PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934683

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934683

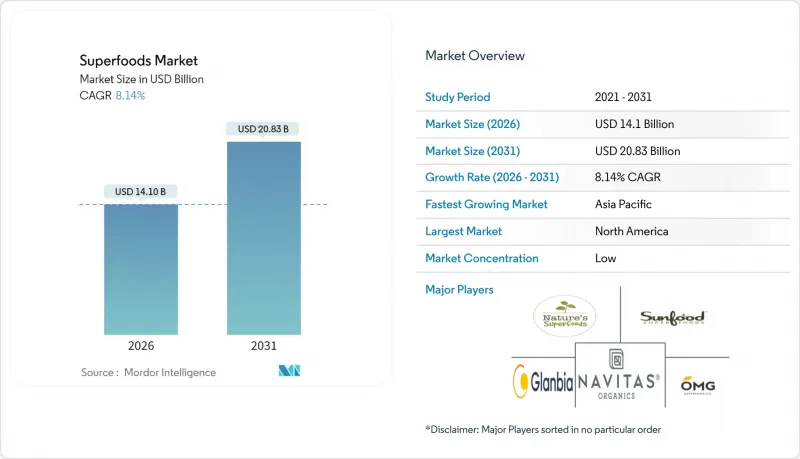

Superfoods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The superfoods market was valued at USD 13.04 billion in 2025 and estimated to grow from USD 14.1 billion in 2026 to reach USD 20.83 billion by 2031, at a CAGR of 8.14% during the forecast period (2026-2031).

This growth trajectory reflects fundamental shifts in consumer behavior toward preventive healthcare and nutrient-dense foods, driven by rising health consciousness in the Superfoods market and the integration of functional ingredients into mainstream diets. The market's resilience stems from its ability to capitalize on multiple demographic trends, including aging populations seeking longevity solutions and younger consumers prioritizing wellness over traditional convenience, a trend reshaping the global superfoods market. Macro forces reshaping the superfoods landscape include regulatory modernization, with the FDA's updated "healthy" claim definition, allowing nutrient-dense foods like avocados, nuts, and salmon to qualify for health labeling .

Global Superfoods Market Trends and Insights

Elevating Health Consciousness Among Consumers

Consumer health awareness has increased significantly, with over 95% of households purchasing organic products in 2024 . This trend has expanded food purchasing decisions beyond price and quality considerations, as consumers increasingly prioritize nutritional value and health impact. Consumers now demonstrate greater nutritional knowledge through detailed label reading, ingredient verification, and research into food production methods, which directly influences their buying patterns. They are willing to pay higher prices for products with proven health benefits, particularly those supported by scientific research and transparent sourcing. The consumption of superfoods has become associated with lifestyle choices and personal values, reflecting a broader shift in how people view food's role in their overall well-being. Many consumers now integrate superfoods into their daily diets, viewing them as essential components of preventive health care rather than luxury items within the superfoods market. This growing health consciousness has particularly benefited algae-based superfoods, as consumers' understanding of their comprehensive nutritional profile - including high protein content, essential fatty acids, and micronutrients - helps overcome initial resistance to taste and texture. The increased awareness of algae's sustainability benefits and minimal environmental impact has further strengthened its market position among environmentally conscious consumers in the global superfoods market.

Expanding Demand for Nutrient-Dense Superfoods

Nutrient density has emerged as the primary value proposition distinguishing superfoods from conventional alternatives, with consumers increasingly seeking maximum nutritional return per calorie consumed. Scientific validation of bioactive compounds in foods like spirulina, which contains 60-70% protein alongside essential fatty acids and antioxidants, provides evidence-based justification for premium pricing. Technological advances in extraction and processing enable manufacturers to concentrate and preserve bioactive compounds, creating products with measurably superior nutritional profiles. This trend particularly benefits microalgae-based products, where innovations in fermentation and extraction can enhance insulin sensitivity and glucose regulation properties. The demand extends beyond individual nutrients to encompass synergistic compound interactions, driving research into optimal superfood combinations and processing methods across the superfoods market.

High Cost of Premium Superfoods Limiting Adoption

Premium pricing remains the primary barrier to mass market penetration, with superfoods commanding price premiums of 200-400% over conventional alternatives, limiting accessibility for price-sensitive consumer segments. Consumer research indicates high price sensitivity, with buyers frequently switching brands for discounts, demonstrating that premium positioning creates vulnerability to economic downturns . The cost structure reflects multiple factors, including specialized cultivation requirements, limited production scales, and complex supply chains requiring cold storage and rapid transportation. However, technological innovations in production and processing offer pathways to cost reduction, with companies like Brevel launching commercial-scale microalgae protein facilities capable of producing hundreds of tons annually at improved cost efficiency. Scale economies in emerging markets, particularly Asia-Pacific, where local production reduces transportation costs and import duties, create opportunities for price optimization. The challenge intensifies as inflation affects healthy eating choices, requiring strategic positioning to maintain accessibility while preserving premium brand equity in the competitive superfoods market.

Other drivers and restraints analyzed in the detailed report include:

- Surging Popularity of Plant-Based and Vegan Diets

- Increasing Demand for Preventive Healthcare Solutions

- Seasonal Supply Constraints of Certain Superfoods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, fruit-based superfoods command a dominant 39.02% market share, underscoring consumer familiarity and robust distribution networks for staples like goji berries, acai, and pomegranate extracts. Meanwhile, algae-based superfoods are making waves as the fastest-growing segment, boasting a 10.33% CAGR projected through 2031. This surge is fueled by technological advancements in cultivation and processing, paving the way for scalable production. Vegetable-based superfoods, represented by kale chips and spirulina powders, hold a notable market presence. At the same time, grains and seed-based superfoods, such as quinoa, chia, and flaxseeds, ride the wave of rising plant-based diet trends and an increasing demand for protein.

The rapid growth of the algae segment is bolstered by scientific endorsements of their nutritional advantages. For instance, spirulina is lauded for its complete amino acid profile, while chlorella is recognized for its concentrated, bioavailable vitamins and minerals. The commercial landscape is evolving, with companies like Brevel spearheading dedicated microalgae protein facilities, underscoring the industrial scalability of what were once considered niche products. Moreover, innovation is pushing boundaries; AlgaeCore Technologies is pioneering spirulina-infused seafood alternatives, boasting an impressive 74% protein content, thus broadening the horizons of algae applications beyond their conventional powder forms in the evolving superfoods market.

Powder formats dominate with 42.01% market share in 2025, benefiting from extended shelf life, concentrated nutrition, and versatile application in smoothies, baking, and meal preparation. Liquid superfoods accelerate at 9.66% CAGR through 2031, driven by convenience preferences and ready-to-consume product demand among time-constrained consumers. Other formats, including capsules, bars, and whole foods, maintain steady growth through specialized applications and consumer preference diversity.

The liquid segment's growth reflects evolving consumption patterns where convenience intersects with nutrition, particularly in functional beverages and ready-to-drink superfood blends. Technological advances in liquid preservation and packaging enable extended shelf life without compromising nutritional integrity, while cold-pressed and flash-pasteurization techniques maintain bioactive compound potency. Innovation in liquid formats includes probiotic-enhanced superfood drinks and adaptogenic beverages targeting specific health outcomes, expanding beyond traditional juice-based products to encompass sophisticated functional formulations driving adoption in the superfoods market.

The Superfood Market Report Categorizes the Industry by Product Type (Fruits-Based Superfoods, Vegetables-Based Superfoods, and More), Form (Powder, Liquid, and Others), Nature (Conventional and Organic), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Size is Given in Terms of Value (USD).

Geography Analysis

North America continues to dominate the global superfood market, holding a significant 43.62% share in 2025. This leadership is underpinned by a combination of high health awareness among consumers, robust purchasing power, and well-established distribution networks that ensure product availability. The region's mature market environment and consumer preference for health-oriented products further solidify its position as a key player in the superfood industry.

The Asia-Pacific region emerges as the fastest-growing segment in the superfood market, with a projected CAGR of 10.16% through 2031. This growth is driven by a rising middle-class population, increasing health consciousness, and proactive government initiatives aimed at promoting functional foods to combat noncommunicable diseases. Demographic transitions, such as urbanization, higher disposable incomes, and aging populations seeking health-supporting nutrition, further contribute to the region's rapid expansion. Additionally, the cultural familiarity with traditional functional foods provides a strong foundation for the adoption of modern superfoods, while younger consumers increasingly embrace dietary supplements and superfoods as part of their daily routines, a trend accelerating across the superfoods industry.

Emerging markets, including South America, the Middle East, and Africa, are gradually adopting superfoods, driven by urbanization and growing health awareness. These regions present significant long-term growth opportunities as economic development progresses and consumer health consciousness evolves. Locally-sourced superfoods, which leverage indigenous nutritional traditions while adhering to modern quality and safety standards, are particularly well-positioned to capture market share in these areas. As these markets mature, they are expected to play an increasingly important role in the global superfood industry.

- Sunfood Superfoods

- Navitas Organics

- Nature's Superfoods LLP

- OMG Superfoods

- Aduna Ltd.

- Impact Foods International Ltd.

- Nutrisure ltd T/A Naturya

- Mannatech Inc

- Glanbia PLC (Amazing Grass)

- Terrasoul Superfoods

- Healthy Truth

- GNC Holdings

- Iovate Health Sciences International Inc.

- Kuli Kuli Foods.

- Morlife Healthcare Pvt. Ltd.

- Del Monte Pacific Ltd.

- Laird Superfood

- BoKU Superfood

- Creative Nature Ltd.

- Nutiva

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Elevating Health Consciousness Among Consumers

- 4.2.2 Expanding Demand for Nutrient-Dense Superfoods

- 4.2.3 Surging Popularity of Plant-Based and Vegan Diets

- 4.2.4 Increasing demand for preventive healthcare solutions

- 4.2.5 Accelerating Demand for Functional Foods

- 4.2.6 Widening Accessibility of Superfoods in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 High Cost of Premium Superfoods Limiting Adoption

- 4.3.2 Competition from Affordable Conventional Foods

- 4.3.3 Seasonal Supply Constraints of Certain Superfoods

- 4.3.4 Preservation Challenges of Perishable Superfoods

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fruits-based Superfoods

- 5.1.2 Vegetables-based Superfoods

- 5.1.3 Grains and Seeds-based Superfoods

- 5.1.4 Algae-based Superfoods

- 5.1.5 Others

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.2.3 Others

- 5.3 By Nature

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets and Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Channels

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sunfood Superfoods

- 6.4.2 Navitas Organics

- 6.4.3 Nature's Superfoods LLP

- 6.4.4 OMG Superfoods

- 6.4.5 Aduna Ltd.

- 6.4.6 Impact Foods International Ltd.

- 6.4.7 Nutrisure ltd T/A Naturya

- 6.4.8 Mannatech Inc

- 6.4.9 Glanbia PLC (Amazing Grass)

- 6.4.10 Terrasoul Superfoods

- 6.4.11 Healthy Truth

- 6.4.12 GNC Holdings

- 6.4.13 Iovate Health Sciences International Inc.

- 6.4.14 Kuli Kuli Foods.

- 6.4.15 Morlife Healthcare Pvt. Ltd.

- 6.4.16 Del Monte Pacific Ltd.

- 6.4.17 Laird Superfood

- 6.4.18 BoKU Superfood

- 6.4.19 Creative Nature Ltd.

- 6.4.20 Nutiva

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK