PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934711

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934711

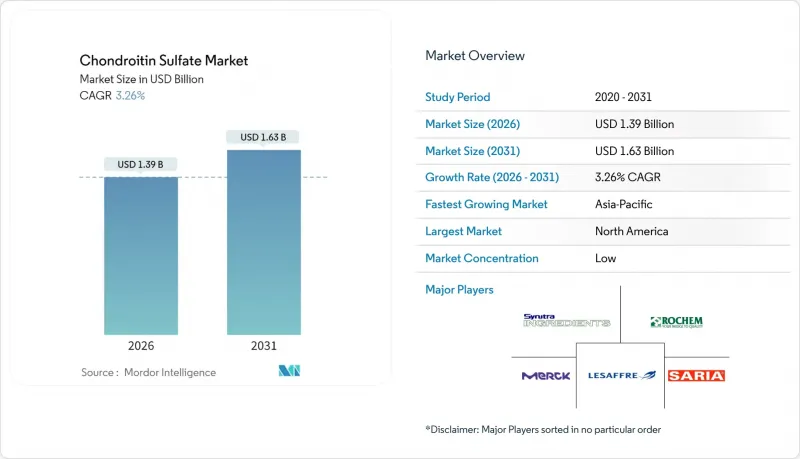

Chondroitin Sulfate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The chondroitin sulfate market was valued at USD 1.35 billion in 2025 and estimated to grow from USD 1.39 billion in 2026 to reach USD 1.63 billion by 2031, at a CAGR of 3.26% during the forecast period (2026-2031).

This steady trajectory is shaped by the rapid rise in osteoarthritis among adults over 45, mounting pressure on animal-derived sources, and growing clinical validation that positions pharmaceutical-grade material as the industry benchmark. Intensifying innovation around synthetic and fermentation-based production underpins long-term supply security, while combination formulations with collagen, hyaluronic acid or Boswellia serrata broaden application breadth. Competitive strategies increasingly emphasize vertical integration to control raw-material quality and leverage regulatory differentiation that rewards higher-grade offerings. Parallel growth opportunities lie in Asia-Pacific manufacturing capacity, which supports export markets and mitigates raw-material price swings that periodically tighten global supply.

Global Chondroitin Sulfate Market Trends and Insights

Intensifying Osteoarthritis Prevalence Among 45+ Population

Rising life expectancy and a larger cohort of adults over 45 sustain demand for pharmaceutical-grade chondroitin sulfate, with osteoarthritis affecting 32.5 million U.S. adults. Large-scale trials such as MOVES confirmed efficacy comparable to celecoxib over six-month regimens. Asia-Pacific mirrors this demographic wave, magnifying nutraceutical uptake. Recent C. elegans work showing 30.6% lifespan extension when endogenous chondroitin doubled adds mechanistic validation that resonates with preventive-care positioning. With musculoskeletal disorders climbing the global disability chart, healthcare systems adopt chondroitin sulfate in multi-modal management, embedding this driver as a long-term pillar.

Rising Nutraceutical Adoption in Joint-Health Supplements

Preventive self-care trends convert pharmaceutical insights into over-the-counter formats, propelling joint-health supplements past USD 100 billion globally. In Asia-Pacific, middle-class consumers integrate chondroitin sulfate powders, granules and chewables into daily routines, attracted by combination formats that cut pain in as few as five days when paired with collagen and Boswellia serrata. Standardization gaps still differentiate pharmaceutical-grade from food-grade, but premium nutraceuticals bridge this divide as brands tout USP-level purity to justify higher price points.

Volatility in Animal-Derived Raw-Material Supply

Livestock disease cycles, slaughterhouse shutdowns and CITES constraints on shark cartilage periodically curtail raw-material flows and elevate costs. Manufacturers hedge through multi-species sourcing and higher inventories, which lift working-capital requirements and price tags for end users. Synthetic pathways and fermentation reduce this exposure, encouraging strategic capex toward controlled bioprocessing.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Upgrades Endorsing Pharmaceutical-Grade CS in EU & US

- Expansion of Bovine Cartilage Processing Capacity in China & India

- Quality & Adulteration Concerns in Food-Grade CS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

2025 revenue shows swine cartilage at 25.12%, supported by mature supply chains and competitive pricing. Yet synthetic output, still below 10% share, races ahead at a 5.81% CAGR. Fermentation systems using engineered E. coli achieve 99% purity in 48 hours. This process yields consistent sulfation patterns that satisfy pharmacopoeia tests and greatly reduce endotoxin risk. The pivot aligns with eco-labeling, kosher/halal demand and vegan positioning, granting first movers a reputational moat. Bovine cartilage remains relevant but must manage BSE perception through certified sourcing. Shark cartilage continues to fall as CITES listings expand, and avian cartilage holds niche status for religious-compliance formulations.

Pricing dynamics illustrate the trade-off: synthetic costs per kilogram currently exceed bovine benchmarks, yet lower purification losses and environmental premiums narrow the gap. As expanded fermenter capacity drives economies of scale, synthetic share is projected to approach 15.3% by 2031, moderating raw-material price spikes that historically pinched margins.

Pharmaceutical-grade products contributed 49.62% of 2025 value and command a widening premium amid stronger clinical evidence and reimbursement recognition. MOVES trial outcomes showed equivalence to celecoxib without gastrointestinal side effects. The chondroitin sulfate market size attributable to food-grade formulations climbs at 5.18% CAGR, reflecting consumer willingness to pay for proactive joint care. Cosmetics-grade remains a micro-segment, integrated in anti-aging serums for moisture retention.

Pharmaceutical manufacturers showcase full ICH-compliant quality systems, batch-release analytics and traceable supply chains that smaller food-grade suppliers often lack. However, nutraceutical brands closing this gap with USP-verified product lines improve shelf appeal and justify higher price points, especially through e-commerce channels emphasizing transparency. The regulatory gradient therefore acts less as an impermeable wall and more as a pathway for capable food-grade players to ascend into prescription markets, provided they allocate resources to validation.

The Chondroitin Sulfate Market Report is Segmented by Source (Bovine Cartilage, Porcine Cartilage, Shark Cartilage, Avian Cartilage, Synthetic, Other Sources), Grade (Pharmaceutical Grade, Food Grade, Cosmetics Grade), Form (Powder, Granules, and More), Application (Pharmaceuticals & OTC Drugs, Dietary Supplements, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 38.62% of 2025 revenue, anchored by insurance coverage for prescription chondroitin sulfate, a large osteoarthritis patient pool and well-established nutraceutical retail channels. GRAS acceptance for food use and FDA guidance on purity thresholds reinforce consumer trust, though litigation risk keeps manufacturers invested in high-end analytics. The region's stable yet modest 2.78% CAGR reflects maturity.

Asia-Pacific rises fastest at 6.54% CAGR, propelled by capacity buildouts in China and India that feed both domestic and export demand. Aging demographics intersect with traditional medicine openness, accelerating uptake of sachet sticks and effervescent drinks that dissolve granulated chondroitin sulfate. Japanese clinical acceptance of condoliase for lumbar disc herniation further diversifies therapeutic landscapes.

Europe benefits from ethical-drug approvals across 13 countries, with physicians prescribing pharmaceutical-grade chondroitin sulfate in place of NSAIDs to mitigate cardiovascular risk. Southern European nutraceutical consumers favor combination formulas featuring Mediterranean botanicals. South America and Middle East & Africa trail but post mid-single-digit CAGR as local distributors negotiate licensing deals with European API suppliers, extending reach into private clinics and upscale pharmacies. Regional heterogeneity in labeling rules and halal certification continues to affect product-launch timelines.

- Bioiberica

- Changzhou Qianhong Bio-pharma Co., Ltd.

- Focus Chem Biotech (Nantong Furuida)

- Gnosis by Lesaffre

- IBSA Institut Biochimique SA

- Jiaxing Hengtai Pharma Co., Ltd.

- Kraeber & Co. GmbH

- Pacific Rainbow International Inc.

- Qingdao WanTuMing Biological Co., Ltd.

- Seikagaku

- Shandong Dongcheng Pharmaceutical Co., Ltd.

- Summit Nutritionals International

- Synutra Ingredients

- Tidal Vision Products

- TSI Group

- Zhaoqing Konson Nutraceutical Co., Ltd.

- Focus Chem Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensifying osteoarthritis prevalence among 45 + population

- 4.2.2 Rising nutraceutical adoption in joint-health supplements

- 4.2.3 Regulatory upgrades endorsing pharmaceutical-grade CS in EU & US

- 4.2.4 Expansion of bovine cartilage processing capacity in China & India

- 4.2.5 Growth of injectable viscosupplement R&D (under-reported)

- 4.2.6 Emerging demand for low-molecular-weight CS in regenerative medicine (under-reported)

- 4.3 Market Restraints

- 4.3.1 Volatility in animal-derived raw-material supply

- 4.3.2 Quality & adulteration concerns in food-grade CS

- 4.3.3 Stricter CITES controls on shark cartilage sourcing (under-reported)

- 4.3.4 Plant-based glycosaminoglycan analogues gaining traction (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Source (Value)

- 5.1.1 Bovine Cartilage

- 5.1.2 Porcine Cartilage

- 5.1.3 Shark Cartilage

- 5.1.4 Avian Cartilage

- 5.1.5 Synthetic

- 5.1.6 Other Sources

- 5.2 By Grade (Value)

- 5.2.1 Pharmaceutical Grade

- 5.2.2 Food Grade

- 5.2.3 Cosmetics Grade

- 5.3 By Form (Value)

- 5.3.1 Powder

- 5.3.2 Granules

- 5.3.3 Tablets & Capsules

- 5.3.4 Injectable / Solution

- 5.4 By Application (Value)

- 5.4.1 Pharmaceuticals & OTC Drugs

- 5.4.2 Dietary Supplements

- 5.4.3 Cosmetics & Personal Care

- 5.4.4 Veterinary Medicine

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Bioiberica S.A.U.

- 6.3.2 Changzhou Qianhong Bio-pharma Co., Ltd.

- 6.3.3 Focus Chem Biotech (Nantong Furuida)

- 6.3.4 Gnosis by Lesaffre

- 6.3.5 IBSA Institut Biochimique SA

- 6.3.6 Jiaxing Hengtai Pharma Co., Ltd.

- 6.3.7 Kraeber & Co. GmbH

- 6.3.8 Pacific Rainbow International Inc.

- 6.3.9 Qingdao WanTuMing Biological Co., Ltd.

- 6.3.10 Seikagaku Corporation

- 6.3.11 Shandong Dongcheng Pharmaceutical Co., Ltd.

- 6.3.12 Summit Nutritionals International

- 6.3.13 Synutra Ingredients

- 6.3.14 Tidal Vision Products

- 6.3.15 TSI Group Ltd.

- 6.3.16 Zhaoqing Konson Nutraceutical Co., Ltd.

- 6.3.17 Focus Chem Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment