PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934723

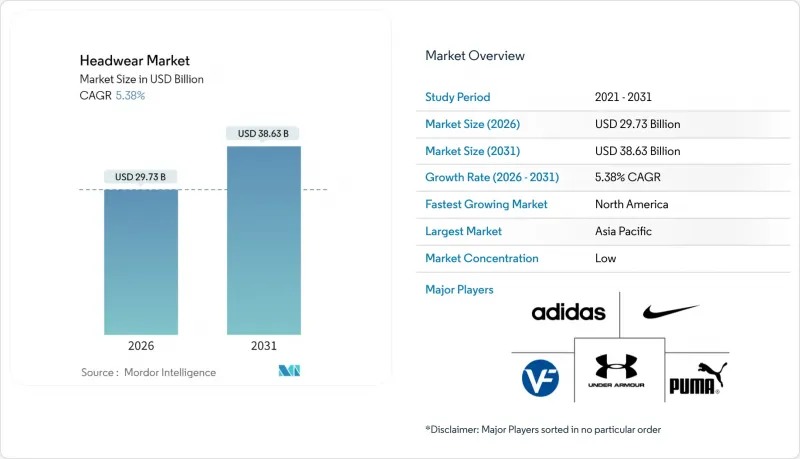

Headwear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The headwear market is expected to grow from USD 28.21 billion in 2025 to USD 29.73 billion in 2026 and is forecast to reach USD 38.63 billion by 2031 at 5.38% CAGR over 2026-2031.

The industry demonstrates resilience through evolving consumer preferences, technological advancements, and diverse applications across fashion, sports, and functional segments. The market growth is driven by lifestyle trends such as athleisure and outdoor activities, alongside the expansion of digital commerce that enhances market accessibility. The increasing demand for performance-oriented products and the growth of e-commerce and social media platforms facilitate improved consumer access and brand engagement. Material innovation, sustainable manufacturing practices, and smart technology integration contribute to market expansion. The market's global reach continues to grow through increased demand from both emerging and established regions, creating a diverse international marketplace.

Global Headwear Market Trends and Insights

Growing fashion trends and personal style expression

The proliferation of social media platforms has fundamentally transformed headwear from functional accessories into significant style statements, facilitating premium segment expansion and product category diversification. The emergence of streetwear culture and athleisure trends has elevated caps, beanies, and bucket hats to essential fashion components, with consumers increasingly utilizing headwear as a medium of personal expression. This transformation has enabled manufacturers to implement higher price points while expanding their consumer base beyond traditional sports and outdoor segments. Lifestyle brands that successfully integrate functionality with fashion aesthetics have experienced notable market advantages. E-commerce platforms have further catalyzed this evolution by providing consumers with comprehensive access to diverse styles and specialized brands, substantially altering traditional purchase patterns and brand discovery methods.

Rising popularity of sports and outdoor activities

The escalating participation in sports and outdoor activities generates consistent demand for performance-oriented headwear that delivers protection, moisture management, and comfort features. The expansion in athletic activities, specifically running, cycling, and outdoor recreation, propels this demand. According to the Japan Productivity Center (JPC), cycling established itself as the predominant outdoor sport in Japan with a 6.1% participation rate in 2024, followed by golfing at 5% . This heightened engagement in outdoor sports necessitates specialized headwear engineered for performance and protection, contributing to market expansion worldwide. Sports headwear integrates safety and style elements while incorporating lightweight, breathable, and moisture-wicking materials, thereby attracting athletes and outdoor enthusiasts. The global emphasis on fitness, health, and active lifestyles further facilitates headwear market growth as consumers seek functional and aesthetically appropriate athletic accessories.

Proliferation of counterfeit products

Brand protection confronts significant challenges as counterfeit headwear operations utilize global supply chains and e-commerce platforms. According to the United States Immigration and Customs Enforcement, authorities confiscated USD 39.5 million in counterfeit sports merchandise in 2025. The expansion of sophisticated counterfeiting operations diminishes profit margins, compromises brand equity, and generates consumer safety concerns due to inferior materials and construction. Digital marketplaces and social media platforms function as primary distribution channels for counterfeit products, necessitating increased corporate investment in monitoring and enforcement. Licensed sports merchandise and luxury fashion brands, which maintain premium price points, experience a substantial impact. Organizations implement anti-counterfeiting measures through blockchain authentication, forensic marking technologies, and systematic enforcement coordination with customs authorities and platform operators.

Other drivers and restraints analyzed in the detailed report include:

- Influence of social media and celebrity endorsements

- Smart and functional technology integration

- Raw-material price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Caps and hats hold a 59.10% market share in 2025, reflecting their broad application across fashion, sports, and functional uses. These accessories serve dual purposes as fashion statements and practical items for sun protection and comfort. The growth of athleisure and personal branding preferences continues to increase demand. The July 2024 multiyear partnership between the National Hockey League (NHL) and New Era Cap, LLC, demonstrates the segment's strength. This agreement enables New Era to produce and distribute headwear and apparel globally for the NHL and its 32 teams, strengthening the global market presence and increasing consumer demand.

Headbands represent the fastest-growing segment with a projected 6.88% CAGR through 2031, supported by fitness trends and performance-focused consumer needs. The integration of athleisure into daily fashion has expanded headband usage from sports to everyday wear. Consumer demand focuses on functional, stylish, and sustainable options, including customizable and environmentally conscious products. The introduction of smart headbands with fitness tracking capabilities appeals to both health-conscious and technology-oriented consumers, contributing to segment growth.

Cotton maintains a substantial market share of 41.20% in the headwear segment during 2025, attributed to consistent consumer preference for natural fibers and enhanced breathability characteristics. The material's inherent moisture-wicking capabilities, textile softness, and wearing comfort render it optimal for regular utilization, specifically in elevated temperature environments. Cotton's biodegradable properties and renewable nature correspond with increasing consumer requirements for sustainable merchandise. The material's versatility facilitates implementation across multiple headwear categories, encompassing caps, hats, beanies, and visors, fulfilling both aesthetic and utilitarian requirements.

Polyester exhibits notable market expansion with a compound annual growth rate of 6.65% in the headwear segment, driven by heightened demand for performance-oriented textiles and recycling initiatives. The material's structural durability, minimal weight characteristics, and moisture regulation capabilities establish its particular efficacy in athletic and performance wear applications. The incorporation of recycled polyester variants addresses environmental considerations, attracting sustainability-focused consumers and manufacturers committed to environmental impact reduction.

The Global Headwear Market Report is Segmented by Product Type (Caps and Hats, Beanies, Headbands, and Others), Material (Cotton, Wool, Polyester, Leather, Nylon, and Others), End-User (Adult, and Kids), Distribution Channel (Offline Retail Stores, and Online Retail Stores), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads global headwear demand with 35.00% market share in 2025, supported by established sports culture, premium brand presence, and consumer willingness to pay for quality products. The region benefits from mature retail infrastructure, licensing partnerships with professional sports leagues, and consumer preferences for branded merchandise. Major sporting events, seasonal variations, and outdoor recreation create consistent demand patterns that enhance inventory planning and supply chain efficiency. Canada and Mexico contribute to regional growth through expanding middle-class populations and increasing sports participation rates.

Asia-Pacific shows significant growth at 7.55% CAGR through 2031, driven by urbanization, rising disposable incomes, and Western fashion adoption. The region's growth reflects large youth populations, economic development, and cultural shifts toward Western lifestyles, particularly in urban areas of China, India, and Southeast Asia. Manufacturing capabilities provide cost advantages and supply chain efficiencies for domestic and export markets. Government support for sports participation and outdoor activities, along with increasing health consciousness, reinforces long-term demand growth.

Europe maintains consistent demand through fashion-conscious consumers and an established outdoor recreation culture, while South America and the Middle East, and Africa offer growth potential through expanding middle-class populations and increasing brand awareness. European sustainability regulations and environmental consciousness influence demand for eco-friendly materials and ethical production. Emerging markets require market-specific strategies and regional distributor partnerships, while companies must manage currency fluctuations and political uncertainty through diversified approaches and adaptable pricing strategies.

- Adidas AG

- Nike Inc.

- New Era Cap LLC

- Under Armour Inc.

- Puma SE

- VF Corporation

- Boardriders Inc.

- Columbia Sportswear Co.

- LIDS Sports Group

- Yupoong Inc. (Flexfit)

- Kangol Ltd.

- Callaway Golf Co.

- Superdry PLC

- Patagonia Inc.

- New Balance Athletics Inc.

- The Gap Inc.

- Deckers Outdoor Corp. (HOKA)

- Fanatics Inc.

- Mizuno Corp.

- JD Sports Fashion Plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing fashion trends and personal style expression

- 4.2.2 Rising popularity of sports and outdoor activities

- 4.2.3 Influence of social media and celebrity endorsements

- 4.2.4 Smart and functional technology integration

- 4.2.5 Sustainability and ethical production

- 4.2.6 Seasonal and climatic demand variations

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit products

- 4.3.2 Raw-material price volatility

- 4.3.3 Limited awareness of premium features

- 4.3.4 Regulatory restrictions on materials

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Caps and Hats

- 5.1.2 Beanies

- 5.1.3 Headbands

- 5.1.4 Others

- 5.2 By Material

- 5.2.1 Cotton

- 5.2.2 Wool

- 5.2.3 Polyester

- 5.2.4 Leather

- 5.2.5 Nylon

- 5.2.6 Others

- 5.3 By End-User

- 5.3.1 Adult

- 5.3.2 Kids

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adidas AG

- 6.4.2 Nike Inc.

- 6.4.3 New Era Cap LLC

- 6.4.4 Under Armour Inc.

- 6.4.5 Puma SE

- 6.4.6 VF Corporation

- 6.4.7 Boardriders Inc.

- 6.4.8 Columbia Sportswear Co.

- 6.4.9 LIDS Sports Group

- 6.4.10 Yupoong Inc. (Flexfit)

- 6.4.11 Kangol Ltd.

- 6.4.12 Callaway Golf Co.

- 6.4.13 Superdry PLC

- 6.4.14 Patagonia Inc.

- 6.4.15 New Balance Athletics Inc.

- 6.4.16 The Gap Inc.

- 6.4.17 Deckers Outdoor Corp. (HOKA)

- 6.4.18 Fanatics Inc.

- 6.4.19 Mizuno Corp.

- 6.4.20 JD Sports Fashion Plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK