PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934750

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934750

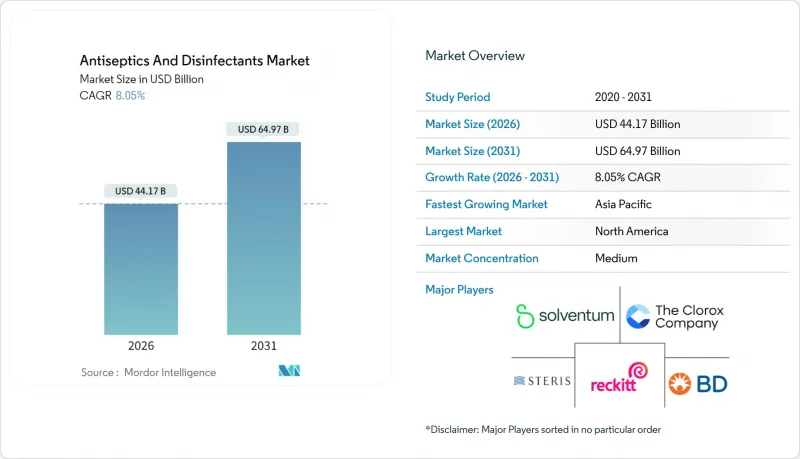

Antiseptics And Disinfectants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Antiseptics and Disinfectants market was valued at USD 40.88 billion in 2025 and estimated to grow from USD 44.17 billion in 2026 to reach USD 64.97 billion by 2031, at a CAGR of 8.05% during the forecast period (2026-2031).

Current spending patterns reveal a clear correlation between infection-control budgets and the financial penalties hospitals incur for healthcare-associated infections (HAIs). Capital allocations for preventive technologies are rising faster than for therapeutic drugs, reflecting a strategic preference for prevention over cure in hospital purchasing departments. The scale of the opportunity is reinforced by the large installed base of high-touch surfaces and reusable medical devices that require disinfection multiple times daily. Consistent market expansion suggests that demand is broadly resilient to economic slowdowns, as infection control is a non-discretionary purchase for healthcare providers. Manufacturers are therefore prioritizing production capacity for hospital-grade products, even as demand from consumer segments grows.

Regulatory scrutiny is accelerating rather than dampening demand, because providers prefer compliant, next-generation chemistries that are less likely to trigger future penalties. The United States Environmental Protection Agency's 90 % emission reduction mandate for ethylene oxide sterilizers, finalised in March 2024 is a prime example: it has pushed purchasers toward low-residue enzymatic blends and vaporised hydrogen peroxide systems . Intellectual property portfolios built around these alternatives are commanding premium valuations in mergers and acquisitions, reflecting a strategic shift toward safer, greener options. Investors also note the long useful life of hospital infrastructure, which locks in repeat sales of compatible formulations, suggesting that actual growth may exceed the headline 8 % CAGR if economic headwinds remain modest.

Global Antiseptics And Disinfectants Market Trends and Insights

Growing Incidences of Hospital Acquired Infections

HAIs continue to climb, with European facilities reporting 8.9 million annual cases, placing budgetary strain on public and private hospitals alike . Hospitals face lost revenue per infection episode, so prevention budgets are receiving priority, which in turn sustains growth in the Antiseptics and Disinfectants market. Facilities with advanced surveillance programs tend to adopt high-performance disinfectants early because data transparency makes the ROI on prevention visible to management.

Increasing Number of Surgical Procedures

Surgical volumes are rising, particularly in ambulatory surgery centers (ASCs) where infection rates sit at just 0.1 % compared with 1 % in hospitals. This success raises institutional confidence in specialized disinfectant protocols designed for rapid room turnover. Suppliers that tailor packaging sizes and contact times for ambulatory surgery centers can gain Antiseptics and Disinfectants market share without direct head-to-head competition with incumbent hospital product lines.

Stringent Regulatory Requirements

The Environmental Protection Agency (EPA) has mandated 90% emission cuts for ethylene oxide sterilizers, affecting roughly half of all device sterilization in the United States. Compliance costs encourage hospitals to trial on-site low-temperature alternatives. A fresh inference is that facilities adopting such alternatives will standardize on compatible surface disinfectants from the same suppliers, reinforcing vendor stickiness.

Other drivers and restraints analyzed in the detailed report include:

- Rising Awareness of Hygiene and Infection Control

- Growth in Healthcare Sector and Hospital Admissions

- Issues Related to Sterilization and Disinfectants of Advanced Medical Instruments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Market size estimates show Quaternary Ammonium Compounds (QACs) hold 27.45 % Antiseptics and Disinfectants market share in 2025, while enzymes record the fastest CAGR of 8.75 % through 2031. Hospitals value QACs for residual activity, but growing regulatory attention is nudging procurement teams toward enzymatic blends that degrade biofilms without leaving toxic residues. A clear inference is that formulators combining QACs with enzymes could offer a transitional product line that meets both efficacy and environmental goals.

Chlorine compounds and alcohol-aldehyde mixes continue serving high-frequency wipe-down tasks thanks to low cost and rapid action. Biguanides such as chlorhexidine remain favored for pre-operative skin prep owing to extended bactericidal persistence. The inference here is that niche chemicals sustain relevance when tied to clinical protocols, even if overall market momentum shifts toward greener solutions.

Liquids account for 51.10 % of Antiseptics and Disinfectants market size in 2025, but wipes display a 9.05% forecast CAGR as hospitals seek dose-controlled, single-use formats. The fresh inference is that wipes also aid inventory control because unit counts align closely with patient volumes, simplifying budgeting.

Sprays remain popular for emergency decontamination of wide areas, while gels and foams gain favor in chronic-wound clinics for their combined disinfectant and healing attributes. An inference is that foam packaging allows precise application on vertical or irregular surfaces, reducing wastage and boosting perceived value.

The Antiseptics and Disinfectants Market Report is Segmented by Product Type (Quaternary Ammonium Compounds, Chlorine Compounds, and More), Formulation (Liquid, Wipes, and More), Application (Enzymatic Cleaners, Medical Device Disinfectants, More), End User (Hospitals & Clinics, Ambulatory & Day-Surgery Centers, and Others), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads with 37.60% Antiseptics and Disinfectants market share in 2025, fueled by high HAI penalties and new EPA rules curbing ethylene oxide emissions. Regulatory alignment between the EPA and FDA is compressing decision cycles for technology upgrades, accelerating product replacement rates. Hospitals in states with the highest infection counts, such as California, are often the first to move because public reporting pressures executive teams.

The Asia-Pacific region shows the fastest growth rate of 9.12% CAGR, driven by large-scale hospital construction and a cultural emphasis on hand hygiene. Local production is increasing, yet premium imports still dominate critical care units, indicating gaps in quality perception. Global brands entering tier-2 cities may gain share before local competitors improve formulation standards.

Europe maintains steady growth underpinned by stringent eco-toxicity standards and a large aging population susceptible to infections. Procurement policies favor products with reduced volatile organic compounds, incentivizing manufacturers to reformulate legacy lines. EU environmental rules often serve as de facto global benchmarks, and early compliance can provide export advantages in other regulated markets.

- Solventum Corporation

- STERIS

- Ecolab

- Reckitt Benckiser Group

- The Clorox Company

- Procter & Gamble

- SC Johnson Professional

- Johnson & Johnson

- Cardinal Health

- Schulke & Mayr GmbH

- Metrex Research, LLC

- GlaxoSmithKline

- Molnlycke Health Care

- Pal International Ltd.

- Diversey Holdings, Ltd.

- GOJO Industries, Inc.

- Zep Inc.

- Kimberly-Clark Worldwide

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Incidences Of Hospital Acquired Infections

- 4.2.2 Increasing Number Of Surgical Procedures

- 4.2.3 Rising Awareness Of Hygeiene And Infection Control

- 4.2.4 Mandatory Endoscope Reprocessing Standards Strengthening High-Level Disinfectant Uptake

- 4.2.5 Growth In The Healthcare Sector And Hospital Admissions

- 4.2.6 Innovative Production Formulations And Technologies

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Requirements

- 4.3.2 Issues Related To The Sterilization And Disinfectants Of Advanced Medical Instruments

- 4.3.3 Volatile Quaternary Ammonium Compound Feedstock Costs

- 4.3.4 Shift To Single-Use Instruments Shrinking Reusable Disinfection Volumes

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Quaternary Ammonium Compounds

- 5.1.2 Chlorine Compounds

- 5.1.3 Alcohols & Aldehydes

- 5.1.4 Biguanides & Iodine Derivatives

- 5.1.5 Enzymes

- 5.1.6 Phenolic & Others

- 5.2 By Formulation

- 5.2.1 Liquids

- 5.2.2 Sprays & Aerosols

- 5.2.3 Wipes

- 5.2.4 Gels & Foams

- 5.3 By Application

- 5.3.1 Surface Disinfectants

- 5.3.2 Medical Device Disinfectants

- 5.3.3 Enzymatic Cleaners

- 5.3.4 Skin & Wound Antiseptics

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Ambulatory & Day-Surgery Centers

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Solventum Corporation

- 6.3.2 STERIS plc

- 6.3.3 Ecolab Inc.

- 6.3.4 Reckitt Benckiser Group plc

- 6.3.5 The Clorox Company

- 6.3.6 Procter & Gamble Co.

- 6.3.7 SC Johnson Professional

- 6.3.8 Johnson & Johnson

- 6.3.9 Cardinal Health Inc.

- 6.3.10 Schulke & Mayr GmbH

- 6.3.11 Metrex Research, LLC

- 6.3.12 GSK plc

- 6.3.13 Molnlycke Health Care AB

- 6.3.14 Pal International Ltd.

- 6.3.15 Diversey Holdings, Ltd.

- 6.3.16 GOJO Industries, Inc.

- 6.3.17 Zep Inc.

- 6.3.18 Kimberly-Clark Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment