PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934765

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934765

Asia-Pacific White Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

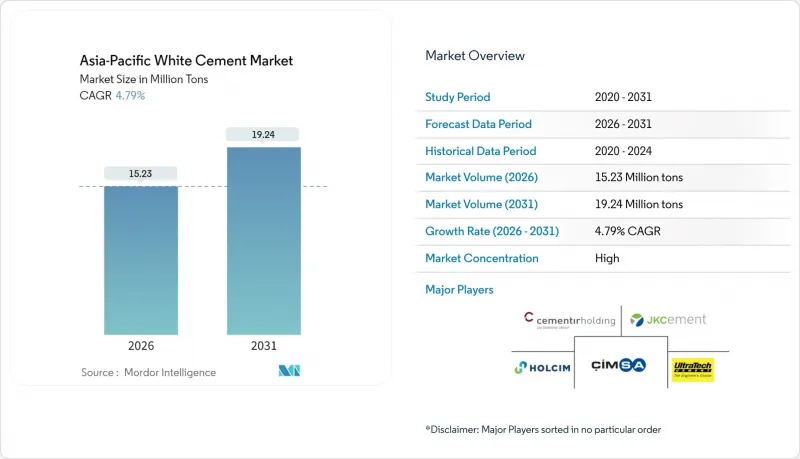

The Asia-Pacific White Cement Market is expected to grow from 14.53 million tons in 2025 to 15.23 million tons in 2026 and is forecast to reach 19.24 million tons by 2031 at 4.79% CAGR over 2026-2031.

Solid infrastructure pipelines, rising disposable incomes, and stricter energy-efficiency rules are reinforcing demand as real estate developers seek materials that combine visual appeal with lower thermal loads. Premium positioning enables producers to secure higher margins despite rising fuel costs, while consolidation among Indian and Chinese manufacturers is unlocking scale benefits that temper price volatility. Ongoing migration to urban centers keeps residential starts elevated, yet forward contracts signed for airports, metros, and mixed-use complexes point to a widening commercial opportunity set. Makers are also capitalizing on sustainability credentials: white cement's high albedo supports cool-roof mandates and helps projects meet LEED and Green Mark targets, fostering a durable pull from architects and project owners.

Asia-Pacific White Cement Market Trends and Insights

Growing Demand from Construction Sector

Infrastructure allocations now exceed 5% of GDP in markets such as the Philippines, while India's Pradhan Mantri Awas Yojana has sanctioned 25.64 million rural homes, sustaining intake of premium binders. Thailand's Eastern Economic Corridor continues to attract logistics and semiconductor plants, underpinning a 3%-4% annual build-rate through 2026. Because white cement commands a 15%-20% price premium over gray cement, producers benefit disproportionately from the upswing of cement prices.

Expanding Precast Concrete Manufacturing

Factory-controlled modules meet developers' need for faster schedules and reduced on-site labor. Japan-headquartered Taiheiyo Cement commissioned a USD 266 million line in Cebu that raises Philippines capacity 50%, specifically to serve facade and panel products that rely on white cement's color stability. UltraTech's "Very Amazing Concrete" portfolio illustrates the parallel shift in India, merging durability additives with bright finishes that architects specify for curtain walls and landscape furniture. Trial runs using calcined-clay blends at Cemcor delivered 3,000 tons of low-carbon precast elements, signalling process convergence between environmental and productivity goals.

High Production Cost

White clinker firing temperatures approach 1,500 °C, elevating fuel costs and kiln refractory wear. Indonesian plants run at just 54.2% utilization, leaving fixed overheads spread across fewer tons and eroding margins. Meanwhile, the World Cement Association cautions that carbon levies add USD 4-6/ton, forcing smaller producers either to upgrade lines or cede share to integrated majors already migrating to alternative fuels.

Other drivers and restraints analyzed in the detailed report include:

- Aesthetic Premium in High-End Architecture

- Surge in Solar-Reflective Roof Coatings

- Competition from Inorganic Pigments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type I captured 51.92% Asia-Pacific white cement market share in 2025 and is on track for a 5.05% CAGR to 2031. Volume traction stems from compatibility with mainstream admixtures and standardized compressive-strength classes, simplifying specification work for engineers on tower, bridge, and metro projects. In 2024, the segment accounted for more than half of the Asia-Pacific white cement market size, reflecting its role as the default binder for architectural precast, terrazzo, and swimming pools.

Capacity deployment favors Type I as kilns can switch between gray and white campaigns with fewer chemistry adjustments, allowing firms like UltraTech to meet seasonal surges without idle inventory. The breadth of end-use cases reinforces bargaining power with distributors who prioritize fast-moving stock. As precasters scale exports to Japan and Australia, uniform specifications around ASTM C150 increasingly lock in Type I as the reference product, reinforcing its dominance through network effects.

The Asia-Pacific White Cement Market Report is Segmented by Type (Type I, Type III, and Other Grades), Application (Commercial, Residential, Infrastructure, and Industrial and Institutional), and Geography (China, India, Japan, South Korea, Thailand, Indonesia, Malaysia, Vietnam, Australia, and Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Ambuja Cement (Adani Group)

- Cementir Holding NV

- CEMEX SAB. de CV

- CIMSA

- HOLCIM

- Hume Cement Sdn Bhd

- India Cements Ltd

- J.K. Cement Ltd

- Royal El Minya Cement

- SCG International Corporation

- SUMITOMO OSAKA CEMENTCo.,Ltd.

- UltraTech Cement Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from Construction Sector

- 4.2.2 Expanding Precast Concrete Manufacturing

- 4.2.3 Aesthetic Premium in High-End Architecture

- 4.2.4 Surge in Solar-Reflective Roof Coatings

- 4.2.5 Net-Zero Building Codes (SG and KR)

- 4.3 Market Restraints

- 4.3.1 High Production Cost

- 4.3.2 Competition from Inorganic Pigments

- 4.3.3 Carbon-Border-Adjustment Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Type I

- 5.1.2 Type III

- 5.1.3 Other Grades

- 5.2 By Application

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Malaysia

- 5.3.8 Vietnam

- 5.3.9 Australia

- 5.3.10 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ambuja Cement (Adani Group)

- 6.4.2 Cementir Holding NV

- 6.4.3 CEMEX SAB. de CV

- 6.4.4 CIMSA

- 6.4.5 HOLCIM

- 6.4.6 Hume Cement Sdn Bhd

- 6.4.7 India Cements Ltd

- 6.4.8 J.K. Cement Ltd

- 6.4.9 Royal El Minya Cement

- 6.4.10 SCG International Corporation

- 6.4.11 SUMITOMO OSAKA CEMENTCo.,Ltd.

- 6.4.12 UltraTech Cement Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment