PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934739

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934739

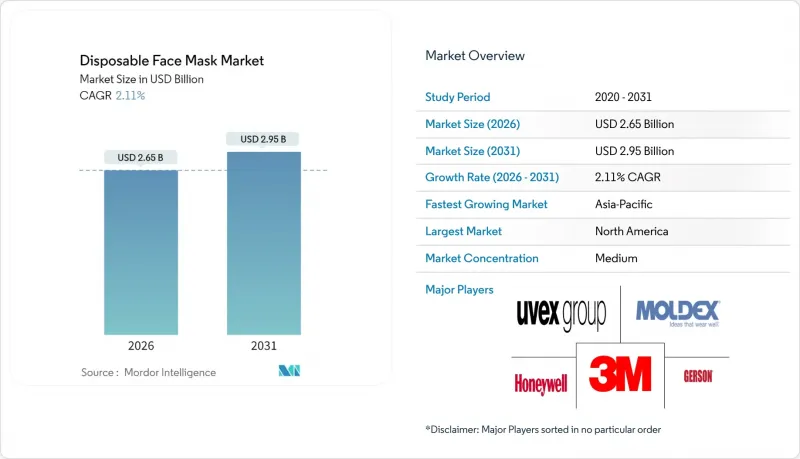

Disposable Face Mask - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The disposable face mask market is expected to grow from USD 2.60 billion in 2025 to USD 2.65 billion in 2026 and is forecast to reach USD 2.95 billion by 2031 at 2.11% CAGR over 2026-2031.

This outlook positions the disposable face mask market as a maturing field where innovation in filtration performance, antimicrobial coatings, and sustainable materials now matter more than pandemic-driven spikes in demand. Industrial buyers continue to underpin volume, but consumer acceptance of higher-specification masks and environmentally friendly variants is rising. Pricing discipline has improved as major raw-material costs stabilize, while channel diversification mitigates regional demand swings. Consolidation among large PPE suppliers creates opportunities for niche players focusing on premium and eco-conscious offerings.

Global Disposable Face Mask Market Trends and Insights

Rising Pollution Levels in Major Urban Clusters

Air-quality deterioration means that 99% of the world's population breathes air exceeding WHO guidelines, prompting consumers in Asian megacities to adopt high-filtration masks year-round . FFP3 dust masks offering 99% filtration for 0.3-micron particles gained popularity in 2025, especially among construction trades. Procurement managers in heavily industrialized regions now specify premium masks, linking real-time pollution indices to protective-equipment inventories. Workplace demand combines with retail uptake, giving the disposable face mask market a non-pandemic growth lever tied to environmental health. Manufacturers capitalizing on this link between pollution spikes and sales enjoy higher average selling prices.

Mandates For Workplace PPE Compliance

OSHA's revised construction-sector rule effective 13 January 2025 codifies fit-testing and documentation requirements, removing ambiguity that once allowed sub-standard protection . Vision AI systems that flag non-compliance in real time strengthen enforcement, making certified disposable masks a baseline cost of doing business. This regulatory tightening affects manufacturing, healthcare, and services, shielding demand from economic cycles. Large industrial buyers negotiate multi-year contracts, ensuring stable throughput for certified suppliers in the disposable face mask market. Smaller firms confront heavier penalties, accelerating the shift toward compliant products.

Volatility In Polypropylene Feedstock Prices

Spot-price spikes of USD 0.11 per pound between January and April 2025 squeeze margins, particularly for small and mid-tier converters. North American resin hikes outpaced Asian markets, complicating global sourcing strategies. Some supply-chain leaders report logistics costs hitting 20% of revenue, eroding competitiveness. Forward-buying and hedging offer limited relief given geopolitical uncertainties. As resin remains the primary input for most disposable masks, cost pass-throughs risk volume losses in price-sensitive segments of the disposable face mask market.

Other drivers and restraints analyzed in the detailed report include:

- Pandemic-Preparedness Stockpiling by Governments

- Antimicrobial Coating Innovations Accelerating Premiumisation

- Shift Toward Reusable Respirators For Sustainability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated the largest singular slice of the disposable face mask market size in 2025, with surgical masks holding 38.74% share alongside broad adoption in hospitals and clinics. Protective masks, however, post the briskest 2.51% CAGR through 2031 as industrial employers upgrade filtration requirements to FFP3 and ASTM Level 3 thresholds. Cross-pollination of technology is evident: antimicrobial coatings, once the domain of high-end protective gear, now appear on surgical offerings, narrowing functional distinctions. Non-woven variants remain cost-efficient for scale production, while novel biodegradable lines seed future growth as ESG metrics influence tenders. The FDA's warning to Baylab USA for unapproved product changes underscores how safety re-classification can restrict market access, reinforcing the importance of unambiguous test data.

Persistent innovation keeps margins defensible despite commoditization risks. Fully automated assembly lines now switch among product types with minor tooling shifts, enabling suppliers to chase demand spikes without capacity penalties. At the same time, the disposable face mask market share attached to specialty dust masks grows within construction verticals responding to dual drivers of air-quality regulation and worker-health litigation. Suppliers that blend function, comfort, and sustainability command premium price bands and customer loyalty.

The Disposable Face Mask Market Report is Segmented by Product Type (Non-Woven, Protective, Surgical, Dust, Others), Application (Industrial Use, Personal Use), Distribution Channel (Offline, Online), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 36.80% of the disposable face mask market in 2025 due to stringent occupational-safety policies and the financial resources to maintain sizeable stockpiles. The Make PPE in America Act shifts procurement toward domestically produced units, sheltering local manufacturers from import volatility. Growth is modest but reliable, pivoting on regulatory upgrades and hospital practice changes that favor antimicrobial and biodegradable variants. Suppliers located in the United States also benefit from federal grants tied to capacity and workforce development.

Asia-Pacific is the momentum engine, expanding at a 2.57% CAGR through 2031 on the back of manufacturing growth, dense urban pollution, and tightening safety standards. China's retail market for masks exceeds CNY 600 billion, with habitual weekly use supporting baseline demand. India's rising surgical volumes and infection-prevention mandates add hospital demand, although market-research-derived forecasts have been excluded to maintain source integrity. Regional producers leverage cost advantages and are increasingly investing in proprietary brands to capture domestic value before exporting excess capacity.

Europe shows balanced development shaped by CE-marking requirements and sustainability legislation. Certification stringency opens doors for high-quality suppliers yet raises entry costs for new players. The European Commission's circular-economy roadmap encourages biodegradable masks, spurring material-science collaborations. Ongoing economic recovery and renewed public-health awareness keep baseline volumes stable, while institutional buyers assess total-lifecycle costs to align with ESG task-force recommendations.

- Solventum

- Honeywell International

- Kimberly-Clark Worldwide

- Cardinal Health

- Moldex-Metric

- Uvex Group

- Ansell

- DuPont

- Kowa

- The Gerson Company

- SAS Safety

- Prestige Ameritech

- Alpha Pro Tech

- Cambridge Mask

- Owens & Minor Inc.

- Medicom Group

- Shanghai Dasheng Health Products Manufacture Co.

- Winner Medical Co., Ltd.

- Lakeland Industries

- Louis M. Gerson Co.

- BYD Company Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Pollution Levels in Major Urban Clusters

- 4.2.2 Mandates For Workplace PPE Compliance

- 4.2.3 Pandemic-Preparedness Stockpiling by Governments

- 4.2.4 Antimicrobial Coating Innovations Accelerating Premiumisation

- 4.2.5 D2C Micro-Brands Growing Via E-Commerce

- 4.2.6 ESG-Driven Demand for Biodegradable Mask Options

- 4.3 Market Restraints

- 4.3.1 Volatility In Polypropylene Feedstock Prices

- 4.3.2 Shift Toward Reusable Respirators for Sustainability

- 4.3.3 Phase-Out Of Temporary PPE Subsidies

- 4.3.4 Counterfeit Certification Undermining Consumer Trust

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product type

- 5.1.1 Non-woven

- 5.1.2 Protective

- 5.1.3 Surgical

- 5.1.4 Dust

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Industrial Use

- 5.2.2 Personal Use

- 5.3 By Distribution Channel

- 5.3.1 Offline

- 5.3.2 Online

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Honeywell International Inc.

- 6.3.3 Kimberly-Clark Corporation

- 6.3.4 Cardinal Health Inc.

- 6.3.5 Moldex-Metric Inc.

- 6.3.6 Uvex Group

- 6.3.7 Ansell Limited

- 6.3.8 DuPont de Nemours Inc.

- 6.3.9 Kowa Company Ltd.

- 6.3.10 The Gerson Company

- 6.3.11 SAS Safety Corp.

- 6.3.12 Prestige Ameritech

- 6.3.13 Alpha ProTech

- 6.3.14 Cambridge Mask Co.

- 6.3.15 Owens & Minor Inc.

- 6.3.16 Medicom Group

- 6.3.17 Shanghai Dasheng Health Products Manufacture Co.

- 6.3.18 Winner Medical Co., Ltd.

- 6.3.19 Lakeland Industries

- 6.3.20 Louis M. Gerson Co.

- 6.3.21 BYD Company Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment