PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934720

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934720

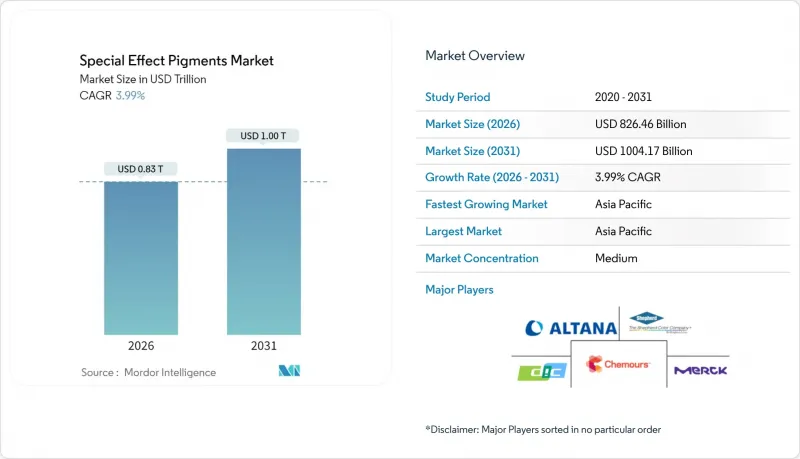

Special Effect Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Special Effect Pigments market size in 2026 is estimated at USD 826.46 billion, growing from 2025 value of USD 794.78 billion with 2031 projections showing USD 1004.17 billion, growing at 3.99% CAGR over 2026-2031.

Structural change rather than headline growth defines the landscape, with rapid consolidation, premium-finish adoption across consumer and industrial goods, and a pivot toward sustainable manufacturing dictating competitive outcomes. Pearlescent grades remain the fulcrum of demand because they deliver both metallic brilliance and regulatory compliance, especially when based on synthetic mica substrates. Automotive OEMs have tightened global color-matching standards, elevating suppliers that can guarantee batch-to-batch consistency in radar-transparent and water-borne systems. Parallel momentum in cosmetics, plastics, and advanced displays is deepening the customer mix, while the Asia-Pacific production base secures raw-material and labor efficiencies that compress cost curves for the entire value chain.

Global Special Effect Pigments Market Trends and Insights

Surging Demand for Premium Finishes in Automotive OEM and Refinish

Automotive design studios are specifying deeper color spaces and multilayer optical effects to differentiate next-generation vehicles. BASF's 2025 color trend palette integrates bio-based resins with infrared-transparent pigments that do not interfere with autonomous driving sensors. Radar transparency disqualifies conventional metallic flakes, adding urgency to pearlescent and crystal-glass innovations that marry aesthetics with sensor performance. Water-borne topcoats now dominate European OEM lines, compelling pigment makers to demonstrate long-term dispersion stability at low VOC levels. The shift extends to refinish operations, where body shops deploy spectrophotometers to replicate OEM shades, guaranteeing ongoing demand for effect pigments able to match factory finishes on repaired panels. These requirements collectively reinforce supplier consolidation because global automakers favor a tightly curated vendor list that can service multi-continent programs with identical quality metrics.

Rapid Uptake of Visual-Effect Cosmetics and Personal-Care Products

Smartphone-driven beauty culture has converted optical novelty into mainstream expectation, lifting demand for holographic and pearlescent microplates that create color-travel and sparkle on skin and nails. The permanent FDA listing of natural mica for eye-area use provides regulatory certainty just as consumers intensify scrutiny of ingredient safety. Major brands now stipulate heavy-metal-free portfolios, encouraging the migration toward synthetic mica and borosilicate glass bases that offer higher platelet uniformity and lower trace metals. Asia's K-beauty innovators accelerate trend cycles, shortening product lifetimes and forcing pigment suppliers to operate agile, small-batch manufacturing that can deliver bespoke shades within weeks. While margin potential rises, sustainment costs climb as firms must certify worldwide compliance dossiers for each new hue.

Stringent REACH and VOC Limits on Metal-Based Effect Pigments

REACH dossier updates demand exhaustive toxicological data for aluminum and copper flakes, obliging smaller pigment companies to allocate disproportionate compliance budgets or exit the region. Simultaneously, the move from solvent to water-borne binders forces reformulation because traditional leafing agents dissolve or gas in alkaline media. Suppliers equipped with proprietary encapsulation and passivation know-how can transform regulatory friction into loyalty-building service, but late adopters are confronting prolonged approval cycles that erode revenue.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Shift to Water-Borne and Powder Coatings

- APAC Industrial Build-Out Boosting Coatings and Plastics Demand

- Volatile Aluminum and TiO2 Cost Base

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pearlescents held 51.02% of the special-effect pigments market share in 2025 and are forecast to maintain the fastest 4.07% CAGR to 2031, confirming their dual status as volume and growth leader. Glass-flake and synthetic mica formulations widen the application canvas by providing radar transparency and ultralow heavy-metal content, attributes prized in electric-vehicle exteriors and luxury-cosmetic powders. The special-effect pigments market benefits as OEM clear-coat layers integrate variable-thickness lamellae that produce color-travel with minimal flop, cutting paint-shop passes and lowering cycle times.

Metallic grades retain core positions in protective topcoats, yet their share of the special-effect pigments market is slipping where radar compliance outranks sparkle intensity. Vendors with advanced silica encapsulation processes defend margins by licensing technology to regional tollers, securing scale without dilution of intellectual property. Optically variable and holographic pigments serve security inks and brand-protection labels; although collectively smaller, they achieve above-average pricing and bolster portfolio profitability, ensuring they remain a strategic extension rather than a commodity add-on.

The Special-Effect Pigments Report is Segmented by Pigment Type (Metallic, Pearlescent, and Other Pigment Types), End-User Industry (Paints and Coatings, Cosmetics, Plastics, Printing Inks, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 45.12% of the special-effect pigments market size in 2025 and is tracking a 4.55% CAGR through 2031, consolidating its role as the global manufacturing hub. China's dominance in automotive coatings underpins regional demand, while India's 7%-plus growth in decorative paints generates incremental volume for pearlescent dispersions. Government incentives for electric-vehicle localization attract foreign assemblers that mandate identical color libraries across continents, encouraging pigment makers to establish in-region technical-service labs. Southeast Asian electronics clusters in Vietnam and Malaysia further diversify downstream channels, absorbing high-purity effect grades for smartphone casings and wearable housings.

Europe wields regulatory influence that shapes worldwide formulation standards. REACH and the 2023 microplastics restriction accelerate the pivot to bio-based surfactants and encapsulated metal flakes, a policy environment that rewards early movers with defensible premium pricing. German and Italian automotive OEMs commit to low-film-thickness clearcoats that intensify optical flop per micron, pushing pigment suppliers toward higher aspect-ratio platelets and tighter particle-size control. In architectural coatings, Nordic countries specify near-zero VOC benchmarks that quickly propagate across the continent, ratcheting technical barriers for imported formulations lacking water-borne credentials.

North America maintains a sizable automotive refinish ecosystem, ensuring predictable pull for metallic and pearlescent touch-up products. The U.S. Food and Drug Administration's permanent listing of mica as an exempt color additive stabilizes raw-material selection for cosmetics effect pigments, streamlining certification for new color launches. Mexico's ascendant vehicle assembly footprint heightens cross-border pigment logistics, with U.S. suppliers leveraging near-shoring to cut lead times. The Middle East and Africa offer long-run upside as infrastructure programs accelerate decorative-coatings use; however, limited local production capacity means import dependence persists, advantaging multinationals with integrated freight networks. South America's pigment demand centers on Brazil's automotive belt, though currency volatility necessitates hedging strategies to manage revenue repatriation.

- ALTANA (ECKART)

- DIC Corporation

- Merck KGaA

- NIHON KOKEN KOGYO CO.,LTD

- OXERRA Americas

- RPM International Inc.

- SCHLENK SE

- Shepherd Color

- Silberline Manufacturing Co., Inc.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- VIAVI Solutions Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Premium Finishes in Automotive OEM And Refinish

- 4.2.2 Rapid Uptake of Visual-Effect Cosmetics and Personal-Care Products

- 4.2.3 Sustainability Shift to Water-Borne and Powder Coatings

- 4.2.4 APAC Industrial Build-Out Boosting Coatings and Plastics Demand

- 4.2.5 AR/VR and Consumer Electronics Requiring Optically Active Pigments

- 4.3 Market Restraints

- 4.3.1 Stringent REACH and VOC Limits on Metal-Based Effect Pigments

- 4.3.2 Volatile Aluminium and TiO? Cost Base

- 4.3.3 Regulatory Scrutiny of Synthetic-Mica Micro-Particles

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Pigment Type

- 5.1.1 Metallic

- 5.1.2 Pearlescent

- 5.1.3 Other Pigment Types

- 5.2 By End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Cosmetics

- 5.2.3 Plastics

- 5.2.4 Printing Inks

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ALTANA (ECKART)

- 6.4.2 DIC Corporation

- 6.4.3 Merck KGaA

- 6.4.4 NIHON KOKEN KOGYO CO.,LTD

- 6.4.5 OXERRA Americas

- 6.4.6 RPM International Inc.

- 6.4.7 SCHLENK SE

- 6.4.8 Shepherd Color

- 6.4.9 Silberline Manufacturing Co., Inc.

- 6.4.10 Sudarshan Chemical Industries Limited

- 6.4.11 The Chemours Company

- 6.4.12 VIAVI Solutions Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment