PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934744

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934744

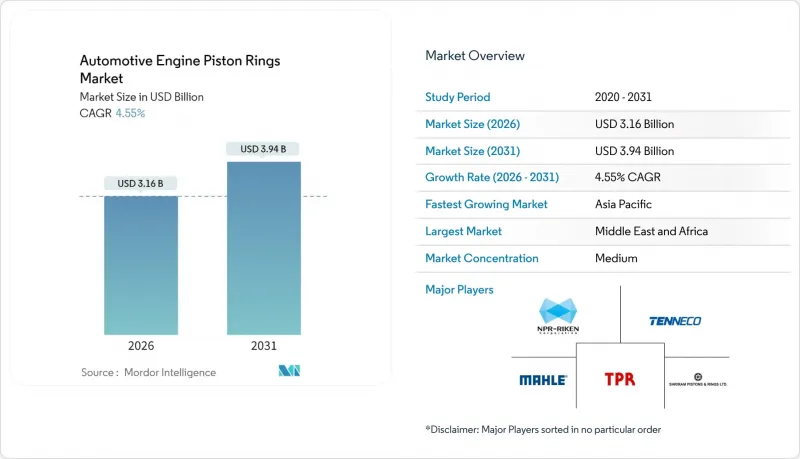

Automotive Engine Piston Rings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The automotive engine piston rings market was valued at USD 3.02 billion in 2025 and estimated to grow from USD 3.16 billion in 2026 to reach USD 3.94 billion by 2031, at a CAGR of 4.55% during the forecast period (2026-2031).

Growing regulatory pressure on internal-combustion engines (ICEs) keeps demand resilient even as electrification accelerates. Automakers prioritize tighter sealing, lower friction, and lighter materials to comply with the U.S. Environmental Protection Agency's 85 g/mi CO2 target by 2032 and the European Union's forthcoming Euro 7 limits. OEMs are also reshoring critical metal supply chains and expanding surface-engineering partnerships to secure capacity for next-generation piston rings. Asia-Pacific dominates current volumes due to high vehicle output and cost-competitive manufacturing. At the same time, the Middle East and Africa present the fastest CAGR due to green-field assembly plants and expanding road networks. Suppliers with proven tribology research and multilayer coating expertise are gaining long-term contracts as engine builders seek turnkey solutions that cut blow-by and oil consumption.

Global Automotive Engine Piston Rings Market Trends and Insights

Strict Emissions and Fuel-Economy Regulations Drive Innovation

Global tailpipe and evaporative standards compel OEMs to redesign sealing components for near-zero blow-by. The EPA's multi-pollutant rule cuts allowed CO2 nearly in half for 2027-2032 light-duty vehicles, while Euro 7 extends limits to non-tailpipe emissions. Suppliers who deliver micron-level tolerances and nano-scale surface treatments win sourcing awards because they help automakers meet fleet-average targets without costly engine redesigns.

Rising ICE Vehicle Production in Emerging Economies Sustains Demand

Demand for ICE-vehicles in countries such as India, especially due to low awareness of the benefits of new-energy vehicles and a lack of efficient public charging infrastructure, is keeping conventional powertrains relevant even as EV volumes soar. Cost-focused buyers in these regions value durable rings over premium coatings, ensuring baseline demand for legacy materials through 2030.

Accelerating BEV Penetration Threatens Traditional Demand

Battery-electric vehicles contain roughly 20 moving parts versus 2,000 for ICEs, eliminating piston rings. EV sales in India jumped 158% year-on-year in FY24, illustrating the headwind even in traditionally cost-sensitive markets. Suppliers must hedge by entering hydrogen-ICE and fuel-agnostic component niches.

Other drivers and restraints analyzed in the detailed report include:

- OEM Shift to Low-Friction, Lightweight Steel Rings Transforms Materials

- Turbo-Gasoline Adoption Demands Tighter Ring Tolerances

- Volatile Steel & Molybdenum Prices Compress Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars controlled 52.74% of the automotive engine piston rings market share in 2025, underpinned by the continual adoption of turbocharged three-and four-cylinder engines that require high-integrity compression rings capable of sealing 20-30 bar peak pressures. Light commercial vans form a resilient sub-pocket as last-mile fleets emphasize fuel efficiency and quick maintenance cycles.

Two-wheelers represent the fastest-growing category, climbing at an 8.32% CAGR due to surging scooter and motorcycle production in India, Indonesia, and Vietnam. Their small-bore engines favor low-tension rings with DLC top layers that slash friction during dense urban duty cycles. Extended drain intervals intensify varnish risks, so suppliers offering hard-chrome scraper rings and precise oil-return slots gain share in this volume-driven niche.

Gray cast iron retained a 47.12% market share in the automotive engine piston rings market in 2025, with established supply chains and forgiving machinability keeping costs low, particularly for high-volume passenger vehicles. Alloyed variants with phosphorus-controlled graphite improve abrasion resistance, enabling thinner cross-sections that save 15-20 g per ring.

Stainless and chromium steels post the quickest growth at 9.12% CAGR as OEMs demand corrosion-resistant, high-strength substrates for downsized turbo engines. These materials boost strength-to-weight by 30%, allowing 0.8 mm ring land heights without compromising durability. Vendors equipped with vacuum degassing and precision wire-drawing lines capture programs where piston rings market share shifts toward premium materials for Euro 7 and Tier 4-final compliance.

The Automotive Engine Piston Rings Market Report is Segmented by Vehicle Type (Passenger Cars, Medium and Heavy Commercial Vehicles, and More), Material Type (Grey Cast Iron and More), Ring Type (Compression Rings and More), Coating Technology (Chrome Plating and More), Fuel Type (Gasoline and More), Sales Channel (OEM and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific dominates the automotive engine piston rings market, holding 52.68% of 2025 revenue. This is owing to China's integrated casting houses and India's component clusters, which ensure economies of scale that underpin the region's leadership. Governments provide production-linked incentives and fast-track environmental approvals that compress factory build-out times, persuading multinationals to source high-volume piston ring programs locally.

The Middle East and Africa are the fastest-growing territories, with a 6.92% CAGR. Saudi Arabia and the United Arab Emirates nurture joint-venture assembly plants aligned with Vision-2030 diversification blueprints. African Union infrastructure corridors stimulate light-truck sales, spurring demand for robust gray iron rings suited to dusty, high-temperature duty cycles.

North America and Europe remain technology bellwethers. Although absolute ICE volumes plateau, stringent emissions timetables support premium coated rings and hybrid-fuel prototypes. Suppliers headquartered here lead in tribology research and exporting process know-how to Asia under licensing agreements. Market participants navigate divergent trajectories: rapid BEV uptake in urban centers versus steady ICE demand in rural and vocational fleets.

- NPR Riken Corporation

- Tenneco Inc. (Federal-Mogul)

- MAHLE GmbH

- TPR Co., Ltd.

- Shriram Pistons & Rings Ltd.

- Asimco Technologies

- IP Rings Ltd.

- SAM Pistons & Rings

- Grover Corporation

- Abilities India Piston & Rings

- Hastings Manufacturing (Hastings Manufacturing Company, LLC)

- Atrac Engineering

- Ks Kolbenschmidt GmbH (Rheinmetall Automotive)

- Wossner Pistons USA

- Quintess International

- Garima Global Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict emissions & fuel-economy regulations

- 4.2.2 Rising ICE vehicle production in emerging economies

- 4.2.3 OEM shift to low-friction, lightweight steel rings

- 4.2.4 Turbo-gasoline adoption demanding tighter ring tolerances

- 4.2.5 Hydrogen-ICE pilot programs needing compatible rings

- 4.2.6 Smart rings with embedded wear sensors

- 4.3 Market Restraints

- 4.3.1 Accelerating BEV penetration

- 4.3.2 Volatile steel & molybdenum prices

- 4.3.3 Premature wear issues with ultra-low-tension rings

- 4.3.4 Precision-grinding talent shortage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.1.4 Two-Wheelers

- 5.1.5 Off-Highway (Construction, Agricultural)

- 5.2 By Material Type

- 5.2.1 Gray Cast Iron

- 5.2.2 Ductile / Alloyed Cast Iron

- 5.2.3 Carbon Steel

- 5.2.4 Stainless / Chromium Steel

- 5.2.5 Advanced Composites & Ceramics

- 5.3 By Ring Type

- 5.3.1 Compression Rings

- 5.3.2 Wiper / Scraper Rings

- 5.3.3 Oil Control Rings

- 5.4 By Coating Technology

- 5.4.1 Chrome Plating

- 5.4.2 Molybdenum / Mo-Spray

- 5.4.3 DLC & ta-C

- 5.4.4 Ceramic & Hybrid Nano-Coatings

- 5.5 By Fuel Type

- 5.5.1 Gasoline

- 5.5.2 Diesel

- 5.5.3 Alternative Fuels (CNG/LPG, Biofuels)

- 5.5.4 Hydrogen ICE

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Indonesia

- 5.7.4.6 Thailand

- 5.7.4.7 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Turkey

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 United Arab Emirates

- 5.7.5.4 South Africa

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 NPR Riken Corporation

- 6.4.2 Tenneco Inc. (Federal-Mogul)

- 6.4.3 MAHLE GmbH

- 6.4.4 TPR Co., Ltd.

- 6.4.5 Shriram Pistons & Rings Ltd.

- 6.4.6 Asimco Technologies

- 6.4.7 IP Rings Ltd.

- 6.4.8 SAM Pistons & Rings

- 6.4.9 Grover Corporation

- 6.4.10 Abilities India Piston & Rings

- 6.4.11 Hastings Manufacturing (Hastings Manufacturing Company, LLC)

- 6.4.12 Atrac Engineering

- 6.4.13 Ks Kolbenschmidt GmbH (Rheinmetall Automotive)

- 6.4.14 Wossner Pistons USA

- 6.4.15 Quintess International

- 6.4.16 Garima Global Pvt. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment