PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934678

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934678

STD Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

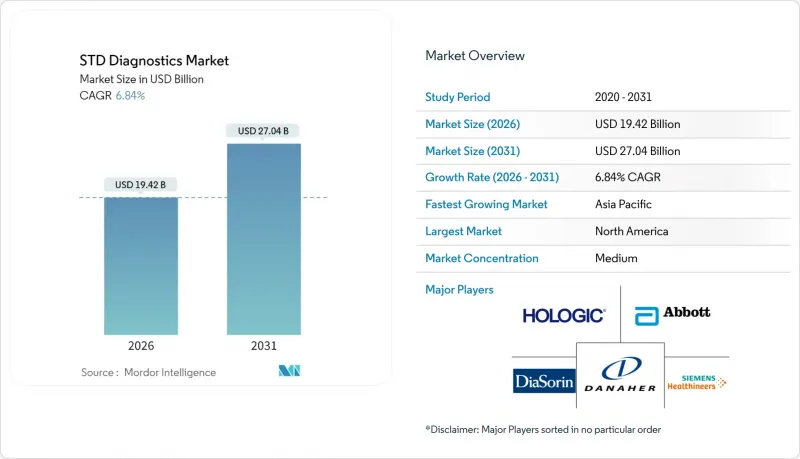

The STD diagnostics market was valued at USD 18.18 billion in 2025 and estimated to grow from USD 19.42 billion in 2026 to reach USD 27.04 billion by 2031, at a CAGR of 6.84% during the forecast period (2026-2031).

Growth is propelled by an 80% surge in U.S. syphilis cases-exceeding 207,000 confirmed infections in 2022-and the creation of a federal task force to curb the trend. The World Health Organization now tracks 8 million global syphilis cases for 2022, underscoring the gap to its 2030 goal of a 90% reduction in adult infections. Overall STI incidence has climbed 58.38% since 1990, with the sharpest burdens in low socio-demographic regions. Regulatory momentum continues as the FDA reclassified nucleic-acid STI assays to Class II in May 2025, shortening approval cycles for innovative platforms. Insurers updated preventive-service tables in May 2024 to guarantee zero-cost STD screening, expanding routine testing volumes. Yet 68% of individuals still cite shame and 85% fear provider judgment, fueling demand for home-based and digitally connected diagnostics.

Global STD Diagnostics Market Trends and Insights

Rising Global STD Incidence

The World Health Organization recorded more than 1 million new sexually transmitted infection cases every day during 2024. Asymptomatic presentations account for roughly 70% of chlamydia and gonorrhea infections, so routine testing is vital to interrupt transmission. Gen Z and young millennials aged 15-24 represent nearly half of new cases, prompting health systems to integrate rapid PoC assays that deliver timely results and curb reinfection chains. The discovery of mpox as a sexually transmitted pathogen in 2024 created further diagnostic demand because clinicians need multiplex panels able to distinguish legacy STIs from emerging threats. Simultaneous detection of pathogens and resistance profiles places nucleic-acid platforms at the center of the expanding STD diagnostics market.

Government-Funded Screening Programmes

The U.S. Preventive Services Task Force broadened its screening guidance in 2024 to recommend annual chlamydia and gonorrhea tests for all sexually active individuals younger than 25. Similar moves in Canada earmarked CAD 74 million (USD 54.8 million) to extend testing in Indigenous and remote communities. European Union member states synchronized guidelines that favor FDA-cleared or CE-marked molecular assays. These programs provide predictable procurement streams, reinforce quality benchmarks, and enlarge the STD diagnostics market size across primary care, public health, and community settings.

Social Stigma & Low Awareness

Survey data show 43% of adults delay or reject STI screening for fear of judgment or privacy breaches. Cultural taboos in certain regions equate testing with promiscuity, disproportionately limiting women's access to reproductive care. Public-health campaigns launched in 2024 re-frame screening as a routine wellness metric, yet uptake remains uneven. Anonymous home kits and app-scheduled clinic slots alleviate stigma for some users, but legal restrictions on telemedicine in several jurisdictions slow wider adoption. Ongoing school-based sex-education pilots have lifted testing rates by 25% where implemented, suggesting long-run gains once curricula scale nationally.

Other drivers and restraints analyzed in the detailed report include:

- Advances in NAAT & Rapid PoC Platforms

- Home Self-Testing & Digital Connectivity

- Regulatory & Reimbursement Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The HIV segment collected 28.45% of 2025 revenue, underscoring entrenched policies that require routine screening in blood services, prenatal care, and high-risk populations. Syphilis anchors the number-two position thanks to prenatal mandates that aim to curb congenital infections. Chlamydia and gonorrhea testing together generated roughly one-third of total revenue, supported by annual testing advice for sexually active youth.

Mycoplasma genitalium reported the quickest 7.77% CAGR outlook through 2031, propelled by growing recognition of its role in persistent urethritis. HPV and HSV segments post steady gains as multiplex NAAT assays streamline differential diagnosis. Trichomonas benefits from same-visit PoC platforms that catch treatable infections before patients leave the clinic. Chancroid remains niche but experiences improved molecular detection accuracy, reducing historical under-diagnosis.

Molecular platforms retained 50.78% share in 2025, delivering rapid, highly sensitive results that support guideline-driven care. Immunoassays remain vital in lower-resource settings, yet accuracy gaps limit additional share gains.

Next-generation sequencing is set for a 9.13% CAGR thanks to simultaneous pathogen and resistance profiling, capabilities prized by surveillance bodies such as the CDC, which purchased fleet NGS systems for USD 45 million in 2024. Biosensor and microfluidic devices integrate sample prep and amplification on a chip, drawing venture funding into portable alternatives that require minimal technician skill. Cost curves remain on a downward slope, opening mid-tier labs to NGS adoption and redefining the competitive stakes within the STD diagnostics market.

The STD DisgnosticsMarket Report is Segmented by Test Type (Chlamydia, Gonorrhea, Syphilis, and More), Technology (Immunoassay-Based Methods, Molecular Diagnostics, Next-Generation Sequencing, and More), Location of Testing (Central & Hospital Laboratories, and More), End User (Hospitals & Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.62% of global revenue in 2025, sustained by insurance mandates that make preventive STD services cost-free and by robust federal coordination to counter the syphilis surge. High discretionary healthcare spending and rapid regulatory approvals keep the region at the innovation vanguard. Nevertheless, intra-regional gaps prevail; Southern states report above-average infection rates, signaling under-served pockets even within a mature market.

Europe follows with a stable base built on universal health coverage and pan-regional regulatory harmonization, yet faces budgetary pressure that favors cost-effective point-of-care models. Asia-Pacific is the fastest-growing territory at a forecast 10.76% CAGR, driven by urbanization, public-health investments, and an 11.6% STI prevalence among reproductive-age women in Southeast Asia. China's anti-corruption clampdown in healthcare briefly slowed foreign diagnostic imports in 2024, but infrastructure spending across ASEAN and India is widening test access. Latin America and the Middle East & Africa together form an emerging corridor where rising awareness and mobile-health penetration offset infrastructure deficits. WHO-backed funding for integrated diagnostics and low-cost multiplex panels is steering donor capital into these regions. South Africa records the world's highest age-standardized STI rates, making it a focal point for donor-supported pilot projects that could shape future expansion models. Overall, geographic diversification strategies will define revenue resilience for vendors competing in the global STD Diagnostics market.

- Abbott Laboratories

- Roche

- Hologic

- Beckton Dickinson

- Danaher

- Siemens Healthineers

- bioMerieux

- Thermo Fisher Scientific

- QIAGEN

- Bio-Rad Laboratories

- DiaSorin

- QuidelOrtho

- Trinity Biotech plc

- Chembio Diagnostics Inc.

- Orasure Technologies

- Sekisui Diagnostics

- Genetic Signatures Ltd.

- LumiraDx Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global STD Incidence

- 4.2.2 Government-Funded Screening Programmes

- 4.2.3 Advances in NAAT & Rapid PoC Platforms

- 4.2.4 Home Self-Testing & Digital Connectivity

- 4.2.5 Multiplex AMR Panels for STI Pathogens

- 4.2.6 Corporate Pre-Employment Screening in EMs

- 4.3 Market Restraints

- 4.3.1 Social Stigma & Low Awareness

- 4.3.2 Regulatory & Reimbursement Hurdles

- 4.3.3 Skilled-Lab-Staff Shortages in LMICs

- 4.3.4 Cross-Reactivity-Driven False Positives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Test Type

- 5.1.1 Syphilis Testing

- 5.1.2 HPV Testing

- 5.1.3 HSV Testing

- 5.1.4 HIV Testing

- 5.1.5 Trichomonas Testing

- 5.1.6 Mycoplasma Genitalium Testing

- 5.1.7 Chancroid Testing

- 5.1.8 Chlamydia Testing

- 5.1.9 Gonorrhea Testing

- 5.2 By Technology

- 5.2.1 Immunoassay-based Methods

- 5.2.2 Molecular Diagnostics

- 5.2.3 Next-Generation Sequencing

- 5.2.4 Biosensor / Microfluidics & Other Emerging Platforms

- 5.3 By Location of Testing

- 5.3.1 Central & Hospital Laboratories

- 5.3.2 Rapid Point-of-Care Platforms

- 5.3.3 Over-the-Counter / Home Self-Testing

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Home Care / OTC

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Hologic Inc.

- 6.3.4 Becton Dickinson and Company

- 6.3.5 Danaher Corporation (Cepheid)

- 6.3.6 Siemens Healthineers AG

- 6.3.7 bioMerieux SA

- 6.3.8 Thermo Fisher Scientific Inc.

- 6.3.9 Qiagen N.V.

- 6.3.10 Bio-Rad Laboratories Inc.

- 6.3.11 DiaSorin S.p.A.

- 6.3.12 QuidelOrtho Corporation

- 6.3.13 Trinity Biotech plc

- 6.3.14 Chembio Diagnostics Inc.

- 6.3.15 OraSure Technologies Inc.

- 6.3.16 Sekisui Diagnostics LLC

- 6.3.17 Genetic Signatures Ltd.

- 6.3.18 LumiraDx Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment