PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934740

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934740

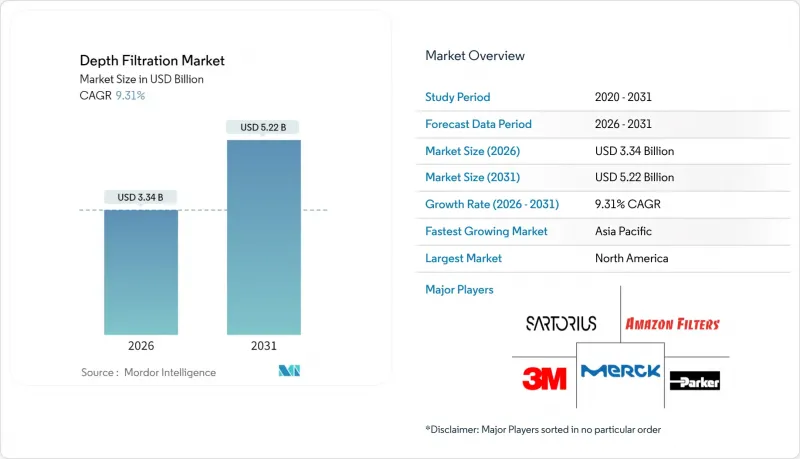

Depth Filtration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The depth filtration market is expected to grow from USD 3.06 billion in 2025 to USD 3.34 billion in 2026 and is forecast to reach USD 5.22 billion by 2031 at 9.31% CAGR over 2026-2031.

Strong demand from biopharmaceutical manufacturers that must meet updated viral-safety rules, alongside cost-effective single-use technologies, underpins the expansion. Cartridge and capsule innovations keep replacement rates high, while pharma, food, beverage, and water processors view depth filters as an indispensable first barrier against particulate and microbial contaminants. Consolidation among equipment vendors, the push for PFAS-free media, and Asia-Pacific's rapid capacity additions enhance opportunities but also intensify competitive pressure. Raw-material supply constraints for diatomaceous earth and tighter waste-disposal regulations temper growth yet open white-space for sustainable cellulose alternatives.

Global Depth Filtration Market Trends and Insights

Rising Demand for Biopharmaceuticals

Capacity expansion in biologics drives sustained uptake of depth filters that must clarify larger batch volumes at higher cell densities. Fujifilm's USD 1.2 billion North Carolina expansion adding 160,000 L of reactors underscores how larger stainless and single-use trains elevate clarification throughput needs. Antibody segment growth at 8% annually through 2030 forces contract manufacturers such as AGC Biologics to double single-use bioreactor capacity, directly multiplying filter-change frequencies. Elevated output targets demand depth filters that combine high flux with low product loss, placing premium pricing power in suppliers' hands. The trend remains long-lived as biosimilar launches intensify cost-of-goods pressure yet rarely compromise on purity specifications.

Shift Toward Single-Use Depth-Filter Systems

Disposable capsules and stacked-disc modules minimize cleaning validation, reduce cross-contamination risk, and shorten changeover times. Cytiva and Pall committed USD 300 million to scale single-use capacity across 13 global sites, reaffirming confidence in the technology's future. Asahi Kasei's Planova SU-VFC unit integrates automated pressure control that fits cGMP suites and cuts operator intervention. Food and beverage processors have followed suit to meet allergen-control mandates without raising water and chemical consumption. Continued regulatory endorsement of disposable trains bolsters adoption, even as recyclability concerns linger.

Membrane & TFF Alternatives Eroding Share

Tangential-flow systems offer concentration and diafiltration in a single continuous unit, reducing hold-up volumes and operator touches. Repligen's automated cassettes with in-line UV monitoring sharpen process control and scalability, allowing users to bypass depth-filter bottlenecks. Falling membrane costs and precise molecular-weight cutoffs tilt the economics in favor of TFF for certain high-value therapeutics. Continuous-manufacturing paradigms accelerate adoption, particularly in green-field plants that can avoid legacy batch equipment. Depth-filter vendors must therefore innovate or risk share attrition.

Other drivers and restraints analyzed in the detailed report include:

- Stringent GMP Purity & Viral-Safety Rules

- Cost-Effective Clarification for High-Density Perfusion Cultures

- Environmental Compliance for Spent Media Disposal

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cartridge filters retained the largest slice of the depth filtration market in 2025, standing at 37.79% revenue share, reflecting entrenched usage across legacy stainless-steel lines and municipal-water facilities. The depth filtration market size for cartridge solutions continues to grow at a steady pace as end users value their predictable change-out intervals and broad chemical compatibility. Yet, capsule formats post a 9.66% CAGR through 2031, fueled by single-use drug-substance manufacturing that benefits from closed-system changeovers without CIP validation. Advanced capsule designs integrate pre-filters and vent ports, compressing skid footprints inside constrained clean-rooms. Genetic Engineering & Biotechnology News reports widening adoption across cell-gene therapy suites, hinting at an inflection favoring disposability.

Product innovation further blurs category lines, with hybrid stack-disc modules housing both depth and membrane layers to extend capacity while protecting downstream viral filters. Suppliers such as Sartorius unveiled PFAS-free high-throughput variants in 2025, positioning to comply with upcoming European legislation while providing equivalent flow performance. Filter sheets and modules maintain relevance in wine, beer, and plasma applications where decades of operating know-how and low capital needs outweigh changeover labor. Overall, product evolution suggests convergence toward multipurpose cartridges and capsules that deliver scalable performance without compromising sustainability targets, keeping the depth filtration market competitive and innovation-rich.

Diatomaceous earth dominated with 39.78% share in 2025 owing to its high dirt-holding capacity and favorable cost profile. The depth filtration market size tied to diatomite media faces headwinds after International Paper shuttered its Georgetown mill, removing 5% of U.S. fluff pulp output and raising input-cost volatility. Cellulose media, in contrast, is projected to grow at 9.93% CAGR as regulators and buyers prioritize compostable, PFAS-free options. Novel silk-cellulose hybrids under development at MIT signal a pipeline of bio-based materials that could further erode reliance on mined minerals.

Activated-carbon composites serve taste, odor, and color removal roles in beverages, while perlite remains the media of choice in high-temperature chemical processes. Vendors are blending adsorptive powders into cellulose mats to create multi-functional depth layers that capture trace organics without separate filtration passes. As media innovation tracks both performance and environmental metrics, cellulose's renewable nature and broad supply base position it for incremental share gains, but diatomaceous earth's entrenched cost advantage and mechanical strength signal coexistence over the forecast horizon.

The Depth Filtration Market Report is Segmented by Product Type (Cartridge Filters, Capsule Filters, and More), Media Type (Diatomaceous Earth, Activated Carbon, and More), Application (Final Product Processing, Small-Molecule Processing, and More), End User (Pharmaceutical & Biotechnology Cos., and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 41.92% of global revenue in 2025, underpinned by mature biologics clusters in Boston, San Francisco, and Research Triangle Park that consistently invest in filter upgrades to comply with FDA guidance on viral reduction. Domestic suppliers strengthen regional supply chains, as highlighted by Purolite's new Pennsylvania resin plant and Pall's Singapore expansion that still funnels product back to U.S. customers. The United States benefits from robust funding for gene-therapy producers, whose adherence to cGMP pushes demand for high-end depth cartridges with validated log-reduction performance.

Asia-Pacific remains the fastest-growing region through 2031 at 10.78% CAGR. China's clinical-trial surge and generous provincial incentives spur new downstream suites requiring single-use clarification lines. India's industrial filtration demand grows on tightening environmental norms and the drive to improve export readiness in pharmaceuticals and specialty chemicals. Regional governments fund water-treatment megaprojects that specify depth filters for turbidity, color, and PFAS removal, further expanding the addressable base.

Europe retains a significant slice due to long-established vaccine and plasma manufacturing. Yet high energy costs and Brexit-related logistics add complexity to just-in-time filter deliveries, incentivizing local buffer stocks. South America and Middle East Africa remain nascent but opportunistic; public health investments and desalination projects create pockets of demand although currency volatility and political risk slow private-sector uptake. Globally, the depth filtration market benefits from universal focus on water quality, heightened biologics activity, and regulatory convergence that recognizes validated depth-filtration steps as foundational to contamination control.

- 3M

- Danaher Corp. (Pall)

- Merck KGaA (MilliporeSigma)

- Sartorius

- Eaton Corporation plc

- Parker Hannifin

- Donaldson Company Inc.

- Alfa Laval AB

- MANN+HUMMEL GmbH

- Porvair

- ErtelAlsop (Micronics)

- Meissner Filtration Products

- Amazon Filters Ltd.

- Pentair PLC

- Freudenberg Filtration Tech.

- Cummins Filtration

- Graver Technologies LLC

- Koch Separation Solutions

- Cobetter Biotech Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for biopharmaceuticals

- 4.2.2 Shift toward single-use depth-filter systems

- 4.2.3 Stringent GMP purity & viral-safety rules

- 4.2.4 Cost-effective clarification for high-density perfusion cultures

- 4.2.5 Depth filters for viral-vector & gene-therapy clarification

- 4.3 Market Restraints

- 4.3.1 Membrane & TFF alternatives eroding share

- 4.3.2 Environmental compliance for spent media disposal

- 4.3.3 Supply tightness of specialty cellulose & DE

- 4.3.4 Scale-up limits with novel chemistries for viscous feeds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value, USD)

- 5.1.1 Cartridge Filters

- 5.1.2 Capsule Filters

- 5.1.3 Filter Modules

- 5.1.4 Filter Sheets

- 5.2 By Media Type (Value, USD)

- 5.2.1 Diatomaceous Earth

- 5.2.2 Activated Carbon

- 5.2.3 Cellulose

- 5.2.4 Perlite

- 5.3 By Application (Value, USD)

- 5.3.1 Final Product Processing

- 5.3.2 Small-Molecule Processing

- 5.3.3 Biologics Processing

- 5.3.4 Cell Clarification

- 5.3.5 Raw-Material Filtration

- 5.3.6 Media & Buffer Filtration

- 5.3.7 Bioburden Testing

- 5.4 By End User (Value, USD)

- 5.4.1 Pharmaceutical & Biotechnology Cos.

- 5.4.2 Food & Beverage Manufacturers

- 5.4.3 Water & Waste-water Facilities

- 5.4.4 Research & Academic Labs

- 5.4.5 Others

- 5.5 By Geography (Value, USD)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Danaher Corp. (Pall)

- 6.3.3 Merck KGaA (MilliporeSigma)

- 6.3.4 Sartorius AG (Sartorius Stedim Biotech)

- 6.3.5 Eaton Corporation plc

- 6.3.6 Parker-Hannifin Corporation

- 6.3.7 Donaldson Company Inc.

- 6.3.8 Alfa Laval AB

- 6.3.9 MANN+HUMMEL GmbH

- 6.3.10 Porvair PLC

- 6.3.11 ErtelAlsop (Micronics)

- 6.3.12 Meissner Filtration Products Inc.

- 6.3.13 Amazon Filters Ltd.

- 6.3.14 Pentair PLC

- 6.3.15 Freudenberg Filtration Tech.

- 6.3.16 Cummins Filtration

- 6.3.17 Graver Technologies LLC

- 6.3.18 Koch Separation Solutions

- 6.3.19 Cobetter Biotech Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment