PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934712

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934712

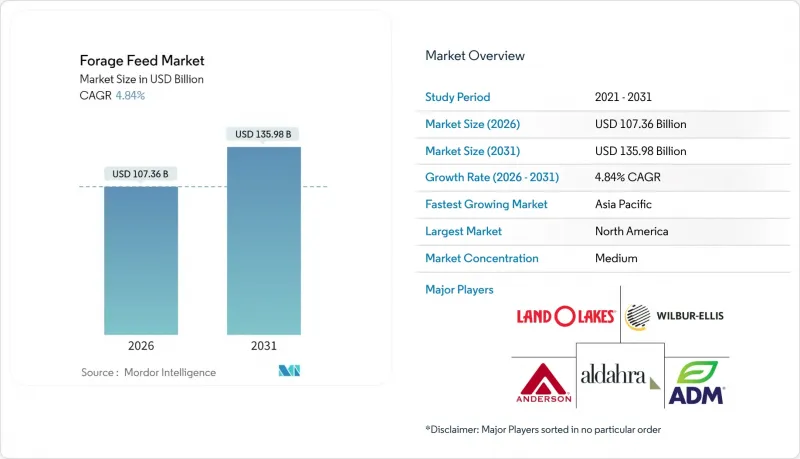

Forage Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The forage feed market size in 2026 is estimated at USD 107.36 billion, growing from 2025 value of USD 102.4 billion with 2031 projections showing USD 135.98 billion, growing at 4.84% CAGR over 2026-2031.

Current expansion reflects rising global demand for animal protein, widening adoption of precision agriculture, and sustained technology investment by integrated feed manufacturers. North America remains the largest regional contributor, anchored by sophisticated logistics and export infrastructure, while Asia-Pacific is set to post the fastest gains as countries like China and India scale intensive livestock systems. In product terms, alfalfa hay accounts for the largest share of the forage feed market, yet value-added silage additives and treated haylage are widening their customer base through methane-reduction protocols and higher nutritional density. Cattle feeding applications dominate the forage feed market, while poultry feeding registers the highest growth prospects as vertically integrated producers pursue cost-optimized, high-throughput diets. Logistics-friendly pellets and cubes are disrupting the long-established baled hay category, and competitive dynamics favor companies that match standardized forage specifications with automated feeding systems.

Global Forage Feed Market Trends and Insights

Rising Global Demand for High-Protein Meat and Dairy

Per-capita meat consumption in Asia-Pacific is forecast to climb 15% by 2030 as urbanization and income growth reshape diets, intensifying procurement of nutrient-dense forage feeds that support higher daily weight gains and milk yields. Livestock integrators in China and Gulf Cooperation Council economies are locking in multi-year supply contracts to safeguard feed quality, enabling forage suppliers to price at premiums linked to crude-protein specifications. The resulting demand spike particularly boosts the forage feed market in export-oriented regions such as the United States and Australia, where large-scale alfalfa operations can guarantee containerized or compressed-bale shipments year-round . Government-backed food-security agendas in Saudi Arabia and the United Arab Emirates further amplify import volumes, anchoring long-term growth in the forage feed market.

Expansion of Large-Scale Dairy and Beef Cattle Farms

Consolidation trends are pushing herd sizes higher, especially in the United States and the Netherlands, where 5,000-cow dairies rely on predictable, uniform forage particle length and moisture content. Operators prioritize feed conversion efficiency and rumen health, stimulating demand for standardized premium alfalfa and precision-cut silage delivered on just-in-time schedules. Al Dahra Agriculture's renewed five-year supply contract with Abu Dhabi agriculture authorities illustrates how large buyers secure volume stability while producers gain revenue visibility.

Weather Variability and Drought Risk

The 2024 El Nino cycle cut hay yields in the western United States by up to 35%, forcing dairies to import higher-priced product from the Pacific Northwest. Similar aridity in Australia triggered export volume caps that jolted Asian buyers relying on multi-port procurement models. These events underscore the need for diversified sourcing strategies and adaptive irrigation investments, constraints that shave an estimated 1.1% points from the forage feed market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Precision Harvesting and Baling

- Carbon-Credit Upside from Nitrogen-Fixing Forage Legumes

- Competition for Arable Land with Cash Crops

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alfalfa hay contributed a 33.62% forage feed market share in 2025, equivalent to roughly USD 34.4 billion in segment revenue. Despite that dominance, silage additives and treated haylage are projected to grow 7.48% annually, expanding the forage feed market size through superior digestibility and methane-reduction credentials. Market incentives from voluntary carbon credit schemes and regulatory emission caps are prompting intensive cattle farms to allocate greater budgets to high-fiber, low-protein blends that optimize rumen function. Supplier portfolios now feature probiotic-infused inoculants and moisture-controlled wrapping that extend shelf life by up to eight months.

Producers such as ACX Pacific Northwest launched pelletized alfalfa variants tailored to dairy total-mixed-ration systems, underscoring the pivot from commodity trading to specification-driven contracting. Timothy hay keeps a stable 14.95% share by catering to premium equine diets, while clover and mixed legumes are inching forward via sustainability premiums. Overall, the product mix shift redefines value propositions, enabling early movers to claim higher margins within the forage feed market.

Cattle feeding accounted for 45.55% of the forage feed market share in 2025, yet the poultry segment is forecast to register a 6.62% CAGR through 2031, strengthening its pull on the forage feed market. Poultry integrators increasingly blend alfalfa meal and fiber-rich haylage to improve gut health and reduce antimicrobial reliance. The forage feed market size for poultry formulations is on track to be estimated to exceed USD 12 billion by the end of the decade. Equine applications, while niche, maintain sizable margins as owners demand toxin-screened, dust-free cubes that ensure respiratory safety.

Dairy operators in Europe are trialing precision-cut beet pulp combined with high-protein clover hay to raise milk solids, supporting incremental uptake of specialty forages. Meanwhile, beef feedlots focus on cost-efficient grass mixes but are gradually shifting toward sustainability-certified inputs to meet downstream retailer mandates. The evolving livestock-type profile thus diversifies revenue pools throughout the forage feed industry.

The Forage Feed Market Report is Segmented by Product Type (Alfalfa Hay, Timothy Hay, and More), by Livestock Type (Dairy Cattle, Beef Cattle, and More), by Form (Bales, Pellets and More), by Distribution Channel (Feed Mills, Direct Farm Supply, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America generated the largest regional contribution to the forage feed market in 2025, with 33.70% market share of the forage feed market size, buoyed by industrial-scale dairy complexes, precision agriculture infrastructure, and robust export pipelines. However, the regional CAGR of 3.05% reflects plateauing herd expansions and heightened land-use competition. The United States leads production, with California and Arizona shipping dehydrated alfalfa to Asian importers through cost-optimized logistics corridors. Canada leverages cool-season crop advantages yet faces freight-rate pressures that squeeze margins. In parallel, the forage feed market size in Mexico is incrementally rising as integrated beef processors upgrade feeding protocols. Asia-Pacific represents the fastest-growing geography at a 6.39% CAGR to 2031, driven by population growth, dietary westernization, and rapid adoption of vertical livestock integration. China's import volumes for premium compressed alfalfa bales surged significantly during 2024-2025, underpinned by intensive dairy installations in Inner Mongolia. India's expanding cooperative dairy network, backed by cold-chain investments, is stimulating demand for fermented haylage and protein-fortified pellets. Australia, while a major exporter, contends with recurring drought cycles and shifting water-allocation policies that may limit volume upside yet position water-efficient legumes as strategic crops within the forage feed market. Europe demonstrates growth potential, as sustainability mandates and Common Agricultural Policy reforms encourage nitrogen-fixing legumes and carbon credit participation. Germany, France and the Netherlands retain strong dairy foundations, yet phytosanitary rules on the United States hay imports are prompting localized sourcing. Eastern European markets such as Hungary are buoyed by new processing investments from ADM's Vitafort joint venture, reinforcing self-sufficiency aspirations. The Middle East and Africa are experiencing growth as governments strive to reduce food import dependence, however, forage self-production is constrained by water scarcity, keeping Gulf buyers active on global spot markets. South America is also expanding, with Brazil's Cerrado development and Argentina's pasture improvement projects enlarging exportable surpluses, albeit subject to climatic volatility and export-tax uncertainties.

- ADM

- Wilbur-Ellis Company LLC

- Triple Crown Nutrition

- Land O'Lakes, Inc.

- Anderson Hay

- Al Dahra ACX, Inc.

- Gruppo Carli

- Border Valley Trading

- Standlee Premium Products, LLC

- Lucerne Farms

- Mitsubishi Corporation (Riverina)

- Baileys Horse Feeds

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global demand for high-protein meat and dairy

- 4.2.2 Expansion of large-scale dairy and beef cattle farms

- 4.2.3 Technological advances in precision harvesting and baling

- 4.2.4 Carbon-credit upside from nitrogen-fixing forage legumes

- 4.2.5 On-farm robotic feeding systems increasing forage throughput

- 4.2.6 Methane-mitigation diets favoring high-fiber forage blends

- 4.3 Market Restraints

- 4.3.1 Weather variability and drought risk

- 4.3.2 Competition for arable land with cash crops

- 4.3.3 Stricter phytosanitary barriers on cross-border hay trade

- 4.3.4 Shift toward fermented concentrates reducing loose-forage imports

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Volume and Value)

- 5.1 By Product Type

- 5.1.1 Alfalfa Hay

- 5.1.2 Timothy Hay

- 5.1.3 Clover & Other Legume Hay

- 5.1.4 Silage

- 5.1.5 Haylage

- 5.1.6 Other Forage (grass mix, crop residues)

- 5.2 By Livestock Type

- 5.2.1 Dairy Cattle

- 5.2.2 Beef Cattle

- 5.2.3 Poultry

- 5.2.4 Equine

- 5.2.5 Swine

- 5.2.6 Other Livestock (sheep, goats, camelids)

- 5.3 By Form

- 5.3.1 Bales

- 5.3.2 Pellets and Cubes

- 5.3.3 Chopped/Chaffed Forage

- 5.3.4 Fermented Haylage and Silage Additives

- 5.4 By Distribution Channel

- 5.4.1 Feed Mills

- 5.4.2 Direct Farm Supply

- 5.4.3 Online Platforms

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADM

- 6.4.2 Wilbur-Ellis Company LLC

- 6.4.3 Triple Crown Nutrition

- 6.4.4 Land O'Lakes, Inc.

- 6.4.5 Anderson Hay

- 6.4.6 Al Dahra ACX, Inc.

- 6.4.7 Gruppo Carli

- 6.4.8 Border Valley Trading

- 6.4.9 Standlee Premium Products, LLC

- 6.4.10 Lucerne Farms

- 6.4.11 Mitsubishi Corporation (Riverina)

- 6.4.12 Baileys Horse Feeds

7 Market Opportunities and Future Outlook