PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934715

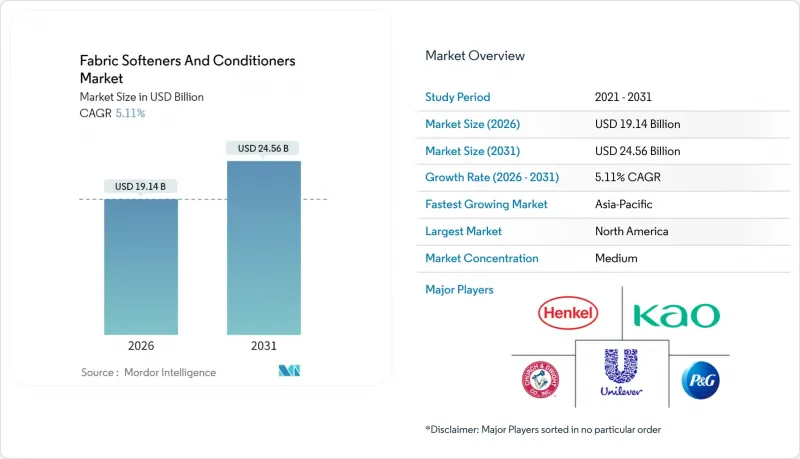

Fabric Softeners And Conditioners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global fabric softeners and conditioners market size in 2026 is estimated at USD 19.14 billion, growing from 2025 value of USD 18.21 billion with 2031 projections showing USD 24.56 billion, growing at 5.11% CAGR over 2026-2031.

The market growth stems from increased consumer awareness about fabric care benefits, such as softness, wrinkle reduction, and fragrance enhancement, along with heightened hygiene concerns that drive demand for quality laundry care products. Urban consumers' preference for time-efficient household solutions has increased fabric softener adoption. The market has adapted to consumer needs through new product developments, including eco-friendly, hypoallergenic, and multifunctional formulations that align with sustainability regulations and health safety requirements. Developing regions show significant market expansion due to higher disposable incomes, urbanization, and increased washing machine adoption, particularly in the Asia-Pacific region.

Global Fabric Softeners And Conditioners Market Trends and Insights

Increased consumer awareness of fabric care and hygiene

Consumer awareness of fabric care and hygiene is driving growth in the global fabric softeners and conditioners market. Consumers understand how fabric care products affect their garments' longevity, appearance, and cleanliness. This has increased demand for fabric softeners that provide softness and pleasant scents while offering hygienic benefits such as reducing bacteria, allergens, and odors in clothing. Consumers value fabric conditioners' ability to protect fabrics from wear and tear, prevent color fading, and extend garment life. Additionally, growing concerns about skin sensitivities and allergies have increased demand for hypoallergenic and dermatologically tested fabric softener formulations. In response, Procter & Gamble launched Downy Gentle Soft + Fresh in August 2025, a fabric softener that combines softness and lasting scent with gentleness. The product excludes heavy perfumes and dyes, providing light, long-lasting freshness suitable for sensitive skin.

Innovation in product formulations

Product formulation innovation functions as a primary growth driver in the global fabric softeners and conditioners market. Consumer requirements have evolved to encompass comprehensive solutions that extend beyond fundamental softness and fragrance attributes, incorporating stain protection, color preservation, wrinkle reduction, and dermatological considerations. Manufacturing entities have substantially increased their research and development investments to formulate advanced products incorporating innovative ingredients and technological implementations. Current advancements encompass biodegradable and plant-derived materials, enzymatic integration for enhanced fabric maintenance, and microencapsulation methodologies for sustained fragrance release. These technological progressions deliver optimized performance while adhering to sustainability requirements and established safety protocols. In April 2025, Henkel implemented concentrated formulations across its liquid laundry product portfolio, demonstrating reduced packaging material utilization and transportation-related emissions while enhancing softening and cleaning efficacy.

Environmental concerns and criticism

Environmental concerns constitute a fundamental impediment within the global fabric softeners and conditioners market. Conventional fabric softeners incorporate quaternary ammonium compounds, synthetic fragrances, and non-biodegradable surfactants, which systematically contribute to the deterioration of aquatic ecosystems. These persistent chemical constituents demonstrably interfere with photosynthetic mechanisms in aquatic flora and substantially compromise the biological integrity of marine organisms. The incorporation of specific colorants and preservative compounds in fabric softeners has generated significant toxicological implications and precipitated enhanced regulatory scrutiny. Consequently, consumer advocacy organizations and governmental regulatory authorities are implementing stringent mandates requiring manufacturers to incorporate biodegradable, plant-derived, and environmentally sustainable constituents while establishing comprehensive protocols to minimize adverse emissions and waste generation.

Other drivers and restraints analyzed in the detailed report include:

- Surge in eco-friendly and sustainable products

- Rising penetration of washing machines

- Allergic reactions and skin sensitivities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid fabric softeners maintain market leadership with an 88.72% share in 2025 due to their effectiveness and practical advantages in fabric care. Consumers prefer liquid variants for their ability to deliver uniform softness and lasting fragrance to clothes. The liquid formulation enables even distribution of conditioning agents during the wash cycle, providing consistent softness and fragrance performance. Liquids offer significant convenience through easy application and concentrated formulations, requiring smaller doses that minimize waste and support efficient packaging. Additionally, liquid softeners dissolve effectively in both hot and cold water, making them compatible with all washing machine types, including fully automatic, semi-automatic, front load, and top load.

Dryer sheets represent the fastest-growing segment in the fabric softeners and conditioners market, with a projected CAGR of 7.55% through 2031. Their growth stems from practical benefits, including convenience, portability, and effectiveness in reducing static cling, softening fabrics, and adding fresh fragrances without liquid measurements. These products particularly appeal to consumers with busy schedules and smaller laundry loads, offering simple application by adding a sheet to the dryer. The segment's growth also benefits from increasing demand for sustainable products. In July 2023, Unilever introduced a laundry dryer sheet containing biodegradable ingredients in recyclable, paper-based packaging. This product development demonstrates the market's shift toward environmental responsibility while maintaining performance standards.

Conventional fabric softeners dominate with an 80.65% market share in 2025. Their superior performance in fabric softness, wrinkle reduction, fragrance retention, and static cling prevention makes them the preferred choice for consumers globally. These products contain synthetic surfactants and conditioning agents that deliver consistent results across various washing conditions, water temperatures, and fabric types. Conventional fabric softeners maintain their market position through competitive pricing compared to organic alternatives, appealing to both emerging and mature markets. The segment's continued growth stems from product innovations, including enhanced fragrance technology, hypoallergenic formulations, and reduced chemical content, which maintain consumer confidence while meeting changing preferences.

The organic fabric softeners segment projects a CAGR of 7.41% through 2031, driven by increasing demand for sustainable and safer fabric care options. This growth reflects heightened health awareness and environmental consciousness among consumers, particularly millennials and Gen Z, who seek alternatives to chemical-based products. Organic fabric softeners, formulated with plant-based, biodegradable, and renewable ingredients, attract environmentally conscious consumers who value ingredient transparency. In November 2023, the Organic World expanded its product range by introducing Osh Fabric Conditioner, featuring 99% natural and plant-derived ingredients without synthetic fragrances, dyes, preservatives, or harmful chemicals. This product launch demonstrates the industry's response to consumer demands for natural and sustainable fabric care solutions.

The Fabric Softeners and Conditioners Market Report is Segmented by Product Type (Liquid, Dryer Sheets, and Others), by Nature (Conventional and Organic), End-User (Adult and Kids), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialty Stores, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

North America holds a dominant 31.05% market share in 2025, driven by established consumer behavior patterns. The region's high living standards, substantial disposable incomes, and cultural focus on cleanliness contribute to this leadership position. North American consumers regularly purchase premium fabric softeners and conditioners to enhance garment maintenance. The market benefits from an extensive retail network of supermarkets, hypermarkets, and e-commerce platforms, along with the presence of major global brands. The region's large working population and time-constrained lifestyles further increase demand for efficient laundry care products.

Asia-Pacific demonstrates the highest growth trajectory with a projected 7.29% CAGR through 2031. This growth stems from urbanization trends, middle-class expansion, and increased washing machine adoption. The region shows evolving consumer preferences toward improved living standards and a greater understanding of the importance of fabric care. China's export of 4.48 billion household appliances in 2024, representing a 20.8% increase from the previous year, according to the China-CEEC Customs Information Center, indicates rising washing machine penetration and subsequent fabric softener demand . These factors create opportunities for market expansion through product innovation and targeted consumer strategies.

Europe maintains consistent market growth despite maturity, influenced by environmental regulations that promote sustainable formulations and packaging. South America, the Middle East, and Africa offer growth potential through urbanization and young demographics, though economic fluctuations affect pricing strategies. These regions benefit from increased manufacturing investment by established companies, with local production facilities helping address import costs and pricing challenges.

- The Procter and Gamble Company

- Unilever PLC

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Kao Corporation

- S. C. Johnson & Son, Inc.

- LG H&H Co., Ltd.

- Colgate-Palmolive Company

- Pigeon Corporation

- Amway Corp.

- Lion Corporation

- Godrej Consumer Products Ltd.

- Blue Moon Group Holdings

- Marico Ltd.

- AlEn USA LLC

- The Clorox Company

- Koparo Clean

- Reckitt Benckiser Group plc

- Blueland

- The Green Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased consumer awareness of fabric care and hygiene

- 4.2.2 Innovation in product formulations

- 4.2.3 Surge in eco-friendly and sustainable products

- 4.2.4 Rising penetration of washing machines

- 4.2.5 Personalization and sophisticated scents

- 4.2.6 Marketing and celebrity endorsements

- 4.3 Market Restraints

- 4.3.1 Environmental concerns and criticism

- 4.3.2 Allergic reactions and skin sensitivities

- 4.3.3 Counterfeit and low-quality products

- 4.3.4 Supply chain and raw material fluctuations

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Liquid

- 5.1.2 Dryer Sheets

- 5.1.3 Others

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By End-User

- 5.3.1 Adult

- 5.3.2 Kids

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience/Grocery Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Procter and Gamble Company

- 6.4.2 Unilever PLC

- 6.4.3 Henkel AG & Co. KGaA

- 6.4.4 Church & Dwight Co., Inc.

- 6.4.5 Kao Corporation

- 6.4.6 S. C. Johnson & Son, Inc.

- 6.4.7 LG H&H Co., Ltd.

- 6.4.8 Colgate-Palmolive Company

- 6.4.9 Pigeon Corporation

- 6.4.10 Amway Corp.

- 6.4.11 Lion Corporation

- 6.4.12 Godrej Consumer Products Ltd.

- 6.4.13 Blue Moon Group Holdings

- 6.4.14 Marico Ltd.

- 6.4.15 AlEn USA LLC

- 6.4.16 The Clorox Company

- 6.4.17 Koparo Clean

- 6.4.18 Reckitt Benckiser Group plc

- 6.4.19 Blueland

- 6.4.20 The Green Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK