 10 dB better speech-in-noise ratio. GN's ReSound Vivia extends machine learning to wind noise prediction, while Oticon's Intent uses head-motion sensors to infer listening intent. Cloud-connected apps push real-time language translation, fall detection and heart-rate trends to smartphones, positioning hearing aids as broader wellness nodes.

Analog offerings persist where reimbursement ceilings or consumer budgets limit digital upgrades, especially in some Latin American and African markets. However, declining microcontroller costs and open-source firmware ecosystems narrow the price delta, and many entry-level products now ship with basic AI noise suppression. As a result, the hearing aids market is likely to reach near-total digital saturation before the end of the decade. The spread of LE Audio further democratizes connectivity, allowing multi-stream sharing in classrooms and conference rooms without specialized infrastructure.

The Hearing Aids Market Report is Segmented by Product Type (Behind the Ear (BTE), Receiver in the Ear (RITE), and More), Type of Hearing Loss (Sensorineural and More), Technology (Conventional Analog and More), Patient Type (Adults and More), Distribution Channel (Prescription and More), Device Design (Disposable Battery, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.40% of global revenue in 2025, supported by Medicare Advantage coverage, Veterans Affairs volume and tech-forward consumers who embrace Apple's FDA-cleared AirPods Pro 2 hearing aid function. High household income and insurance penetration enable premium ASPs, especially for AI-based receivers with health-monitoring add-ons. Canada's single-payer system reimburses basic models, while private plans cover upgrades, sustaining a balanced public-private mix. Mexico records rising uptake through public tender programs and mid-tier private clinics targeting urban middle-class professionals.

Europe maintains a solid presence through universal coverage and Medical Device Regulation harmonization. Germany leads unit volume under statutory health insurance that subsidizes entry-level digital aids, yet consumers often co-pay for rechargeable or Bluetooth-enabled options. The United Kingdom faces dual regulatory pathways post-Brexit, requiring CE and UKCA marks that raise compliance costs. Italy and Spain continue to modernize aging audiology centers with tele-fitting tools, while France expands occupational hearing conservation, creating upstream screening demand.

Asia-Pacific is the fastest-growing hub at 7.86% CAGR, led by Japan where fashionable designs overcome stigma and benefit from strong yen purchasing power. China's Healthy Elderly 2030 plan reimburses digital aids for low-income seniors, expanding public funding. India sees private chain hospitals entering tier-2 cities with bundled ENT and audiology services, although GST adds cost pressure. South Korea pioneers 5G-enabled cloud fitting, and Australia broadens its Hearing Services Program to cover remote indigenous communities. Southeast Asia benefits from rising middle-class incomes and corporate insurance packages that include hearing benefits.

- Sonova

- Demant A/S (Oticon)

- GN Store Nord A/S (ReSound, Jabra Enhance)

- WS Audiology (Signia, Widex)

- Starkey Hearing Technologies

- Cochlear

- MED-EL

- Amplifon

- Eargo Inc

- Rexton

- Phonak

- Audina Hearing Instruments Inc

- Horentek Hearing Diagnostic

- Vivtone

- Elehear

- Nuheara Ltd

- Lively Hearing / Jabra Enhance

- Audicus

- Bose Corporation (SoundControl)

- Sony Corporation (CRE-C10)

- Apple Inc (AirPods-hearing features)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Hearing Loss

- 4.2.2 Aging Population & Prolonged Life-Expectancy

- 4.2.3 Technological Advances (Digital, AI, Connectivity)

- 4.2.4 OTC Legalization & Broader Access

- 4.2.5 Smart-Wearable Convergence: Health Monitoring Biosensors

- 4.2.6 Hearables Ecosystem Pull From Consumer-Audio Brands

- 4.3 Market Restraints

- 4.3.1 High Device Cost & Presence Of Cheaper Substitutes

- 4.3.2 Patchy Insurance / Reimbursement Coverage

- 4.3.3 Social Stigma & Low Adoption In Emerging Markets

- 4.3.4 Lithium-Ion Supply-Chain Volatility For Rechargeables

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Behind-the-Ear (BTE)

- 5.1.2 Receiver-in-Canal (RIC) / Receiver-in-Ear (RITE)

- 5.1.3 In-the-Ear (ITE)

- 5.1.4 Completely-in-Canal (CIC)

- 5.1.5 Implantable (Cochlear, Bone-anchored)

- 5.1.6 Other Hearing Aids

- 5.2 By Technology

- 5.2.1 Conventional Analog

- 5.2.2 Digital

- 5.2.3 AI-enabled / Smart

- 5.3 By Type of Hearing Loss

- 5.3.1 Sensorineural

- 5.3.2 Conductive

- 5.3.3 Mixed

- 5.3.4 Single-sided Deafness

- 5.4 By Patient Type

- 5.4.1 Adults

- 5.4.2 Pediatrics / Children

- 5.5 By Distribution Channel

- 5.5.1 Prescription (Hearing-care professionals)

- 5.5.2 OTC Retail Pharmacies

- 5.5.3 Online Direct-to-Consumer

- 5.5.4 Hybrid Tele-audiology

- 5.6 By Device Design

- 5.6.1 Disposable Battery

- 5.6.2 Rechargeable Lithium-ion

- 5.6.3 Energy-harvesting / Solar

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Sonova Holding AG

- 6.3.2 Demant A/S (Oticon)

- 6.3.3 GN Store Nord A/S (ReSound, Jabra Enhance)

- 6.3.4 WS Audiology (Signia, Widex)

- 6.3.5 Starkey Hearing Technologies

- 6.3.6 Cochlear Ltd

- 6.3.7 MED-EL

- 6.3.8 Amplifon SpA

- 6.3.9 Eargo Inc

- 6.3.10 Rexton

- 6.3.11 Phonak

- 6.3.12 Audina Hearing Instruments Inc

- 6.3.13 Horentek Hearing Diagnostics

- 6.3.14 Vivtone

- 6.3.15 Elehear

- 6.3.16 Nuheara Ltd

- 6.3.17 Lively Hearing / Jabra Enhance

- 6.3.18 Audicus

- 6.3.19 Bose Corporation (SoundControl)

- 6.3.20 Sony Corporation (CRE-C10)

- 6.3.21 Apple Inc (AirPods-hearing features)

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment