PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934691

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934691

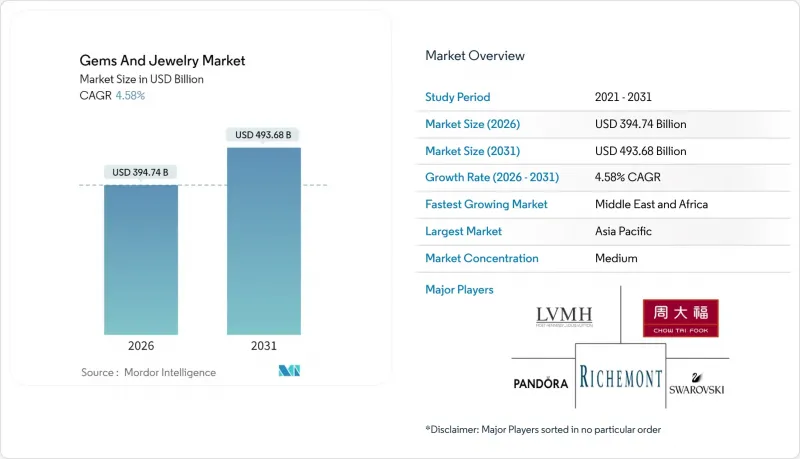

Gems And Jewelry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The gems and jewelry market was valued at USD 377.45 billion in 2025 and estimated to grow from USD 394.74 billion in 2026 to reach USD 493.68 billion by 2031, at a CAGR of 4.58% during the forecast period (2026-2031).

The increasing adoption of lab-grown diamonds, the rapid shift toward digital retail platforms, and changing consumer demographics are driving market growth. These factors are broadening the customer base, while sustainability concerns are prompting significant changes in supply chains. Regional demand patterns vary significantly. The Asia-Pacific region continues to dominate in terms of revenue, while the Middle East and Africa are witnessing the fastest growth in sales volume due to a combination of cultural preferences and rising wealth. Consumer preferences are also shifting, with a growing interest in jewelry for everyday fashion rather than just traditional bridal categories. The men's jewelry segment is emerging as a key area of demand. In terms of competition, the market is moderately competitive, with companies focusing on technology investments, ethical sourcing practices, and creating engaging omnichannel experiences to differentiate themselves and attract customers.

Global Gems And Jewelry Market Trends and Insights

Jewelry as an investment and wealth-preservation hedge

Jewelry is increasingly seen as a reliable way to preserve wealth, especially during times of global economic uncertainty and rising inflation. In India, gold continues to dominate as the preferred investment option, as per the Gem and Jewellery Export Promotion Council, with gold demand in 2024 reaching 802.8 tonnes, a 5% rise compared to the previous year. Investment demand alone increased by 14% year-on-year in Q4 2024, reaching 76 tonnes. This growing confidence among institutions is boosting retail demand for high-purity and certified jewelry, including rare gemstones and vintage items. Platforms offering secure storage and verification of authenticity are becoming popular among wealthy individuals looking to diversify their investments. The Reserve Bank of India (RBI) significantly increased its gold reserves from 16 tonnes in 2023 to 72.6 tonnes in 2024, reflecting a strategic effort to protect against economic instability and inflation, as per the World Gold Council. This move shows strong institutional trust in gold as a stable asset, which further strengthens retail investor confidence and drives demand for high-quality investment jewelry.

Growing fashion and lifestyle trends

Jewelry has evolved from being an occasional luxury to becoming a part of everyday self-expression, supported by rising consumer purchasing power. The International Monetary Fund (IMF) reports that the global GDP per capita has reached USD 14,210 in 2025, reflecting stronger financial capacity among consumers. Social media has become a factor in spreading trends rapidly, with influencers creating viral "must-have" moments that make affordable luxury more popular. To keep up with these fast-changing trends, brands are adopting quicker design-to-market strategies and utilizing digital fashion weeks to stay relevant. For instance, Kendra Scott's 2024 LoveShackFancy collection, which featured bow necklaces and heart-shaped lockets, demonstrated how limited-edition releases, combined with compelling storytelling and personalization, appeal to younger, style-conscious consumers. These approaches foster long-term brand loyalty, and as a result, the jewelry market is increasingly shifting toward fashion-focused designs and creating unique, experience-driven offerings for consumers.

Proliferation of counterfeit products

The growing issue of counterfeit products is a major challenge for the gems and jewelry market, as it weakens consumer confidence and harms the reputation of trusted brands. For instance, in August 2025, a case in Chennai exposed how two individuals deceived a bank out of over INR 2 crore by using fake gold jewelry. Similarly, United States Customs and Border Protection intercepted counterfeit jewelry valued at USD 30 million in Louisville in August 2025, showcasing the widespread nature of this problem. To address this, manufacturers are increasingly using advanced technologies such as laser inscriptions, blockchain-based tracking systems, and QR-coded certifications to ensure product authenticity. Regulatory authorities are intensifying their enforcement efforts and launching awareness campaigns to educate consumers about identifying genuine products. These combined efforts not only protect buyers and uphold brand integrity but also play a crucial role in fostering trust in authentic products, which is vital for the market's sustained growth.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of lab-grown diamonds for sustainability and cost

- Emergence of AR/VR virtual try-on tools

- High import duties and taxes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rings remain the leading category in the gems and jewelry market, capturing a substantial 33.02% share in 2025. Their strong demand is primarily due to their significance in engagements, weddings, and other special occasions, making them a timeless choice for consumers. The availability of classic, modern, and personalized designs further enhances their appeal. The growing popularity of online shopping has made it easier for customers to explore a wide range of options, with many seeking unique, high-quality craftsmanship to suit their preferences.

The necklace segment is expected to experience the fastest growth among jewelry categories, with a projected CAGR of 6.19% from 2026 to 2031. This growth is driven by changing fashion trends, such as layering and mixing styles, which encourage consumers to purchase multiple necklaces. Social media platforms and influencer campaigns are significantly influencing younger buyers, promoting innovative and trendy designs. Moreover, necklaces are increasingly being used as versatile accessories for both everyday wear and formal events, further boosting their demand across global markets.

Precious metals led the gems and jewelry market in 2025, contributing 62.10% of the total market share. Gold remains a popular choice due to its value as an investment and its cultural significance, while silver attracts consumers with its affordability and versatility. Buyers are increasingly interested in both traditional and modern designs, with customization options and high-quality craftsmanship adding to their appeal. The segment also benefits from a strong presence in retail stores and the growing popularity of online shopping, making it accessible to a wide range of customers.

Base-metal jewelry is expected to grow the fastest among material categories, with a projected CAGR of 6.85% through 2031. This growth is supported by advancements in technology, such as anti-tarnish coatings and hypoallergenic materials, which make these pieces more durable and suitable for everyday use. Social media trends and influencer promotions are driving interest in affordable and stylish base-metal jewelry, especially among younger consumers. Innovative designs and finishes are helping this category gain popularity in global markets, offering a cost-effective yet fashionable option for buyers.

The Gems and Jewelry Market Report is Segmented by Product Type (Rings, Earrings, and More), Material Type (Precious Metals, Base Metals, and More), End User (Men, Women, and More), Category (Fine and Costume), Distribution Channel (Offline Retail Channels And, More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38.74% of the revenue in 2025, driven by a strong cultural preference for gold, increasing disposable incomes, and its leading role in cutting and polishing gemstones. Countries like China are utilizing heritage-inspired designs to attract domestic consumers, while India benefits from reduced duties that enhance its export competitiveness. Surat's lab-grown diamond production is helping the region by lowering costs and improving supply chain efficiency. Urbanization is also boosting bridal jewelry spending, as consumers aspire to replicate celebrity wedding trends.

The Middle East and Africa are expected to grow at a CAGR of 6.88%, combining high spending from oil wealth with the cultural significance of jewelry in traditional ceremonies. Gold jewelry in this region serves both as a decorative item and a form of savings, ensuring steady demand even during economic downturns. Dubai's tax-free shopping hubs act as key re-export centers for Africa and Europe, while local mining activities in countries like Kenya and Ghana strengthen the upstream supply chain. The growing youth population and increasing e-commerce adoption are expanding the customer base in this region.

North America and Europe represent mature markets that are now focusing on innovation to sustain growth. Consumers in these regions are increasingly drawn to sustainable practices, lab-grown diamonds, and personalized shopping experiences. In the United States, tariffs are encouraging near-shoring and vertical integration, while the European Union's conflict-minerals regulations are driving the adoption of blockchain technology for tracking product origins. Millennials and Gen Z are reshaping the market with their preference for online shopping and self-purchasing, challenging traditional retail formats. Ethical sourcing and digital convenience are becoming key factors for success in these established but competitive markets.

- LVMH Moet Hennessy Louis Vuitton SA

- Compagnie Financiere Richemont SA

- Chow Tai Fook (Holding) Limited

- Pandora A/S

- Kalyan Jewellers

- De Beers Group

- Swarovski AG

- Lao Feng Xiang Co Ltd

- Titan Co Ltd

- Chow Tai Seng Jewellery Co Ltd

- Mokingran jewellery Group Co Ltd

- Malabar Group

- Joyalukkas Holdings

- Luk Fook Holdings (International) Ltd

- Chow Sang Sang Holdings International Ltd

- Chanel SA

- Kering SA

- Damas International Ltd

- H&M Hennes & Mauritz AB

- Chopard & Cie SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing fashion and lifestyle trends

- 4.2.2 Rising customization and personalization

- 4.2.3 Adoption of lab-grown diamonds for sustainability and cost

- 4.2.4 Jewelry as an investment and wealth-preservation hedge

- 4.2.5 Cultural and traditional significance

- 4.2.6 Emergence of AR/VR virtual try-on tools

- 4.3 Market Restraints

- 4.3.1 Volatility in precious metal and gem prices

- 4.3.2 High import duties and taxes

- 4.3.3 Proliferation of counterfeit products

- 4.3.4 Ethical and sustainability concerns

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Rings

- 5.1.2 Necklaces

- 5.1.3 Earrings

- 5.1.4 Bracelets

- 5.1.5 Chains and Pendants

- 5.1.6 Other Product Types

- 5.2 By Material Type

- 5.2.1 Precious Metals

- 5.2.2 Base Metals

- 5.2.3 Mixed Materials

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Children

- 5.4 By Category

- 5.4.1 Fine

- 5.4.2 Costume

- 5.5 By Distribution Channel

- 5.5.1 Offline Retail Stores

- 5.5.2 Online Retail Stores

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Colombia

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Argentina

- 5.6.2.6 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Poland

- 5.6.3.7 Belgium

- 5.6.3.8 Sweden

- 5.6.3.9 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Australia

- 5.6.4.5 Indonesia

- 5.6.4.6 South Korea

- 5.6.4.7 Thailand

- 5.6.4.8 Singapore

- 5.6.4.9 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 LVMH Moet Hennessy Louis Vuitton SA

- 6.4.2 Compagnie Financiere Richemont SA

- 6.4.3 Chow Tai Fook (Holding) Limited

- 6.4.4 Pandora A/S

- 6.4.5 Kalyan Jewellers

- 6.4.6 De Beers Group

- 6.4.7 Swarovski AG

- 6.4.8 Lao Feng Xiang Co Ltd

- 6.4.9 Titan Co Ltd

- 6.4.10 Chow Tai Seng Jewellery Co Ltd

- 6.4.11 Mokingran jewellery Group Co Ltd

- 6.4.12 Malabar Group

- 6.4.13 Joyalukkas Holdings

- 6.4.14 Luk Fook Holdings (International) Ltd

- 6.4.15 Chow Sang Sang Holdings International Ltd

- 6.4.16 Chanel SA

- 6.4.17 Kering SA

- 6.4.18 Damas International Ltd

- 6.4.19 H&M Hennes & Mauritz AB

- 6.4.20 Chopard & Cie SA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK