PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934722

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934722

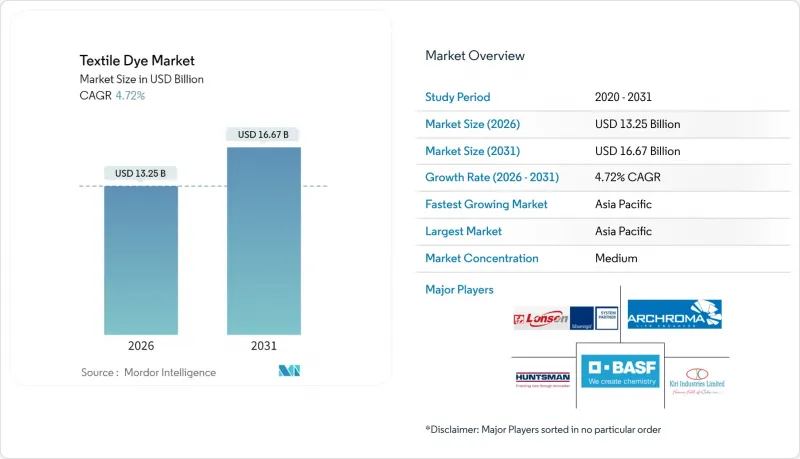

Textile Dye - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Textile Dye Market was valued at USD 12.65 billion in 2025 and estimated to grow from USD 13.25 billion in 2026 to reach USD 16.67 billion by 2031, at a CAGR of 4.72% during the forecast period (2026-2031).

Rising fast-fashion output, wider adoption of on-demand digital printing, and stricter brand sustainability targets are strengthening demand across both natural and synthetic colorant systems, while ongoing consolidation gives large suppliers the scale needed to invest in lower-impact chemistries. Dispersive formulations, prized for polyester processing, held the largest dye-type share at 32.08% in 2024 and continue to benefit from high-temperature application efficiency. Asia-Pacific remains the production hub: supportive government programs in China, India and Vietnam converge with e-commerce-led small-lot orders to keep capacity additions brisk. At the same time, EU and US effluent rules are accelerating the shift toward closed-loop systems and bio-based shades, creating near-term opportunities for suppliers able to certify greener chemistries under future Digital Product Passport requirements.

Global Textile Dye Market Trends and Insights

Soaring Fast-Fashion Output in Emerging Economies

Fast-fashion brands have shortened collection cycles and pushed mills in China, India and Vietnam to integrate high-speed dyeing and finishing lines that meet quality expectations at volume; China alone seeks 70% digitalization of its textile businesses by 2025. Indian production-linked incentives and new integrated parks allocate INR 726 crore for combined weaving, printing and dyeing assets that trim raw-material imports and tighten response times to consumer trends. Vietnam, targeting USD 48 billion in textile exports by 2025, is scaling cost-effective polyester programs that favor dispersive chemistries capable of rapid color changeovers to serve global buyers.

Expansion of On-Demand Digital Textile Printing

Eliminating screens, plates and excess liquor, digital equipment supports vivid short-run designs and drops water use by as much as 95% compared with rotary workflows. The textile dyes market is therefore seeing incremental demand for high-purity, micro-encapsulated dispersive and reactive inks that jet reliably at industrial speeds. Automotive and aerospace makers have joined apparel brands in piloting digitally printed technical textiles that require exact color matches and minimal weight gain, a niche previously underserved by traditional batch dyeing.

Tightening Global Effluent Discharge Norms

The EU Ecodesign regulation prioritizes textiles in its 2025-2030 workplan, compelling mills to document chemical inputs, extend product life and recover fibers, with PFAS bans in France reinforcing the policy push. California's SB 707 similarly obliges US producers to finance end-of-life collection, adding cost pressure until closed-loop infrastructure matures.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Technical & Protective Textile Usage

- Retail Brand Sustainability Mandates Drive Bio-Based Dye Adoption

- Volatility in Petro-Derived Dye Intermediates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dispersive chemistries accounted for 31.34% of the textile dyes market in 2025 and are forecast to rise at 5.44% CAGR through 2031 on the back of polyester's continued popularity. Within the textile dyes market size for colorants applied to synthetics, their water-insoluble nature enables rapid diffusion at 120-130 °C, delivering bright shades and high wet-fastness. Suppliers now segment offerings into E-, SE-, S-, P- and RD-series to target leveling, sublimation or rapid batch objectives, while research into hydrazide-hydrazone azo structures promises even higher color strength at lower pH windows. Reactive systems retain critical roles in cotton, leveraging mono- and multi-anchor chemistry to achieve covalent fixation that passes home-laundry durability standards. Vat and sulfur options remain niche but indispensable where maximum light fastness is mandated, for example on workwear sold into extreme climates.

Second-generation dispersive grades also anchor the drive toward water-free routes such as super-critical CO2 dyeing and digitally jetted high-solids inks, both prioritizing low process-liquor ratios. Combined, these innovations support broader adoption across fashion, athleisure and technical textiles, reinforcing the leadership position of dispersive chemistry in the textile dyes market.

The Textile Dyes Market Report is Segmented by Dye Type (Reactive, Dispersive, Direct, Vat, Acidic, Basic, Other Dye Types), Fiber Type (Cotton, Polyester, Nylon, Wool, Acrylic, Viscose, Other Fiber Types), Application (Apparel, Household Textiles, Industrial Fabrics, Other Applications), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 49.10% of the global textile dyes market in 2025 and is on track to sustain the fastest 5.58% CAGR through 2031, powered by China's digital-factory push and India's USD 45 billion export ambition. Government-backed parks integrate dyeing, printing and finishing to shorten supply chains, while Vietnam's export targets intensify regional rivalry for large sportswear orders. Local access to purified terephthalic acid and mono-ethylene glycol supports dispersed-dye producers, ensuring raw-material continuity despite global shipping disruptions.

Europe's regulatory stance reshapes demand, steering buyers toward transparent, traceable and low-hazard colorant systems. The upcoming Digital Product Passport and a PFAS-free mandate by 2030 will force mills to audit auxiliaries, invest in ion-exchange effluent treatment and adopt dope-dyed solutions that minimize downstream releases. Luxury hubs in Italy and France leverage these changes to market premium sustainably dyed collections, while Scandinavian retailers pilot take-back programs that feed mechanically and chemically recycled fibers into circular dyeing loops.

North America is moving in parallel: California's SB 707 establishes the first US extended-producer system, catalyzing alliances such as the Selenis-Syre polyester recycling venture in North Carolina set for mid-2025 start-up. Concurrently, Archroma's USD 750,000 South Carolina expansion underlines the reshoring trend, ensuring regional access to specialty formulations as import reliance on certain azo intermediates diminishes. While the region sits behind Asia on volume, higher added-value segments and stricter compliance requirements translate to attractive margins for innovative suppliers.

- AkikDye

- Archroma

- Atul Ltd

- BASF

- Clariant

- Colourtex Industries Private Limited

- Huntsman International LLC

- Jiangsu World Chemical Co., Ltd

- KeyColour

- Kiri Industries Ltd

- Longsheng Group

- Mahickra Chemicals Limited

- NICCA CHEMICAL CO.,LTD.

- Sun Chemical

- TAIYO HOLDINGS CO., LTD.

- Vipul Organics Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring Fast-Fashion Output in Emerging Economies

- 4.2.2 Expansion of On-Demand Digital Textile Printing

- 4.2.3 Growth in Technical & Protective Textile Usage

- 4.2.4 Retail Brand Sustainability Mandates (Bio-Based Dyes)

- 4.2.5 E-commerce Led Rise in Small-Lot Apparel Orders

- 4.3 Market Restraints

- 4.3.1 Tightening Global Effluent Discharge Norms

- 4.3.2 Volatility in Petro-Derived Dye Intermediates

- 4.3.3 Competitive Threat from Naturally-Colored Cotton

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Dye Type

- 5.1.1 Reactive

- 5.1.2 Dispersive

- 5.1.3 Direct

- 5.1.4 Vat

- 5.1.5 Acidic

- 5.1.6 Basic

- 5.1.7 Other Dye Types

- 5.2 By Fiber Type

- 5.2.1 Cotton

- 5.2.2 Polyester

- 5.2.3 Nylon

- 5.2.4 Wool

- 5.2.5 Acrylic

- 5.2.6 Viscose

- 5.2.7 Other Fiber Types

- 5.3 By Application

- 5.3.1 Apparel

- 5.3.2 Household Textiles

- 5.3.3 Industrial Fabrics

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 AkikDye

- 6.4.2 Archroma

- 6.4.3 Atul Ltd

- 6.4.4 BASF

- 6.4.5 Clariant

- 6.4.6 Colourtex Industries Private Limited

- 6.4.7 Huntsman International LLC

- 6.4.8 Jiangsu World Chemical Co., Ltd

- 6.4.9 KeyColour

- 6.4.10 Kiri Industries Ltd

- 6.4.11 Longsheng Group

- 6.4.12 Mahickra Chemicals Limited

- 6.4.13 NICCA CHEMICAL CO.,LTD.

- 6.4.14 Sun Chemical

- 6.4.15 TAIYO HOLDINGS CO., LTD.

- 6.4.16 Vipul Organics Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment