PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934777

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934777

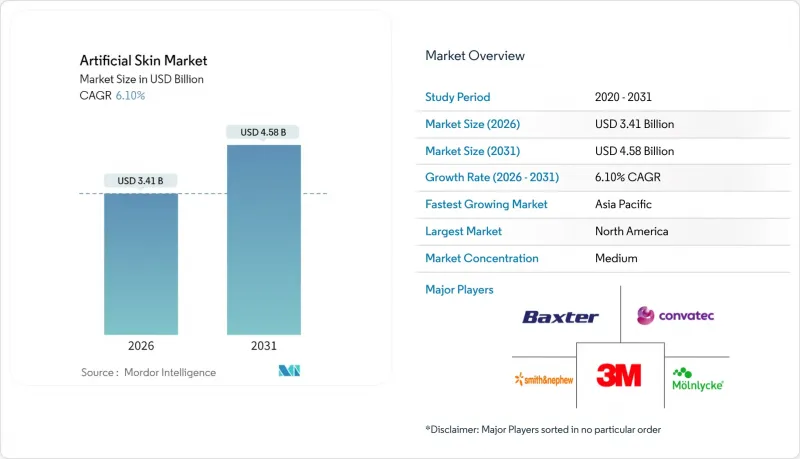

Artificial Skin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The artificial skin market is expected to grow from USD 3.21 billion in 2025 to USD 3.41 billion in 2026 and is forecast to reach USD 4.58 billion by 2031 at 6.1% CAGR over 2026-2031.

The upward path reflects synergistic gains from 3D bioprinting, smart biomaterials and AI-enabled electronic skin platforms that shorten healing times and widen clinical indications. Accelerated adoption in diabetic foot management, pressure-injury prevention and cosmetic resurfacing adds breadth to the demand base. Hospitals continue to procure premium composite scaffolds because they lower total cost of care by reducing graft failures and revision surgeries. Regulatory moves to flat-rate reimbursement are prompting manufacturers to automate production, expand bio-hybrid pipelines and cultivate efficiency partnerships with contract developers. Collaboration between research institutes and device firms speeds translation of laboratory breakthroughs into commercial products, helping preserve high single-digit growth even as pricing pressure intensifies.

Global Artificial Skin Market Trends and Insights

Technological Innovations in Regenerative Medicine

AI-guided 3D bioprinting now fabricates patient-specific lattices that mimic native extracellular matrices at micron resolution. Korea Institute of Science and Technology researchers achieved a 120% uplift in healing rates with wireless sensor-embedded collagen-fibrin grafts, showing how smart materials merge tissue repair with biomechanical feedback. The University of Granada's UGRSKIN platform has shown nearly 80% survival in major burn patients since 2016, validating living-cell constructs in severe trauma care. Precision software that tailors pore geometry and cytokine gradients personalizes therapy, supporting the premium segment of the artificial skin market. Hospitals reward these outcomes with formulary preference even while payer scrutiny on price intensifies.

Increasing Incidence of Chronic and Acute Skin Injuries

Diabetic foot ulcers affect more than 540 million people, driving annual global wound-management costs above USD 17 billion. Bioengineered fish-skin grafts closed 44% of diabetic ulcers within 16 weeks versus 26% under standard dressings, cutting amputation risk and inpatient days. Rising traffic trauma and industrial burns in urban Asia amplify demand for fast-acting dermal matrices. Providers embrace evidence that early graft placement reduces infection rates and accelerates discharge, reinforcing growth across the artificial skin market.

High Treatment Costs and Budget Constraints

Extreme burn cases can exceed USD 9.8 million per patient when multiple grafts and ICU stays accumulate, prompting payer alarm. The Centers for Medicare & Medicaid Services has proposed cutting skin-substitute reimbursement to a flat USD 125.38 per square centimeter, a sharp shift from cost-plus formulas that previously encouraged premium pricing. Providers in low-income economies often delay adoption due to budget caps, limiting early-stage penetration of the artificial skin market. Manufacturers accelerate lean manufacturing, seek lower-cost collagen sources and partner with contract producers to preserve margins under price ceilings.

Other drivers and restraints analyzed in the detailed report include:

- Rising Geriatric and Diabetic Population

- Growing Demand for Advanced Wound Care Solutions

- Stringent Multiregional Regulatory Frameworks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Temporary devices retained the largest slice of the artificial skin market in 2025 at 47.92% revenue because clinicians rely on them for prompt protection that controls exudate and lowers infection risk. Although non-cellular and cost-effective, these matrices require follow-up grafting when wounds penetrate the dermis. Composite and hybrid formats are now rising at an 8.3% CAGR as they combine a temporary epidermal layer with a durable dermal scaffold, reducing the number of surgical steps and shortening hospital stay. Hospitals value the integrated approach because it cuts donor-site morbidity and minimizes painful dressing changes, propelling steady uptake. Continuous R&D in electrospinning and melt-electrowriting is closing the cost gap with single-layer products, setting the stage for hybrid platforms to overtake incumbents later in the decade. The transition signals an inflection point for the artificial skin market as clinicians gravitate toward turnkey constructs that fuse immediate coverage with long-term regeneration.

Second-generation bilayer films exhibit tensile strength within 5% of native human skin and support vascular ingrowth as early as day 10 post-implantation. Automated roll-to-roll fabrication now produces homogenous pore structures that improve fluid drainage and cell migration. These technical gains will likely keep composite solutions on the reimbursement formularies of high-volume burn units even after pricing reform. Meanwhile, permanent full-take skin substitutes hold a niche in syndromic conditions yet grow steadily as living-cell sourcing and cold-chain logistics become more robust. The artificial skin industry therefore reflects a widening ladder of clinical sophistication rather than a binary shift, preserving choice across acuity levels.

Dermal matrices generated 57.02% of 2025 revenue by recreating the collagen-rich layer that provides strength and elasticity. Surgeons have long targeted dermal repair first because epidermal autografts can later repopulate the surface. Full-thickness grafts are expanding fastest at an 8.52% CAGR now that bioreactors can co-culture keratinocytes and fibroblasts on the same scaffold without delamination. These all-in-one constructs reduce operative time by eliminating staged procedures, an efficiency prized in busy trauma centers. Early adopters report 27% smaller donor sites when using systems such as RECELL, easing morbidity and improving patient satisfaction. Epidermal-only films still serve cosmetic resurfacing and minor burns but face substitution risk as composite devices fall in price.

Looking ahead, academic consortia are experimenting with vascularized pre-assembled skin flaps that may further compress treatment timelines. If trials validate superior graft-take rates, reimbursement committees could endorse full-thickness options as first-line therapy for deep burns, accelerating their mix shift within the artificial skin market size hierarchy. However, regulatory data requirements remain high, so dermal substitutes will retain scale for the foreseeable future.

The Artificial Skin Market Report is Segmented by Product Type (Permanent, Temporary, and Composite/Hybrid), Replacement Area (Dermal, Epidermal, and Full-Thickness), Material (Natural, Synthetic, and Bio-Hybrid), Application (Acute Wounds, and More), End-User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 40.10% of 2025 global revenue thanks to robust trauma care infrastructure, generous reimbursement and a dense network of burn centers. The United States drives regional dominance with early FDA clearances such as RECELL GO mini, which treats wounds up to 480 cm2 and reduces autograft requirements. Canada and Mexico trail but grow steadily as universal healthcare systems invest in modern wound-care pathways. Upcoming payer reforms may compress unit prices yet also stimulate volume through broadened indications. The artificial skin market size for North America is forecast to advance in single digits as innovators substitute costly living-cell grafts with cheaper bio-hybrids that retain outcome parity.

Asia-Pacific is projected to post a 7.28% CAGR to 2031, the fastest worldwide. Rapid urbanization, aging populations and rising diabetes prevalence underpin high procedure volumes, while governments expand insurance coverage. China pushes domestic bioprinting ventures under Made-in-China policy incentives, seeking self-sufficiency and export potential. Japan maintains sophisticated tissue-engineering regulations that accelerate approval of proven constructs, helping early adoption. India and Indonesia still face affordability hurdles, but public-private partnerships aim to supply subsidized grafts for trauma centers along major highway corridors. As scale rises, localized production will trim logistics costs and support price-sensitive markets, reinforcing APAC as a strategic growth engine within the artificial skin market.

Europe holds significant share via mature healthcare systems and coordinated trauma networks. Germany and France prioritize evidence-based purchasing, favoring products backed by randomized trials. The region's strict Medical Device Regulation imposes high documentation but assures clinicians of product quality, sustaining steady uptake. Eastern European nations leverage cohesion funds to upgrade burn units, creating incremental demand. Middle East & Africa and South America remain nascent yet promising. Wealthier Gulf states import premium constructs for complex cosmetic surgeries, whereas Brazil integrates grafts into its Unified Health System for accident victims. Exchange-rate volatility and limited reimbursement slow broader penetration, though humanitarian aid projects occasionally deploy composite grafts in conflict zones where burn injuries are prevalent.

- 3M

- Smiths Group

- Integra LifeSciences

- Baxter

- Convatec Group

- Molnlycke Health Care

- Medtronic

- Hartmann Group

- MIMEDX Group

- Bioventus (Solsys Medical)

- Organogenesis Holdings

- Avita Medical

- Episkin (L'Oreal)

- Stratatech (Mallinckrodt)

- Tissue Regenix

- PolarityTE

- RenovaCare

- Gunze Limited

- Vericel

- TissUse

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Innovations in Regenerative Medicine

- 4.2.2 Increasing Incidence of Chronic and Acute Skin Injuries

- 4.2.3 Rising Geriatric and Diabetic Population

- 4.2.4 Growing Demand for Advanced Wound Care Solutions

- 4.2.5 Favorable Government Funding and Reimbursement Policies

- 4.2.6 Expanding Applications in Aesthetic and Robotic Fields

- 4.3 Market Restraints

- 4.3.1 High Treatment Costs and Budget Constraints

- 4.3.2 Stringent Multiregional Regulatory Frameworks

- 4.3.3 Limited Vascularization and Integration Challenges

- 4.3.4 Supply Chain Vulnerability for Biological Raw Materials

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Intensity Of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Permanent

- 5.1.2 Temporary

- 5.1.3 Composite / Hybrid

- 5.2 By Replacement Area

- 5.2.1 Dermal

- 5.2.2 Epidermal

- 5.2.3 Full-Thickness (Composite)

- 5.3 By Material

- 5.3.1 Natural (Collagen, Fibrin, Etc.)

- 5.3.2 Synthetic (PGA, PCL, PU, Etc.)

- 5.3.3 Bio-Hybrid

- 5.4 By Application

- 5.4.1 Acute Wounds (Burns, Trauma)

- 5.4.2 Chronic Wounds (Diabetic Ulcers, Pressure Ulcers)

- 5.4.3 Cosmetic & Aesthetic Procedures

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Specialised Burn & Wound-Care Centres

- 5.5.3 Ambulatory Surgical Centres

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Smith & Nephew Plc

- 6.3.3 Integra Lifesciences Corporation

- 6.3.4 Baxter International Inc.

- 6.3.5 Convatec Group

- 6.3.6 Molnycke Health Care AB

- 6.3.7 Medtronic

- 6.3.8 Paul Hartmann AG

- 6.3.9 MiMedX

- 6.3.10 Bioventus (Solsys Medical)

- 6.3.11 Organogenesis Holdings

- 6.3.12 Avita Medical

- 6.3.13 Episkin (L'Oreal)

- 6.3.14 Stratatech (Mallinckrodt)

- 6.3.15 Tissue Regenix

- 6.3.16 PolarityTE

- 6.3.17 RenovaCare

- 6.3.18 Gunze Limited

- 6.3.19 Vericel Corporation

- 6.3.20 TissUse GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment