PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934780

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934780

Blood Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

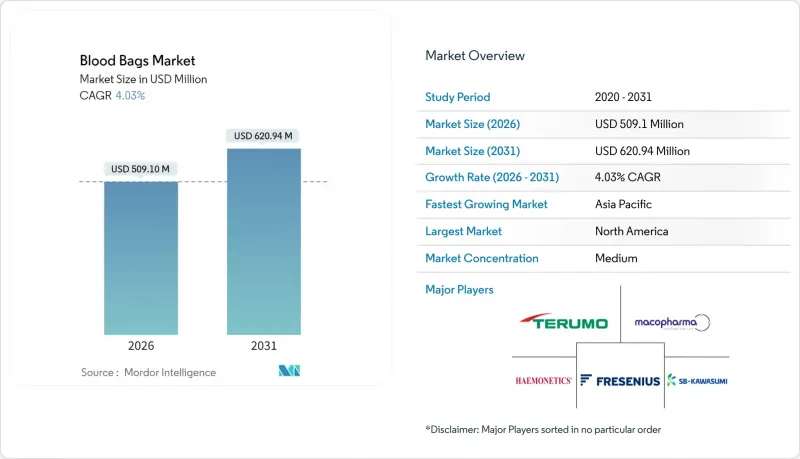

The blood bags market is expected to grow from USD 489.37 million in 2025 to USD 509.1 million in 2026 and is forecast to reach USD 620.94 million by 2031 at 4.03% CAGR over 2026-2031.

Steady expansion reflects rising surgical volumes, higher trauma incidence, and stricter blood-safety regulations that oblige health systems to modernize collection, processing, and storage infrastructure. Regulatory mandates such as the European Union's REACH rule and California's AB 2300 are accelerating the transition from DEHP-plasticized polyvinyl chloride (PVC) toward safer formulations, spurring material innovation and capital spending. Hospitals and blood centers are adopting pathogen-reduction platforms, automated component-separation systems, and RFID-enabled traceability, which collectively raise demand for multi-compartment bag configurations. North America leads on account of advanced trauma care networks, yet Asia-Pacific records the fastest growth as voluntary donation campaigns and local plasma-fractionation plants scale capacity.

Global Blood Bags Market Trends and Insights

Prevalence of Trauma and Chronic Diseases Raising Transfusion Volumes

Level 1 trauma centers report transfusion triggers below hematocrit 32.08 for red cells and platelet counts under 130,000 µL, illustrating rising demand for packed components. Based on the medRxiv preprint by Turkulainen et al. published in November 2024, electronic health records from HUS Helsinki University Hospital reveal that 107,331 blood units were transfused to 19,637 patients during 2021-2022, with 61.5% driven by emergency department admissions and peak usage occurring during early evening hours. Simulated mass-casualty drills in the United States reveal inadequate inventories of platelets and O-negative red cells, pushing hospitals to enlarge onsite storage and adopt whole-blood resuscitation that lowers 30-day mortality. These usage patterns boost procurement of single and triple bags for immediate transfusion and quadruple sets for component therapy. Manufacturers scaling production capacity address this volume surge by integrating in-line leukoreduction filters and high-flow tubing that meet updated AABB hemolysis limits.

Expanding Surgical Procedures Worldwide

Elective and trauma surgeries continue to climb, yet audits at Omdurman Teaching Hospital show only 30% of cross-matched units are transfused, yielding a 4.4 cross-match-to-transfusion ratio that signals large wastage. Burn-surgery models increasingly predict intra-operative blood requirements, prompting OR managers to adopt smarter bag systems that support on-demand component extraction and minimize over-ordering. Asia-Pacific hospitals, which account for the bulk of new OR capacity, prefer double and triple configurations to streamline high-volume orthopedic and bariatric cases. The automation trend extends to post-operative settings, where Immucor Neo Iris analyzers process 165 specimens concurrently and cut hemolytic reactions by 80%, reinforcing hospital interest in integrated bag-plus-software bundles.

Contamination Recalls & Bag-Quality Failures

Sterility breaches prompted FDA warning letters in 2024, underscoring cGMP lapses that can adulterate blood components. Platelet units carry a 1-in-2000 bacterial-contamination risk; common isolates include Staphylococcus epidermidis and S. aureus, spurring strict lot-release testing and driving adoption of pre-storage leukoreduction filters. Such incidents impose extra documentation, halt shipments, and erode confidence, temporarily softening demand in affected locales.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Voluntary Non-Remunerated Blood Donations

- Wider Adoption of Pathogen-Reduction Technologies

- Shift Toward Autologous Transfusion & Blood Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single bags held the largest 34.97% share of blood bags market size in 2025, while quadruple bags are projected to post a 4.42% CAGR through 2031. Rising component-therapy preference pushes hospitals to adopt triple, quadruple, and penta systems that facilitate simultaneous platelet and plasma recovery. Fresenius Kabi's CompoFlow line integrates in-line leukofilters that meet European leukoreduction guidelines, cutting preparation time by 30%. Double bags remain popular in cost-sensitive procurement programs, offering balanced throughput without the premium of higher-compartment sets.

Multi-compartment adoption correlates with healthcare maturity; U.S. trauma centers favor quadruple bags to supply chilled platelets for six-hour windows, whereas rural blood banks in low-income countries still rely on single-bag donations for whole-blood transfusion. JMS's CPD-SAGM systems extend red-cell shelf life to 42 days, a critical feature for remote regions with infrequent donation drives. Continuous innovation around anti-hemolysis additives and self-sealing ports positions the product-type segment for incremental upgrades across the forecast horizon.

PVC (DEHP) still accounts for 62.20% of 2025 revenue, yet DEHP-free alternatives will register a 4.72% CAGR and capture incremental share as regulators enforce plasticizer restrictions. California's AB 2300 exempts blood bags but signals longer-term convergence toward DEHP-free norms, prompting manufacturers to validate trioctyl trimellitate or BTHC as substitutes. Fresenius Kabi trials confirm non-DEHP red-cell storage maintains acceptable hemolysis and ATP levels through 42 days, fueling procurement confidence.

PET and multilayer polyolefin bags surface in R&D pipelines, offering superior oxygen permeability control but facing tooling-cost hurdles. The blood bags industry dedicates R&D budgets to resin compatibility with irradiation and photochemical protocols necessary for pathogen reduction. Global suppliers undertake costly line retrofits and file multiple 510(k) clearances, but early movers expect pricing premiums as healthcare providers align with sustainability and safety mandates.

The Blood Bags Market Report is Segmented by Product Type (Single, Double, Triple, Quadruple, Penta Blood Bags), Material (PVC DEHP, PVC DEHP-Free, PET, Other Polymers), End-User (Blood Banks, Hospitals, Others), Application (Collection, Transportation/Storage, Processing), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 37.88% of 2025 revenue, benefiting from established donation networks, high surgical volumes, and early pathogen-reduction adoption . FDA guidance issued in 2025 on evaluating non-DEHP materials offers regulatory certainty that steadies capital planning for manufacturers. Trauma-center simulations demonstrated critical platelet shortages, prompting state-funded storage-capacity grants and new standing orders for chilled platelet bags.

Asia-Pacific is the fastest-growing region at a 4.86% CAGR to 2031 as hospital infrastructure scales and national donation campaigns close supply gaps . Indonesia's partnership with SK plasma to construct a 600,000-liter fractionation plant will lift annual domestic bag demand by double digits. Donation rates across India, Vietnam, and the Philippines remain below WHO's 10-per-1000 target, signaling sustained expansion for collection and processing bags. Regional governments channel COVID-era procurement lessons into broader medical-device localization programs, favoring suppliers with on-the-ground capacity.

Europe maintains solid share through regulatory leadership; the REACH deadline compels all DEHP-containing blood bags to transition by July 2030, driving early-order pipelines for DEHP-free SKUs. Hospitals coordinate multi-year framework agreements to hedge conversion risk, and EU Horizon grants subsidize pilot production of bio-based polymers. Middle East & Africa witness capacity building through WHO Quality Management System initiatives, and Gulf Cooperation Council states continue to import U.S.-made quadruple bags for tertiary trauma centers. South America progresses steadily, led by Brazil's public-blood-bank upgrades that integrate leukoreduction and barcode traceability.

- Fresenius

- Terumo

- MacoPharma

- Haemonetics

- Grifols

- Kawasumi Laboratories

- B. Braun

- JMS Co. Ltd.

- Shandong Weigao Group Medical Polymer Co. Ltd.

- Poly Medicure Ltd.

- HLL Lifecare

- Demotek Ltd.

- AdvaCare

- Mitra Industries Pvt. Ltd.

- Neomedic International

- Span Healthcare Private Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Prevalence of trauma & chronic diseases raising transfusion volumes

- 4.2.2 Expanding surgical procedures worldwide

- 4.2.3 Growth in voluntary non-remunerated blood donations

- 4.2.4 Wider adoption of pathogen-reduction technologies

- 4.2.5 RFID-enabled blood-bag traceability initiatives

- 4.2.6 Cord-blood banking boom driving specialized bag demand

- 4.3 Market Restraints

- 4.3.1 Contamination recalls & bag-quality failures

- 4.3.2 Shift toward autologous transfusion & blood substitutes

- 4.3.3 DEHP phase-out raising conversion costs

- 4.3.4 Advances in synthetic oxygen carriers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Single Blood Bags

- 5.1.2 Double Blood Bags

- 5.1.3 Triple Blood Bags

- 5.1.4 Quadruple Blood Bags

- 5.1.5 Penta Blood Bags

- 5.2 By Material (Value)

- 5.2.1 PVC (DEHP)

- 5.2.2 PVC (DEHP-Free)

- 5.2.3 PET

- 5.2.4 Other Polymers

- 5.3 By End-User (Value)

- 5.3.1 Blood Banks

- 5.3.2 Hospitals

- 5.3.3 Others

- 5.4 By Application (Value)

- 5.4.1 Collection

- 5.4.2 Transportation / Storage

- 5.4.3 Processing (Leukoreduction, etc.)

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Fresenius SE & Co. KGaA

- 6.3.2 Terumo Corporation

- 6.3.3 Macopharma SA

- 6.3.4 Haemonetics Corporation

- 6.3.5 Grifols S.A.

- 6.3.6 Kawasumi Laboratories Inc.

- 6.3.7 B. Braun Melsungen AG

- 6.3.8 JMS Co. Ltd.

- 6.3.9 Shandong Weigao Group Medical Polymer Co. Ltd.

- 6.3.10 Poly Medicure Ltd.

- 6.3.11 HLL Lifecare Limited

- 6.3.12 Demotek Ltd.

- 6.3.13 AdvaCare Pharma

- 6.3.14 Mitra Industries Pvt. Ltd.

- 6.3.15 Neomedic International

- 6.3.16 Span Healthcare Private Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment