PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934779

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934779

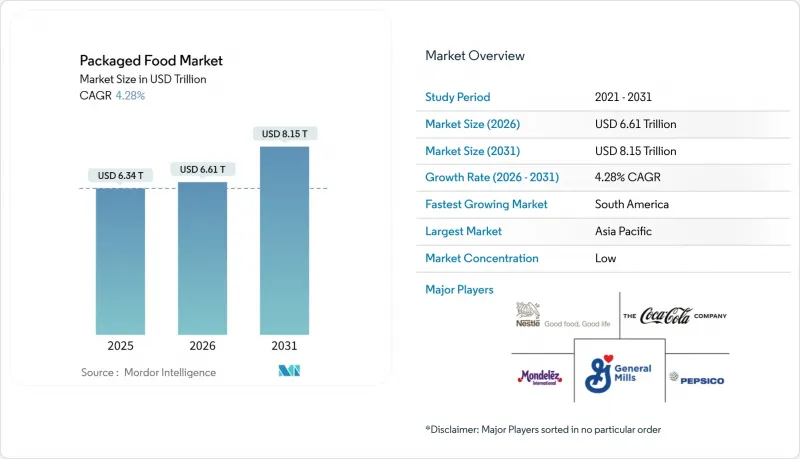

Packaged Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Dairy and dairy alternatives are projected to be the fastest-growing segment in the packaged food market, expected to register a CAGR of 4.81% through 2031.

The Packaged food was valued at USD 6.34 trillion in 2025 and estimated to grow from USD 6.61 trillion in 2026 to reach USD 8.15 trillion by 2031, at a CAGR of 4.28% during the forecast period (2026-2031). Rapid urbanization, rising disposable income in emerging economies, and consumers' preference for convenient yet nutrient-dense products are redefining category dynamics. Demand is gravitating toward natural, organic, and free-from options, while functional claims such as probiotic, high-protein, and fortified benefits migrate from niche lines into mainstream shelves. Distribution patterns are fragmenting as e-commerce compresses delivery windows below fifteen minutes in dense cities, obliging supermarkets to retrofit micro-fulfillment zones. Meanwhile, sustainability mandates are accelerating material innovation, shifting packaging away from single-use plastics toward fiber-based or enzymatically recyclable substrates, even at a 15-25% cost premium. Competitive intensity is rising as incumbents prune underperforming SKUs and acquire plant-based specialists to secure relevance with younger cohorts.

Global Packaged Food Market Trends and Insights

Ethnic and global flavor exploration

Growing consumer interest in ethnic and global flavor exploration is significantly driving innovation and product development in the packaged food market. Increasing cultural exposure through travel, digital media, and multicultural urban populations has encouraged consumers to experiment with international cuisines and diverse taste profiles. Packaged food manufacturers are responding by introducing products inspired by Asian, Latin American, Middle Eastern, and Mediterranean flavors to meet evolving taste preferences. This trend is particularly strong among younger consumers seeking novel and authentic culinary experiences in convenient formats. Limited-edition launches, fusion flavors, and regionally inspired recipes are helping brands differentiate their offerings in competitive retail environments. Additionally, the rising popularity of ready-to-eat meals and snack products featuring global seasonings supports higher consumer engagement and repeat purchases.

Increasing demand for functional and health-oriented foods

Consumers are driving growth in the packaged food market by prioritizing nutrition and preventive health in their daily diets. Rising awareness of lifestyle-related health issues, such as obesity, diabetes, and digestive concerns, is pushing demand for products with enhanced nutritional benefits. The International Diabetes Federation (IDF) reports that in 2024, 589 million adults aged 20-79 lived with diabetes, with projections reaching 853 million by 2050. Manufacturers are introducing fortified foods, high-protein snacks, probiotic items, and products enriched with vitamins, minerals, and fiber. Health-conscious buyers increasingly prefer clean-label formulations, reduced sugar content, and natural ingredients. The International Food Information Council's Food and Health Survey 2024 shows that 67% of Americans consider healthfulness crucial in food and beverage choices, highlighting wellness trends' strong influence on purchasing behavior. Interest in immunity-boosting and functional ingredients continues to grow, driven by a focus on long-term health management.

Health concerns related to sugar, salt, and preservatives

Growing health concerns related to high levels of sugar, salt, and preservatives are limiting the growth potential of the packaged food market as consumers become more cautious about ingredient consumption. Increasing awareness of lifestyle-related conditions such as obesity, hypertension, diabetes, and cardiovascular diseases has led consumers to scrutinize nutritional labels more carefully. Many packaged food products are often perceived as highly processed, which can discourage health-conscious consumers from frequent consumption. Regulatory bodies across several countries are also introducing stricter labeling requirements and reformulation guidelines to reduce sodium and sugar content in processed foods. This has increased pressure on manufacturers to reformulate products while maintaining taste, texture, and shelf life, often leading to higher production costs. Additionally, negative consumer perception toward artificial preservatives and additives is encouraging a shift toward fresh or minimally processed alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Rising consumer preference for clean-label and transparent ingredients

- Innovation in sustainable and recyclable packaging solutions

- Rising input, labor, energy, and production costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bakery products accounted for the largest share of the packaged food market in 2025, contributing 34.27% of total market revenue, primarily driven by their widespread consumption and strong consumer familiarity across regions. Products such as bread, biscuits, cakes, pastries, and savory baked snacks continue to serve as convenient meal and snacking options for consumers with busy lifestyles. The segment benefits from frequent product innovation, including healthier formulations such as whole grain, high-fiber, and reduced-sugar variants, which help maintain strong demand among health-conscious consumers. In addition, the expansion of organized retail and online grocery platforms has improved product accessibility and visibility, further strengthening sales performance.

Growth in this segment is largely supported by increasing consumer awareness regarding nutrition, protein intake, and functional health benefits associated with dairy-based products. At the same time, rising lactose intolerance awareness and the growing popularity of plant-based diets have accelerated demand for dairy alternatives such as almond, soy, oat, and coconut-based products. Manufacturers are actively expanding product portfolios with fortified, low-fat, and probiotic-rich offerings to cater to evolving consumer preferences. The introduction of innovative flavors, convenient packaging formats, and ready-to-consume dairy beverages has further strengthened market expansion.

The Packaged Food Market is Segmented by Product Type (Dairy, Confectionery, Bakery, Snacks, Meat, Breakfast Cereals, Baby Food, and More), by Category (Conventional and Organic), by Distributional Channels (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and More), and by Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

Asia-Pacific accounted for the largest share of the packaged food market in 2025, holding 33.67% of the global market, driven by its large population base, rapid urbanization, and evolving consumer lifestyles. Rising disposable incomes across countries such as China, India, Indonesia, and Vietnam have accelerated demand for convenient, ready-to-eat, and value-added food products. The expansion of modern retail infrastructure, including supermarkets, hypermarkets, and e-commerce platforms, has further improved product accessibility across urban and semi-urban areas. In addition, changing dietary patterns, increasing participation of women in the workforce, and growing demand for packaged snacks, dairy products, and frozen foods continue to support strong regional consumption.

South America is projected to register the fastest growth rate, with a CAGR of 5.03% through 2031, supported by improving economic stability, rising urban populations, and increasing adoption of packaged and convenience foods. Countries such as Brazil, Argentina, and Chile are witnessing a gradual shift from traditional fresh food consumption toward packaged alternatives due to changing work patterns and time constraints among consumers. The growing presence of international food brands alongside expanding domestic production capabilities has enhanced product availability and variety in the region.

Europe, North America, and the Middle East & Africa collectively represent mature yet evolving markets characterized by strong demand for premium, health-oriented, and sustainably packaged food products. In North America and Europe, consumer preferences are increasingly shaped by clean-label formulations, organic ingredients, and functional foods, driving innovation among established food manufacturers. Meanwhile, the Middle East & Africa region is experiencing gradual growth supported by rising urbanization, expanding retail infrastructure, and increasing reliance on imported packaged foods, particularly in Gulf Cooperation Council (GCC) countries.

- Nestle SA

- PepsiCo Inc.

- The Coca-Cola Company

- General Mills Inc.

- Mondelez International

- Danone SA

- Unilever PLC

- Kraft Heinz Co.

- Tyson Foods Inc.

- JBS SA

- Kellogg Co.

- Conagra Brands

- Hormel Foods Corp.

- Grupo Bimbo SAB de CV

- Campbell Soup Company

- Mars Inc.

- Smithfield Foods Inc.

- Ajinomoto Co. Inc.

- CJ CheilJedang

- National Beef Packing Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ethnic and global flavor exploration

- 4.2.2 Increasing demand for functional and health-oriented foods

- 4.2.3 Innovation in sustainable and recyclable packaging solutions

- 4.2.4 Rising consumer preference for clean-label and transparent ingredients

- 4.2.5 Growing personalization and dietary preference-based product development

- 4.2.6 Product innovation and premiumization across packaged food categories

- 4.3 Market Restraints

- 4.3.1 Health concerns related to sugar, salt, and preservatives

- 4.3.2 Rising input, labor, energy, and production costs

- 4.3.3 Supply chain disruptions and raw material price volatility

- 4.3.4 Stringent regulatory requirements and compliance costs

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Dairy and Dairy Alternatives

- 5.1.2 Confectionery

- 5.1.3 Bakery

- 5.1.4 Snacks

- 5.1.5 Meat, Poultry & Seafood and Substitutes

- 5.1.6 Breakfast Cereals

- 5.1.7 Baby Food

- 5.1.8 Food Spread

- 5.1.9 Ready Meals

- 5.1.10 Condiments and Sauces

- 5.1.11 Other Product Types

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Natural/Organic/Free-From

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets / Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Nestle SA

- 6.3.2 PepsiCo Inc.

- 6.3.3 The Coca-Cola Company

- 6.3.4 General Mills Inc.

- 6.3.5 Mondelez International

- 6.3.6 Danone SA

- 6.3.7 Unilever PLC

- 6.3.8 Kraft Heinz Co.

- 6.3.9 Tyson Foods Inc.

- 6.3.10 JBS SA

- 6.3.11 Kellogg Co.

- 6.3.12 Conagra Brands

- 6.3.13 Hormel Foods Corp.

- 6.3.14 Grupo Bimbo SAB de CV

- 6.3.15 Campbell Soup Company

- 6.3.16 Mars Inc.

- 6.3.17 Smithfield Foods Inc.

- 6.3.18 Ajinomoto Co. Inc.

- 6.3.19 CJ CheilJedang

- 6.3.20 National Beef Packing Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK