PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934742

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934742

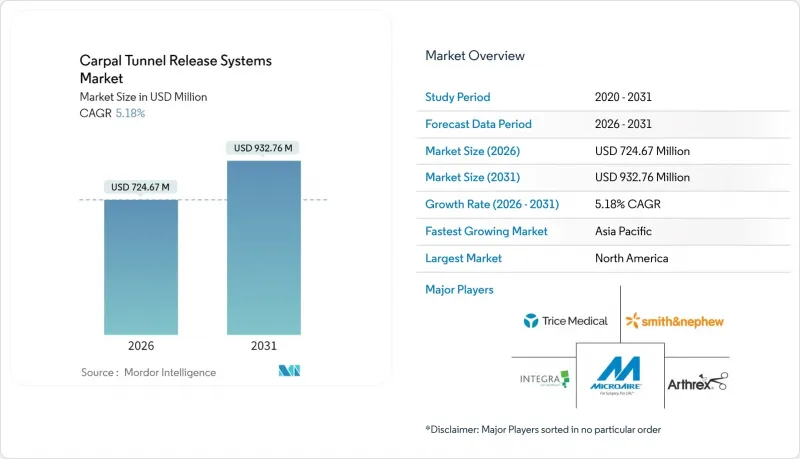

Carpal Tunnel Release Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

carpal tunnel release systems market size in 2026 is estimated at USD 724.67 million, growing from 2025 value of USD 688.98 million with 2031 projections showing USD 932.76 million, growing at 5.18% CAGR over 2026-2031.

Rising median-nerve decompression demand from an aging workforce, growing surgeon preference for minimally invasive techniques, and payer support for ultrasound-guided approaches are the prime growth levers. Endoscopic solutions drive adoption because they shorten recovery times, while office-based wide-awake surgery models cut facility fees and anesthesia costs by an estimated USD 750 million each year in the United States alone. Technological innovations-including AI-enabled nerve mapping, disposable optics, and single-use instrumentation-further strengthen the value proposition for outpatient settings. Regionally, North America leads due to robust reimbursement and specialist density, yet Asia-Pacific is set to outpace all other regions as healthcare access broadens and awareness of minimally invasive options rises.

Global Carpal Tunnel Release Systems Market Trends and Insights

Aging Workforce Driving CTS Incidence

Workers aged 45-60 experience the highest rates of carpal tunnel syndrome, a demographic fact closely tied to postponed retirement ages and longer exposure to repetitive tasks. Tissue aging reduces tendon elasticity and increases median-nerve compression vulnerability, making ergonomic programs insufficient for many patients. As 3.8% of the global population is affected, the persistent patient pipeline underpins robust procedure volumes and, by extension, sustained demand for the carpal tunnel release systems market. Developed economies remain epicenters because of their older labor forces, but industrializing Asian nations are quickly converging. Employers' awareness of productivity losses fosters corporate adoption of early-intervention pathways, ensuring that surgical demand continues even with preventive measures in place.

Shift to Outpatient & Office-Based CTR Procedures

Endoscopic releases enable same-day discharge, with patients resuming light activities in a matter of days versus weeks for open surgery. Wide-awake local-anesthetic protocols further compress total procedure time, allowing more cases per surgical day and reducing costs for payers. This configuration unlocks revenue opportunities for ambulatory surgery centers and office suites that can market convenience alongside equivalent clinical outcomes. Such settings reinforce adoption of disposable kits that eliminate re-processing, thereby strengthening infection-control compliance while streamlining logistics.

Post-Operative Pillar Pain & Litigation Risk

Pillar pain occurs in 7-48% of release procedures and may linger up to a year, fueling dissatisfaction and malpractice exposure, especially in litigious regions. While endoscopic routes demonstrate somewhat lower incidence, they do not eliminate the syndrome. Preoperative sensory-profile assessments can stratify risk, yet add time and cost. Surgeons may hesitate to adopt new devices if perceived incremental benefits fail to outweigh legal hazards, temporarily dampening uptake.

Other drivers and restraints analyzed in the detailed report include:

- Reimbursement Expansion for Ultrasound-Guided CTR

- Surge in Ergonomic-Injury Prevention Programs

- Shortage of Hand Surgeons in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endoscopic solutions captured 55.64% of carpal tunnel release systems market share in 2025, underlining sustained surgeon preference for minimally invasive visualization with sub-15-mm incisions. The carpal tunnel release systems market size for endoscopic devices is set to compound thanks to disposable kit launches that remove sterilization overhead. Single-portal variants offer reduced learning curves, while two-portal systems deliver broader visual fields for complex ligament anatomy. Ultrasound-guided platforms, although representing a smaller absolute base, are logging the fastest 5.63% CAGR because they enable true office-suite procedures without general anesthesia. AI-assisted imaging overlays streamline ligament-division path planning, narrowing skill-gap barriers for early adopters. Open systems linger for revision cases complicated by adhesions, and mini-invasive knife-light kits provide hybrid cost-saving alternatives that merge tactile feedback with LED illumination.

In parallel, price competitiveness intensifies as manufacturers introduce tiered configurations ranging from reusable scopes for high-volume centers to single-use blades packaged for remote ambulatory sites. The United States, benefitting from insurers' facility-fee incentives, is the principal revenue generator, yet growth hotspots are shifting to high-population countries such as India and China, where industrial job expansion accelerates CTS incidence. Product differentiation now emphasizes software upgrades as much as hardware refinements, underscoring an ecosystem view that links diagnostics, surgical guidance, and postoperative analytics into an integrated workflow.

The Carpal Tunnel Release Systems Report is Segmented by Product Type (Open Carpal Tunnel Release Systems, Endoscopic Carpal Tunnel Release Systems, Ultrasound-Guided CTR Systems, Mini-Invasive Kit-Based CTR Systems), End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.84% of total 2025 revenues on the back of comprehensive insurance coverage and dense networks of fellowship-trained hand surgeons. Its continued leadership is helped by early adoption of AI-enabled ultrasound systems and an ecosystem that quickly validates real-world evidence via multicenter registries. Europe maintains steady uptake through public-payer mechanisms and standardized clinical guidelines; however, state budget caps moderately temper premium-priced kit penetration.

Asia-Pacific, forecast at a 5.93% CAGR, is the fastest-growing territory as demographic aging converges with industrial workplace expansion. Government insurance expansions in South Korea and pilot device-rental programs in India reduce upfront costs for private clinics, further stimulating procedure volumes. Vietnam's Ministry of Health approving MicroAire endoscopic units for national-level hospitals exemplifies regional policy endorsement. China's urban-worker insurance pool now reimburses endoscopic releases, triggering procurement by high-tier public hospitals and cascading procedure familiarity to county-level facilities. Latin America exhibits mixed dynamics: Brazil's supplemental insurance market funds minimally invasive releases, but device import duties slow broader adoption. The Middle East and Africa remain nascent; Gulf countries invest in tertiary orthopedic centers, whereas Sub-Saharan nations still rely on humanitarian missions for specialist surgeries. Manufacturers view these regions as long-tail opportunities necessitating hybrid sales models that blend capital-equipment leasing with surgeon-training scholarships.

- Arthrex

- Stryker

- Conmed

- MicroAire

- Smiths Group

- AM Surgical

- Sonex Health Inc.

- Seg-WAY Orthopaedics Inc.

- Spirecut SA

- Valor Health Co. Ltd.

- MPR Surgical

- Innomed Inc.

- Karl Storz

- Trice Medical Inc.

- Integra LifeSciences Holdings Corp.

- Surgical Instruments (Evans Knife Guide)

- ThreadTech Medical Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging workforce driving CTS incidence

- 4.2.2 Shift to outpatient & office-based CTR procedures

- 4.2.3 Reimbursement expansion for ultrasound-guided CTR

- 4.2.4 Surge in ergonomic-injury prevention programs

- 4.2.5 AI-enabled pre-operative nerve mapping tools

- 4.2.6 Disposable single-use endoscopes reducing SSI risks

- 4.3 Market Restraints

- 4.3.1 Post-operative pillar pain & litigation risk

- 4.3.2 Shortage of hand surgeons in emerging economies

- 4.3.3 Capital cost barrier for ultrasound systems

- 4.3.4 Supply-chain fragility in medical-grade optics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Threat of New Entrants

- 4.7.3 Threat of Substitutes

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Bargaining Power of Buyers

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Product Type

- 5.1.1 Open Carpal Tunnel Release Systems

- 5.1.2 Endoscopic Carpal Tunnel Release Systems

- 5.1.3 Ultrasound-Guided CTR Systems

- 5.1.4 Mini-invasive Kit-based CTR Systems

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Specialty Clinics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 GCC

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Arthrex Inc.

- 6.3.2 Stryker Corporation

- 6.3.3 CONMED Corporation

- 6.3.4 MicroAire Surgical Instruments LLC

- 6.3.5 Smith & Nephew plc

- 6.3.6 AM Surgical Inc.

- 6.3.7 Sonex Health Inc.

- 6.3.8 Seg-WAY Orthopaedics Inc.

- 6.3.9 Spirecut SA

- 6.3.10 Valor Health Co. Ltd.

- 6.3.11 MPR Surgical

- 6.3.12 Innomed Inc.

- 6.3.13 Karl Storz SE & Co. KG

- 6.3.14 Trice Medical Inc.

- 6.3.15 Integra LifeSciences Holdings Corp.

- 6.3.16 Surgical Instruments (Evans Knife Guide)

- 6.3.17 ThreadTech Medical Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment