PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934719

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934719

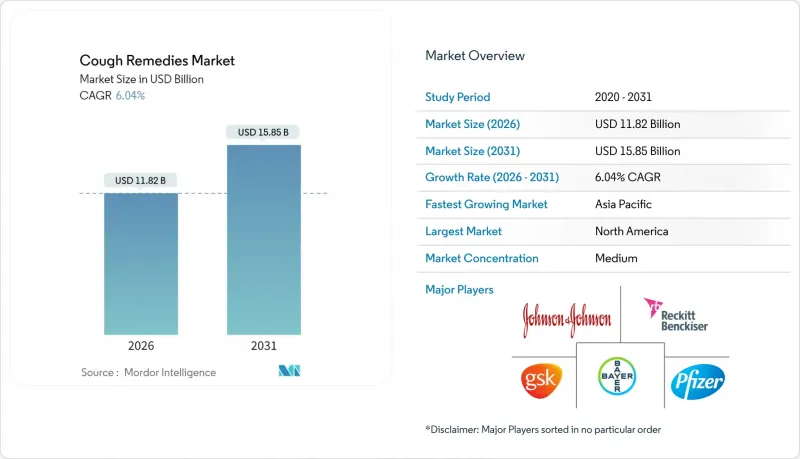

Cough Remedies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The cough remedies market is expected to grow from USD 11.15 billion in 2025 to USD 11.82 billion in 2026 and is forecast to reach USD 15.85 billion by 2031 at 6.04% CAGR over 2026-2031.

Steady demand stems from the high prevalence of respiratory diseases, regulatory frameworks that preserve consumer access to non-prescription care, and a brisk pace of product reformulation prompted by ingredient rulings. Innovation is accelerating in non-opioid antitussive compounds, helping manufacturers counterbalance tighter codeine and phenylephrine restrictions. Meanwhile, digital retail expansion and rising self-care behaviors are channeling more volume toward e-pharmacies, reshaping competitive priorities across the cough remedies market. Consolidation among multinational drug makers is intensifying as firms seek differentiated respiratory assets that can weather shifting policy landscapes.

Global Cough Remedies Market Trends and Insights

Growing Global Burden of Respiratory Diseases

Over 213 million individuals are living with chronic respiratory disease, while lower respiratory infections remain the fifth-leading cause of death, keeping preventive cough management high on clinical agendas. About 90% of COPD-related deaths occur in low- and middle-income countries, creating sustained demand for accessible therapies that can be purchased without a prescription. Epidemiological studies also link chronic cough to poor sleep quality and reduced workplace productivity, prompting patients to seek more effective options than traditional symptomatic relief. Global alliances such as GARD reinforce early intervention and community-level education that enlarge the addressable base for the cough remedies market. As incidence and awareness rise in APAC and MEA, multinational manufacturers are ramping up supply chains and localized marketing to capture incremental volume.

Expanding Over-The-Counter Drug Accessibility

Regulators are opening pathways that allow certain prescription molecules to migrate into OTC settings under structured conditions. The United States enacted Additional Conditions for Nonprescription Use (ACNU) in 2024, enabling consumers to secure stronger cough remedies after completing an electronic questionnaire that screens for contraindications. Vietnam revised its pharmacy law in 2025 to authorize e-commerce sales of approved medicines, shortening dossier processing and lowering market-entry costs for innovators. Simplified routes to shelf encourage firms to reformulate or reposition legacy products now threatened by ingredient bans, thereby maintaining supply diversity across the cough remedies market. Wider OTC availability also reduces routine physician visits for uncomplicated cough, supporting health-system efficiency goals.

Stringent Regulatory Framework for Cough Medication Ingredients

Ingredient reviews are shrinking product portfolios and inflating compliance costs. The United Kingdom's 2024 switch of codeine linctus from OTC to prescription-only status typifies the tightening trend after 59% of consultation respondents cited misuse risks. In the United States, FDA reviewers concluded that oral phenylephrine lacks measurable benefit, jeopardizing nearly USD 1.8 billion in annual retail revenue. European guidelines mandate 10-plus years of bibliographic evidence for combination herbal actives, hampering rapid line extensions. If future deliberations convert dextromethorphan to prescription status, stakeholders project a USD 21-31 billion surge in clinician visits and productivity losses, highlighting the financial stakes. Smaller manufacturers face particular strain financing the clinical work needed to satisfy diverging global standards.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Preference for Self-Care Healthcare

- Increasing Adoption of Digital Retail Channels

- Safety Concerns Related to Opioid and Codeine-Based Formulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Combination formulations commanded 34.29% cough remedies market share in 2025, a reflection of consumer appetite for single-dose relief covering cough, congestion, and fever. The segment draws strength from cross-category promotions during cold-and-flu spikes and from value-added delivery formats like coated tablets that mask bitter actives. Herbal / natural lines are winning new households at an 8.54% CAGR as shoppers seek gentler profiles amid rising ingredient skepticism. Clinical literature continues to validate botanicals such as thyme-primula blends that show non-inferior results to synthetic comparators, reinforcing their credibility among pharmacists. Antitussive innovation focuses on P2X3 or TRP channel blockers poised to replace codeine, while expectorants anchored by guaifenesin maintain volume through physician endorsement for productive cough. Mucolytics are also finding broader application in obstructive lung disease, adding incremental tonnage to the cough remedies market size for chronic-care patients.

Second-order impacts are emerging: decongestants containing phenylephrine will require reformulation, pushing retailers to adjust planograms and granting herbal or saline-based sprays new shelf space. FDA clearance of gummy formulations demonstrates regulator openness to novel oral vehicles, encouraging brands to experiment with zinc-enhanced chewables or honey-lavender melts. Antibiotic adjuncts are receding as antimicrobial stewardship discourages use in viral infections, reallocating R&D dollars toward immune-supportive botanicals and cough reflex modulators.

Syrups and linctuses held 58.10% of cough remedies market share in 2025, favored for soothing mouthfeel and rapid mucosal absorption that appeals to both adults and children. Yet palatability improvements in gummies, jellies, and thin films are fueling an 8.63% CAGR as busy parents favor mess-free packets for on-the-go dosing. Manufacturers are leveraging pectin or gelatin matrices to embed standard USP actives, broadening flavor libraries to win repeat purchase. Tablet and capsule formats remain staples for adult professionals seeking discreet daytime relief, while sustained-release beads lengthen efficacy windows to cover work shifts. Lozenges deliver targeted throat lubrication, and new sugar-free recipes cater to diabetic or calorie-conscious shoppers, maintaining relevance amid evolving health trends.

Regulatory updates announced in 2025 permit monograph holders to switch between solid oral forms without filing a new drug application, accelerating life-cycle management and enabling rapid technology migration. Nasal sprays capitalize on localized action for upper-respiratory congestion, and demand typically spikes alongside allergy season, offering a hedge against cooldowns in cough incidents. Vapor rubs and steam inhalants continue to serve caregivers seeking tactile comfort remedies, especially in geriatric settings where oral polypharmacy is a concern.

The Cough Remedies Market Report is Segmented by Product Type (Antitussives, Expectorants, and More), Dosage Form (Syrup/Linctus, Tablets & Capsules, and More), Age Group (Pediatrics & Adolescents (Below 18 Years), and More), Distribution Channel (Retail Pharmacies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed the largest slice of global revenue at 38.10% in 2025, anchored by high insurance coverage, expansive retail pharmacy networks, and early adoption of technology-enabled self-care. Manufacturers allocate sizable promotional budgets toward national television and social media campaigns timed with cold-and-flu peaks, reinforcing brand preference. Ongoing FDA reviews of active ingredients inject some forecast uncertainty, yet they also catalyze reformulation pipelines that can rejuvenate mature labels. The United States remains the focal point for clinical trials of next-generation P2X3 antagonists, reinforcing the region's role as launchpad for innovation. Canada's proactive codeine limitations pressure marketers to position non-opioid lines more prominently, subtly reshaping the cough remedies market landscape.

Asia-Pacific is the fastest-growing theatre, clocking a 7.46% CAGR between 2026-2031, propelled by burgeoning middle-class consumption, urbanization, and regulatory modernization that expedites product approvals. China and India represent high-volume opportunities, though their pricing controls and linguistic diversity necessitate granular segmentation strategies. Japan's aging population drives steady demand for expectorants and mucolytics tailored to chronic conditions, while Vietnam's e-commerce legalization ushers in cross-border shipments from regional hubs. Australian authorities integrate cough remedies into community-pharmacy practice standards that endorse evidence-based natural medicines, encouraging SKU diversity. Collectively, these dynamics enlarge the cough remedies market size in APAC while intensifying competition from domestic generics.

Europe balances mature demand with increasingly stringent oversight. The reclassification of codeine formulations in the United Kingdom and phenylephrine efficacy challenges across the bloc force companies to re-engineer top-selling SKUs, temporarily tightening shelf supply. On the upside, European Medicines Agency approvals of novel respiratory vaccines spotlight continued scientific leadership that may spill over into antitussive research. Germany remains Europe's largest revenue generator, sustained by a robust insurance system that reimburses certain OTC cough aids for vulnerable populations. Southern European markets see rising uptake of herbal syrups aligned with traditional phytotherapy practices, reinforcing regional product-mix nuance.

South America and the Middle East & Africa are displaying double-digit value growth from a small base. Urban pharmacies in Brazil and Mexico are modernizing layouts to stock combination cough remedies in frontline aisles, reducing stigma and increasing basket size. GCC countries expand insurance coverage for chronic respiratory treatments, benefiting high-margin non-opioid inhaled agents. In sub-Saharan Africa, donor-backed programs that distribute childhood pneumonia diagnostics are indirectly lifting parental awareness of cough symptom management, although affordability remains a constraint.

- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Boiron Group

- Church & Dwight Co.

- Cipla

- Dabur

- Engelhard Arzneimittel GmbH & Co. KG

- GlaxoSmithKline

- Haleon Plc

- Himalaya Wellness Co.

- Hisamitsu Pharmaceutical Co.

- Johnson & Johnson

- Novartis SA

- Otsuka Pharmaceutical Co.

- Perrigo Company

- Pfizer

- Prestige Consumer Healthcare

- Procter & Gamble

- Reckitt Benckiser Group

- Sanofi

- Sun Pharmaceuticals Industries

- Takeda Pharmaceutical Co.

- Tris Pharma Inc.

- Viatris

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Global Burden of Respiratory Diseases

- 4.2.2 Expanding Over-The-Counter Drug Accessibility

- 4.2.3 Rising Consumer Preference for Self-Care Healthcare

- 4.2.4 Increasing Adoption of Digital Retail Channels

- 4.2.5 Development of Novel Non-Opioid Antitussive Therapies

- 4.2.6 Government Initiatives Promoting Public Health Awareness

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Framework for Cough Medication Ingredients

- 4.3.2 Safety Concerns Related to Opioid and Codeine-Based Formulations

- 4.3.3 Limited Clinical Evidence Supporting Product Efficacy

- 4.3.4 Availability of Alternative Non-Pharmacological Therapies

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Antitussives (Opioid & Non-Opioid)

- 5.1.2 Expectorants

- 5.1.3 Mucolytics

- 5.1.4 Bronchodilators

- 5.1.5 Antihistamines

- 5.1.6 Decongestants

- 5.1.7 Combination Medications

- 5.1.8 Other Product Types

- 5.2 By Dosage Form

- 5.2.1 Syrup/Linctus

- 5.2.2 Tablets & Capsules

- 5.2.3 Lozenges/Pastilles

- 5.2.4 Nasal Drops/Sprays

- 5.2.5 Gummies & Confectionery

- 5.2.6 Balms/inhalers

- 5.3 By Age Group

- 5.3.1 Pediatrics & Adolescents (Below 18 Years)

- 5.3.2 Adults (18-60 Years)

- 5.3.3 Geriatrics (Above 60 Years)

- 5.4 By Distribution Channel

- 5.4.1 Retail Pharmacies

- 5.4.2 Hospital/Clinic Pharmacies

- 5.4.3 Online / E-Pharmacies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 AstraZeneca Plc

- 6.3.2 Bayer AG

- 6.3.3 Boehringer Ingelheim GmbH

- 6.3.4 Boiron Group

- 6.3.5 Church & Dwight Co.

- 6.3.6 Cipla

- 6.3.7 Dabur

- 6.3.8 Engelhard Arzneimittel GmbH & Co. KG

- 6.3.9 GSK plc

- 6.3.10 Haleon Plc

- 6.3.11 Himalaya Wellness Co.

- 6.3.12 Hisamitsu Pharmaceutical Co.

- 6.3.13 Johnson & Johnson

- 6.3.14 Novartis SA

- 6.3.15 Otsuka Pharmaceutical Co.

- 6.3.16 Perrigo Company Plc

- 6.3.17 Pfizer Inc.

- 6.3.18 Prestige Consumer Healthcare Inc.

- 6.3.19 Procter & Gamble Co.

- 6.3.20 Reckitt Benckiser Group Plc

- 6.3.21 Sanofi S.A

- 6.3.22 Sun Pharmaceutical Industries Ltd.

- 6.3.23 Takeda Pharmaceutical Co.

- 6.3.24 Tris Pharma Inc.

- 6.3.25 Viatris Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment