PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934693

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934693

Running Apparel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

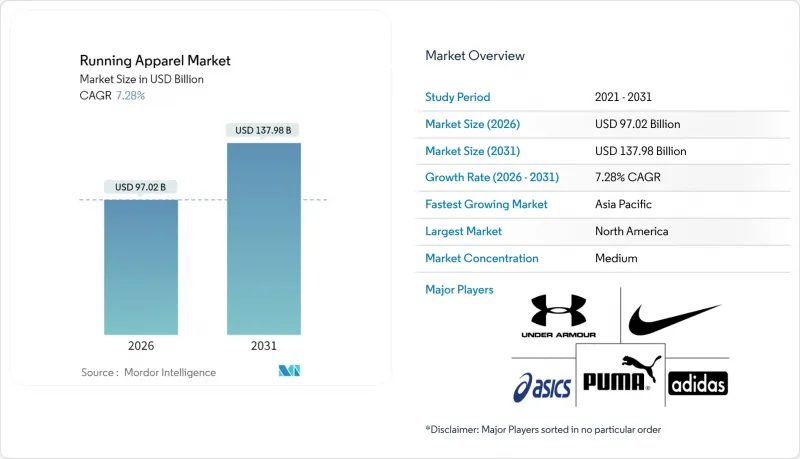

The running apparel market was valued at USD 90.44 billion in 2025 and estimated to grow from USD 97.02 billion in 2026 to reach USD 137.98 billion by 2031, at a CAGR of 7.28% during the forecast period (2026-2031).

This growth is attributed to increasing health awareness, advancements in material innovation, and the integration of performance and lifestyle apparel, which appeals to a wide range of age groups. The growing participation of women in fitness and running activities has led to a significant demand for gender-specific designs and collections. While premiumization is prominent in mature markets, urbanization and rising disposable incomes are driving growth in emerging economies. The combination of athletic wear with everyday fashion enhances the versatility and style of running apparel, attracting a broader audience beyond dedicated runners. Although synthetic fabrics dominate the market, recycled and bio-based materials are gaining traction due to stricter regulations and a shift in consumer preferences toward sustainability. The expansion of online sales channels provides consumers with convenient access to a variety of running apparel, offering features such as virtual try-ons, personalized recommendations, and competitive pricing. While global brands and specialty players continue to consolidate, new entrants are identifying opportunities by focusing on women's fit, sustainable materials, and digital-first distribution strategies.

Global Running Apparel Market Trends and Insights

Surge in global health and fitness participation initiatives

Government-led health initiatives and corporate wellness programs are significantly transforming the demand for running apparel across developed and emerging markets. In the United States, participation in running and jogging increased from 48.31 million in 2023 to 51.05 million in 2024, according to the Sports and Fitness Industry Association. This rise extends beyond recreational activities to include structured programs, marking a record high in sports participation. In England, 6,544,700 individuals participated in running activities in 2024, as reported by Sport England. The combination of institutional support and grassroots enthusiasm is driving sustained demand for performance-focused running apparel that seamlessly transitions between structured training and casual fitness activities. Corporate wellness programs are increasingly prioritizing measurable fitness outcomes, boosting the demand for technical apparel that supports performance tracking while meeting professional appearance standards.

Rise of marathons and running events

Marathons, charity runs, trail races, and other organized running events attract millions of participants annually. Many participants purchase specialized running apparel, such as moisture-wicking tops, lightweight outerwear, and accessories, to prepare for these events. Motivated to improve performance and prevent injuries, they increasingly demand technologically advanced, comfortable, and high-utility apparel, especially since training often lasts for months. In 2024, marathon participation reached record-breaking levels, with the world record for the largest marathon being surpassed twice, first in Berlin and later in New York City. The TCS New York City Marathon, with over 56,000 finishers in November, not only regained its position as the world's largest marathon but also became the largest race of any distance in the United States, according to Running USA. This trend extends beyond elite events, as mass participation organizers are now focusing on lifestyle-oriented running events. This shift is creating commercial opportunities for apparel partnerships and event-specific merchandise that go beyond traditional performance categories.

Prevalence of counterfeit products

Counterfeit running apparel remains a significant threat to market growth, with enforcement actions exposing the scale of illicit trade that harms both brand value and consumer safety. In 2025, U.S. Immigration and Customs Enforcement seized counterfeit sports merchandise worth USD 39.5 million through Operation Team Player. This initiative is part of a broader effort that has confiscated over USD 455 million in counterfeit sports merchandise, as reported by U.S. Immigration and Customs Enforcement in 2025. Counterfeit products not only pose safety risks due to inferior materials and manufacturing processes but also erode consumer trust and brand equity. The expansion of e-commerce platforms and the prevalence of small-package international shipping have complicated enforcement efforts. Over 90% of counterfeit seizures occur in mail and express channels, prompting brands to invest in advanced authentication technologies and improve supply chain transparency.

Other drivers and restraints analyzed in the detailed report include:

- Influence of social media platforms and celebrity endorsements

- Growing adoption of athleisure fashion

- Emerging micro-plastic regulations on synthetics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tops maintain market dominance with a 41.62% share in 2025, reflecting their versatility across training intensities and seasonal conditions. Running tops, frequently seen in marathons, charity runs, and club events, drive increased demand for event-branded tops, serving as memorabilia and team identifiers. Socks and accessories represent the fastest-growing segment, with an expected CAGR of 7.73% through 2031. This significant growth reflects a shift in consumer preferences, moving beyond basic apparel to performance-enhancing accessories that improve training efficiency and prevent injuries. The strong growth in the accessories segment indicates a more informed consumer base that prioritizes performance optimization through specialized products. Technical socks, featuring moisture-wicking, compression, and blister prevention technologies, address training challenges while commanding premium prices.

The Hong Kong Polytechnic University introduced iActive intelligent activewear that integrates technology into performance textiles. It employs engineered structures designed to enhance moisture wicking and sweat evaporation. Bottoms, positioned as a stable middle segment, benefit from the athleisure trend, which emphasizes versatility for various occasions. Outerwear, while subject to seasonal demand fluctuations, gains from climate adaptability and layering strategies, supporting year-round training. The integration of wearable technology further enhances value propositions, driving the accessories segment's growth by creating new product categories that combine traditional textile functionality with electronic features.

Synthetic fabrics such as polyester, nylon, and spandex hold a 66.75% market share in 2025, driven by their moisture management, durability, and cost-efficiency. However, recycled and bio-based synthetics are experiencing the fastest growth, with an 8.29% CAGR (2026-2031), signaling a significant shift toward sustainability fueled by regulatory demands and growing consumer awareness. The raw material pricing landscape reveals complexities: cotton prices decreased by 2% in 2024, while synthetic fiber costs rose. This trend has increased margin pressures, making premium-positioned sustainable alternatives more attractive. At the same time, natural and blended fabrics, including merino wool and cotton blends, maintain niche appeal due to their comfort and temperature-regulating qualities, catering to premium markets and specific applications.

The transition to sustainability goes beyond compliance, serving as a strategic approach for brands to stand out and justify premium pricing. For instance, in July 2024, CARBIOS and Nouvelles Fibres Textiles signed an agreement to supply 5,000 tons of polyester textiles annually to CARBIOS's enzymatic biorecycling plant starting in 2026, showcasing progress in industrial-scale circular economy practices. These advancements provide a competitive advantage to brands that effectively incorporate sustainable materials while maintaining performance and cost efficiency.

The Running Apparel Report is Segmented by Product Types (Tops, Bottoms, Outerwear, Socks and Accessories), Fabric and Material (Synthetic, and More), End User (Men, Women, Kids), Distribution Channels (Offline Stores, Online Stores), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America accounted for a significant 41.10% share of the revenue in 2025, supported by a well-established jogging culture, high disposable incomes, and a dense network of specialty stores. The region benefits from a mature sports infrastructure, extensive retail networks, and widespread e-commerce penetration, which collectively ensure consumers have easy access to products and a seamless shopping experience. Regional players prioritize performance differentiation and employ premium storytelling strategies to maintain their market share against competition from global entrants. The presence of major global brands such as Nike, Adidas, Under Armour, and New Balance, which are either headquartered in or maintain a strong operational presence in North America, further enhances the market's scale and competitiveness. Additionally, government initiatives, such as grants for community fitness trails, play a crucial role in expanding the participatory base and driving consistent upgrades in footwear and apparel.

Asia-Pacific, while currently smaller in market size, is projected to grow at the fastest rate among all regions, with a robust CAGR of 8.01% through 2031. This growth is fueled by rising middle-class incomes, urban development projects like bike lanes, and the incorporation of kinesiology-friendly curricula in schools, which collectively unlock new demand segments. Increasing health awareness, along with the growing popularity of organized running events and marathons, significantly contributes to the market's expansion. The region sees intense competition between local sportswear manufacturers and international brands, both of which focus on offering affordable and diverse product ranges to appeal to a price-sensitive yet aspirational consumer base. Furthermore, domestic e-commerce platforms play a pivotal role in providing cost-effective distribution channels for international brands, although the risk of counterfeit products remains a challenge in the region.

Europe continues to experience steady growth, driven by a strong consumer preference for sustainability. Over 60% of European consumers consider eco-credentials as a key factor influencing their purchasing decisions. The rapid adoption of recycled synthetic materials and the implementation of stringent regulations on micro-plastics are expected to shape both fabric innovation and marketing strategies in the region. In South America, the market benefits from a young and growing population as well as increasing urbanization. However, the region remains highly price-sensitive due to macroeconomic volatility, which poses challenges to sustained growth. The Middle East and Africa represent emerging opportunities, particularly in Gulf Cooperation Council countries, where high per-capita spending and government-backed sports initiatives drive market development and consumer engagement.

- Nike, Inc.

- Adidas AG

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Puma SE

- ASICS Corporation

- New Balance Athletics Inc.

- Columbia Sportswear Co.

- Authentic Brands Group

- Mizuno Corporation

- Wolverine World Wide Inc.

- Amer Sports

- Berkshire Hathaway

- New Wave Group

- Decathlon S.A.

- Odlo International AG

- Pentland Group

- Gap Inc.

- On Holding AG

- Patagonia, Inc.

- Tracksmith

- W.L. Gore and Associates

- Rohnisch Sportswear

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in global health and fitness participation initiatives

- 4.2.2 Rise of marathons and running events

- 4.2.3 Influence of social media platforms and celebrity endorsements

- 4.2.4 Growing adoption of athleisure fashion

- 4.2.5 Significant growth in women sports participation rate

- 4.2.6 Technological innovation in fabrics

- 4.3 Market Restraints

- 4.3.1 Prevalence of counterfeit products

- 4.3.2 Emerging micro-plastic regulations on synthetics

- 4.3.3 Seasonal demand fluctuations

- 4.3.4 Volatile raw-material costs for advanced fabrics

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Types

- 5.1.1 Tops

- 5.1.2 Bottoms

- 5.1.3 Outerwear

- 5.1.4 Socks and Accessories

- 5.2 By Fabric and Material

- 5.2.1 Synthetic (Polyester, Nylon, Spandex)

- 5.2.2 Recycled and Bio-based Synthetics

- 5.2.3 Natural and Blended (Merino, Cotton Blends)

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Kids

- 5.4 By Distribution Channels

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nike, Inc.

- 6.4.2 Adidas AG

- 6.4.3 Under Armour, Inc.

- 6.4.4 Lululemon Athletica Inc.

- 6.4.5 Puma SE

- 6.4.6 ASICS Corporation

- 6.4.7 New Balance Athletics Inc.

- 6.4.8 Columbia Sportswear Co.

- 6.4.9 Authentic Brands Group

- 6.4.10 Mizuno Corporation

- 6.4.11 Wolverine World Wide Inc.

- 6.4.12 Amer Sports

- 6.4.13 Berkshire Hathaway

- 6.4.14 New Wave Group

- 6.4.15 Decathlon S.A.

- 6.4.16 Odlo International AG

- 6.4.17 Pentland Group

- 6.4.18 Gap Inc.

- 6.4.19 On Holding AG

- 6.4.20 Patagonia, Inc.

- 6.4.21 Tracksmith

- 6.4.22 W.L. Gore and Associates

- 6.4.23 Rohnisch Sportswear

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK