PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934756

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934756

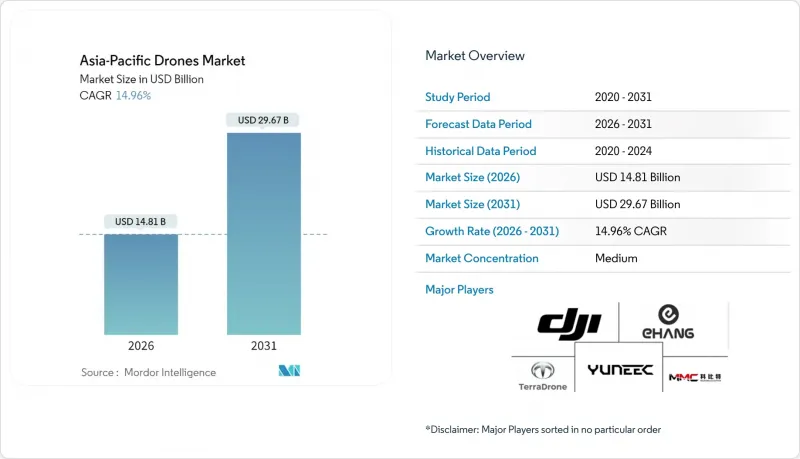

Asia-Pacific Drones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific drones market is expected to grow from USD 12.88 billion in 2025 to USD 14.81 billion in 2026 and is forecast to reach USD 29.67 billion by 2031 at 14.96% CAGR over 2026-2031.

Solid public-sector incentives, widening enterprise use cases, and steady sensor cost deflation give the Asia-Pacific drones market a clear runway for double-digit expansion. Construction surveillance, precision agriculture, and urban logistics to anchor commercial demand. At the same time, Chinese policy support for a "low-altitude economy" multiplies local production and export momentum. Concurrently, India's scale-up from USD 500 million in FY2024 to an expected USD 11 billion by FY2030 signals a decisive geographic diversification within the Asia-Pacific drones market. Over the forecast horizon, autonomy software, hybrid/VTOL design breakthroughs, and diversified battery chemistries will likely widen supplier differentiation.

Asia-Pacific Drones Market Trends and Insights

Government Incentives for Commercial UAV Adoption

Policy initiatives across leading economies are shrinking regulatory lead times and lowering ownership costs. China embedded the low-altitude economy in its 2024 Work Report, earmarking funds for vertiports and digital air-traffic infrastructure. Japan doubled Ministry of Defense R&D partnerships to 30 projects in fiscal 2023, channeling funds toward a dual-use drone platform. India cleared up to USD 470 million in new investment commitments, with fiscal perks and import-substitution mandates encouraging domestic airframe production. Australia's draft Advanced Air Mobility Strategy outlines interoperable rulesets that should let Asia-Pacific drone market operators fly cross-border without redesigning avionics. Together, these frameworks tilt the total ownership cost in favor of local manufacturers and accelerate international standard setting.

Rapid Proliferation of Precision-Agriculture Programs

The Asia-Pacific drones market gains structural tailwinds as farming shifts from pilot projects to fleet-scale spraying and imaging. China now fields about 220,000 agricultural UAVs that treat one-third of the national farmland. AI-enabled multispectral analytics trim pesticide volumes by 30% and deliver yield lifts. In Southeast Asian rice belts, automated irrigation routines cut water use by 25% while preserving grain quality. For Australian broad-acre wheat, drones map variable-rate fertilizer zones in real time. Labor migration from rural areas converts these efficiency gains into immediate cost offsets, ensuring sustained 16.32% segment CAGR inside the Asia-Pacific drones market.

Air-Traffic-Management Bottlenecks in Mega-Cities

Legacy ATC systems prioritize manned aviation and cannot dynamically de-conflict thousands of low-altitude paths. Seoul's urban-air-mobility roadmap shows that drones may be forced into off-peak slots that undermine promised speed advantages without digital separation standards. Congestion around Mumbai and Jakarta airports exposes similar gaps. Detect-and-avoid tooling adds heavy compute loads that present cost hurdles for smaller operators. The Asia-Pacific drones market, therefore, depends on accelerated U-space rollouts to unlock scale economics.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure-Monitoring Demand Along Belt and Road Projects

- Urban E-commerce BVLOS Delivery Pilots

- Limited Pool of Certified Commercial Drone Pilots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Construction captured 34.74% of the Asia-Pacific drones market share in 2025, thanks to immediate ROI from site surveying, materials tracking, and safety audits. High-resolution photogrammetry feeds 4D BIM dashboards, letting contractors compare real-time progress against schedule baselines. Companies operating across Belt and Road clusters deploy swarms to digitize earthworks simultaneously, cutting ground survey labor by 60%. Agriculture follows as the fastest-growing vertical, expanding at 15.88% CAGR and moving the Asia-Pacific drones market size for farm solutions toward a USD-billion scale by decade-end. Southeast Asian cooperatives use multispectral data to automate fertilizer dosing, while Australian growers overlay yield maps to fine-tune variable-rate seeding.

Second-tier verticals add diversified revenue. Energy utilities deploy LiDAR-equipped drones for power-line thermography, halving mandatory outage durations. Media firms monetize aerial live-stream rights for tourism and sports events, and public-safety agencies embrace AI-driven crowd analytics for urban surveillance. This cross-pollination of features and models sustains healthy order books for both fixed-wing and rotary-wing OEMs operating within the Asia-Pacific drones market.

Fixed-wing platforms accounted for 40.77% of the Asia-Pacific drones market size in 2025, preferred for corridor mapping, crop scouting, and pipeline patrols that require multi-hour endurance. Yet, hybrid/VTOL designs are scaling at a 16.94% CAGR. Gas-turbine hybrid eVTOL prototypes demonstrated successful hover tests in early 2024, unlocking range profiles that battery-only craft cannot match. City-center logistics players value vertical take-off to avoid runway infrastructure and fixed-wing cruise to maximize payload economics.

Rotary-wing craft keep their niche in facade inspection and emergency response, where hover precision outranks range. The resulting design segmentation encourages component specialization-from tilt-rotor assemblies to distributed electric propulsion-that enriches supplier ecosystems inside the Asia-Pacific drones market.

The Asia-Pacific Drones Market Report is Segmented by Application (Construction, Agriculture, Energy, and More), Type (Fixed-Wing Drones, Rotary-Wing Drones, and More), Weight Class (Nano/Micro, Small, and More), Mode of Operation (Remotely Piloted, and More), End-User (Commercial and Consumer/Hobbyist, Government and Civil), and Country (China, India, Japan, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SZ DJI Technology Co., Ltd.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Terra Drone Corporation

- MicroMultiCopter (MMC) Aero Technology Co. Ltd.

- Yuneec International (ATL Drone)

- Shenzhen Hubsan Technology Co., Ltd.

- Garuda Aerospace Pvt. Ltd.

- XAG Co., Ltd.

- Chengdu JOUAV Automation Tech Co., Ltd.

- Autel Robotics Co., Ltd.

- Skydio, Inc.

- Parrot Drones SAS

- ideaForge Technology Ltd.

- Throttle Aerospace System Pvt. Ltd. (TAS)

- Primoco UAV SE

- Aerosense Inc.

- Motodoro UAV

- Alphaswift Industries Sdn Bhd

- MATA Aerotech Sdn Bhd

- Asteria Aerospace Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government incentives for commercial UAV adoption

- 4.2.2 Rapid proliferation of precision-agriculture programs

- 4.2.3 Infrastructure-monitoring demand along Belt and Road projects

- 4.2.4 Urban e-commerce BVLOS delivery pilots

- 4.2.5 Pay-per-flight insurtech coverage models

- 4.2.6 Falling LiDAR and multispectral sensor costs

- 4.3 Market Restraints

- 4.3.1 Air-traffic-management bottlenecks in mega-cities

- 4.3.2 Limited pool of certified commercial drone pilots

- 4.3.3 Lithium-cell supply risk from EV sector crowd-out

- 4.3.4 Escalating GNSS spoofing and jamming incidents

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Construction

- 5.1.2 Agriculture

- 5.1.3 Energy

- 5.1.4 Entertainment

- 5.1.5 Law-Enforcement

- 5.1.6 Other Applications

- 5.2 By Type

- 5.2.1 Fixed-Wing Drones

- 5.2.2 Rotary-Wing Drones

- 5.2.3 Hybrid/VTOL Drones

- 5.3 By Weight Class

- 5.3.1 Nano/Micro (Less than 2 kg)

- 5.3.2 Small (2-25 kg)

- 5.3.3 Medium (25-150 kg)

- 5.3.4 Large (Greater than 150 kg)

- 5.4 By Mode of Operation

- 5.4.1 Remotely Piloted

- 5.4.2 Optionally Piloted

- 5.4.3 Fully Autonomous

- 5.5 By End-User

- 5.5.1 Commercial and Consumer/Hobbyist

- 5.5.2 Government and Civil

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Australia

- 5.6.6 Indonesia

- 5.6.7 Singapore

- 5.6.8 Malaysia

- 5.6.9 Thailand

- 5.6.10 Vietnam

- 5.6.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market overview, core segments, financials, strategic info, market rank/share, products and services, recent developments)

- 6.4.1 SZ DJI Technology Co., Ltd.

- 6.4.2 Guangzhou EHang Intelligent Technology Co. Ltd.

- 6.4.3 Terra Drone Corporation

- 6.4.4 MicroMultiCopter (MMC) Aero Technology Co. Ltd.

- 6.4.5 Yuneec International (ATL Drone)

- 6.4.6 Shenzhen Hubsan Technology Co., Ltd.

- 6.4.7 Garuda Aerospace Pvt. Ltd.

- 6.4.8 XAG Co., Ltd.

- 6.4.9 Chengdu JOUAV Automation Tech Co., Ltd.

- 6.4.10 Autel Robotics Co., Ltd.

- 6.4.11 Skydio, Inc.

- 6.4.12 Parrot Drones SAS

- 6.4.13 ideaForge Technology Ltd.

- 6.4.14 Throttle Aerospace System Pvt. Ltd. (TAS)

- 6.4.15 Primoco UAV SE

- 6.4.16 Aerosense Inc.

- 6.4.17 Motodoro UAV

- 6.4.18 Alphaswift Industries Sdn Bhd

- 6.4.19 MATA Aerotech Sdn Bhd

- 6.4.20 Asteria Aerospace Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment