PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934745

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934745

China Processed Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

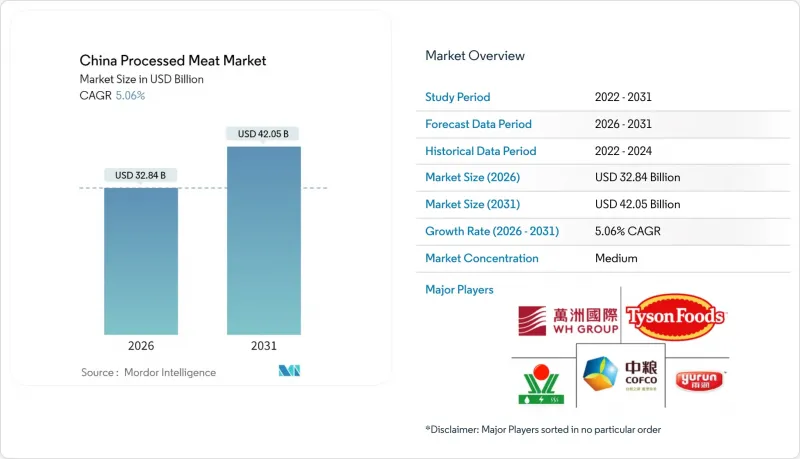

The China's processed meat market was valued at USD 31.26 billion in 2025 and estimated to grow from USD 32.84 billion in 2026 to reach USD 42.05 billion by 2031, at a CAGR of 5.06% during the forecast period (2026-2031).

The expansion reflects steady demand for convenient animal protein, resilient supply-chain investments, and tightening food-safety regulations that favor branded offerings. Government-funded cold-chain capacity climbed to 30,742.7 million m3 in 2024, enabling an 80% low-temperature processing rate that safeguards quality during distribution. At the same time, recurring African swine fever (ASF) and stricter additive limits are accelerating portfolio diversification toward poultry, premium pork, and value-added snacks. E-commerce fulfillment models using flash-express warehouses now link processors to urban households within two hours, lowering last-mile costs and expanding geographic reach. Carbon-neutral policies further incentivize automation and cleaner energy inputs, raising barriers to entry yet creating efficiency gains for scale players.

China Processed Meat Market Trends and Insights

Rising Demand for Ready-to-Eat Protein Snacks Among Urban Millennials

China's urban millennials and Gen Z consumers are increasingly seeking portable meat formats that align with their active lifestyles and perceived health benefits. Survey data show 53.5% of Gen Z respondents prioritize health attributes when choosing packaged protein, even though the cohort accounts for less than 20% of the total population. Snack-sized jerky, mini-sausages, and baked nuggets meet on-the-go needs and command price premiums that support profitability. Manufacturers reformulate traditional recipes to reduce sodium and leverage leaner cuts, thereby positioning products as guilt-free indulgences. The Ministry of Agriculture's inclusion of novel proteins in its national food strategy validates continued diversification, yet conventional processed meat retains dominance due to familiar taste and expanding cold chain coverage. Robust social-commerce campaigns amplify aspirational branding, reinforcing purchase intent among tech-savvy shoppers.

Government Push for Cold-Chain Infrastructure Expansion

Beijing's 14th Five-Year Plan identifies cold-chain logistics as critical to food security and rural revitalization. Nineteen national backbone cold-chain bases were added in 2025, taking the total to 105 and ensuring coverage across every province. New-energy refrigerated trucks grew 230.96% year-on-year in 2024, reflecting policy incentives for green transport. Expanded chilled capacity lowers spoilage rates and widens distribution radii, allowing processors to penetrate inland prefectures once constrained by temperature excursions. Integrated digital monitoring also raises traceability standards that favor scaled players able to invest in IoT sensors and AI route optimization. Longer term, the network underpins export ambitions, linking bonded-zone facilities such as Haikou with Latin American beef suppliers to streamline re-export operations.

ASF Recurrence Disrupting Pork Supply

African swine fever resurfaced across major pig-producing provinces, shrinking the national herd by 6% in 2024 and forcing authorities to trim reproductive-sow targets. Outbreaks cut hog production by 25.8% at peak, while spot prices occasionally tripled, squeezing processor margins. Volatility complicates raw-material procurement and forward contracting, prompting larger companies to accelerate vertical integration and diversify protein portfolios. Biosecurity upgrades-closed-loop transport, on-site rendering, and smart surveillance-raise capital intensity, disadvantaging smaller abattoirs. Although vaccination research progresses, commercial rollout remains years away, sustaining supply-side uncertainty that tempers overall China processed meat market growth.

Other drivers and restraints analyzed in the detailed report include:

- Domestic Brand Premiumisation Targeting Lower-Tier Cities

- E-commerce Fresh-Food Logistics Innovations Lowering Delivery Cost

- Stricter Sodium & Nitrate Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pork commanded 56.42% of China processed meat market share in 2025, reaffirming its cultural centrality and well-established supply chains. However, recurrent ASF outbreaks and growing health awareness are slowing incremental gains within the segment. Manufacturers respond by launching leaner ham slices and convenience-oriented luncheon meat while hedge-sourcing imported pork cuts to stabilize input cost. Despite these efforts, price volatility remains a structural challenge that narrows profit spreads during epidemic spikes.

Poultry is positioned as the strongest challenger, advancing at a 7.56% CAGR through 2031 as consumers perceive chicken as leaner and more affordable. The protein benefits from industrialized farming practices that reduce disease risk, illustrated by smart facilities producing more than 1.7 million birds annually under automated climate control. This stability encourages processors to expand breaded fillet and smoked chicken snack lines, capturing share within the mainstream family occasion. Beef, mutton, and niche proteins leverage premiumization, particularly imported beef routed through bonded zones, yet contribute modest volume individually. Uniform GB 19303-2023 hygiene rules favor capital-rich players capable of multi-protein diversification, accelerating consolidation across the category.

The China Processed Meat Market Report is Segmented by Product Type (Poultry, Pork, Beef, Mutton & Goat, Other Meats), End-User (Food Processing Industry, HoReCa/Food Service, Retail/Household), and Geography (China). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- WH Group Limited

- Tyson Foods, Inc.

- Shuanghui Development

- China Yurun Food Group Ltd.

- Jinluo Group

- COFCO Meat Holdings Ltd.

- Hormel Foods Corporation

- NH Foods Ltd.

- Doyoo Group

- Liuhe Group

- Henan Zhongpin Food Share Co.

- BEKS (Beijing Ershang)

- Shandong Delisi Group Co., Ltd.

- Foshan Huanan Poultry Co.

- Wen's Food Group

- Muyuan Foods Co., Ltd.

- Sichuan Giant Food

- Guangdong Evergreen

- Sunner Development

- Rui Xiang Food

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Ready-to-Eat Protein Snacks Among Urban Millennials

- 4.2.2 Government Push for Cold-Chain Infrastructure Expansion

- 4.2.3 Domestic Brand Premiumisation Targeting Lower-Tier Cities

- 4.2.4 E-commerce Fresh-Food Logistics Innovations Lowering Delivery Cost

- 4.2.5 Food-Safety Scandals Driving Shift to Packaged Branded Meat

- 4.2.6 Automation & AI in Slaughtering Boosting Yield, Lowering Cost

- 4.3 Market Restraints

- 4.3.1 ASF Recurrence Disrupting Pork Supply

- 4.3.2 Stricter Sodium & Nitrate Regulations

- 4.3.3 Consumer Health Shift Toward Plant-Based Proteins

- 4.3.4 Carbon-Neutral Targets Increasing Compliance Costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 By Meat Type

- 5.1.2 Poultry

- 5.1.2.1 Poultry

- 5.1.2.2 Chicken Nuggets and patties

- 5.1.2.3 Deli Meats

- 5.1.2.4 Tenders

- 5.1.2.5 Sausages

- 5.1.2.6 Others

- 5.1.3 Pork

- 5.1.3.1 Sausages - avaialble in Beef, pork, poultry versions

- 5.1.3.2 Bacon

- 5.1.3.3 Sausages

- 5.1.3.4 Nuggets

- 5.1.3.5 Luncheon Meat

- 5.1.3.6 Jerkey

- 5.1.3.7 Others

- 5.1.4 Beef

- 5.1.4.1 Corned Meat (Beef, pork)

- 5.1.4.2 Jerkey

- 5.1.4.3 Corned beef

- 5.1.4.4 Sausages

- 5.1.4.5 Deli Meats

- 5.1.4.6 Luncheon Meat

- 5.1.4.7 Cooked and Smoked Beef Cuts

- 5.1.4.8 Others

- 5.1.5 Mutton & Goat

- 5.1.5.1 Smoked and cured lamb

- 5.1.5.2 Jerkey

- 5.1.5.3 Sausages

- 5.1.5.4 Salami

- 5.1.5.5 Luncheon Meats

- 5.1.5.6 Others

- 5.1.6 Other Meats (Duck, Pigeon, Rabbit, Turkey)

- 5.2 By End-User

- 5.2.1 Food Processing Industry

- 5.2.2 HoReCa/ Food Service

- 5.2.2.1 Hotels

- 5.2.2.2 Restaurants

- 5.2.2.3 Catering

- 5.2.3 Retail/ House Hold

- 5.2.3.1 Supermarkets & Hypermarkets

- 5.2.3.2 Convenience & Neighborhood Stores

- 5.2.3.3 Online Retail

- 5.2.3.4 Specialty stores

- 5.2.3.5 Others (Wet Markets)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 WH Group Limited

- 6.4.2 Tyson Foods, Inc.

- 6.4.3 Shuanghui Development

- 6.4.4 China Yurun Food Group Ltd.

- 6.4.5 Jinluo Group

- 6.4.6 COFCO Meat Holdings Ltd.

- 6.4.7 Hormel Foods Corporation

- 6.4.8 NH Foods Ltd.

- 6.4.9 Doyoo Group

- 6.4.10 Liuhe Group

- 6.4.11 Henan Zhongpin Food Share Co.

- 6.4.12 BEKS (Beijing Ershang)

- 6.4.13 Shandong Delisi Group Co., Ltd.

- 6.4.14 Foshan Huanan Poultry Co.

- 6.4.15 Wen's Food Group

- 6.4.16 Muyuan Foods Co., Ltd.

- 6.4.17 Sichuan Giant Food

- 6.4.18 Guangdong Evergreen

- 6.4.19 Sunner Development

- 6.4.20 Rui Xiang Food

7 Market Opportunities and Future Outlook