PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934735

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934735

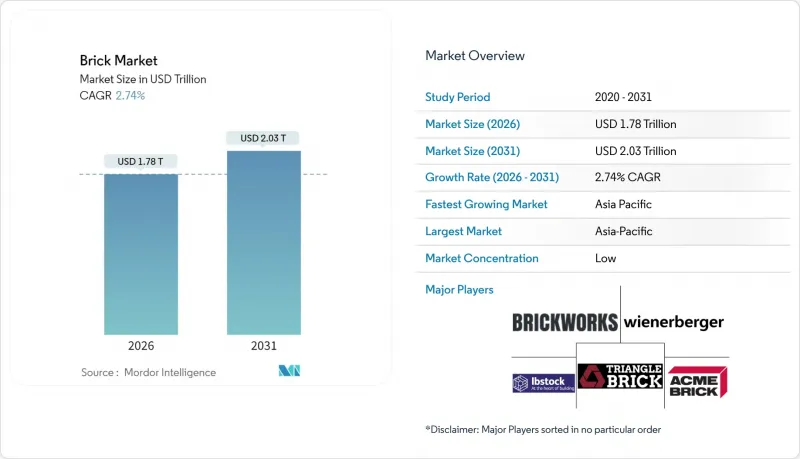

Brick - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Brick Market size in 2026 is estimated at USD 1.78 trillion, growing from 2025 value of USD 1.73 trillion with 2031 projections showing USD 2.03 trillion, growing at 2.74% CAGR over 2026-2031.

Asia-Pacific remains the anchor, supplying both the largest sales volumes and the strongest growth momentum as urban populations rise and infrastructure programs scale up. Product innovation focuses on low-carbon fly-ash and calcium-silicate variants in response to tightening climate rules, while direct project-based procurement accelerates as contractors seek fewer intermediaries. Demand from non-residential construction-especially warehouses, data centers, and transport hubs-outpaces residential activity, reflecting the expanding digital economy and public-works spending. Meanwhile, European producers face cost pressures from the Carbon Border Adjustment Mechanism, prompting early movers to invest in decarbonized kilns and alternative fuels.

Global Brick Market Trends and Insights

Post-COVID Re-urbanisation Boost

Rapid migration back to major Asian cities is refilling pipelines for mid-rise housing projects, sustaining steady brick market demand. UN ESCAP projects the region's urban population will touch 3.2 billion by 2030, spawning 22 megacities. Mid-rise formats rely on masonry for cost-effective load-bearing walls and local labor familiarity. Governments are increasing social-housing budgets to narrow deficits-India alone recorded an 18.7-million-unit gap in 2024, while Indonesia tallied 12.5 million units, each amplifying baseline need for bricks. Vendors position supply hubs close to Tier-1 growth corridors to minimize freight costs. Equipment upgrades that raise kiln capacity without higher fuel burn ensure contractors receive on-time deliveries during cyclical building surges.

'Green' Building Codes

Europe's 90% emissions-cut target for 2040 is reshaping the brick market, accelerating the adoption of fly-ash and calcium-silicate bricks with smaller carbon footprints. Calcium-silicate units consume 241 kWh/t of primary energy versus higher values for traditional clay, appealing to designers seeking certification under the UK Net Zero Carbon Buildings Standard. Concrete bricks that bypass firing processes can save 2.4 tonnes of CO2 per house and become net absorbers over their lifecycle. Public-sector projects now embed minimum recycled-material thresholds, pushing plants to integrate glass cullet and combusted solid waste into mixes. Manufacturers that verify cradle-to-site life-cycle data lock in specification advantage for renovation and public procurement tenders.

Prefabricated Construction Components

As labor shortages intensify, builders in North America and Europe pivot toward volumetric modules that sideline brick facades. Prefab solutions remove 30-50% of on-site time and lower labor costs by 50-80%. With the United States needing another 501,000 skilled workers in 2025, contractors view standard panels as risk hedges. Thin-brick slips and mechanically fixed veneers let masonry suppliers stay relevant, yet overall unit demand dips where full-bed bricks are displaced. Manufacturers invest in robotic laying lines to service hybrid wall panels but must amortize capital across a shrinking traditional volume base, squeezing margins.

Other drivers and restraints analyzed in the detailed report include:

- Modular Construction

- Government-Subsidised Housing

- Carbon-Tax Exposure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Clay bricks dominated the brick market with 64.35% of revenue in 2025, yet fly-ash bricks record a 3.12% CAGR through 2031, widening their presence in regions tightening carbon rules. This shift is anchored in industrial-waste utilization, enabling plants to cut firing temperatures by 20% and align with circular-economy mandates. The brick market size for fly-ash variants is forecast to expand faster than any other type, helped by public procurement criteria that reward recycled content. Calcium-silicate units attract architects pursuing thermal-mass advantages in Europe's cool climates, while concrete blocks that skip kiln firing appeal where electricity is available and fuel security is uncertain.

Technological advances include char-based thin bricks exhibiting 4-7% water absorption, outperforming commercial peers and costing USD 25.83 per sq m, less than half the prevailing price for traditional options. Makers also promote hollow configurations that cut embodied CO2 and lighten logistics loads. Collectively, these innovations reinforce the brick market goal of decarbonization without sacrificing structural reliability. Only a handful of early adopters own patents, hinting at near-term licensing revenue streams that could reshape profit pools within the brick industry.

Building applications accounted for 59.10% of brick market share in 2025, reflecting masonry's historic role in structural walls and facades. Code updates promoting airtight envelopes and fire resistance sustain this core demand. The brick market size for path and paving solutions, however, is expanding at a 3.02% CAGR as households invest in outdoor upgrades and municipalities retrofit sidewalks to endure heavier pedestrian flows.

Manufacturers in the brick industry exploit colorfast clays and high-friction textures to serve landscaping customers seeking design variety with low maintenance. Bricks configured with interlocking edges accelerate installation, lowering contractor costs and aligning with quick-turn renovation schedules. Parterre and decorative garden formats resurface in premium estates where aesthetic differentiation commands higher margins. Industrial customers favor acid-resistant bricks for furnace linings and chemical-processing pits, reinforcing a diverse end-use spread that shelters producers from single-sector downturns.

The Brick Market Report is Segmented by Brick Type (Clay, Sand Lime, Fly-Ash Clay, and More), Application (Buildings, Path, Parterre, and More), End-Use Industry (Residential Buildings and Non-Residential Buildings), Distribution Channel (Direct and Dealer and Retail Network), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 47.30% of 2025 global sales and is projected to grow 3.30% annually to 2031, buoyed by record urban migration and transport megaprojects. China and India spearhead masonry consumption as public-sector housing pushes converge with subway, airport, and industrial-park builds. Producers deploy tunnel kilns with waste-heat recovery to meet provincial emission caps and reduce coal dependence, safeguarding supply resiliency during demand spikes.

North America is experiencing growth in market value, driven by pending interest-rate cuts that are unlocking stalled projects. The AIA Consensus Construction Forecast sees non-residential spending rising 2.2% in 2025 and 2.6% in 2026 after a strong 2023-2024 run. Fly-ash bricks gain traction among designers chasing LEED points, while thin-brick panels speed up urban multifamily builds. Canada's colder climate sustains demand for high-thermal-mass clay units in residential retrofits to cut heating loads.

Europe trails in growth but leads innovation as the CBAM exposes carbon-intensive imports and rewards local low-carbon pioneers. The continent imported over 500 million bricks in 2022, generating 288,190 tonnes of CO2, prompting calls for onshoring greener capacity. Scandinavia's public-procurement policies stipulate embodied-carbon ceilings, channeling orders toward calcium-silicate or unfired concrete bricks. Eastern Europe builds capacity to serve domestic and German markets facing material tightness.

South America's brick market pivots on warehouse and logistics developments catalyzed by e-commerce. Brazil accelerates industrial parks along new highways, increasing demand for large-format blocks that reduce lay-rate time. Material suppliers invest in local plants to sidestep currency volatility and import duties. Middle East and Africa, although smaller today, hold the loftiest upside as 70% of buildings required by 2040 are yet to be built. Kenya, Nigeria and Egypt roll out public-private partnerships to deliver affordable homes, embedding brick procurement targets into tender documents to stimulate domestic manufacturing.

- Acme Brick Company

- BigBloc Construction Ltd.

- Bowerston Shale

- Brampton Brick

- Brickworks

- Brickworks

- Cemex SAB de CV

- Columbia Brick Inc.

- Forterra Building Products Ltd

- General Shale Inc.

- Glen-Gery Corporation

- HEBRON BRICK

- Ibstock Plc.

- LEE Building Products

- Lignacite Ltd

- Oldcastle APG

- Palmetto Brick Company

- Supreme Concrete

- Triangle Brick Co.

- Wienerberger AG

- Xella International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-COVID Re-urbanisation Boosting Mid-Rise Housing Demand in Asia

- 4.2.2 Green' Building Codes Driving Fly-Ash and Calcium-Silicate Brick Uptake in Europe

- 4.2.3 Modular Construction Increases Demand for High-Strength Hollow Bricks

- 4.2.4 Government-Subsidised Low-Cost Housing in Sub-Saharan Africa

- 4.2.5 Expansion of E-Commerce Warehousing in South America

- 4.3 Market Restraints

- 4.3.1 Increasing Trends of Prefabricated Construction Components

- 4.3.2 Volatility in Clay Feedstock Prices in Asia

- 4.3.3 Carbon-Tax Exposure for Energy-Intensive Kilns in Europe

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Brick Type

- 5.1.1 Clay

- 5.1.2 Sand Lime

- 5.1.3 Fly-Ash Clay

- 5.1.4 Other Brick Types

- 5.2 By Application

- 5.2.1 Building

- 5.2.2 Path

- 5.2.3 Parterre

- 5.2.4 Other Applications

- 5.3 By End-Use Industry

- 5.3.1 Residential Buildings

- 5.3.2 Non-Residential Buildings

- 5.4 By Distribution Channel

- 5.4.1 Direct (Project-Based)

- 5.4.2 Dealer and Retail Network

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acme Brick Company

- 6.4.2 BigBloc Construction Ltd.

- 6.4.3 Bowerston Shale

- 6.4.4 Brampton Brick

- 6.4.5 Brickworks

- 6.4.6 Brickworks

- 6.4.7 Cemex SAB de CV

- 6.4.8 Columbia Brick Inc.

- 6.4.9 Forterra Building Products Ltd

- 6.4.10 General Shale Inc.

- 6.4.11 Glen-Gery Corporation

- 6.4.12 HEBRON BRICK

- 6.4.13 Ibstock Plc.

- 6.4.14 LEE Building Products

- 6.4.15 Lignacite Ltd

- 6.4.16 Oldcastle APG

- 6.4.17 Palmetto Brick Company

- 6.4.18 Supreme Concrete

- 6.4.19 Triangle Brick Co.

- 6.4.20 Wienerberger AG

- 6.4.21 Xella International

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Carbon-Neutral Kiln Technologies