PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934687

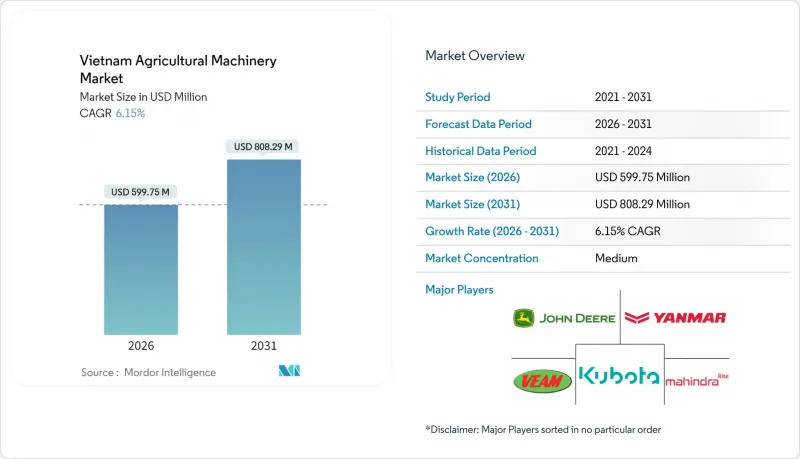

Vietnam Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam agricultural machinery market size in 2026 is estimated at USD 599.75 million, growing from 2025 value of USD 565 million with 2031 projections showing USD 808.29 million, growing at 6.15% CAGR over 2026-2031.

Government mechanization initiatives, decreasing rural workforce availability, and improved financing options drive market growth. The market expansion is supported by frequent tractor upgrades, increased adoption of precision planting equipment through the "One Million Hectares of High-Quality Rice" program, and comprehensive after-sales services. The market's sustained growth is further supported by increased rice export revenues, growing adoption of cooperative machinery-sharing systems, and rural electrification programs. The market shows significant potential in electric vehicles, autonomous farming robots, and data-driven agricultural solutions. The industry remains moderately concentrated under these established companies.

Vietnam Agricultural Machinery Market Trends and Insights

Declining Agricultural Labor Availability

Vietnam's agricultural labor force continues to decline as younger generations migrate to urban areas, leaving an aging population of growers. This demographic shift increases the demand for mechanization across rice, fruit, and industrial crop systems. The consolidation of agricultural land makes tractors, harvesters, and mechanical planters more economically viable. Increasing seasonal labor costs impact farm margins, particularly during peak planting and harvesting periods.

Rising Mechanization Incentives

The Vietnamese government supports agricultural mechanization through financial incentives and policy reforms. Farmers receive soft loans, tax relief, and access to demonstration farms to encourage the adoption of modern equipment. The establishment of the Ministry of Agriculture and Environment in February 2025 aims to enhance coordination and efficiency in the agriculture and rural sector.Provincial smart farms demonstrate the effectiveness of automated irrigation and soil analytics systems. Farmers can access subsidized credit lines and reduced interest rates to replace outdated machinery, facilitating broader access to advanced agricultural equipment.

Small Farm-size Fragmentation

Vietnam's agricultural landscape is dominated by small farms, which limits the economic viability of mechanization. Seventy percent of farms operate on less than 0.5 hectares, weakening machinery payback ratios. The fragmented plots reduce tractor efficiency and complicate implement usage across multiple fields. While land consolidation reforms show early promise, cultural ties to ancestral land slow progress. Cooperative models and custom hire services offer partial solutions through resource pooling, but their effectiveness depends on strong governance and coordination. Until consolidation becomes more widespread and service ecosystems mature, fragmentation will continue to hinder agricultural machinery adoption, limiting productivity gains and sector transformation.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Trade Policy

- Surge in Rice-export-linked Cashflows Funding Equipment Upgrades

- High Up-front Capex

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The tractor segment accounts for 54.40% of the Vietnam agricultural machinery market size, serving essential functions in land preparation, transportation, and residue management. The segment's prominence aligns with national mechanization objectives and high mechanized land preparation rates. While compact tractors remain prevalent in the fragmented northern farmlands, mid-range models see increasing adoption in the consolidated southern agricultural regions. The integration of four-wheel drive systems and precision steering capabilities, often as retrofits to existing equipment, maintains strong replacement demand. Tractors remain fundamental to Vietnam's mechanized farming operations, serving diverse geographical conditions and farm structures.

The planting machinery segment demonstrates the highest growth rate at 7.55% CAGR, as farmers transition from manual rice seed broadcasting to drill seeders and transplanters. These technologies improve germination rates and reduce seed consumption, particularly benefiting agricultural cooperatives. The market share for planting equipment is projected to increase, supported by national initiatives promoting efficient input usage. The harvesting machinery segment maintains steady growth due to agricultural labor shortages and stricter grain quality requirements. The haying and forage equipment segment supports livestock operations in the northern highlands. The market sees companies entering the other product types category with drones and autonomous robots, introducing service-based models that reduce capital requirements and indicate future trends in agricultural automation. Kubota's versatile platform robots preview multirole automation that can perform multiple functions in a single pass.

The Vietnam Agricultural Machinery Market Report is Segmented by Product Type (Tractors, Planting Machinery, Harvesting Machinery, Haying and Forage Machinery, and Other Product Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kubota Corporation

- Yanmar Holdings Co., Ltd.

- Vietnam Engine & Agricultural Machinery Corp (VEAM)

- Iseki & Co., Ltd.

- Truong Hai Group Corporation (THACO)

- Deere & Company (TTC Bien Hoa)

- Mahindra & Mahindra Ltd.

- Yamabiko Corporation

- LS Group

- Zetor Tractors a.s. (HTC Investments)

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Netafim Ltd. (Orbia)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining Agricultural Labor Availability

- 4.2.2 Rising Mechanization Incentives

- 4.2.3 Favorable Trade Policy

- 4.2.4 Surge in Rice-export-linked Cashflows Funding Equipment Upgrades

- 4.2.5 Ag-drone Service Cooperatives Reducing Pesticide Spend

- 4.2.6 OEM Bundled-finance Programs

- 4.3 Market Restraints

- 4.3.1 Small Farm-size Fragmentation

- 4.3.2 High Up-front Capex

- 4.3.3 Low Rural Electrification Hindering Electric Tractors

- 4.3.4 Rising Cybersecurity Risk in Tele-matics-equipped Machines

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Tractors

- 5.1.1.1 Engine Power

- 5.1.1.1.1 Less than 15 HP

- 5.1.1.1.2 15 to 30 HP

- 5.1.1.1.3 31 to 45 HP

- 5.1.1.1.4 46-75 HP

- 5.1.1.1.5 More than 75 HP

- 5.1.1.1 Engine Power

- 5.1.2 Planting Machinery

- 5.1.3 Harvesting Machinery

- 5.1.4 Haying and Forage Machinery

- 5.1.5 Other Product Types

- 5.1.1 Tractors

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Kubota Corporation

- 6.4.2 Yanmar Holdings Co., Ltd.

- 6.4.3 Vietnam Engine & Agricultural Machinery Corp (VEAM)

- 6.4.4 Iseki & Co., Ltd.

- 6.4.5 Truong Hai Group Corporation (THACO)

- 6.4.6 Deere & Company (TTC Bien Hoa)

- 6.4.7 Mahindra & Mahindra Ltd.

- 6.4.8 Yamabiko Corporation

- 6.4.9 LS Group

- 6.4.10 Zetor Tractors a.s. (HTC Investments)

- 6.4.11 Zoomlion Heavy Industry Science and Technology Co., Ltd.

- 6.4.12 Netafim Ltd. (Orbia)

7 Market Opportunities and Future Outlook