PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934776

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934776

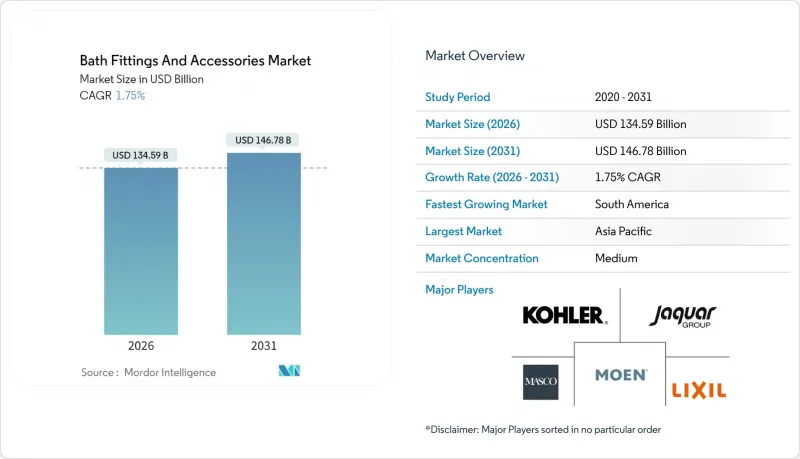

Bath Fittings And Accessories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Bath Fittings And Accessories market size in 2026 is estimated at USD 134.59 billion, growing from 2025 value of USD 132.27 billion with 2031 projections showing USD 146.78 billion, growing at 1.75% CAGR over 2026-2031.

This growth indicates a maturing demand profile in North America and Europe, offset by faster expansion in emerging regions where rising disposable income, accelerating urbanization, and upgraded building codes shape renovation cycles. Persistent water-scarcity concerns push manufacturers to design low-flow products that satisfy tightening regulations, while smart-device penetration steers premium buyers toward voice-activated faucets, sensor-driven showers, and connected flush controls. Competitive pressure is moderate, with the top five suppliers controlling 55.2% of global revenue and leveraging scale to absorb commodity shocks and fund technology roadmaps. E-commerce disruption, aging-in-place retrofits, and post-pandemic hospitality upgrades round out the core demand drivers that will continue to reshape price bands and specification standards. Together, these forces sustain a modest yet resilient expansion path for the bath fittings and accessories market.

Global Bath Fittings And Accessories Market Trends and Insights

Construction Boom in Emerging Economies

Expanding housing pipelines in Brazil, India, and Southeast Asia fuel unit demand for faucets, showers, and grab bars as governments prioritize affordable housing that meets stricter water-efficiency codes. Brazil's USD 132.2 billion (BRL 696 billion) construction agenda allocates around half of project value to residential builds, stimulating mid-tier fixture sales that balance price and durability. Hindware's domestic leadership in sanitaryware, coupled with LIXIL's strategic entry, underscores how global groups localize production to capture rapid growth segments. Modular construction and prefabricated bathroom pods further accelerate adoption by standardizing component specifications and compressing installation timelines. Builders increasingly prefer suppliers capable of delivering complete fixture bundles, elevating vertically integrated vendors in the bath fittings and accessories market.

Smart/IoT-Enabled Bathroom Adoption

Connected bathrooms move beyond novelty as homeowners and facility managers link faucets, bidet seats, and flush plates to broader smart-home ecosystems for leak detection and usage analytics. Uptake varies by age and region; TOTO's WASHLET bidet seats gained 20% penetration among consumers aged 46-55, while Geberit's Bluetooth-enabled Sigma flush controls support centralized water-management dashboards for large facilities. Manufacturers face a dual challenge: meeting interoperability standards and training installers to commission digital products. Firms that bundle installation support with hardware improve sell-through in markets where plumbing contractors lack IoT experience. Integration also raises data-privacy considerations that smart vendors must address via secure firmware and encrypted data exchange, further differentiating premium offerings in the bath fittings and accessories market.

Raw Material Price Volatility

Copper, brass, and stainless-steel price swings compress operating margins by up to 300 basis points when manufacturers cannot fully pass increases through to downstream channels. Matco-Norca's 7% list-price hike on copper press fittings and Merit Brass's 10-20% adjustments illustrate industry-wide ripple effects tied to commodity markets. To hedge exposure, LIXIL uses 78% recycled aluminum in certain lines, and GROHE reaches 80% recycled brass content, lowering reliance on virgin inputs. Regional sourcing and near-shoring strategies gain traction, shortening lead times and reducing currency risk. These moves, however, require capital investment in localized casting and finishing operations that only scale players can justify. Such volatility remains the largest short-term drag on profitability across the bath fittings and accessories market.

Other drivers and restraints analyzed in the detailed report include:

- Water Conservation Regulations

- Aging-in-Place Retrofits

- Intense Price Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Faucets captured 33.28% revenue in 2025, anchoring the bath fittings and accessories market size at the product-level and benefiting from near-universal installation in both new builds and retrofits. Smart faucets surge at 11.43% CAGR because embedded sensors, voice control, and usage tracking command price premiums of 25-40% over mechanical models. Smart-ready showers, bidet seats, and flush plates follow a similar trajectory as consumers integrate bathrooms into broader home-automation ecosystems. Traditional categories such as bathtubs, sinks, and towel racks grow more slowly, but still serve essential replacement cycles in developed regions. Accessory items hooks, paper holders, and grab bars, ride a DIY wave as homeowners order coordinated sets online for quick weekend upgrades. Manufacturers operate dual-brand strategies that isolate technology-heavy SKUs from cost-optimized lines, enabling them to secure volumes across divergent price tiers in the bath fittings and accessories market.

Grab bars, though niche, experience outsized momentum from aging-in-place retrofits and commercial accessibility mandates. Retail giants like Home Depot refresh private labels to target this safety segment, while specialist suppliers improve aesthetics to match contemporary decor. Regulatory frameworks, notably U.S. ADA guidelines and similar standards in Europe and Japan, require sturdy anchoring hardware and load-bearing certification, nudging consumers toward branded solutions. Certification costs and liability considerations discourage low-quality imports, preserving margin for reputable firms. Meanwhile, water-conserving faucet aerators and flow-balanced shower valves introduce incremental upgrade paths for households not yet ready to jump to full smart capability. Collectively, these product-level currents underline a pronounced split between premium innovation and value-driven replacements in the bath fittings and accessories market.

The Bath Fittings and Accessories Market Report is Segmented by Type (Faucets, Showers, Bathtub, Bathroom Sinks, Towel Rack/Ring, Hook, Paper Holder, Grab Bars, Other Types), End User (Commercial, Residential), Distribution Channel (Mass Merchandisers, Specialty Stores, Online, Other Distribution Channels), and Geography (North America, South America, Europe, and Other). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 32.08% share in 2025, anchored by robust construction pipelines in China, India, and Southeast Asia that demand affordable yet regulation-compliant fixtures. China's expanding urban middle class upgrades bathrooms beyond basic functionality, prompting global brands to localize manufacturing and tailor designs to regional style preferences. India's residential surge, demonstrated by Hindware's aggressive revenue targets, reinforces domestic capacity for faucets and sanitaryware, along with regional export potential. Japan's mature replacement cycle favors premium water-efficient bidet seats and touch-free taps, consistent with consumer willingness to pay for hygiene and convenience. South Korea and ASEAN countries adopt modular construction practices, generating demand for standardized bathroom pods that accelerate project schedules and boost average order sizes in the bath fittings and accessories market.

South America records the fastest CAGR at 9.18% through 2031, propelled by Brazil's R$69 billion sanitation investments and Argentina's improving housing starts. The Brazilian Minha Casa Minha Vida program channels roughly half of its budget toward residential builds, stimulating sustained demand for competitively priced yet water-efficient fixtures. Modular and prefabricated bathroom solutions gain traction, offering predictable cost structures amid volatile currency and commodity environments. Local suppliers partner with international brands to meet quality standards, while government initiatives enforce progressive flow-rate caps inspired by WaterSense metrics. This stewardship lifts product-performance requirements without sacrificing affordability, extending market reach to low-income housing segments across the bath fittings and accessories market.

North America and Europe display mature, replacement-led dynamics but remain lucrative due to high average selling prices and stringent water-conservation mandates. EPA WaterSense and evolving EU directives compel non-discretionary upgrades, ensuring baseline demand despite slower unit growth. Aging demographics foster accessibility retrofits, including grab bars and walk-in bathtubs, with insurers and government subsidies partially offsetting out-of-pocket costs. Middle East markets emphasize luxury installations in hospitality and residential towers, where high-end finishes and smart-bathroom suites differentiate premium real estate. Africa exhibits nascent demand, centered on basic sanitation solutions as infrastructure improves. Collectively, geographic differentiation compels manufacturers to balance localized price-leadership strategies with global innovation rollouts in the bath fittings and accessories market.

- Kohler Co.

- LIXIL Group (GROHE, American Standard)

- Masco Corp. (Delta Faucet, Hansgrohe)

- Moen (Fortune Brands Innovations)

- Jaquar Group

- Roca Sanitario

- Toto Ltd.

- Villeroy & Boch

- Duravit AG

- Geberit AG

- Ideal Standard

- Vitra Eczacibasi

- Hindware Ltd.

- Sloan Valve Company

- Oras Group

- Rohl LLC

- Pfister Faucets

- Brizo

- Kludi GmbH

- Elkay Manufacturing

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction boom in emerging economies

- 4.2.2 Adoption of smart/IoT-enabled bathroom fittings

- 4.2.3 Hospitality sector renovation wave

- 4.2.4 Water-conservation regulations mandating low-flow fixtures

- 4.2.5 Aging-in-place retrofits boosting grab-bar installations

- 4.2.6 DIY e-commerce kits for quick bathroom upgrades

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (brass, stainless steel)

- 4.3.2 Margin pressure from intense price competition

- 4.3.3 Long replacement cycles in mature regions

- 4.3.4 Complex building codes delaying smart-fitting roll-outs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Faucets

- 5.1.2 Showers

- 5.1.3 Bathtub

- 5.1.4 Bathroom Sinks

- 5.1.5 Towel Rack/Ring

- 5.1.6 Hook

- 5.1.7 Paper Holder

- 5.1.8 Grab Bars

- 5.1.9 Other Types

- 5.2 By End User

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.3 By Distribution Channel

- 5.3.1 Mass Merchandisers

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 APAC

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.4.7 Rest of APAC

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 United Arab Emirates

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Kohler Co.

- 6.4.2 LIXIL Group (GROHE, American Standard)

- 6.4.3 Masco Corp. (Delta Faucet, Hansgrohe)

- 6.4.4 Moen (Fortune Brands Innovations)

- 6.4.5 Jaquar Group

- 6.4.6 Roca Sanitario

- 6.4.7 Toto Ltd.

- 6.4.8 Villeroy & Boch

- 6.4.9 Duravit AG

- 6.4.10 Geberit AG

- 6.4.11 Ideal Standard

- 6.4.12 Vitra Eczacibasi

- 6.4.13 Hindware Ltd.

- 6.4.14 Sloan Valve Company

- 6.4.15 Oras Group

- 6.4.16 Rohl LLC

- 6.4.17 Pfister Faucets

- 6.4.18 Brizo

- 6.4.19 Kludi GmbH

- 6.4.20 Elkay Manufacturing

7 Market Opportunities & Future Outlook

- 7.1 Circular-economy refurbishment & take-back programs

- 7.2 Antimicrobial coated fittings for post-COVID hygiene premium